Dare Adekoya and his team of six want to create a fun community around requesting and sending money in Africa.

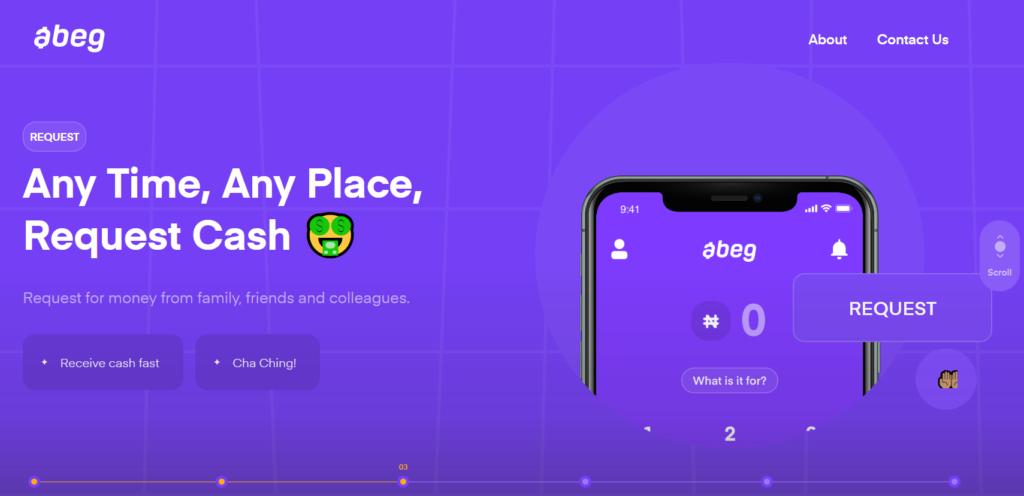

Abeg, their mobile app with a purple and green-colored interface, taps into the cultural sensibilities of one of the most popular words in the Nigerian lexicon. Every Nigerian you know says “Abeg” when asking favours from a friend. At markets and bus stops, Abeg is a neighbourly, non-aggressive way to preface requests to strangers, and friends alike.

What other brand name could be better for an app that lets friends exchange money?

The product idea isn’t entirely original. Adekoya says inspiration for the app came from a friend’s tweet in December 2018 about building a Nigerian version of CashApp, the American app for money transfer owned by Square (the Twitter CEO, Jack Dorsey’s other company).

Also, Adekoya doesn’t claim to be inventing Nigeria’s first ever wallet-type money transfer app. In fact, he pursued the Abeg idea to break the rules with current fintech startups.

“Everybody is just doing boring shit… I’ve never been excited about any app and that’s sad,” he tells TechCabal.

We are speaking over video conferencing on the sixth day after the app’s launch on September 22 (the app first appeared on Google’s Play store on September 4). Adekoya and four colleagues speak from one phone, with the sixth member of staff at another location.

Four young men and two women confident they are about to take over the world.

They are excited about Abeg’s viral moments on Twitter but not surprised. Adekoya believes it’s the fruit of the two years of work that has gone into deliberately designing the app’s emotional and functional appeal.

It’s taken two years to roll out a minimum viable product because different people have joined and left him since he started on the idea. But a serious sprint towards launch began January 1st this year.

The result is an app intentionally designed to please the youngest adult demographic in Nigeria – the generation referred to as the Gen Z (born between mid 1990s up to 2010). But it also caters to millennials already adept to a smartphone-driven digital media lifestyle.

With its constellation of avatars bearing ear and eyebrow piercings, of hair-dying avant gardists and a Hijabi, Abeg’s web page is a screaming declaration: we are THE FUTURE of finance consumer apps. Focus on us.

Is it a Cash App clone though? What makes Abeg relevant to a Nigerian user in a way that is different from Cash App?

To the first, the team says “No” despite the obvious similarities in the logos. Abeg’s goal is to sell payment “experiences not features,” Michael Okoh, the startup’s CTO, says.

Signing up on Abeg with a full name, phone number, email address and password occurs in a matter of minutes. A four-digit PIN and bank verification number are required, but not an account number.

The basic use case right now is to request and send money. To prevent spamming, a user can only request money from an Abeg user on their contact list but can send money to anyone with an Abeg tag.

It seems a single, narrow use case and doesn’t seem tied to an intense, high-frequency need.

But the team doesn’t intend to rest on this basic case. Product features in view include group savings (called “Ajo” in some parts of Nigeria), and fundraising.

Though launched as a peer-to-peer platform, Abeg’s growth may lie in its adoption by small businesses: neighbourhood restaurants, salons and mid-sized supermarts who are familiar with their customers.

Instead of needing an ATM card that may be declined for some reason, you use Abeg.

It remains to be seen how open these small business owners will be to adopt the app. Right now, they either collect payments by cash, bank transfer or cards.

Easy adoption will depend on how comfortable these merchants are with smartphone apps – having to transfer funds from their Abeg apps to the bank accounts for withdrawal might be the big challenge to converting and retaining them.

After two weeks, Abeg has been downloaded over 5,000 times on Play store. It has been updated a number of times to fix bugs, and users are reaching out to the team to create more features. All of this engagement has been generated without any spend on marketing.

No influencers have been paid, but Abeg has creatively added checkmarks to the accounts of people they deem to be influencers. Naturally, such people have been encouraged to share how they use the app on Twitter.

Adekoya is coy on revealing how they hope to make money from the app. For now, gathering a large base of P2P money exchangers is the team’s focus. Okoh doesn’t see any wallet apps as competitors, yet. Abeg hopes to break through the crowd by doubling down on making the experience delightful and visually relatable.

They have certainly attracted a dose of attention most startups can only dream of within the first two weeks of launching.

“I saw purple as an exciting colour, to attract attention. It speaks to royalty and premium [experiences],” Adekoya, whose previous design experience was at a Nigerian bank, says.

The green signifies money and the longing for greener pastures.

It’s still early days but there are similarities between the reception that has been accorded Abeg and some other fintech apps. Paystack and Piggyvest come to mind, but that’s no guarantee of what may or may not become for Adekoya and co.

Psychedelics-inspired trendy digital finance app or not, the young Abeg team still has to do the heavy lifting of figuring out business development. That’s the difference between buzzy pretenders and potential unicorns.

One thing is certain: every Nigerian knows what “Abeg” means. That could count in these young founders’ favour as they push their solution beyond social media to a mass audience.