From a fresh and relatable perspective, the Ask an Investor series focuses on investors in Africa — Investment Banks, sovereign wealth funds, Private Equities, Venture Capitalists and every other class of investors, explaining why and how these investments happen by talking to the people who make them happen.

Before co-founding Almentor, Ihab Fikry wore three hats. He was a management professor, author of bestsellers on management (mainly in Arabic) and a multinational expatriate at companies like PricewaterhouseCoopers and Exxon Mobil.

Then he decided to quit it all to start sharing his knowledge via different mediums – television, newspapers, and YouTube.

While he was doing this, he saw it as an opportunity to give back to the community until May 2015 when the news of Microsoft acquiring Lynda.com for $1.5 billion caught his attention. He spent the next 12 months learning about video-based learning. He was certain there was a business case for the video content he was putting out on YouTube.

In June 2016, he partnered with co-founders who worked for Google, Microsoft and other multinationals to start Almentor, a video-based online learning platform for the Middle East and North Africa. They started with a seed round of $3.5m.

The initial plan was to generate $10,000 in sales just to validate the business idea but they ended up making $300,000 in sales that year.

In 2019, they crossed the $1 million revenue line and raised the next funding round – Series A. Almentor’s Series A round was led by Sawari ventures.

In today’s edition of Ask an Investor I talk to one of the oldest venture capital firms in the Middle East and North Africa – Sawari Ventures.

Fikry pointed out that Sawari Ventures helped Almentor in three critical areas: Governance, networking with the ecosystem and technical support.

Sawari Ventures helped them put structures that enable the company to last for decades. It also helped with meeting relevant people in the ecosystem and provided good technical support and advice.

I talk to Tamer Azer, a principal at Sawari Ventures; he joined the firm in 2019. One of the first things he pointed out to me early in our initial email exchange was that he had done an Ask an Investor series before. His own version was a free-flowing conversation with people interested in learning about how investors make decisions and the differences between concepts like equity and convertible notes.

Daniel Adeyemi: Tell me about Sawari Ventures

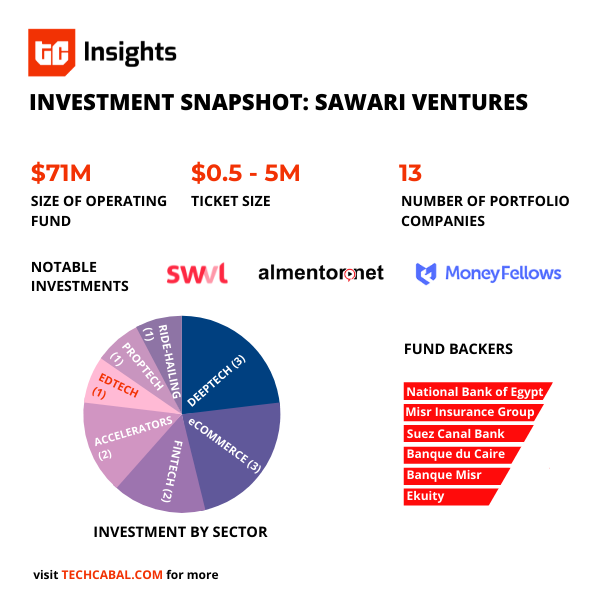

Tamer Azer: Sawari ventures has been around since 2010. It was founded by three partners – Ahmed El Alfi, Hany Al-Sonbaty and Wael Amin. They’re also the founders of Flat6Labs – the MENA region’s largest accelerator. Sawari Ventures is also a limited partner in Flat6Labs Cairo and Flat6Labs Tunis. We invest in companies anywhere from a million to $3 million per ticket and up to $5 million for the life of the company, across Egypt, Tunisia and Morocco. We’re fairly sector-agnostic. We most definitely look for companies who have a very clear product-market fit and are doing something really innovative and meaningful.

DA: What’s the premise behind the investments you make?

TA: There’s an argument to be made that the tech entrepreneurship ecosystem in Egypt became a lot more attractive after the Arab Spring when a lot of people found their sense of purpose and sense of independence.

It’s picking up a lot from there. A lot of people saw it as a way to express themselves in a way to be able to engage on their own terms. There’s an argument that a lot of people make that’s connected somehow. In terms of the investment thesis, we’re definitely sector-agnostic. We look out for companies that really have unique intellectual property. I’m not just talking about documentation. The company has to be doing something really defensible and really unique. It can be doing something that we all know and love, but in a way that nobody else has done. Obviously, teams factor in a huge way. We’re looking for professionally mature people who work with intention, who are coachable, who understand why, what and how they’re doing it.

DA: How do you find these companies or better still how do people get your attention?

TA: I made a decision when I first started working in this industry to respond to absolutely everybody. I respond to anyone who messages me on LinkedIn, anyone who emails me. I try to put myself out there a lot and speak at events and do articles like the one I’m doing with you right now, so that people hear about me and they try to reach out to me. Deal sourcing is always two ways.

Sometimes it takes me longer than I’d like to admit, but I do try my best to respond to absolutely everyone.

DA: That’s really generous. If you get more popular you’ll probably need to get an assistant. So does Sawari invest in cohorts?

TA: We’re not an accelerator. These are types of activities that Flat6Labs would organize. For us, we look for companies that are a bit more mature than that.

DA: What’s the relationship between Flat6Labs and Sawari ventures?

TA: The founders of Sawari Ventures and the founders and Flat6labs are the same. When Sawari Ventures raised its North Africa fund, we invested in Flat6Labs Cairo and Flat6Labs Tunis. There’s something really important here I need to point out between when a company joins Flat6Labs and when it can join Sawari Ventures. There has to be a bit of a gap, where they go out into the world and raise their middle round.

Just because you get into Flat6Labs does not mean that once you graduate you’re going to get money from Sawari Ventures automatically. We look out for whoever survives, manages to go out into the world, get a seed fund, grow their business even more, and then they can come to Sawari for their Series A round.

DA: What does support from Sawari Ventures look like?

TA: Typically, one of the partners of the firm would sit on the board. We’ve worked very closely with our companies in the beginning to build a strong relationship and to build a strong plan for the business. Moving forward, we work very closely with them to help with business development, growth, as well as fundraising. We work with them to analyze the data that they share with us and help them make data-driven decisions. Obviously, we deploy our entire network to support their growth.

These are how most VCs support the portfolio companies. We’re also in a position where we have some very strong limited partners who are interested in co-investing. We have a really wide network that allows us to bring a lot of international VCs into the next rounds for the companies. For instance, we brought in Partec to co-invest with us in MoneyFellows.

DA: How does due diligence happen and how long does it take?

TA: Each company will have a different level of preparedness, investment readiness, and every company will have different rounds. A priced round will have a very different timeline than a convertible note round or a safe round. So ultimately, every process is fluid depending on the nature of the round and the co-investors in the round and the lead.

We will always want to be the lead on any investment that we make and we’re always trying to bring co-investors into the process. We definitely conduct four layers of due diligence. There’s commercial, financial, legal, and tech.

The rest happen a little later in the process. Initially, there has to be a good solid commercial due diligence, so we can buy into the market, the team, the company, and then we take it forward from there.

DA: What are some red flags?

TA: One that comes to mind is coachability. I’m turned off when I see that a founder or co-founders are not really being responsive to feedback from an investor or a customer. When they have a reputation for being not just defensive, but being uncoachable. That’s a major red flag because when you invest in someone, the relationship is very close for a very long period of time. If you can’t give and take, then it becomes really tricky to nurture this relationship over that period of time. Another thing I really look for as a red flag is co-founder dynamics. Are they both at the pitch? How do they talk during the pitch? How do they answer questions? What does the dynamic and the relationship between them look like? If it looks out of sync, that’s a pretty major red flag.

DA: You said Sawari Ventures typically takes the lead on investments. Why the emphasis on this?

TA: We also co-lead. As regards the times we lead investment rounds, it’s because of the environment. Many companies in this region find investors who can’t and won’t lead, who will tell them, find the lead and we’ll follow. It’s part of a fund ethos that we like to lead our own investments because we really believe in them. Another reason is the market dynamics in the region, there’s a lot of people who want to follow on, but not lead, which ultimately leaves you in a strong position when you are capable and willing.

We’re a very experienced team. We have very clear intentions about what we like to invest in and why we invest in certain things.

DA: What are your thoughts on exits and M&A?

TA: I think the African market, we’re all suffering from a lack of exits. We all have that problem. Angel investors all over the continent are just dying for an exit because they’ve been investing for years and years. We’re all really dying for exits but exits are really a function of foreign direct investment. It’s a function of mature stock exchanges. I think we’re going to start seeing more and more exits from North Africa. We have seen a few and they’re getting bigger, but we still need so many more before more capital comes into North Africa and that capital gets redeployed.

You know how it works, you have a company and you exit, all of a sudden you’re an angel investor. Then you’re a fund manager or you start another company that people want to invest in quickly because you already have a successful exit. We’re seeing the industry in North Africa mature, and it’s heading more and more towards some of these interesting exits. We’re starting to see bigger rounds. We’re starting to see exits, we’re starting to see mergers in the continent, in North Africa and in Egypt especially because it’s the market that I’m closest to. We are seeing a lot of maturity, a lot of growth. For example, a lot of ex-Uber and ex-Careem staff are starting companies that have been doing fantastically well. As more and more of these things happen, the maturity of the entrepreneurs and investors grows, and exits will come. We just have to keep at it.

DA: What’s the difference between raising money as a VC fund and a startup?

TA: VC funds are different. They have a limited lifetime, They have a 10 year lifetime. You’ll spend the first third of your time investing, the second third growing and the last third exiting your investments. You need to give the money back to your investors. It’s really the only way for many of us to actually make money off of this business. And it takes time.

Just like startups, we go out into the market and raise money. Startups get the money a little bit at a time, and have to prove themselves every 12 to 18 months.

We have to raise all the money at once. So you come with a bit of a track record, and then you go out into the market and try to raise capital. It’s not like you’re raising a million or two million dollars in rounds. You’re raising 50 to 100 million dollars from a market and institutional investors that haven’t really gotten comfortable with the asset class yet. You’re reaching out to international investors, asking people in the United States and Europe to invest in Africa. It’s not just about writing checks, we have to get the money to be able to write these checks first.

It’s a very different dynamic and we have to work really hard to be able to write these checks. We work really hard to make the decisions on who we should give this money to.

DA: What are some trends you’re seeing in the market?

TA: I think for me, the main trends are the fact that people are starting to solve deep-rooted fundamental problems. They’re starting to solve access to finance. They’re starting to solve financial literacy and financial inclusion. They’re starting to solve healthcare problems. People are actually tackling the big-ticket issues that were previously left to the public sector. We’re seeing the market respond very positively to that.

DA: Any final words?

TA: It’d be interesting to see more engagement from large institutional investors with investing in startups. There’s immense potential and having your local financial institutions support you as a fund manager helps immensely when it comes to getting international development. It’s a team effort, we have to do it together.

I’m encouraging more engagement from African financial institutions, not just banks but hedge funds, insurance companies and pension plans.