Buy now pay later (BNPL)—a short-term consumer financing that allows shoppers to purchase products online and pay in installments with nominal or no fees—is sweeping the global e-commerce sector. Afterpay, Klarna, Affirm, and Zip are some of the players leading this charge while tech and payments giants Apple, Square, PayPal, and Visa have their respective BNPL initiatives as they look to get a slice of the action.

In Africa, BNPL activity is beginning to take shape and one of the pioneers in this space, CredPal, on Tuesday announced that it’s raised $15 million in a bridge round comprising equity and debt. This will be used to expand its consumer credit offerings in its home country, Nigeria, and scale across Africa.

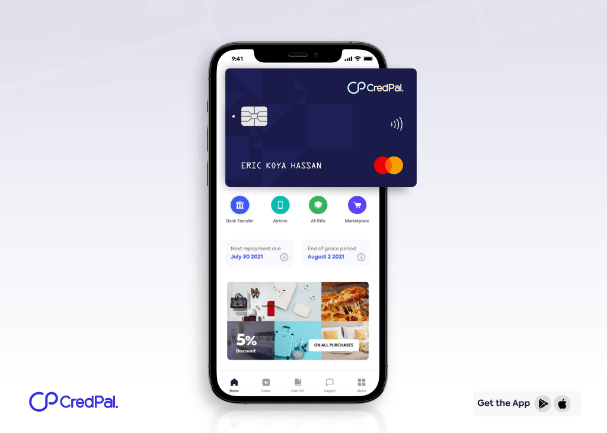

Launched in 2018 by CEO Fehintolu Olaogun and COO Olorunfemi Jegede, Y Combinator- and Google-backed CredPal allows individuals and businesses to pay for purchases in instalments across online and offline merchants, for both large and small-ticket items—from as low as ₦2,000 up to ₦5 million. CredPal claims to have over 85,000 active customers and more than 4,000 active merchants.

In addition to providing infrastructure that allows banks and other financial institutions to deliver consumer credit in real-time, CredPal offers its customers access to credit cards, which was launched in November 2020.

“What we’ve done is encapsulate the lifestyle of the average working-class Nigerian and ensure that every person can find something specifically for them on CredPal,” Olaogun said in a recent interview. “For instance, a professional who earns ₦250,000 can get a credit card with a limit that they can pay back at the end of their billing cycle or use it to buy now and pay later.”

With the new funding, the startup plans to extend partnerships with merchants through its recently deployed CredPal Pay, an omnichannel merchant suite that allows businesses seamlessly accept buy now, pay later. The point-of-sale infrastructure enables BNPL through various means, including a credit payment link, checkout plugin, QR codes, and a transaction management system.

“Our commitment to better credit facilities for African consumers and helping sellers grow their sales is getting a huge boost with these latest milestones,” Olaogun says in a statement.

The latest funding brings the total investment secured by CredPal to $16.7 million, per Crunchbase data, having previously raised $1.5 million in 2020, part of which was used to roll out its credit cards.

Participating in this bridge round are existing investors, including Greenhouse Capital (which is also an investor in Kenya’s BNPL startup Lipa Later), as well as new backers including Uncovered Fund, LongCommerce, First Circle Capital, and Adii Pienaar, co-founder and former CEO of WooCommerce. Meanwhile, a number of undisclosed financial institutions provided the debt facility.

The funding announcement coincides with a new partnership with Airtel Nigeria to enable consumers across Nigeria to access BNPL to own smartphones and broadband modems, CredPal says, without sharing specific details about the deal.

The fresh investment will also support the startup’s planned expansion across Africa, starting with Kenya, Egypt, Ghana, and Cameroon, the company said.

With the bulk of African consumers severely starved of efficient and sustainable credit solutions, the BNPL movement is waxing strong across the continent and so is the competition among players.

Lipa Later is one of the early companies in the space in Kenya and there is M-Kopa—which has since expanded into phones and retail products—in Kenya, Uganda, and Nigeria. CDCare, PayQart, and Carbon also play in Nigeria. And in South Africa, there are PayJustNow and Payflex. The latter was recently acquired by Australian BNPL Zip.

While competition appears to be heating up, there is a significantly large market of consumers and merchants to be tapped. But success will largely be determined by how effectively players can drive the adoption and use of credit financing and cards by African consumers.

If you enjoyed reading this article, please share it in your WhatsApp groups and Telegram channels.