The expression “buy the dip” can be used to describe a fundamental investment approach. This does not imply that you should go “all in” when an asset’s price is falling low; rather, it implies that you should average in as the price falls and/or buy after the price has settled.

This method is also far safer to utilize when the market is bullish, in a condition of stagnant economy or when the main trend is up or sideways, rather than in a volatile market.

So, if passive income starts with smart investments, buying the dip in today’s market seems to be the best possible move for a thriving digital wallet.

“Buying the Dip” Strategy

– Accumulate little amounts of the cryptocurrency when the price falls, building up an average position with the goal of purchasing more as the price falls even further. This allows you to create an average price instead of hitting volatile spikes;

– Keep your money in the bank until the price has stabilized, and possibly even begun to recover, and then buy – this is called buying a reaction off of support;

– Allow for the fulfillment of buy orders at lower prices. Setting buys immediately before historical support levels, massive “buy walls,” and psychological levels are particularly effective approaches in the stock market (because prices tend to make at least a brief recovery from these levels).

“Buy the Dip” – Ethereum (ETH)

Is it worth it to buy the dip? The on-chain analysis is a critical tool for distinguishing between the speculative and the utility value of a cryptocurrency. Many measures are showing bullish signs right now.

The on-chain metrics of Ethereum appear to be extremely strong, despite the aggregate cryptocurrency market’s somewhat sluggish start to 2022.

Since the beginning of the year, the usefulness and acceptance of Ethereum (ETH) have increased significantly, owing to enlarged capital inflows and on-chain activities.

As a result of Ethereum’s undervalued fundamentals and its present price of 2.761.35, which is well below its all-time highs, the present could be the best moment to buy the dip before the second most prominent cryptocurrency launches its next bullish surge (The Merge).

Ethereum (ETH) Merge

The ETH Merge is expected to take place later this year and with it, the major business route in cryptocurrencies will be enhanced and improved at its very core.

In particular, Ethereum is poised to undergo the most significant change in its almost two-decade history: it will transition from its current PoW (proof-of-work) consensus method to a PoS (proof-of-stake) mechanism. The great news is that the transition to Proof-of-Stake technology will lower the network energy consumption by a minimum of 99.95 percent.

Visit the official website at https://ethereum.org/en/ to learn more

“Buy the Dip” – Seesaw Protocol (SSW)

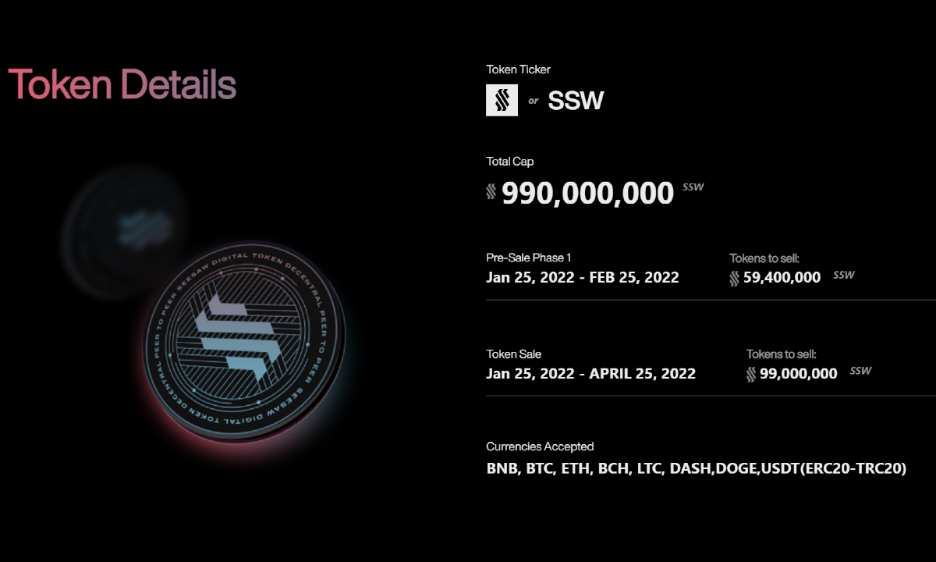

Seesaw Protocol (SSW) is an ecosystem comprised of multi-chain DeFi technologies, protocols, and use cases. It is represented by the ticker symbol SSW and operates on the Ethereum blockchain. SSW, being a multi-chain protocol, has intentions to be implemented on a variety of platforms, including the BNB Smart Chain and Polygon.

Seesaw Protocol (SSW) is a blockchain-based service that offers a variety of services to users that want to take advantage of the trustless, low-fee, and decentralized range of services that the blockchain has to offer.

It is a full-on-chain liquidity protocol that may be deployed on any blockchain that supports smart contracts, including the BNB Smart Chain, the Polygon blockchain, and Ethereum. It can serve as an endpoint for automated market-making (buying and selling tokens) in the context of a smart contract.

An important purpose of the project is to disrupt the old way of engaging with and thinking about cryptocurrency by remodeling education while simultaneously developing a platform to promote education and cryptocurrency to people all over the world, as well as to ensure financial and technology literacy among all members of society.

Seesaw Protocol’s native utility token SSW can be purchased on PancakeSwap (V2). The current market price is $0.012

Seesaw Token has a total market capitalization of $ 990,000,000 at the moment.

On April 8, 2022, the token presale came to an end and the market trends made the value dip. Right now investors are buying the dip – like they’re doing for ETH and BTC as the analytics still show growth potential.

Visit the protocol’s official website at https://www.seesawprotocol.io/ to learn more

“Buy the Dip” – Bitcoin (BTC)

Bitcoin (BTC) reached a high of $50,000 for the first time on December 27, 2021. Five months later, the “first” cryptocurrency is trading at $37,948.63 way below the $40.000 mark. However, investors and analysts remain quite positive that inflation has hit the critical threshold to initiate BTC acceptance.

There is no way to anticipate what would ignite a Bitcoin bull run. However, with “a considerable volume of coin supply” amassing around $45,000, traders and analysts still think that BTC can hit $50,000 by the end of summer 2022. If that’s the case, then buying the dip might mean millions for investors who still believe in Satoshi Nakamoto and his genius.

Visit the official website at https://bitcoin.org/en/ to learn more

KEYWORDS: Buy the Dip, Seesaw Protocol, SSW, Bitcoin, BTC, Ethereum, ETH, Market,