In Nigeria, wages for formal-sector employees are paid monthly; in the informal sector, however, this is paid daily. Now, when salaried employees go broke between paydays, they have three options: borrow, take a loan, or request a salary advance. But loans, most times, come with exploitative interest rates and salary advance schemes could plunge an employee deeper into debt.

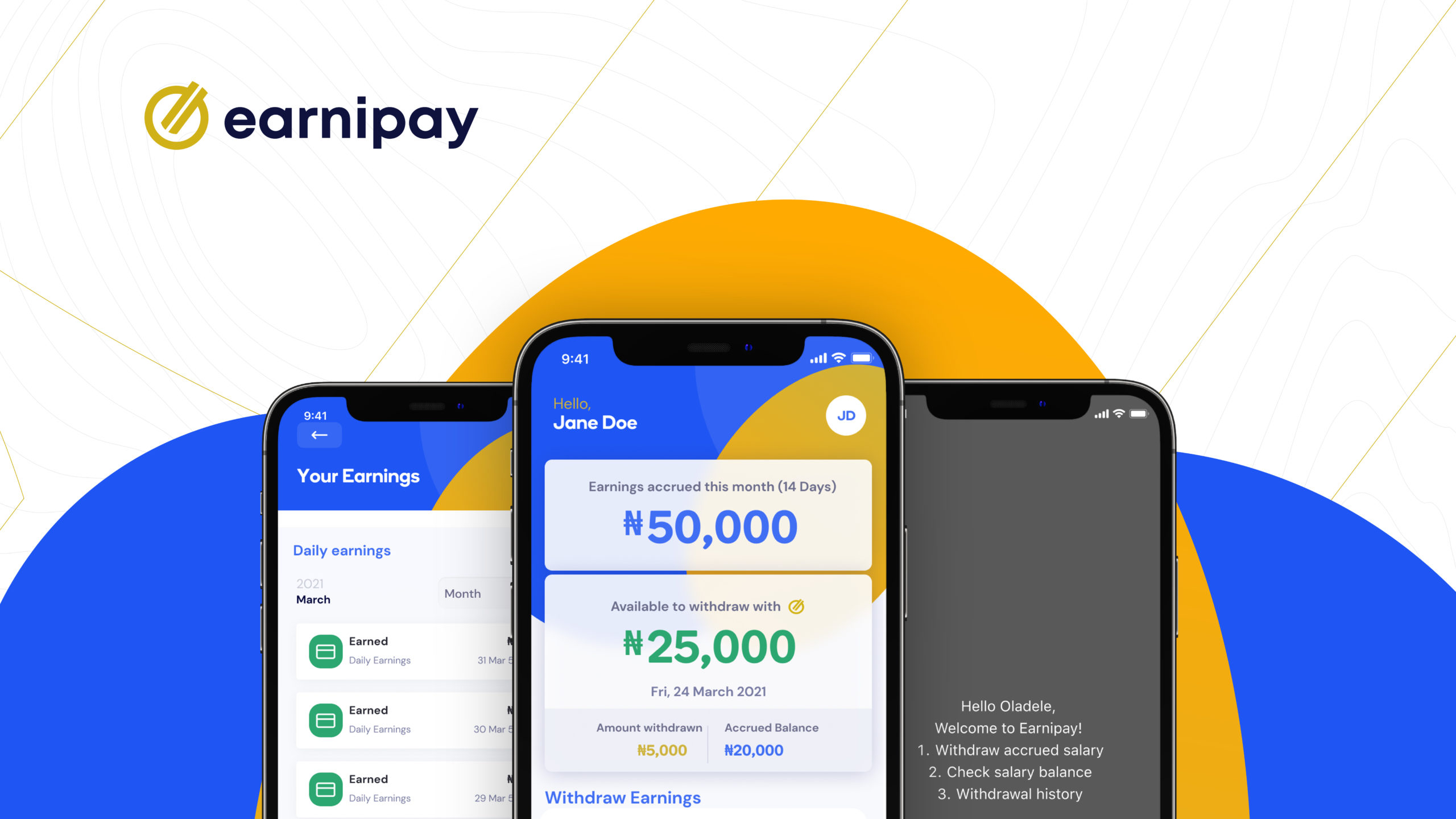

Earnipay, a fintech solution, founded by Nonso Onwuzulike, allows employees flexible access to their accrued salaries on any day of the month.

Revising the payday cycle

In 2019, Onwuzulike started a recycling company in Accra, Ghana, to reduce plastic waste and enable plastic recycling in the capital city. While running the business, he hired waste collectors and placed them on a monthly payment schedule. However, these employees—all of them coming from informal-sector backgrounds—were unhappy about this. They were used to being paid after a job was completed, or at the end of the workday. The monthly payment cycle left them cash-strapped and unable to match their daily expenses to their income. Consequently, once salaries were paid at the end of the month, many of the workers quit the company in search of other employment.

Eager to stem the high attrition rate among the waste collection staff, the company switched from a monthly payment schedule to a flexible one, allowing the workers to be paid more frequently—weekly or bi-weekly. The change increased their productivity and fewer workers jumped ship.

It was a light-bulb moment for Onwuzulike. He went on to survey 100 formal employees within his network to find out how often they ran out of cash before payday and what their employers did to alleviate their financial difficulties.

Onwuzulike’s original intention for Earnipay was to build a salary advance solution—in keeping with similar solutions already in existence in Nigeria, some of them powered by traditional banks. But plans changed when the results of the 100-person survey showed that 90% of salaried employees would rather have flexible access to their accrued salaries.

“People don’t need payday loans or salary advances to fund their lives; they just wish to be paid more frequently,” Onwuzulike said on a call with TechCabal.

Earnipay is currently in beta, with Onwuzulike serving as CEO, Busayo Oyetunji COO, and Joshua Ajayi CTO. As Onwuzulike tells TechCabal, all three of them consider themselves co-builders of the product.

“Works like an ATM”

Earnipay is unavailable to individual employees, so employers need to sign up and onboard their staff. The Earnipay app allows employees to withdraw up to 50% of their daily accrued salary as earned at the time of access, at any time of the month. Earnipay funds the withdrawal.

For example, if one dips into their salary on the ninth day of the month, it means they’re entitled to half the amount they’ve earned for working nine days. At the end of the month, their employer deducts from their salary the amount withdrawn, uses it to refund Earnipay for initially funding that withdrawal, then pays the employee the balance as their salary for the month.

Transaction-fee tiers are attached to withdrawals. Withdrawing ₦5,000-₦10,000 attracts a fee of ₦500, and withdrawing ₦10,001-₦50,000 attracts a ₦1,000 fee.

“It works just like an ATM,” Oyetunji said.

Intersecting the formal and informal workforce

The informal sector makes up about 80.8% of the workforce in urban Africa. In Nigeria where Earnipay operates out of, the sector makes up over 70% of the workforce.

When Earnipay piloted three months ago, Onwuzulike envisaged that the solution would be useful only for low-income staff and informal employees, but the income profile of the app’s users vary, Onwuzulike claims. “One of our customers earns a million naira a month,” he said.

So far, 17 companies have signed onto the app as active users and their employees have used Earnipay over 400 times.

No doubt, there are upsides to shorter payment cycles. For example, an employee can see their salary breakdown from day to day on the app, and unlike a loan or salary advance, which are borrowed funds, an Earnipay withdrawal is earned wages.

Still, some of the threats inherent in loan-taking and salary advances may come up here as well. For instance, an earner who is unable to manage their personal finances may end up dipping into their salary before payday for the most frivolous reasons, and even after receiving their salary balance at month end, may still struggle to control their spending.

Responding to these concerns, Oyetunji said, “The main issue here is, we’re not financially educated. Whether you get your money at the end of the month or access it [daily] as you work, if you’re not financially disciplined, Earnipay may not make a difference to your spending habits.”

Scaling up

At the height of the COVID-19 pandemic last year, Africa’s formal and informal economies took hits. Six percent of formal workers were out of work in Malawi, and in Nigeria, that figure climbed to as high as 45%. Now, as Africa adjusts to the reset forced on the entire world by the pandemic, financial well-being across all employment sectors has become more important than ever. “We’re in a financial health pandemic,” Oyetunji said. “Quality of life is reduced because people can’t fund their everyday needs. How can our expenses be on-demand yet access to salaries earned isn’t?”

The Earnipay team began building the product in July, received pre-seed funding of an undisclosed amount in August, and took their Minimum Viable Product (MVP) to market in September.

Commenting on Earnipay’s plans for 2022, Onwuzulike said, “Our goal is to partner with employers to improve employee financial well-being. We provide tools for income earners to make better financial decisions and improve their quality of life. In addition to flexible salary access, we provide financial education to advise employees on best practices to manage their finances, and other products to assist them daily.”