IN PARTNERSHIP WITH

Good morning ☀️ ️

On Friday, Facebook announced that former president Donald Trump would remain banned on its social platforms until at least January 2023 when it will decide whether he still presents “a serious risk to public safety.”

In today’s edition:

- Nigeria’s government vs Twitter

- WeBuyCars’ long journey to success

- TC Insights: Make way for King MoMo

Nigerian Government vs Twitter

Since the morning of Saturday, June 5, most people living in Nigeria haven’t been able to access Twitter.

Wait, what?

On Friday afternoon, the Federal Government announced that it had indefinitely suspended the operations of Twitter in Nigeria.

The reason for the suspension wasn’t stated but the announcement came two days after Nigeria’s president, Muhammadu Buhari’s tweet was deleted.

The tweet in question was widely criticised and a violation of Twitter’s policy on tweets that may seem to threaten violence against a group of people.

Back to the shutdown

Telcos and Internet Service Providers like MTN, Airtel and 9Mobile have cut off access to Twitter’s app and website. VPNs have become the primary medium to stay on Twitter for most Nigerians.

But that’s not all

The Nigerian Government has also directed the National Broadcasting Commission (NBC) to immediately commence the process of licensing all Over-the-top (OTT) and social media operations in Nigeria. Over-the-top platforms include instant messaging apps like WhatsApp, Telegram, Netflix, Showmax and other streaming platforms. Basically, any media and communication service that uses data provided by internet service providers.

In effect, suspending Twitter is just the beginning, a taste of what is sure to be a very unsavoury meal.

Why it matters

The suspension brings Twitter squarely into the heart of the debate about the intersection of democracy and internet freedom in Africa.

It’s also a timely reminder of Twitter’s decision to locate their first African office in Ghana instead of Nigeria. A move it made because it claimed Ghana is “a champion for democracy, a supporter of free speech, online freedom, and the Open Internet, of which Twitter is also an advocate.”

What’s next? A number of nations and agencies have criticised the actions of the Nigerian government, but only time will tell what effect that will have.

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

🏾 Learn more at paystack.com/storefrontCan you smell what TechCabal is cooking?

Well, you probably can’t smell it right now but trust us, it’s amazing – and it’ll be here soon.

Can you guess what we’ll be unveiling? Reply this email with your guesses, I’d love to read them!

How WeBuyCars became a $300m business

“If you don’t enjoy what you do or have a passion for it, then you’re dead in the water. So, have a passion for it and be patient.”

Some startups reach multi-million dollar valuations within a few months after launch, while others take many years to achieve that. WeBuyCars’ success story is a reminder that sometimes success takes time.

How it started: Buying and selling cars started as a hobby for two brothers Faan and Dirk van der Walt while still in school in Bronkhorstspruit, South Africa. This hobby translated to the company WeBuyCars. It was founded in 2001, with its first vehicle supermarket launched in Pretoria in 2010.

Over the next 16 years, the company was self-funded with negligible operational debt, despite its rapid expansion.For example, until November 2018 much of the business, including its inventory management process, was kept on Excel spreadsheets. Only the buying process was automated.

What next: They partnered with investment firm Fledge Capital, which provided additional funding and technical and business expertise. Over time the two brothers sold 40% of WeBuyCars to Fledge Capital.

Today WeBuyCars has a presence in all nine South African provinces and offers a range of services, including financing, insurance, tracking, and online auctions. And the company’s website attracts 814,000 unique visitors per month.

Last year, WeBuyCars’ success attracted the attention of the publicly listed Transaction Capital, which bought a non-controlling 49.9% stake in the company for R1.8 billion ($130m). Last month, Transaction Capital signed an agreement to increase its shareholding in WeBuyCars from 49.9% to 74.9%.

Read more: How we built a R4-billion ($300m) company

Future Africa has invested $3 million in 13 African startups in 2021, doubling its fund deployments for 2020. It’s invested in companies like Termii, Ongair, Lami and Stitch and is on the way to invest $10 million this year.

Read its announcement here.

TC Insights: King MoMo

In 2018, Ola visited a friend in the Ibeju-Lekki area of Lagos, Nigeria. During his visit, Ola needed to get some money so he walked out to look for a bank or an ATM. Ola walked for a while but still couldn’t find a bank or ATM – this surprised him.

When he asked where he could withdraw money around, he was shown a mobile money agent in the area.

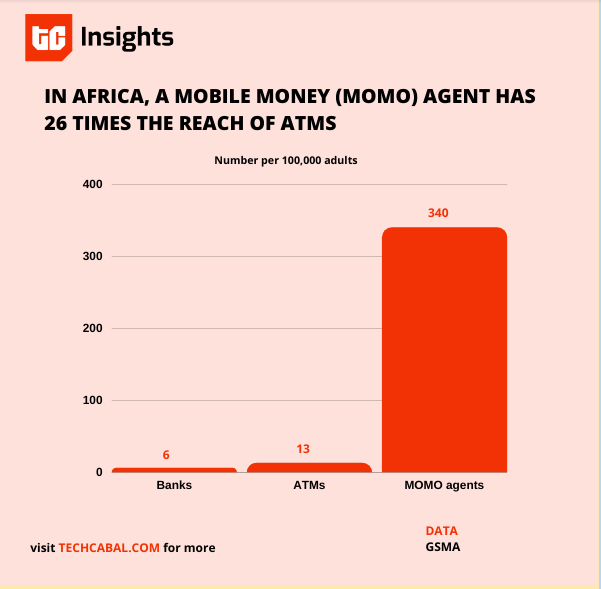

Data shows that a mobile money agent has 26 times the reach of ATMs and 58 times the reach of bank branches in Africa. So you are more likely to run into a mobile money agent than a bank or an ATM.

Africa is the world’s mobile money leader. There are 3.4 million registered agents on the continent. More than 4 out of 10 agents in the world are in Africa. Agents are the fastest way to convert cash to digital value and vice versa.

About $124 billion in digital value passes through mobile money services and agents every year. There are 481 million registered mobile money accounts in Sub-Saharan Africa, 50 million of them were registered in 2019. From remittances to airtime top-up, mobile money has become an integral part of how money moves on the continent.

But despite significant progress with mobile money penetration – registered accounts grew by only 12% in 2019 compared to 2018 figures – financial exclusion is still in the double digits in a number of African countries.

Note: Get our report on Nigeria fintech’s future and watch videos from our fintech townhall. Send us your research requests via tcinsights@bigcabal.com.

Ask us anything

We love the responses we’ve been getting and want more.

What’s a lingering question about an aspect of tech or the stories we share that you’ve been wanting to ask? Ask us here, we’ll be happy to answer your question and possibly share with the wider TC Daily audience. There are no stupid questions!

JOB OPPORTUNITIES

- Reliance Health – Backend Engineer, Telesales Manager, Operations Manager and other roles

- Dotline Digital Technologies – Mid-level WordPress web designer, send email to info@ddigitaltech.com

- Prospa – Software engineering manager

- Prospa – Growth Engineer

Check out other opportunities on our Job Opportunities page