By even a sober measure, the last 12 months have thrown up a strong case for investing in the creator economy: NFTs. New TikTok celebrities. Gen Z millionaires riding bitcoin’s meteoric rise in value. Coinbase’s IPO. And so naturally, the a16z guys felt validated.

Not every aspect of the boom in the creator economy has been tied to crypto – Elsa Majimbo’s fame is based on the same tech that made Mark Zuckerberg a billionaire in 2008, barely a year after the first iPhone.

But convinced that “the next wave of computing innovation will be driven by crypto,” a16z has quadrupled their last fund – a new $2.2bn to invest in up-start and mature crypto-driven platforms in North America. Possibly in Britain and the rest of Europe too.

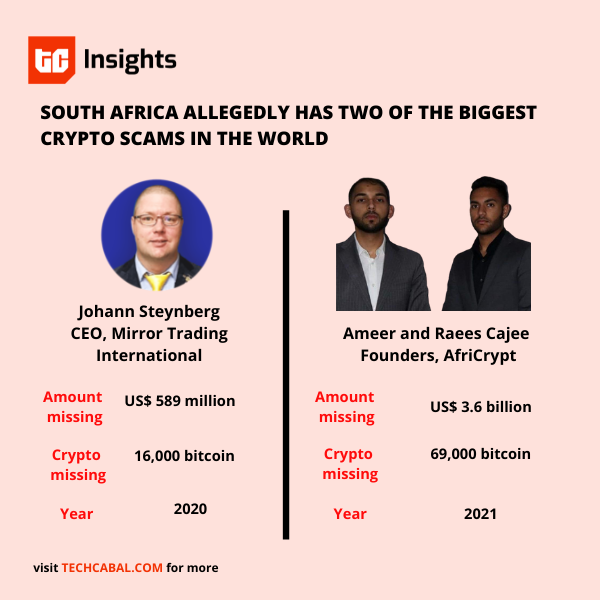

Meanwhile, $3.6bn worth of bitcoin has vanished in South Africa.

Two smart twenty-something year-olds are at large, and their phones are sending client calls to voicemail. As you can imagine, some of the affected investors’ frustration is diffusing across the continent, fanning flickers of crypto scepticism. After all, this is the second of such a scam in South Africa alone in as many years.

Olanrewaju Odunowo/TC Insights

If two kids can just up and leave after feigning to be legit for only two years (they founded their crypto exchange, Africrypt in 2019), what is it about crypto that is good and trustworthy?

“I think crypto will also have some negative news here and there but we should not let one bad incident paint the whole industry black,” Yele Bademosi, CEO and founder of Bundle, a Nigerian crypto-enabled startup, tells me.

“Long-term I think crypto’s reputation will be fine, the industry has evolved and come a long way. For every bad actor, there are 100’s of good actors.”

That is fine to say, but short term losses can do real damage. Left to fester, there might be no “long-term” benefits to enjoy at the end of the tunnel. Surely there must be a way to assure current crypto investors that they are not guinea pigs who may need to get burned now for the future industry to harvest stability.

Firewalls for the lab

Crypto optimists use the word “evolve” often because crypto is an experiment. Its decentralised nature and ambition to redefine global finance make it an especially controversial one. Yet, we are kind of accepting it as a necessary universal experiment.

Like all experiments though, crypto might need a controlled environment, stacked with experts familiar with titration techniques, people who know when to activate circuit breakers.

That means some form of regulatory oversight – South African financial authorities have not investigated AfriCrypt for lack of jurisdiction – but also the right people around crypto builders.

That is the other key takeaway from a16z’s announcement this week. A $2.2bn crypto fund is incredible but did you notice who they now have on their crypto team? One former director at the US SEC who has experience with digital assets. A former Hillary Clinton and Joe Biden advisor. A former VP of communications at Coinbase.

If Africa will throw billions of coins in crypto experiments, it would be ideal to know that startups in the space have a similar level of expertise around them, wouldn’t it?