From a fresh and relatable perspective, the Ask an Investor series focuses on conversations with investors in Africa – investment banks, sovereign wealth funds, private equities, venture capitalists and every other class of investors, explaining why and how these investments happen by talking to the people who make them happen.

In 2010, Sam Sturm quit his job as a teacher to become a filmmaker. While he waited to hear back from the film schools he’d applied to, he joined the leadership team of an edtech startup to make ends meet.

Two years at that job was what it took for him to realise he wanted to learn to scale businesses – so he swapped film school for business school.

Following business school, he and Roo Roger spent the next five years running the Spring Accelerator program that has helped several entrepreneurs across East Africa and South Asia to grow their businesses. Two of those businesses are Ugandan motorcycle hailing company SafeBoda and Bangladesh based healthcare company Maya.

Together with Roo Roger, Alina Truhina, and Kofo Sanusi, Sturm decided to partner with Founders Factory UK to launch Founders Factory Africa.

“Founders Factory Africa was born based on the belief that entrepreneurs are the drivers of emerging economies. These entrepreneurs are on par with others in developed economies but they don’t have the support needed,” Sturm said.

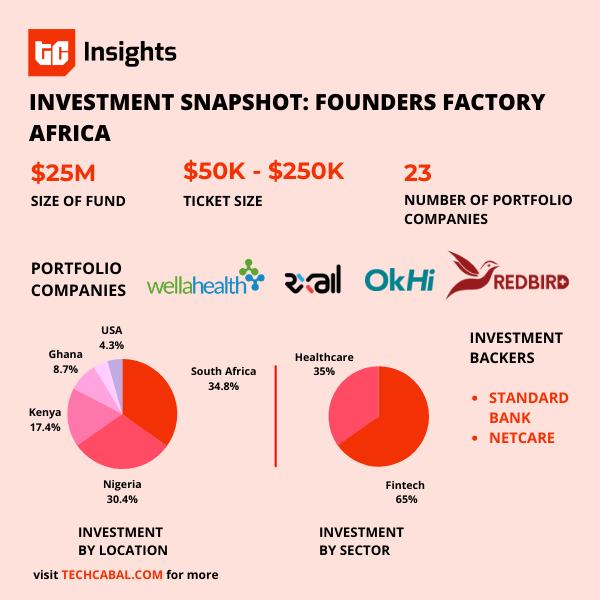

Founders Factory Africa (FFA) started two years ago and now has a portfolio of 23 businesses with plans to add about 15 more within the next year.

For this episode of Ask An Investor, our conversation with FFA’s Chief Venture Architect, Sam Sturm begins with a pertinent question regarding Founders Factory Africa’s brand identity.

Daniel Adeyemi: What’s Founders Factory Africa about and how are you different from Founders Factory UK?

Sam Sturm: While they’re related, Founder’s Factory Africa (FFA) is not a spin-off from the Founders Factory in the UK (FF London). We are sister organizations and work very closely together.

The founders of FFA had been working together for five years prior to launching FFA. We’re a team of practitioners who are familiar with emerging markets and what it takes for ventures to be successful, particularly in Africa.

We exist to help entrepreneurs move their ideas further along the maturity curve faster than they would without us. This means putting in cash but also partnering to deliver hands-on support to solve their most pressing challenges.

As a result, we can partner across the early-stage spectrum. We invest in existing businesses looking to grow. We’re usually looking at a seed or pre-series A – that’s our sweet spot for scaling.

We also build businesses with founders. At FFA, we recognize that each venture is different, with unique challenges and needs. From customer acquisition to working with them to develop and execute a growth plan, the spectrum of what we’re able to do and the kind of support we’re able to provide is broad.

Our investors at FFA are Pan-African corporations. We have Standard Bank, the continent’s largest bank, as our investor for our FinTech vertical and Netcare, which is the largest private hospital network in South Africa as our healthcare investor. These relationships allow us to leverage the assets, resources, and experience of these corporations to help our ventures grow.

In addition to our investors, we are part of the Founders Factory global family. Founders Factory has a portfolio of over 100 ventures worth over £250 million.

Being part of that network gives us access to capital, resources, and investors, for our ventures; putting them on this global stage.

Our belief is, we are not building South African businesses or investing in Nigerian businesses. We believe that the businesses that we are working with ought to be and can be pan-African and we believe that the best pan African businesses should be global.

DA: What’s your investment focus? I notice you only mentioned fintech and healthcare.

SS: Yes, for now. But I’ll say that our interpretation of fintech and healthcare is pretty broad.

Our fintech portfolio includes logistics, shipping, payment and neo banking. For healthcare it’s really about wellness and health insurance – the latter falls between healthcare and fintech. We recognize that there are amazing things happening across the spectrum.

DA: What do you look for in companies you invest in?

SS: Look, every business at different stages will have different metrics and ought to have proven different things.

First, we always want to see a real user need that’s being solved. Even if it’s a niche need, if the solution to it can be delivered at scale, we’re interested.

Then, a scaled market opportunity in solving that need, we believe those needs should cross borders and address multiple segments of the population.

We also look for credible founders, who we believe can develop the solutions necessary. That credibility can mean that they’ve run two startups before. Maybe both failed, but they have the experience. It can also be they have really specific industry relationships. We are looking out for someone who is insistent that they are right and also able to admit when they are wrong and to act upon that information.

The final thing we look for is evidence. For an early-stage business, it can be transcripts from 50 customer interviews where most people tell you that this is a problem.

It can be a proof of concept, maybe you have a hundred users, but every single one of your users is coming back and giving you great ratings or referrals.

It’s not always about the popular metrics. I think very frequently people get caught on revenue metrics or growth metrics and look, those are important. What we look for is the evidence that’s right-sized for the company’s stage.

DA: More specifically, what type of fintech and healthcare companies are you looking to invest in?

SS: We’re looking for different things at different times as healthcare and fintech are broad.

For example, in healthcare recently, we’re really interested in ventures that are looking at women’s health and in pharmacies.

We’re also interested in solutions that are looking to drive down the cost of healthcare. We decide on these themes based on our view of what the market is interested in and what our investors are invested in.

That will drive specific investment cycles for us. Having said that, we’re always looking for the best businesses. We will develop investment themes, but it’s rare that we won’t consider great businesses outside of them.

DA: How can entrepreneurs reach you?

SS: We are constantly doing calls for applications on our website and social streams and we are constantly sharing job opportunities within our portfolio companies.

Our entrepreneurs are also constantly making introductions to other people they think would be a good fit. It’s also great encouragement that our founders find the Founders Factory’s value proposition and our work valuable.

DA: How much do you usually put in and what does it get you?

SS: $250,000 in cash in our build program. It’s typically $50k to start with the ability to follow-on with up to $200K and provide nearly double that value in services. In our scale program, it’s $100,000 in cash and roughly $200,000 in services.

In terms of equity, on the scale side, we generally ask for between 5 – 8%, depending on evaluations and existing traction.

On the build side, depending on maturity, it can go anywhere from 15% up to 30%. Investing roughly $600,000 worth of value in a business that all they have is an idea is a lot much riskier for us and that’s why you’d see us taking close to 30%.

DA: You mentioned about $200,000 worth of services, what do these look like?

SS: We don’t start off by developing a scope of work that says this is all you’re going to get. We are a venture building studio, and this means that a business can expect to get support from members of our makers lab and our product team: private coaches, product managers, product designers, etc.

We are much more than advisors. We are on those calls together. Even right now our head of engineering is running the interviews along with one of our entrepreneurs for a CTO.

DA: Why is hands-on support so important to you?

SS: We believe that capital isn’t the only way to support a business. You need it so that you can execute but at the end of the day, capital isn’t what solves problems.

We believe that the challenges of product-market fit, customer acquisition, or retention are not the kind of challenges that capital alone can solve.

Those are the challenges that you’re looking to entrepreneurs to solve, that you’re looking to the team to solve. If you can supplement them with experienced and talented people you’d be successful.

DA: For red flags, what types of businesses aren’t you interested in?

SS: There are plenty of businesses that only want money. If that’s the case, we’re generally not the best fit.

I would argue though that that’s also not the kind of founder that we would want to work with because a founder that only wants money thinks they have everything figured out. I want to work with a founder who recognizes that there are people who know things. That’s the type of leader I am. I want people around me who know more than I do.

We want to work with people who believe deeply in what they’re doing, but also believe that the best way for them to get there is to build it, build an ecosystem and a support network around them. And that’s what the best entrepreneurs do.

DA: How long does it take to vet these companies – due diligence?

SS: I think we just recently did a deal in somewhere between four to six weeks but it generally takes a little longer than that, about a few months.

Our due diligence is less about documentation though. That is part of it but it’s much more around the entrepreneur and opportunity.

I want to know that they have an idea about what the revenue is going to look like, but I care much less about their three-year financial projections because those projections are going to be wrong and that’s okay.

We’re focused more on the entrepreneur’s understanding of the market? Do they have a credible pathway to success? What evidence do they have that tells us that there’s an opportunity here?

We sometimes might take longer because we are deeply engaged with the founder and working closely with the founder to figure out the answers to those questions.

DA: Okay, what do you think about Mergers & Acquisitions / Exits?

SS: Founders Factory makes money through exits. Yes, we believe that the businesses we invest in are scalable and we believe that scale means exits.

There are now examples of this happening – the Paystacks of the world. They are among the first but they will not be the last. In terms of our portfolio, we’re still very early. No company has exited, but we also don’t expect to have done that yet. That’s not something we expect for the next couple of years.

We have a number of ventures that have already raised additional funding, those entering markets, or have signed JV deals.

Some are along a progression that we believe have the potential for future exits. Certainly again, we are often the first money in and we would love for our businesses to be valued at a billion dollars within 18 months, but we recognize that those cases are few and far between.

DA: You have only two investors, How much influence do they have?

SS: It’s a really symbiotic relationship in that our investors recognize that we are experts in the startup markets and what it takes to build a business from scratch and enter new markets.

For Standard Bank we really trust them to help us understand market opportunities because they’re the largest bank on the continent. They understand the workings of financial systems in a way we don’t.

The same goes for Netcare. We are not doctors or healthcare experts. We look to them for guidance in helping us understand the healthcare landscape. To help us understand if something is viable because of regulatory concerns or if a healthcare solution that someone is promising is clinically viable. They supplement our knowledge and help us make better decisions about specific ventures.

At the end of the day, they do not dictate the direction of ventures.

DA: How patient are they?

SS: The way we see it, you have to be patient with your capital but impatient in your desire to solve problems.

I think you have to match those two different mindsets and be willing to discover that the path forward is not what you expected.

That’s the other thing we bring to our corporations, when corporations invest, they usually make a plan and create a roadmap and spend a lot of time doing it and then go execute on it. We know that’s not how startups grow, and it doesn’t allow for iteration and the discovery is necessary for a successful startup. We are bringing that lens to our activities and our investments as well, which is that things are going to change.

DA: What key trends are you seeing in the market?

SS: Fintech is everything, then quality health. Also, I’m interested in how to support more women-led businesses.