IN PARTNERSHIP WITH

Good morning 🌞

The iPod will soon be no more.

Yesterday, Apple announced that it will be discontinuing the iPod touch, the last remaining model of its dedicated music player.

iPods were launched 20 years ago, when dedicated music players, wired headphones, and Blackberry phones were still helpful products. But as phones grow in sophistication, single-use digital products have outperformed.

The iPods era might have come to an end, but Apple has noted that its spirit lives on in all of its devices that play music, such as the iPhone, iPad, and HomePod Mini.

In today’s edition

- Uganda says no to crypto

- Airtel Africa partners with WorldRemit

- Another innovation hub for Kenya

- Manara raises $3 million

- Event: How investors are betting on early-stage companies in Africa

- Opportunities

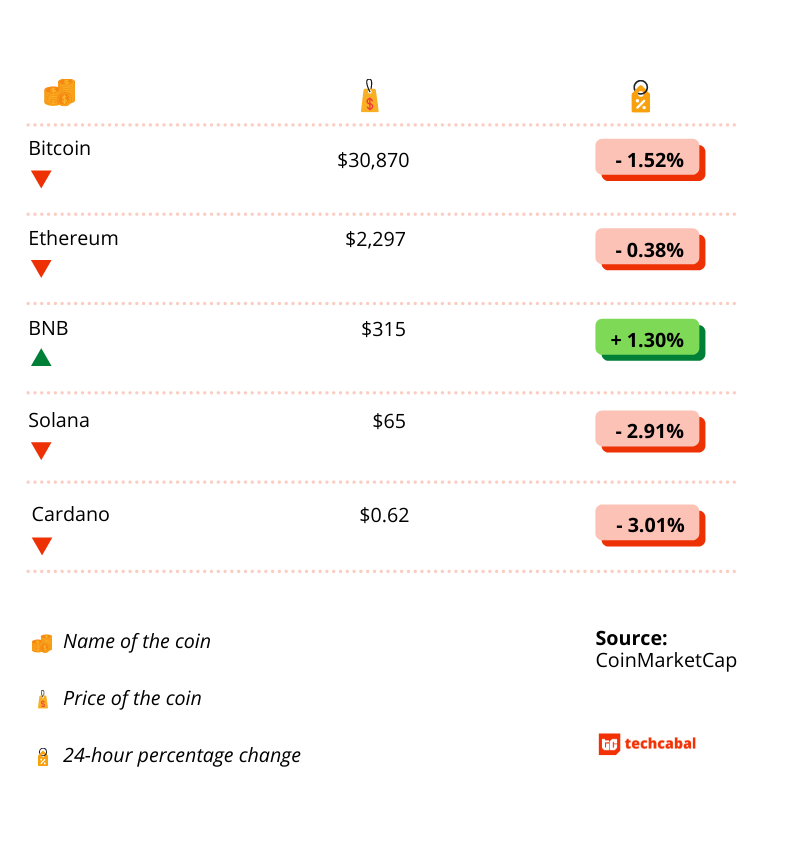

UGANDA SAYS NO TO CRYPTO

Uganda is shunning CAR, and following in Nigeria’s footsteps.

What’s up?

It’s clamping down on cryptocurrency trading.

Recently, the Bank of Uganda (BoU) issued a warning to all payment service providers, prohibiting them from any form of crypto trading in the country. The bank stated that it had not licensed any company to offer the services, and any provider doing so is performing an illegal act.

“Bank of Uganda has noted press reports and adverts advising the public that they can convert cryptocurrencies into mobile money and vice versa. We are also aware that such a conversion cannot happen without the participation of the payment service providers and or payment system operators. This is to advise that Bank of Uganda has not licensed any institution to sell cryptocurrencies or to facilitate the trade in crypto-currencies,” the statement read.

Why is the BoU saying this now?

BoU has revealed that crypto transactions have opened up the country to an increase in fraudulent transactions and scams.

From 2018 till date, Ugandans have reportedly lost $1 billion to crypto-related scams. Last year, the ill-fated Dunamis Coins cost 5,000 victims $2 million. Five other crypto firms, including Global Cryptocurrencies, Finetergy, and Fital Science, also vanished with $26 million Ugandans had wanted to invest in crypto.

Since the pandemic, crypto scams have been on the rise in Uganda—as with many other countries—but are bans really the way out?

With its recent statement, the BoU has also reinforced its 2019 position that Uganda does not recognise crypto as legal tender.

The country is reportedly moving to update its Anti-Money Laundering Act to include providers of virtual assets such as crypto, as persons who can be liable for money laundering.

Zoom out: Seems like African countries are addressing crypto the same way parents address the topic of sex to children: they don’t. It’s arguable that the best way to beat the rise in scams is by increasing awareness of crypto and providing legal channels. People are increasingly using crypto, the numbers don’t lie. Is the best way forward banning trading within legal entities?

Don’t just send money, send money fast. Send and receive money directly to mobile wallets, bank accounts, Barter or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

AIRTEL AFRICA PARTNERS WITH WORLDREMIT

Tanzania’s $54 million mobile money market is receiving a boost.

Yesterday, Airtel Africa announced a partnership with global payments service, WorldRemit. The partnership will allow Airtel Money users in Tanzania to send and receive money from over 50 countries from their mobile money wallets.

About 45% of Tanzanians use mobile money frequently; that’s at least 23 million people across urban and rural regions who will have access to better remittance services. Airtel isn’t Tanzania’s biggest mobile money service provider though, as Tigo Pesa and Safaricom lead market shares. It is, however, the first to link its users’ mobile money wallets to WorldRemit.

Before the partnership, Tanzanians had to be present at banks before they could receive or send through WorldRemit—same as most African countries where WorldRemit is present. The new partnership cancels these bank trips and makes the process faster and cheaper for users.

Its partnership with Airtel Money isn’t WorldRemit’s first tango with mobile money services on the continent. In Uganda and Rwanda, WorldRemit has similar services that let users send and receive money via their mobile money wallets.

If there’s one hitch to this partnership, it’s that users will need smartphones and internet to access this new service. But it shouldn’t be a problem for Tanzania where 95% of the population reportedly has access to the internet.

More e-money news

In other news regarding e-money, Tanzania may also be closer to releasing its own central bank digital currencies (CBDC).

Last year, after Nigeria’s launch of the e-naira, the Bank of Tanzania governor, Florens Luoga, shared with Bloomberg that the country had begun preparations for its own CBDC, in response to the rising adoption of cryptocurrency there.

On Monday, the governor revealed that it’s closer to the goal and has now sent delegates to countries implementing CBDCs—including Nigeria—in order to gather key information.

Zoom out: Tanzania may be making strides with mobile money but it’s still stagnant with other digital currencies. The governor states that Tanzania is developing its own CBDC as a “safe alternative to crypto”, but anyone who knows anything about digital currencies knows that this is probably the most unwise reason. Easy remittance may be a driver for crypto adoption on the continent, but the real motive is the insurance crypto offers against fiat currencies. A Tanzanian CBDC would be equal to the Tanzanian shilling, and unless sub-Saharan Africa solves intra-country remittance, users will still have the same problem: difficulties in sending the shilingi to anyone outside Tanzania.

ANOTHER INNOVATION HUB FOR KENYA

NEAR Foundation, the Swiss non-profit overseeing the governance and development of the NEAR protocol, has launched a blockchain innovation hub in Kenya. The new hub has been launched in partnership with the blockchain community Sankore and will be led by Kevin Imani, the founder of Sankore.

Competing with major blockchains like ethereum, NEAR Protocol seeks to address the scalability issue. Web3 adoption has been hindered by high fees, relatively low speed, and threats to the earth’s climate. Unlike other networks, NEAR allows software developers to easily create new crypto applications, from Non Fungible Tokens (NFTs) to decentralised finance products. With NEAR, developers can also launch new business models and consumer products.

Excited by the potential avenues throughout Africa for blockchain solutions, Marieke Flament, CEO of the NEAR Foundation said, “The hub represents a unique opportunity to partner with local talent not only for the opportunities that exist today but also for the opportunities yet to be created in the future.”

What is brewing in Kenya?

Cryptocurrency adoption in Africa increased 1,200% from July 2020 to June 2021, and Kenya reportedly ranked 5th in the world—and first in Africa.

There has been a growing appetite among sub-Saharan African youth for technical training and education opportunities. In response, the Kenyan Ministry of ICT, Youth Affairs, and Innovation created a national digital master plan to revolutionise its ICT sector.

In the past weeks, big tech companies have been taking turns launching new hubs in Kenya. Global payments company Visa opened its first African Innovation Studio in Nairobi, Kenya. Microsoft opened its first Africa Development Centre in Kenya and Nigeria. In addition, Google recently announced that it will soon launch its first African product development centre in Nairobi, Kenya.

What’s brewing in Kenya? Looks like a digital revolution, and competition for Lagos, Nigeria.👀

Payment collection just got easier on Fincra!

Receive payments from your customers via debit/credit cards or bank transfers and settle these payments to your Fincra wallet or your bank account.

Create an account in less than 2 mins and Try the Fincra checkout here.

This is partner content.

MANARA RAISES $3 MILLION

Female-led ed-tech startup Manara has raised $3 million in a pre-seed round led by Stripe. Also participating in the round are LinkedIn founder, Reid Hoffman; Y Combinator founder, Paul Graham; Lean Startup founder, Eric Ries; and founder and CEO of Careem, Mudassir Sheikha.

Backstory: Founded last year by Iliana Montauk (CEO) and Laila Abudahi (CTO), the startup offers training in computer science to qualified applicants. While its students do not pay any tuition fee, they are required to commit to Manara 10% of their salary in their first 2 years of employment.

Manara says 86% of its trained engineers receive job offers within 5 months of graduating. Seventy-one per cent of its alumni have reportedly been deployed to big tech companies like Meta and Google across Europe and the S. Others get up to a 300% pay hike after the training. Committed to diversifying the gender of the talent pool, 43% of its engineers are women.

Manara plans to use this investment to scale its training capacity from 60 engineers per year to 6,000. The team also plans to launch a self-service product for interview practice, networking, and mentorship that can reach millions of software engineers.

Silicon valley is hungry for more Andelas

Investors are searching for the new Andela, and Manera might be it.

The startup reportedly attracted more investors than it wanted. Seedcamp managing partner, Carlos Espinal, said the edtech’s location in the Middle East and North Africa makes it an apparent fit for Silicon Valley because of their proximity and time zones. It should be noted, however, that earlier this year, Nigerian edtech AltSchool raised $1million pre-seed to build an alternative school for raising African tech talent.

Considering the calibre of investors that participated in this funding, can we assume that Silicon Valley is increasingly interested in tech solutions that offer access to highly skilled talent from emerging markets?

If this is true, edtech may attract more funding than the 3.6% of tech investments it attracted last year.

EVENT: HOW INVESTORS ARE BETTING ON EARLY-STAGE COMPANIES IN AFRICA

Today, we’re discussing early-stage investment in Africa.

In the early-stage investment report we launched on Monday, we found that there has been a dramatic increase in the investment size required by early-stage startups. Prior to 2020, pre-seed and seed funding used to range between $200,000 to $2 million. Recently, we’ve seen startups raise between $3 million to $17 million in early-stage rounds. Are African startups needing more runway funding or is there just enough funding to go around?

In partnership with Future Africa and The Baobab Network, TechCabal Insights is hosting a webinar to discuss the findings from the report today with Zachariah George, Managing Partner at Launch Africa, and Yvonne Johnson, Founder/CEO at Indicina, at 5 PM WAT.

Join us as we dive into the report together to understand how Africa’s investment landscape will fare in the future and how we can prepare for it.

Intercom’s platform helps you engage and support your users through personalised chat-like experiences, with over 25,000 companies using it every single day.

If you’re an early-stage, high-growth start-up, you can get access to its Early Stage Academy today at a 95% discount!

This is partner content.

OPPORTUNITIES

- The Seedstars Migration Entrepreneurship Prize 2022 is now open to Applications. Twenty startups from the Middle East and Africa (MEA) region harnessing the positive benefits of migration will get to join the Seedstars Investment Readiness Programme, join the Online Seedstars World Competition activities, and access increased visibility. Move it!

- The Last Mile Money Startup Accelerator is now open to ventures working at the intersection of last-mile users and financial empowerment. Selected startups will receive design support, access to Last Mile Money’s network, and up to $50,000 in equity-free grants. Apply here.

- Applications are now open for the 2022 Africa’s Business Heroes Prize Competition. Ten outstanding entrepreneurs across the continent will get to share a myriad of prizes including access to a community of international leaders and a $1.5 million grant. Co-founders of African origin can apply or be nominated for the prize here.

What else we’re reading

- Introducing SpaceNXT—the co-working hub leading the charge for innovation and technological advancement in Nigeria.

- Nigeria’s 54gene completes initial phase of the $100,000 Genome Project.

- Kenya Power will spend more than $1 million on legal fees in tariff negotiations.

- Capitec Bank partners with nCino to drive digital business banking innovation.

- The Wireless Access Providers Association (WAPA) is calling on the South African government to open the 6GHz band to wifi.