When it was time to pick a name for their investment company, Jack Knellinger, Dave Richards, and Will Poole knew it had to be one that’d always be relevant to what they do. So, after a bit of back and forth, they arrived at “Capria”, which means capital flow. A befitting name considering that their goal was to ensure that capital flowed from investors to fund managers and startups in need of funding.

The story of Capria Ventures dates back to Knellinger’s transition from being a software developer to exploring what else was out there. He eventually joined Ashoka, which sparked his interest in impact entrepreneurship and building sustainable solutions. At Ashoka, Knellinger learnt how leading entrepreneurs in emerging markets were solving the challenges in their markets while also generating profit and returns for their investors. This experience was his own version of an MBA programme.

Over the next few years, he worked with a couple of acceleration programmes, and that was how met his eventual partners at Capria Ventures— Richards and Poole.

The trio worked together on a couple of projects in the early-stage startup scene over a space of five years before launching Capria Ventures together.

“While I was consulting with startups in the US, Will and Dave, co-founders of the Unitus Seed Fund, a $23 million impact investment seed fund focused on India, reached out saying there was growing interest and activity from startups in emerging markets around the world,” Knellinger said. “We got a sense of this from some early-stage investment funds in India but felt that there were more opportunities beyond India.”

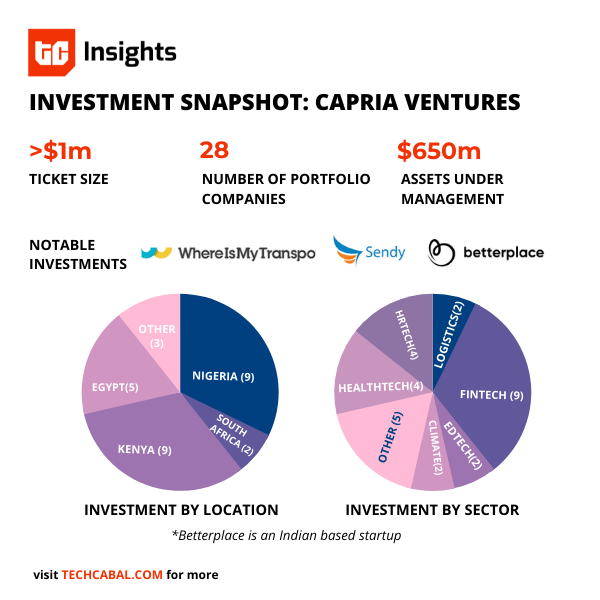

In 2015, they partnered to start Capria Ventures to tackle the issue of unlocking capital for founders across emerging markets. Today, Capria Ventures has investment activity in about 50 countries with $650 million worth of current assets under management.

Daniel Adeyemi: Capria’s approach is different in that it’s an investor that invests in other investors. Did you start out with this approach or did it evolve to this?

Jack Knellinger: We’re a global VC tech investor focused on opportunities across the global south—Africa, Latin America, and South Asia. Yes, our approach is different from the standpoint that you just mentioned. We believe that to really be effective, particularly in the early-stage era, it’s important to have strong local partnerships and relationships with other investors who have the right expertise, cultural context, and knowledge of the regulatory environment. And so the approach that we’ve chosen to take is to back strong fund managers and work in close partnership with them. We invest in their funds and then also invest directly in opportunities within their portfolio alongside them as they’re growing and scaling.

DA: Now Capria has backing from the likes of the International Finance Corporation and Bill Gates, in his personal capacity. But take me back to the beginning: how did you start out?

JK: So, prior to me joining up with Will and Dave, they had launched an early-stage direct investment fund in India, along with another partner there. And so, that was really part of the genesis and inspiration for what Capria has become. The big question for investors like us is always, “Can we find strong fund managers and strong direct and co-investment opportunities to back?”

We got started with what I would consider a smaller pilot fund of $5 million, which allowed us to validate our thesis that there were strong fund managers and strong yields coming out of these emerging markets that are overlooked. After this, we raised what we consider proper fund one, which ended up being around $60 million. And now, we will be raising our next fund, which will be about $200 million.

DA: What do you look out for in fund managers you want to invest in?

JK: As a baseline, we lookout for these traits: learning rate, agility, grit, and integrity. You know this is a business where things are rapidly changing, so these fund managers always have to have that learning hat on, if they’re really going to be successful. And then from there, we look at the background of the partners, in particular their expertise and investing experience. Have they been at present or previous funds? Have they built an angel portfolio? What kind of deals have they done together? How long have they been working together? Do they have complementary skill sets?

In addition to the investing side of things, we also like to see operational experience in terms of the kind of experience they have working with startups, founders, and companies. Next, we look at how their experience matches their strategy for their fund. We’re focused on early-stage/early-growth funds: from pre-seed to Series B as a general kind of rule-of-thumb.

DA: What do you look out for in founders or startups before investing?

JK: Interestingly, I think there’s a parallel between funds and startups. We’re still looking for the same traits: learning rate, agility, grit and integrity. Then, we’re obviously looking at the key performance indicators (KPIs) of the company; how the company is performing against these. Are they delivering on what they said they’re going to deliver? How are they performing compared to their forecast?

When we come in to make direct investments, we invest at a later stage, say Series A or B.

We expect that there’s already a strong product-market fit and strong revenue growth on an annualised basis that could be within the range of 50% or 200%, for example.

Obviously, it depends on a lot of different factors in terms of where the company is in their overall journey. Also, we look at the size of the opportunity in terms of the addressable market. Does the company have the right formula to really have breakout potential? Another thing that’s important to us is whether we can add value. Do we have some expertise to bring to the table? Can we really roll up our sleeves and help support the CEOs and entrepreneurs in ways that are important to them?

DA: Impressive! I’m curious, though: why did you decide to start investing alongside your fund managers?

JK: That’s a good question. If you look at fund managers or funds more broadly, there’s a limit to what they can do, like not necessarily having enough capital to really take up their pro-rata rights. There’s only so much capital that these funds have to deploy.

We view our role as direct investors as being very much complementary to what our fund managers do already, being that we can invest more money at a later stage.

We also think that we add value coming in as a direct investor alongside our fund managers, as we’re able to tap into our global network. We are able to connect entrepreneurs in different countries like Nigeria, Kenya, Egypt, or even India, who may be two or three years further into building their company in a similar domain or similar sector. They’re not necessarily competitive, but they can learn from each other.

DA: What’s your typical ticket size when you invest in funds and startups?

JK: We invest anywhere from $500,000 to $3 million into funds. The reason the range here is wide is because we have smaller funds and larger funds in our network. In startups, we invest anywhere from $1,000,000.

DA: What does providing support for fund managers look like? What do they typically reach out for?

JK: I’ll probably put these in three buckets. Obviously, the main thing top of mind is fundraising—helping them close their fundraising. Here, it involves everything from introductions to reviewing pitch materials. We look at how the funds are being positioned as well as the terms and negotiations with limited partners to ensure there’s alignment between the fund managers, general partners, and limited partners.

As soon as the fundraising is done, we move to portfolio management. How are they putting in place the right systems and processes to grow, scale, and institutionalise the firm? Here, there’s a wide range of things to be done in that regard, from team development to appropriately conducting due diligence before investing. When the fund managers have built up their portfolio of companies, we move to how they think about exits. What’s the right time to exit? Do they want to look at partial exits?

When a firm has mastered these aspects and gone on to raise multiple funds. We look at how they’re telling the story of the firm and the funds you’ve managed.

On the entrepreneurial side, we ask, “Are there business development opportunities?” What connections can be made to other investors for future rounds? Where were they looking at scaling and expanding the business? And are there things that we could do to make that more efficient, more seamless, or gain traction?

DA: You’ve been investing and supporting startups for about a decade now. Are there any notable achievements or lessons learnt along the way?

Yes, we’ve learnt a lot in the past six to seven years. We view it as a mutual learning process in terms of our partnerships and relationships with fund managers, as well as with CEOs and entrepreneurs directly. Here are a couple of things that I think stand out.

One, fundraising is difficult. Obviously, we’re in a pretty unique phase right now where there’s quite a bit of capital flowing to startups. But from a fund standpoint, it takes a big lift to get going. We’ve noticed a lot of times that fund managers underestimate the time that it’s going to take to get a fund up and running. And that’s particularly true for first-time managers as there are reservations among some investors when it comes to first-time fund managers.

I think the second thing we’ve had to learn is the “right formula” in terms of what to look for across the team dynamics and what it’s going to take to ultimately be successful. We’ve continued to adapt how we approach everything from selection to portfolio management.

The third thing is, that the opportunity that we were keen on and excited about six to seven years ago has continued to evolve. It is even more exciting in terms of the attention that both funds and entrepreneurs in emerging markets around the world are finally garnering. The fact that things are really taking off in terms of the local funds and local entrepreneurs shows that we’re on the right path.