IN PARTNERSHIP WITH

Good morning 🌄

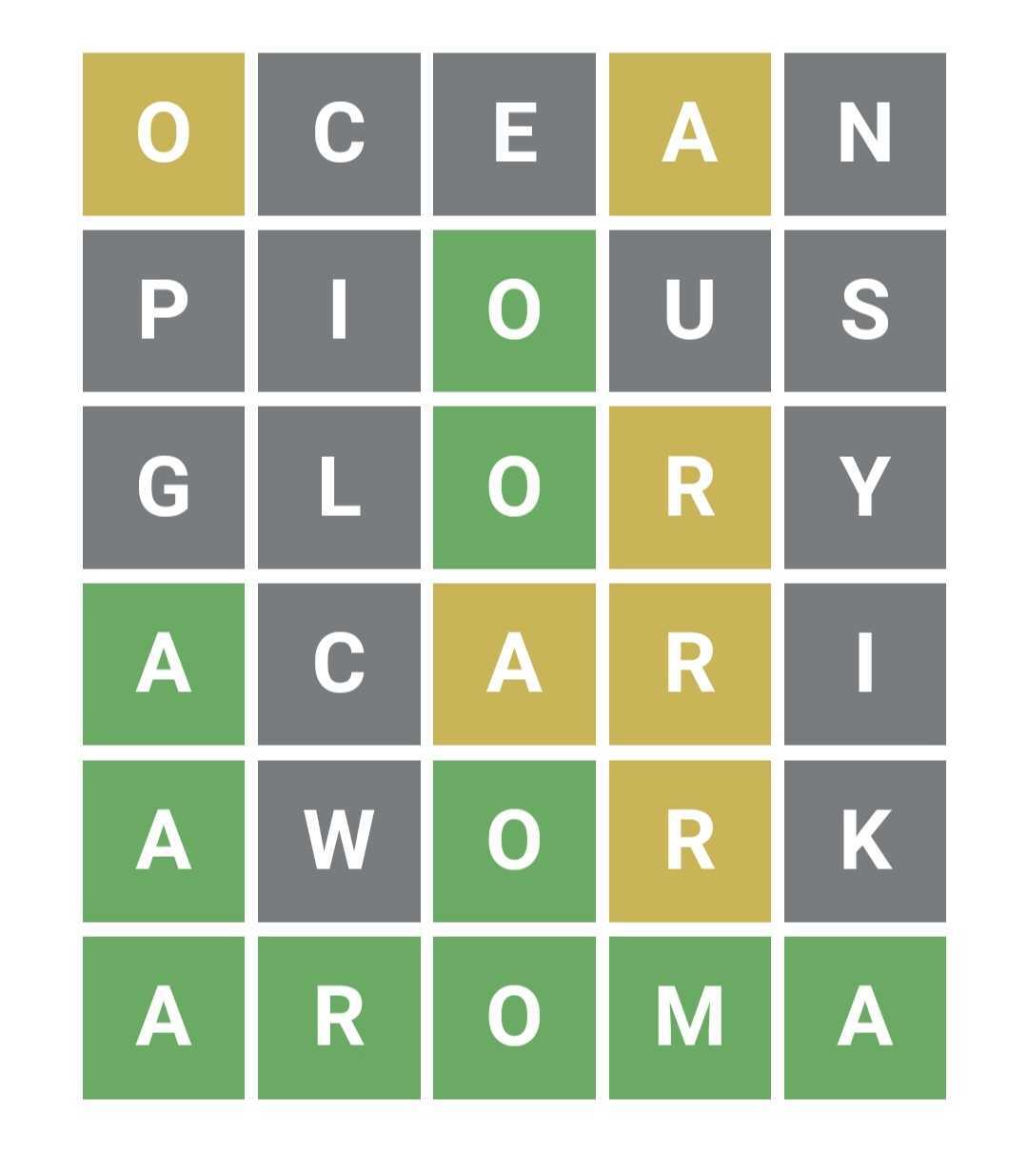

Did Wordle get harder?

Since its acquisition by The New York Times kicked in, many players of the beloved word game are reporting that it’s becoming harder to guess the words.

NYT has denied making any changes, and some experts agree. Some say that people may just be looking for a pattern where there is none.

All I know is that it took me all 6 guesses to spell “aroma” yesterday, and I’ve never gotten to 6 guesses before. It’s also possible that I was recovering from Valentine’s horror. Has Wordle gotten harder for you?

In today’s edition

- Why Paystack’s CEO is building a football club

- EU launches a $169 billion investment plan in Africa

- Ghana wants to tax online businesses from 2022

- Stitch raises $21 million

- Opportunity: FAVE-YC 2.0

WHY PAYSTACK’S CEO IS BUILDING A FOOTBALL CLUB

On Sunday, a few hundred fans gathered at the Teslim Balogun Stadium in Lagos, Nigeria, to witness the launch of a new football club, Sporting Lagos FC.

What’s kicking?

If you’re wondering why Sporting Lagos is news, it’s because it was founded by one of Nigeria’s most successful fintech founders, Paystack’s Shola Akinlade.

The club was announced last Thursday, ahead of its campaign into the 2021/2022 season of the Nigeria National League which kicked off last December.

According to Akinlade, the club is inspired by a commitment to deepen his involvement in the community, a commitment he settled on when his father died in 2021.

While he will continue to focus on Paystack’s accelerated growth, Akinlade plans to “provide most of the financial investment necessary to get this off the ground” while a full-time team shoots for the win.

The goal?

To take sports with an entrepreneurial spirit, and improve the lives of the players, sponsors and fans.

Sports, football especially, is a lucrative business and more tech companies are betting on it for visibility. For example, Spotify is finalising a $320 million deal with FC Barcelona that will see the club’s stadium renamed after the streaming app. At the recently concluded African Cup of Nations (AFCON), TikTok and Binance were among the top sponsors. At Sporting Lagos’ first game, banners from apps like Piggyvest and Helium Health encircled the stadium.

Sporting Lagos also hopes to help Lagosians identify strongly with national clubs the same way Europeans identify with their indigenous clubs. While national teams have strong followings, state clubs do not. To achieve this, Sporting Lagos has a founding member option for a one-time fee of $120 where members can get access to future events of the club.

For players, the club plans to create an academy that will build players and provide a player sales option in the future.

Editor’s note: If it appears that some of the metaphors/puns used in this piece are peculiar, please know that it is because this writer knows next to nothing about football, and for the life of him does not know why people sit in the sun to watch other people play with balls. TechCabal’s newsroom has summarily shunned the writer for such disgraceful ignorance, ugh.

Send and receive Naira, Cedis, Rand, Shilling, USD, Euros and other currencies directly to your mobile wallet, bank account, Barter wallet or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

EU LAUNCHES A $169 BILLION INVESTMENT PLAN IN AFRICA

The European Union has launched a new investment package worth €150 billion ($169.67 billion) for Africa to create an alternative to the “unfavourable and opaque Chinese funds”.

The European Commission President Ursula von der Leyen announced the investment plan at a news conference in Dakar, Senegal, last week, with Senegalese president Macky Sall.

This investment is half of the EU’s €300 billion Global Gateway scheme, which was launched in December last year. It will be disbursed over the next 7 years to finance internet infrastructure, renewable energy, agriculture, mobility, and more across the African continent.

How unfavourable is Chinese funding?

Since 2013, China has entered agreements with many nations in sub-Saharan Africa as part of its Belt and Road Initiative—a global infrastructure initiative that’s seeing China investing in railway, highway, and port projects.

Presently, China has invested over $43 billion in Africa, with loans from China to Africa estimated at $150 billion from 32 countries.

While the loans themselves are helping development, concerns about repayment bring up questions. China’s willingness to renegotiate loan terms and the transparency of the process are both in question. Uganda, for example, risks losing control over its Entebbe Airport if it is unable to repay a $320 million loan by 2035. Sierra Leone also cancelled a loan agreement in 2018 due to “uneconomical terms”.

How will the EU’s package work?

Though the complete disbursement plan hasn’t been revealed yet, however, at the launch of the Gateway fund in December, the EU said the investment would come in the form of grants, loans, or guarantees from EU institutions, governments, EU financial institutions, and national development banks.

Also according to Reuters, an EU source said “the €150 billion could come in payments of €20 billion per year, of which only €6 billion would come from EU funds and the rest from EU states and private investors”.

How do you think this will play out? Will it scale to become a solution or a bigger problem than the one it aims to solve?

At Busha, we want everyone everywhere in Nigeria to have access to crypto. That’s why you can buy as low as ₦250, set recurring buys, get the best rates, and soon 🤐 on Busha. Join 300,000+ Nigerians already using Busha.

This is partner content.

GHANA PLANS TO TAX ONLINE BUSINESSES

2022 is shaping up to be a difficult year for online businesses and even consumers in Ghana.

What’s Ghana happen?

Well, first there’s Ghana’s e-levy bill which imposes a 1.75% charge on all electronic transactions. According to Finance Minister Ken Ofori-Atta, the country is imposing the e-levy to “widen the tax net and rope in the informal sector.” Many, however, believe that the government is just eying its share in Ghana’s billion-dollar e-transaction market.

The bill was supposed to kick off this month but has received stiff opposition from the public; there are presently protests in Ghana from citizens who have demanded that parameters be put in place to ensure fairness.

More recently, the country announced plans to start taxing online businesses.

How’s this different from the e-levy?

Well, the levy taxes users while this new tax has online business owners as its mark.

The Ghana Revenue Authority (GRA) revealed that it would start taxing betting, gaming, and e-commerce companies from the second quarter of this year as the agency aims to generate up to GHC 2.7 Billion ($400 million) from taxes this year.

Affected companies will include online foreign entities like Facebook, Tiktok and Twitter, and local startups as well. Multiple reports suggest that after talks with the GRA, some of the companies have already started registering within Ghana to comply with the new tax policy.

Per Edward Gyamerah, the GRA’s Commissioner of the Domestic Tax Revenue Division (DTRD), the tax agency is developing a system, which is currently under test trial, that will help it monitor operations of online companies.

“The plan is to deploy it in the second quarter of 2022,” Gyamerah said. “We appeal to the players and other stakeholders to support the authority to collect the right taxes due to the state.”

Big picture: Here’s one of the few things that will probably happen after the implementation of both these taxes: service charges for online businesses and transactions will increase, and internet or mobile money penetration rates will slow down. The government can, however, implement tax exemption for new cm=ompanies who are just finding their feet.

Fincra is a payment infrastructure that provides fintechs, online platforms, and global businesses with reliable payment solutions for quick collections and payouts in different currencies. You can gain access to Fincra’s payments platform or integrate their APIs for seamless payments processing.

This is partner content.

STITCH RAISES $21 MILLION

Stitch, a South African API fintech company, announced on Monday that it had closed a $21 million Series A funding round led by The Spruce House Partnership.

The funding round also saw participation from PayPal Ventures, TrueLayer, Firstminute Capital, The Raba Partnership, CRE Venture Capital, Village Global, Zinal Growth (the investment vehicle of Checkout.com founder Guillaume Pousaz) and others, including founders of Chipper Cash, Quovo, and Unit.

A stitch in time

Founded in 2019, Stitch offers data and payments solutions that reduce the effort required for businesses to connect to their users’ financial accounts and enable bank-to-bank payments without leaving the existing app interface. Its infrastructure-led approach supports several use cases, including KYC and onboarding, personal and business financial management, lending, wallet top-ups, e-commerce checkouts, and more.

Stitch exited stealth mode in 2021, with the close of a $4 million seed round, and a $2 million extension round in October when it expanded into Nigeria. The company has also partnered with fast-growing businesses like Luno and Chipper Cash.

In the last quarter alone, the company said that it saw 44% month-on-month (MoM) customer growth and a 72% MoM increase in linked financial accounts on the platform. It’s had 104% MoM growth in payments value since launch.

Moving forward: Stitch plans to push its new investment towards launching new product offerings like financial graphs, an infrastructure for financial building blocks that can interoperate across regions, providers, banks, and other types of financial accounts, allowing businesses to write code once, launch in multiple markets, and scale more quickly. The funding will also be going into significantly expanding the team and entering new markets.

OPPORTUNITY: FAVE-YC 2.0

In July 2021, Future Africa launched FAVE-YC to help ambitious and mission-driven African founders get into Y Combinator. FAVE-YC 1.0 supported selected founders with thorough application reviews, mock interview sessions, business model reviews and recommendations to YC.

Of the 29 applicants accepted into FAVE YC 1.0, 13 got an interview invitation, and 4 were accepted into YC. That’s an acceptance rate of over 13%, and comparing this to YC’s 2-3% acceptance rate, this means that startups who work with FAVE YC are >4 times more likely to get into YC.

If you’re an African founder looking to apply and get accepted into YC’s 2022 summer batch, Future Africa will provide all the help, resources and networks you need for your application.

Apply here.

Applications are open to post-launch startups only and close by Monday, February 28, 2022.

What else we’re reading

- The Next Wave: How can Nigeria solve its talent problem?

- Why Africa will be the world’s fastest-growing video game market.

- Here’s what actually happens to all your online shopping returns.

- Intel buys Tower Semiconductor for $5.4 billion so it can make more chips for other companies.