The idea to start Peppa, a social commerce startup, was born after Bankole Alao lost $7,000 in an online transaction in 2021.

Alao, a digital marketer based in Lagos, was searching online for a car to buy. He eventually found someone he thought was a credible seller located in Abuja. After a few conversations, they agreed to the price and other terms of the transaction. Alao paid the money and had a friend in Abuja stationed at the car dealership where the car was situated.

Unfortunately, for Alao, the car dealership never received any payment as the person who received it on behalf of the dealership never remitted it or wasn’t affiliated with them.

“When the car dealership said no money had arrived, my ears just perked up immediately and I figured out that it was a bad deal,” Alao said. The guy [seller] then stopped picking up my calls within an hour or two later.”

The experience felt like déjà vu to Alao. Before making the purchase, he had anticipated the possibility of being duped and asked around for a product that provided an escrow service. However, he was unable to get a tangible response.

“I asked around, even asking my friends in finance if there is a product where the money can be stored and then released after I confirmed receipt of the item but they didn’t have any answers for me,” Alao said.

This sad experience inspired Alao to team up with Bridget Yadua-Soremekun and Emmanuel Obute to start Peppa, a social commerce platform that is making it safer for Africans to buy items on social platforms through the use of payment protection.

Alao believes that Peppa is best suited for social media not just because of his experience, but because scam incidents are most prevalent on these platforms.

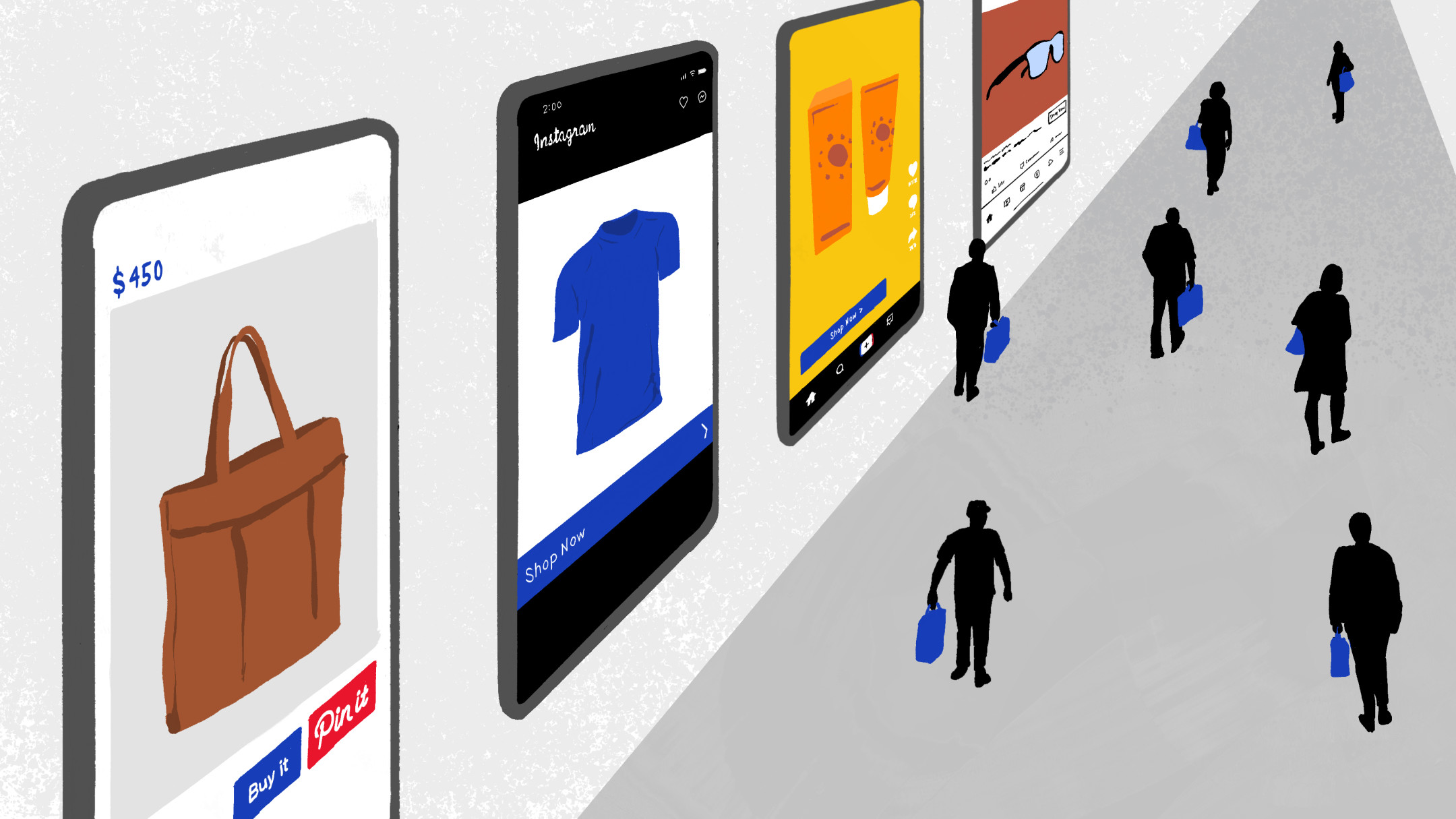

In Africa, almost 400 million Africans use social media platforms, with many making their first online purchase through these platforms. This large number of users has spurred social commerce to gain momentum in Africa. In 2022, social commerce in Africa and the middle east was estimated to be a $9 billion market. The industry is expected to grow at a compound annual growth rate (CAGR) of 55.2% from 2022 to 2028.

Despite this impressive growth, social media is also a hotbed for fraud and scams. More than one in four people who reported losing money to fraud in 2021 said it started on social media with an advert, a post, or a message, according to the US Federal Trade commission. Almost 100,000 people reported about $770 million in losses to fraud initiated on social media platforms in 2021.

“When you think of the opportunities this market offers, you also think of the fact that people are afraid of using it,” Alao said.

To reduce the lack of trust that exists on social media platforms, Peppa offers an escrow service, which protects merchants and their customers by acting as a safe deposit to collect and hold payments from customers until the customers confirm that the products they have received are satisfactory, at which point the payment is released to the merchant. The escrow service ensures that buyers and merchants keep to their ends of agreements and helps to boost trust and increase sales.

Peppa, which is backed by Techstars, also provides merchants with a variety of tools to display their products in an online store.

Peppa generates revenue through two sources. It takes a commission of 1-2.5% from the payments made by buyers. For sellers, the startup offers paid subscription services that give them access to unlimited uploads of products, door-to-door delivery for orders, insights and reports, and notification of orders via SMS and email. Peppa is also working on including a micro-pension plan for its sellers to which the company will contribute a portion.

According to Peppa, in the eight months since the startup began operations, it has processed millions of Naira worth of Gross Merchandise Value. The platform has about 1,000 sellers and predicts that it will host over 100,000 sellers and about 300,000 buyers by the end of 2023. Peppa has already signed a partnership agreement with First Bank to integrate its offerings into its mobile money service.

Alao believes that one of the key differentiating factors that Peppa has compared to other social commerce platforms is that it doesn’t need users to use its stores. People can simply use its escrow payment service when they want to make a purchase over a direct message.

“You can conclude your conversation in the DM and then when you want to make payments and you’re having second thoughts, that’s where we come in. This is one of the major differences between us and competitors,” Alao said. “People don’t have to go through the behavioural change of moving from DMs to using storefronts.”