The beauty of transitioning between calendar years is that it seems easier than normal to take stock of what has been over the past twelve months and what will be over the next year. For angel investing in Africa, 2016 was a firm step in the right direction and 2017 is set to build on this.

2016 Quick Highlights

- Double the number of Angel groups in Africa

- Lagos Angel Network introduced syndicated Deal Days

- South African Business Angel Network launched

- 3rd African Angel Investor Summit took place

- 500+ investors attended Angel training

- Better Angel/VC data emerging

- Consistent, pervasive expose of the “African Opportunity” at leading global events

- Multiple firsts

- Growing interest and involvement from diaspora

- More support from major global institutions including AfDB, WorldBank and EIB, while most African countries also in 2016 offered a challenging business environment

“2016 saw the rise of cross border collaboration of Angel groups across the continent and an increasing focus on Angel investor education as their investments in startups continued to grow. We also saw a marked increase in the number of Business Angel Syndicates and Networks emerging.”

– Tomi Davies, ABAN President

Lessons learnt or reinforced over the past year

- Angel investing in Africa is in its infancy; there is still much work to be done to introduce potential investors to the concepts and best practices of early stage investing.

- Co-investing is critical to moving Angel investing forward faster. This is a vital mechanism in risk reduction, more shared learning and on-boarding first time investors.

- Inspiring events are the number one way to draw communities together, allowing investors to make relevant connections.

- For Investors-By Investors is a format of knowledge sharing that is set to grow, resonating with established and prospective Angel investors.

- Funding is only one aspect of Angel investing, contributing relevant business acumen and market access to a startup are just as important. This makes angel funding Smart Capital.

- Corporate CEOs and successful Founders in Africa are in prime position to become Angel investors. Introducing them to early stage investing will be key for the future.

- There is still a long way to go before anyone expects national policy makers to introduce incentives for Angel investing in Africa.

- It is crucial that both Angels and Founders are aligned with similar values, expectations and a common end goal.

- Comparative to the US and Europe, Angel investors in Africa need relatively little capital to be notable players in the market. This presents a real opportunity for new and small players in the US and Europe to have a superior market position by relocating to/focusing on African deals.

- Increasing interest and involvement from the African diaspora Angel Investors

- Angel Investing in Africa is a long-term game and there are very real challenges to doing business

There are two facts from the last year that are particularly exciting and worth writing home about:

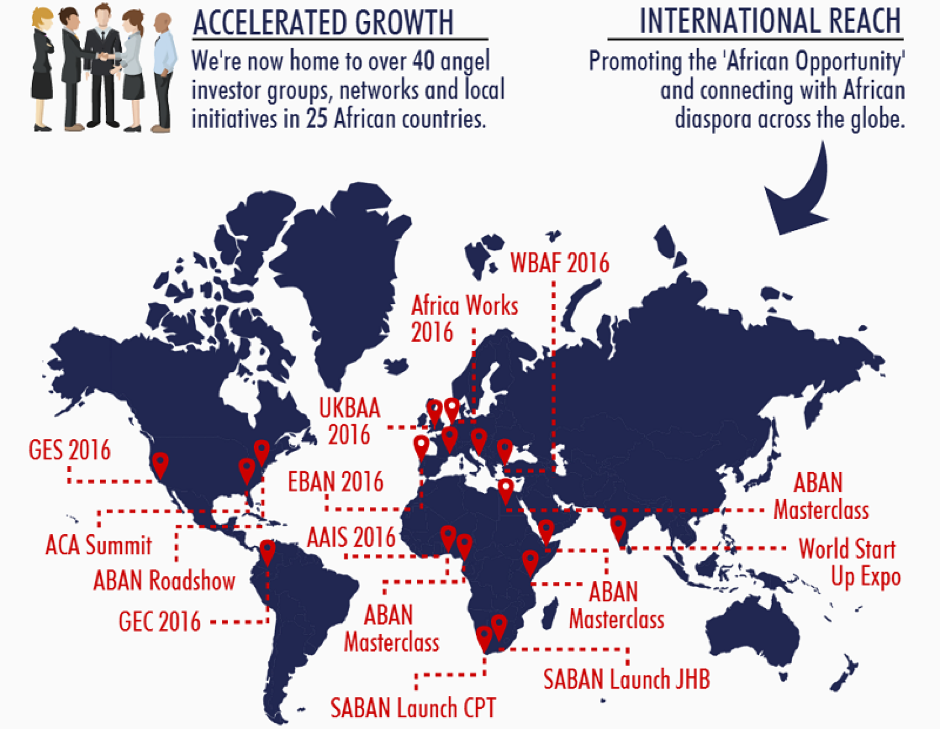

- The number of visible Angel investor groups, networks and initiatives grew to over 40 across 25 African countries (up from 20 at the end of 2015); and

- More than 500 established and new investors based in Africa participated in ABAN Masterclasses and Bootcamps over 2016.

Arguably this suggests a ‘coming-of-age’ and reaching critical mass for Angel Investing in Africa. There is a growing community of African Angel investors talking to each other (unimaginably important) and uniquely positioned to fund and grow African startups. Angel investing in Africa is kicking into second gear. Angel capital unlocks the innovative ventures and entrepreneurs critical to generating much of Africa’s employment and hope for a better future.

How ABAN fits into the picture

The African Business Angel Network (ABAN) has been one of the pivotal drivers behind this shift. Formally established as a non-profit organisation in 2015, its mission has been to increase the quantity and quality of Angel groups and investors active in African early stage investment markets.

ABAN has organised, co-organised, supported and addressed dozens of events since its formation. This activity has revolved around a clarion cry to understand and invest in the “African Opportunity”.

For the African diaspora and investors resident on other continents, this means showcasing the forecasted trajectory of Africa’s economic growth and the high calibre of existing start-ups. In other words, raising awareness of of the opportunity to invest in African start-ups, now, on the continent forecast to have the greatest economic growth over the next 20 years.

For potential and existing investors in Africa, the opportunity is the same, but the call to action is to lead and not wait for international investors to come to Africa. Improving know-how, connecting networks, mentoring new investors, shaping policy and encouraging greater levels of investment are all part of growing a stronger culture of Angel Investing in Africa.

Tomi Davies, President of ABAN motivates that, “Yes, we have problems, especially in the space of education, power and security. But we have something else — a growing middle class with cars and university degrees and a youthful population with energy and drive. The rest of the world is excited about what we can achieve and ready to support us. But first we must support ourselves.”

To get a sense of the of the growing level of activity around Angel Investing in Africa, here is a list of the 2016 events that ABAN led or contributed to:

Istanbul, Turkey, February 21-23, World Business Angels Investment Forum

Medellin, Colombia, March 14-17, GEC and inaugural GBAN members meeting

Washington DC, USA, March 22, ABAN Roadshow

Philadelphia, USA, May 9-11, ACA Summit

Porto, Portugal, May 26-27, EBAN Annual Congress

London, UK, June 22, Africa Technology Business Network

Silicon Valley, USA, June 22-24, Global Entrepreneurship Summit

Nairobi, Kenya, August 11, ABAN Masterclass

Johannesburg, South Africa, August 24, SABAN Johannesburg launch

Johannesburg, South Africa, August 26, ABAN Workshop @ DEMO Africa

Hargeisa, Somaliland, September 19-21, ABAN Masterclass

London, UK, September 29, The Next Frontier by MEST

Douala, Cameroon, October 7-8, ABAN Masterclass

London, UK, November 1, UKBAA Summit

Marseille, France, November 3-4, EMEA Business Forum

Cape Town, South Africa, November 10, SABAN Cape Town Launch

Amsterdam, The Netherlands, November 11, Africa Works Conference

Lagos, Nigeria, November 17, 3rd African Angel Investor Summit

Bangalore, India, November 21-23, World Start-Up Expo

Zagreb, Croatia, November 28-30, EBAN Winter University

Cairo, Egypt, December 6, ABAN Masterclass

Lagos, Nigeria, December 10, ABAN Masterclass with Rising Tide Africa

Connecting people, organisations and opportunities is at the core of nurturing Angel Investing in Africa. Starting 2017 compared to a few years ago, there is a vastly superior awareness of (and information about) what is happening, where and who is involved.

Event highlights from 2016

1. 3rd African Angel Investor Summit

It should come as no surprise that the theme of the 3rd African Angel Investor Summit was Co-Investing: Making It Work Together. Held in Lagos on 17 November 2016, over 150 investors gathered to connect and share best practices – opening up the channels of communication and trust required for syndication and co-investment.

2. SABAN launches

In the latter parts of the 2016 the South African Business Angel Network (SABAN) launched in Johannesburg and Cape Town, establishing a body that not only drives forward Angel Investing in South Africa, but also connects the financial and other infrastructure of South Africa to Angels around the continent and abroad.

Over 150 people participated in these two launches, with many more expected to benefit from SABAN’s initiatives in 2017. Speakers included Baybars Altuntaş (Chair, World Business Angels Investment Forum), Anthony Record MBE (Co-Founder, Welsh ICE) and Connie Tzioumis (Director of Global Partnerships, U.S. State Department) and Audrey Mothupi (NFBAN Board Member).

3. LAN launches Lagos Startup Deal Days

The inaugural Lagos Angel Network (LAN) Startup Deal Day took place on 31 March 2016, followed by two further Deal Days on June 30th and November 16th. These three events brought investors and startups together, generating much needed investment activity and providing important opportunities for experienced and novice investors to co-invest.

In total US$475k was raised directly over the three days and more than US$200k in subsequent transactions – small by US standards, but significant in Africa (for now).

4. Masterclasses Series expanded

Following on from Nairobi, Lagos and Cape Town in 2015, ABAN Masterclasses took place in Hargeisa Somaliland, Douala, Cairo, Nairobi, Johannesburg and Lagos in 2016. With a focus on For Investors-By Investors, these sessions were well attended with top speakers sharing skills and experience with local investors.

Candace Johnson (EBAN President), Ndidi Nnoli-Edozien (Rising Tide Africa Lead Investor), Swiss-based investor Balz Roth, Brigitte Baumann (Go Beyond Investing), Tomi Davies (ABAN President) and Stephen Gugu (Victoria Ventures lead) were just a few of those contributing to Masterclasses.

The value of partnerships and collaborating

The primary reason Angel Investing in Africa took a big step forward in 2016 is due to the many organisations and individuals who have collaborated and partnered – investing their time and resources to see more Smart Capital unlocked in Africa.

In particular ABAN’s work would not have been possible without the headline support of the WorkInProgress! Alliance and the LIONS Africa Partnership. Many other organisations have been instrumental to the success of the year including VC4A, EBAN, GEN, WBAF, Intercontinental Limited Trust, Socius and all the different national and local Angel groups across Africa.

David van Dijk, ABAN’s Director General, comments that, “Our supporters, volunteers and advocates are among the best any non-profit organisation could hope for – we are enormously proud of them all and appreciate the contributions they are making to Angel Investing in Africa”.

Looking ahead to what 2017 has in store, ABAN has a busy year lined up – assisting as many investors, groups and networks as possible realise their Angel investing potential. Masterclasses, Bootcamps and the 4th African Angel Investor Summit will all take place in the second half of 2017. In Q1 ABAN will be present and participating at two global events, the first in Istanbul for the World Business Angels Investment Forum (WBAF) and the second in Johannesburg for the Global Entrepreneurship Congress.

Reminder: All investors and VCs are invited to participate by 23 January to the 2017 Venture Finance in Africa research (5 minutes to complete) conducted by VC4A and partners. The 2016 report can be found here on VC4A.