It’s Season 6 of Big Brother Naija (BBN), and the theme is ‘Shine ya eye” – a theme that BBN’s tech sponsors like Patricia and Abeg are taking quite seriously.

Big Brother Nigeria is Nigeria’s take on the Dutch Reality TV show, Big Brother, which got its inspiration from George Orwell’s 1984 novel. The book imagines a world where your every move is monitored by an all-seeing ‘Big Brother’ and that’s exactly what BBN is all about.

Launched by Multichoice in 2007, the BBN show has run for 5 seasons, with its winners cashing out huge sums of money, and more people tuning in every year.

Fun fact: There are over 20 million subscribers on the Multichoice platform

That’s a lot of eyeballs and potential customers glued to screens across Africa and even in the UK. Do you see why sponsors are falling over themselves to headline this show?

The last Big Brother Naija edition saw companies like KudaBank, Flutterwave and Patricia throwing their weight behind the show—and profiting. For instance, shortly after the end of the season, Flutterwave announced that it had raised its Series B funding and processed more than 140 million transactions worth over $9 billion.

Well, this year’s lucky headline sponsor is a wildcard and a relative newcomer to the tech ecosystem. We’ll give you three clues: Paytech, giveaway, and Nigerian slang.

Okay, okay, we’ll tell you who they are. The name is Abeg.

No, we aren’t pulling your leg. It’s Abeg.

Abeg! What is Abeg?

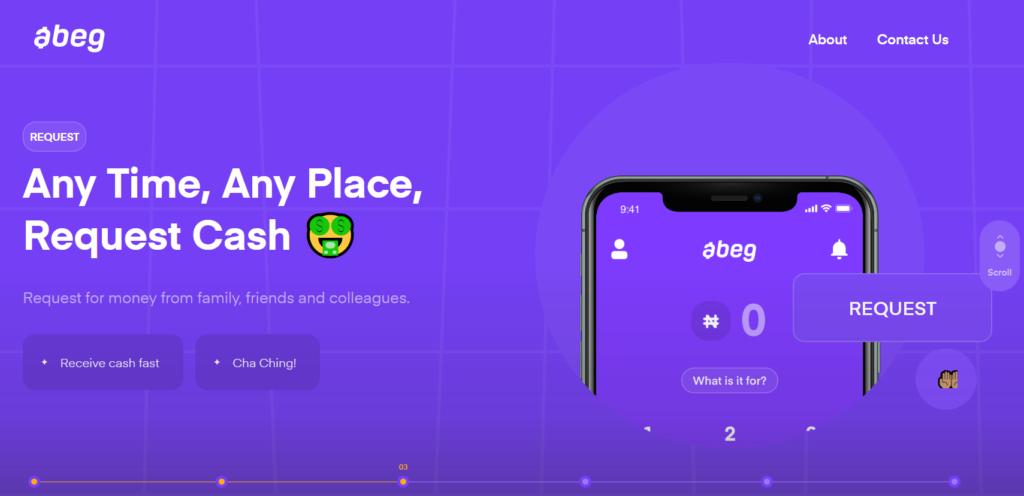

Abeg is a peer-to-peer (P2P) social payments platform that lets you send or request money from another Abeg user without having to input any bank details. All you need is their Abeg tag to send them money and request funds from them.

The app was founded by three young men, Muheez Akanni, Michael Okoh, and Dare Adekoya, and is only available to Nigerians, for now. Funding an Abeg wallet requires a Bank Verification Number (BVN) and a local phone number linked to your account.

Although Abeg is similar to Cashapp, its founders hope it’ll break boring rules surrounding current fintech startups and change how regular people think about payment technology.

Abeg makes gifting money and splitting bills between friends easier. Got a frighteningly huge bar tab after that TGIF party? You can contribute to the bill by Abeg-ging it.

You can also buy airtime, pay bills, and link your social media accounts to find Abeg users on Twitter or Instagram.

Other unique features you can find on the Abeg app include a Giveaway option, Ajo (a group saving tool), Cliques (for your bill splitting) and loans. The last three are still in the pipeline though.

Why should I care?

Sending cash via Abeg won’t cost you a pretty kobo. You can send thousands of naira to Abeg tags (usernames) for free but withdrawals to bank accounts will attract a small fee of ₦10.

This transaction fee is cheaper when compared to P2P payment solutions like Wallets Africa which charge ₦ 23 for successful transfers above ₦5000, amongst other fees.

On the other hand, Barter (a Flutterwave payment option) doesn’t charge any fees for transfers to other Barter users. However, it charges you for withdrawals though, just like Abeg.

Abeg also offers referral bonuses to users who invite their friends to create an Abeg account. If your friends download the app through your invite code, and you initiate the first transfer, you get a ₦500 bonus for your troubles.

How do I sign up?

You can log into the Abeg app with these simple steps:

- Install the app from your Google Play Store or the Apple Store.

- Tap “Create an account.”

- Complete the sign-up process by entering your name, phone number, email address, and password.

- They’d send a One-Time Passcode (OTP) to your line for verification.

- Once you’re in, you’d need to provide your BVN. This is how they link your bank account to the app, so you can fund your wallet.

- You’d also need to create a transfer tag that you can share.

- You can link your social media accounts to your Abeg app to see mutual Abeg users.

What are people saying about Abeg?

If you enter the words “abeg app” on the Twitter search tab, you will see dozens of tweets about the app– more so since their BBN sponsorship announcement went live a couple of months ago.

One of the most iconic Abeg tweets is this one from 2018, long before the app was launched. The tweet asked for a Cashapp copy, but with a Nigerian flavour. The tweet even suggested calling the Cashapp clone, $Abeg.

Coincidence? I think not. The people called, and the tech universe answered with a nifty app for your cash gifting needs.

Overall, people have nothing but praise for the app. It’s been described as funny, impressive, and the best app on the planet.

Celebrities aren’t left out in the Abeg frenzy too. Don Jazzy, popular Mavin Records boss, has given away tons of cash with the handy giveaway feature on the app.

The Abeg giveaways seem to be the most popular tool in the app with many people organising massive giveaways and many more cashing out.

But it’s not all roses though. Sprinkled amongst all the posts gushing about the app are tweets about verification problems.

There are also concerns that the app may be a one-trick pony, and may not sustain its momentum after the BBN show.

What is the big ‘but’ though?

Well, asides from the free giveaway, airtime recharge and easy P2P transfer features, Abeg doesn’t have much going for it now. Unlike the other payment solutions mentioned above, Abeg’s use case is limited. You can’t create virtual dollar cards like Barter and Wallets Africa on Abeg. Neither can you send money abroad or even to other African countries. Even the bill payment angle only works if the business has downloaded the app and recognises payments made through it.

For now, the app connotes one thing— giveaways. And a lot needs to be done for it to break out of that box.

However, it’s still early days for the young app, and there’s room to improve. Already, the app has over 10k downloads on the Google Play Store, and these numbers may increase after this Big Brother Nigeria season. Hopefully, before the show ends, the Abeg team would’ve added upgrades to the app and extend its services to include potential ‘Abeg-gers’ in other African countries.