Slowly, disruption is coming to Nigeria’s sluggish insurance industry.

“A few years ago or traditionally, how long do you think it would take us to insure 1 million people?” Jim Ovia, one of Nigeria’s veteran bankers asked an audience in March. “40 years; it would take 40 years to write traditional insurance for 1 million persons,” he said, answering his own question.

The digital world represents a new opportunity for insurance. Today, the growing adoption of digital solutions means insurance products could be promoted to more people at a quicker pace and reduced costs.

In March Ovia’s insurance company, Prudential Zenith Life, partnered with telecom company MTN to launch a new USSD service that allows people sign up easily for insurance services.

As the least innovative sector in Nigeria’s finance industry, this solution is a giant leap to providing insurance coverage to Nigeria’s over 180 million people.

Nigeria’s underdeveloped insurance industry

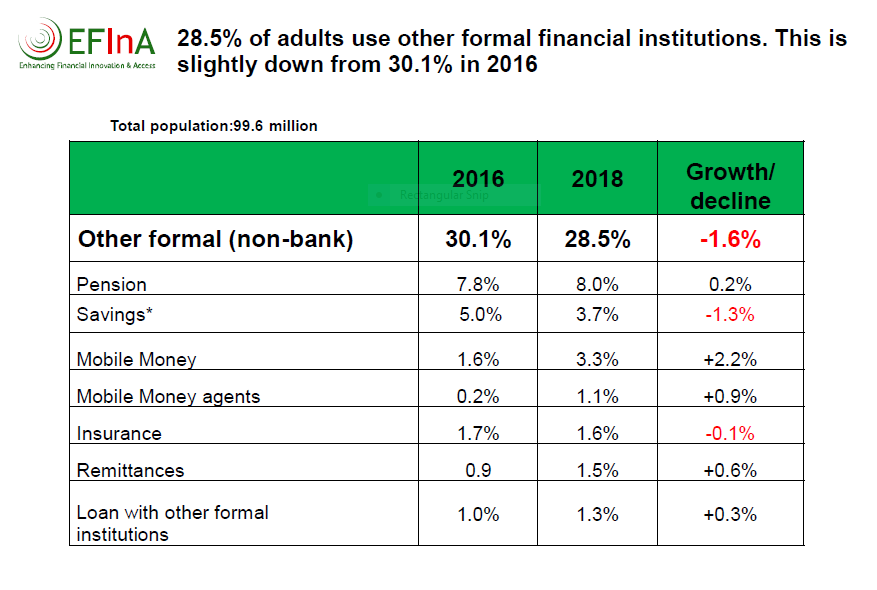

In 2018, Nigeria’s adult population was 99.6 million with nearly 40% having access to financial services. However, insurance penetration remains low as only 1.9% of them have insurance coverage [PDF] and the industry contributes just 0.3% to Nigeria’s GDP.

“Why is tech not jumping at insurance the way they are in other financial services?” asks Wale Olusi, Head of Research at United Capital. “It is because tech is an enabler.”

“The reason why you have tech in banking and investments is so that they can do what the traditional banks are doing more efficiently,” he explained. “But then again, the demand was already there.”

For insurance, this is not the case.

Knowledge of the insurance industry is extremely low as a combination of low income and perception about the industry has affected the reach of insurance services in the mass market.

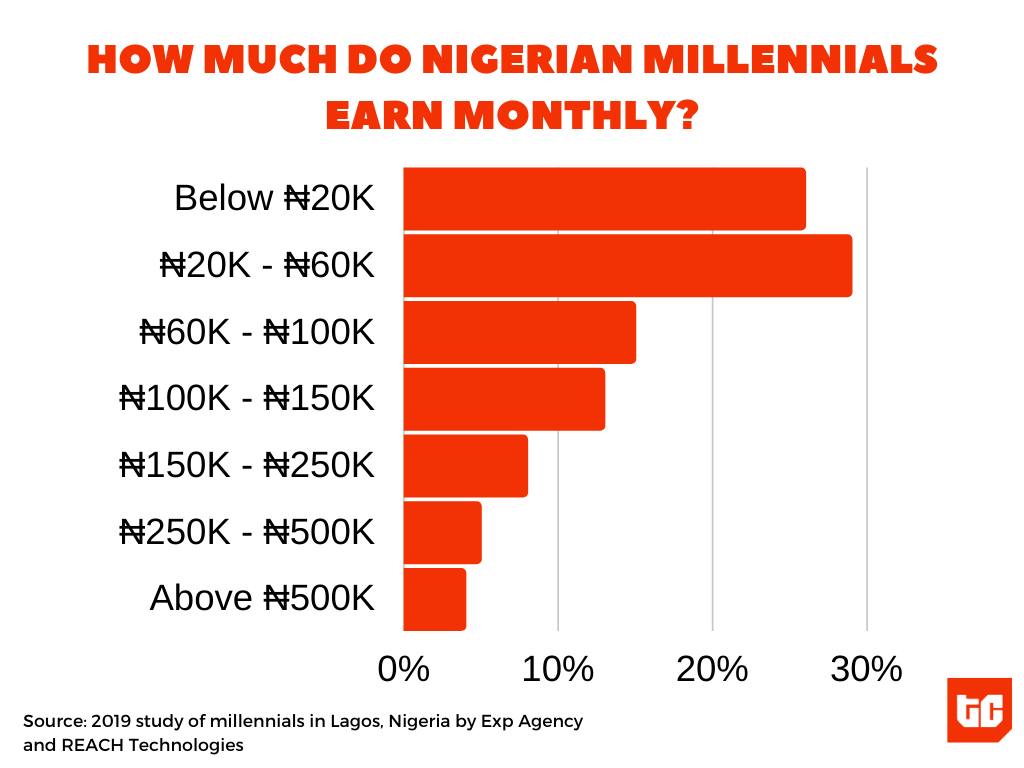

“Nigerians are very poor,” said a financial consultant who spoke to TechCabal on conditions of anonymity. People are struggling and living off their daily bread, he explained. “People with low income cannot afford to subscribe to insurance services.”

At least 30.8% of Nigerian adults say they cannot obtain insurance services because of economic constraints, according to a study by EFiNA. 15% of them say they can’t afford it, while 14.9% say they have nothing to insure.

“The income level in the system affects the adoption of insurance products,” explains Olusi. “It is easy for you to buy insurance if you have money,” he shared. “But if one doesn’t have money it is difficult to convince them to buy insurance for a risk that may not happen.”

People with low income will always look for alternatives to expensive essential needs. If they can’t find one, they’ll develop rational explanations for why they don’t need the product in the first place.

Olusi explained that for people who can’t afford the service their first reaction when insurance products are offered to them is to turn them down; hoping the event the insurance covers never happens.

In a religiously charged, if not superstitious, low-income country like Nigeria, this is the reality. People pray against bad things and hope God prevents evil things from coming their way. Insurance recognises that bad things do happen but can be recovered from; hence the need to insure against them to reduce future costs. But this is at odds with the sentiments of the average Nigerian.

For instance, motor insurance is coverage against accidents; recognising that motor accidents can happen. Meanwhile, many Nigerians fervently pray against accidents. So willingly obtaining motor insurance is a lack of faith in God’s power to protect, many believe.

“In African countries, they have what we call funeral insurance,” Ovia told the crowd at the launch of Prudential Zenith’s USSD product. “But in this part of the world [Nigeria], the word ‘funeral’ appears to be anathema, people don’t want to hear that.”

“So we don’t call it funeral insurance,” Ovia explained. “[We call it] life insurance.”

With little incentives, government regulations have become an important driver for insurance adoption. According to a World Bank-sponsored report [PDF], “compulsory insurance… continues to be a strong driver in the market.”

This explains why motor insurance is one of the biggest segments in the market. It is one of the five compulsory insurance products in the country. Between 2007 and 2011, it accounted for over 29% of the gross written premium for general insurance.

“A lack of understanding has also affected demand for insurance,” said Olusi. This circle has kept insurance penetration low and excluded millions of people.

Baked into all this is a misconception that it is difficult to get insurance companies to pay claims. This is part of the general distrust Nigerians have for financial service providers including bank offerings like loans.

For the insurance industry, this challenge is amplified by the low awareness of how the industry works. According to a World Bank report, over 30% of Nigerian adults are not aware of insurance.

In 2016, Nigerian drivers paid ₦40.3 billion ($103.2 million) as premium for motor vehicle insurance. Most drivers choose to obtain compulsory third party insurance over comprehensive insurance.

Yet when accidents happen, very few people go back to claim their insurance; which is limited to ₦1 million ($2,580) for third party insurance. The ratio of motor vehicle claims paid relative to the premium collected was 0.43 in 2016, indicating a low value for customers.

Meanwhile, regulatory efforts have increased the speed with which insurance companies pay claims, Olusi said.

New tech and innovation trends in Nigeria’s insurance sector

In recent times, technology is slowly becoming important in the industry. Over the last two years, a number of partnerships and tech developments are helping to push insurance products to more customers.

Like other financial services, the insurance business is heavily regulated. Financial requirements for insurance companies is on the high side. It mirrors the banking sector with capital requirements between ₦2 billion ($5.2 million) and ₦10 billion ($25.8 million). However, microinsurance carries lower financial requirements. Microinsurance is “insurance developed for low-income populations, low valued policies, micro and small-scale enterprises.”

It is limited to a few insurance products and is restricted to only a few locations depending on the type of licence acquired. Proper microinsurance regulation was introduced in 2018 and capital requirements are between ₦40 million and ₦600 million.

Considering that not about anybody can get into the insurance industry, tech innovation has been insignificant. Until now.

In September 2019, private equity firm, Verod Capital acquired a 100% stake in Metropolitan Life Nigeria, a life insurance company in Nigeria. The company has since been renamed Tangerine Life. By March 2020, it deepened its market reach by acquiring another company, ARM Life Insurance.

According to a press release, that acquisition makes Tangerine Life the fourth largest insurance company in the country. Tangerine Life describes itself as a “financial technology company”, giving a hint on the sort of growth path it plans to follow.

Meanwhile, over the last two years, fintechs have used partnerships to bring insurance products to more customers. The trend started with PiggyVest partnering Avon HMO to have insurance on the savings app.

Banks have also increased their play in the insurance sector. In 2018, Zenith-Prudential Life Insurance started a bancassurance partnership with Zenith Bank, allowing it to sell insurance products to the bank’s customers.

Both trends were stepped up in 2020 as more companies have developed new ways to reach users. Most recent launches have paralleled the outbreak of the COVID-19 pandemic in Nigeria.

In mid-March, Aella Credit, the digital lender, partnered with Hygeia HMO to offer health insurance services on the lending app. Called AelllaCare, the service provides affordable health coverage with a premium as low as ₦2,000 per month.

In April, Carbon, the digital lending company, partnered with AXA Mansard to introduce a number of insurance services on the app. AXA Mansard is Nigeria’s third-biggest company offering general insurance services.

In March, GTBank, one of Nigeria’s most profitable banks, launched Beta Health, a low-cost insurance product available via USSD. In the same month, Zenith-Prudential launched its own USSD service in partnership with MTN. Jim Ovia called the new product “a game-changer.”

Healthtech company, Helium Health, has also developed a new product called Helium Cover to provide insurance for healthcare providers. The feature is baked into Helium Health’s all-encompassing hospital management software which is used by over 300 hospitals in Nigeria, Ghana and Liberia.

According to sources in the industry, the recent push to digitise insurance is only just beginning.

“Recently, a number of startups are developing different innovative insurance products and could all launch in the second half of 2020,” said a source who did not want to be quoted.

The microinsurance licence is aiding this push. Although limited, the licence provides a good start for innovators to break into the market quickly and improve insurance penetration. In addition, in a 2016 EFiNA research, 36.1% of Nigerian adults said they would be interested in microinsurance products.

In 2019, Casava Microinsurance Ltd acquired the licence with the sole purpose of using technology to drive insurance penetration. “The world’s 1st WhatsApp AI Insurance,” it calls itself. The soon to launch product offers employment insurance and will be available via WhatsApp.

In the midst of these transformations, industry regulator, National Insurance Commission (NAICOM) is set to introduce new capital requirements for insurance companies.

“An insurance company is supposed to insure a bank,” Olusi shared, explaining that they are as valuable to the financial system as banks if not more. So it won’t be odd if they had higher requirements.

The new requirements were expected to kick in on June 1, but have since been extended to 2021 due to the COVID-19 pandemic. Regardless, the microinsurance licence will not change. With this stability, a number of new challengers could arrive in the market.