Music streaming and discovery service, Audiomack has officially expanded to Nigeria with a new office in Lagos. The eight-year-old company is positioning itself for a growth in music streaming in the country over the coming years.

Audiomack has hired a three-person team to lead operations in the West African country. They include Adeyemi Adetunji, head of operations and commercial partnerships; Charlotte Bwana, business development and media partnerships; and Olive Uche, head of content strategy. While all three new hires will be based locally, the company says they will also handle other activities across the continent.

In an email to TechCabal, Audiomack said it is serious about dedicating resources to Nigeria.

“Nigeria is the sixth biggest country in the world,” said David Ponte, Audiomack’s co-founder and Chief Marketing Officer. “And when you look at majority English speaking countries, [Nigeria is] second after the United States. Since most of the artists we have are English speaking, it makes practical sense to see Nigeria as a growth opportunity both for Audiomack and all of the artists who upload their music to the platform,” Ponte added.

Beyond demography, the Nigerian music industry has matured over the last 15 years. The country now frequently produces international megastars famous for the unique brand of music: Afrobeats. Burna Boy, Davido, Wizkid among many others have become famous worldwide as the music business goes digital.

While local artists depend majorly on concerts for their revenue, many of them now realise that streaming offers them a higher chance of being discovered by new fans and music lovers. In 2019, new acts like Joeboy and Naira Marley racked up millions of streams from just Spotify and other platforms, helping them to increase their fanbase.

“Nigeria is home to so many influential artists and a distinct sound that other African countries, US music fans, and our whole audience want to listen to,” Ponte told TechCabal. “Our team on the ground shows that we are serious about dedicating resources to Nigeria.”

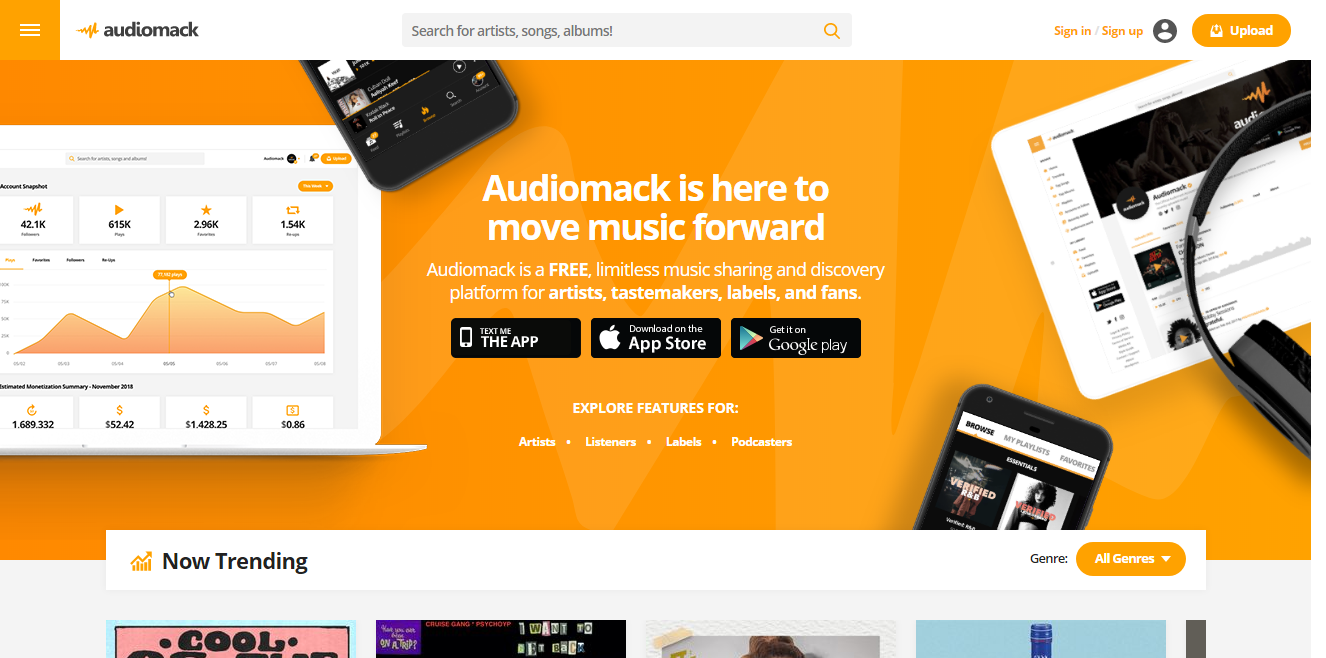

The streaming platform offers artists an opportunity to distribute their music for free and monetize their sounds through the Audiomack Monetization Program. Ponte says the company is also looking to hold meetings with key music industry stakeholders and create “compelling video and audio content with artists in our new Lagos office.”

By expanding to Nigeria, Audiomack is entering a somewhat saturated market. A number of important streaming platforms are already operating in this market. Boomplay is one of the biggest. Owned by smartphone manufacturer Transsion and Chinese streaming company NetEase, Boomplay has been in Nigeria for the last five years. The app comes preloaded on millions of phone brands such as Infinix, Tecno and Itel. It claims to have 75 million users globally with a significant number of them in Nigeria.

Other streaming services in the market include Apple Music, Deezer, UduX, Spotify and SoundCloud. Telecom company, MTN also launched its own music streaming service in 2019 called MusicTime.

Despite the presence of these services, the Nigerian streaming market is still small. Uptake has been slow as the country’s internet users switch to gradually to faster broadband.

“The music streaming industry [in Nigeria] is in its nascent stage right now,” Ponte told TechCabal. “There is a big opportunity for growth and adoption by a higher percentage of the population.”

In 2014, total music streaming revenue was just $300,000 with only 2 million gigabytes worth of streams, according to PwC industry data. By 2018, Nigerian internet users streamed 107 million gigabytes worth of music generating revenue of $3.3 million.

This is still small for a country with an internet population of over 100 million. Illegal music download is quite popular in Nigeria, causing artists to lose the financial reward for their creativity. Concerts, which are expensive and delicate to plan, have historically been the biggest source of income for artists. But that revenue base has been flat at less than $4.3 million for the last six years and was expected to grow to just $4.6 million by 2019.

However, a growing number of record labels and talent management companies have made strategic moves to give their artists more digital revenue streams. PwC predicts that Nigerian music streaming consumption will grow to 1.85 billion GB by 2023 with revenue rising to $18 million.