IN PARTNERSHIP WITH

Good morning 🌞

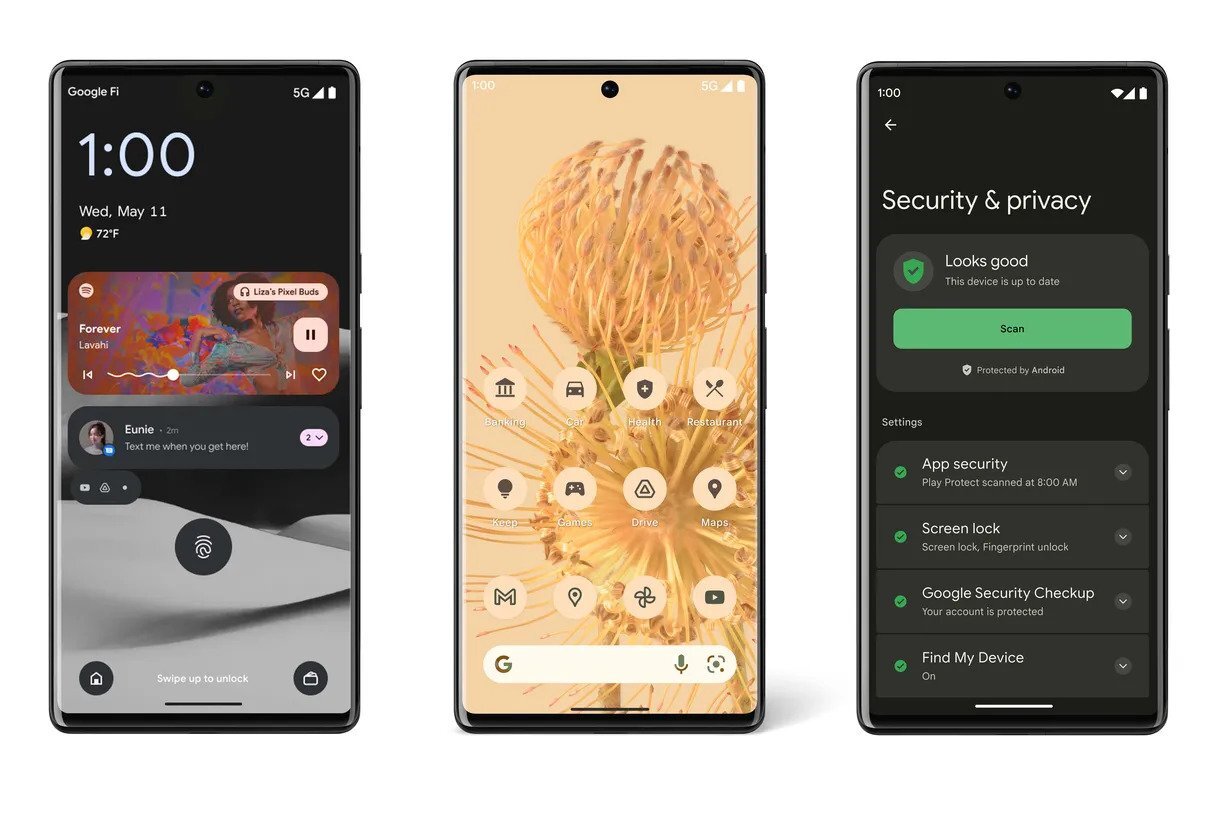

Yesterday, Google held its annual developer conference, I/O 2022.

Here are the highlights from the event:

- As expected, Android 13 has been announced with customisations that focus on privacy and user safety. There are also optimisation updates like the Material You colour schemes which will cover third-party apps so your phone can stop looking like a superstore. Users will also be able to select language on an app-by-app basis.

- Google is launching My Ad Centre, a feature that gives users control over ads they see on all Google services including YouTube. The feature will also allow users know which of their personal details are available on Google Search.

- Google is also launching Multisearch Near Me, a feature that will allow users search for items like food or groceries that are available near them.

- Google Maps is also getting better for regions like Africa and India where buildings were not readily visible. In a future update, users will be able to select cities, view weather forecasts in those cities, and even view traffic.

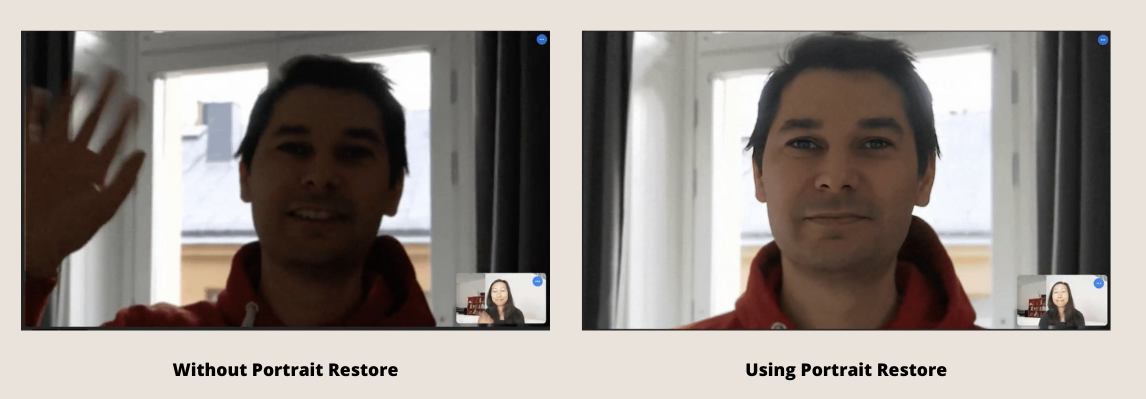

- Google Meet is also getting some important AI updates that will set it apart from other conferencing services One is called Portrait Restore. The feature uses Google AI technology “to improve video quality, so even if you’re using Google Meet in a dimly lit room using an old webcam, your video will be enhanced.” There’s also Portrait Light which helps users adjust the lighting position during meetings, and an automated transcription feature.

- There’s also Google’s new virtual cards option which will be released later in the year. Google will allow users create virtual cards on Google Chrome so users don’t have to share their real card numbers online.

- Some new devices were also announced, including the Google Pixel 6A, Pixel 7, and 7 Pro which are scheduled for a later release. There is also the Pixel Bud Pro earbuds which Google claims have a battery life of 11 hours. Finally, Google announced the long-awaited Pixel Watch, and announced its plans to release the first Pixel tablet later in 2023.

In today’s edition

- Ethiopia launches 5G testing

- Facebook is getting sued

- A pan-African union in Kenya

- Million-dollar crypto raises

- Event: Fintech London Week

- Opportunities

ETHIOPIA LAUNCHES 5G TESTING

5G is coming to Ethiopia.

On Monday, state-owned telecoms Ethio Telecoms announced that it had piloted 5G tests across the country’s capital, Addis Ababa. Ethio Telecoms will be the first to pilot 5G in Ethiopia, beating out Kenyan Safaricom which was only granted its operating license in July 2021.

The 5G service was developed by Huawei Technologies, a China-based firm, and is reported to have cost $40 million.

Similar to other countries that have launched 5G, Ethiopia’s launch is only available in select locations in Addis for now as the telecoms is still testing the spectrum.

“The 5G service is launched in selected places in Addis Ababa. In the coming 12 months, we will have 150 5G sites in Addis Ababa and in major cities outside the capital,” said Frehiwot Tamru, CEO of Ethio Telecoms.

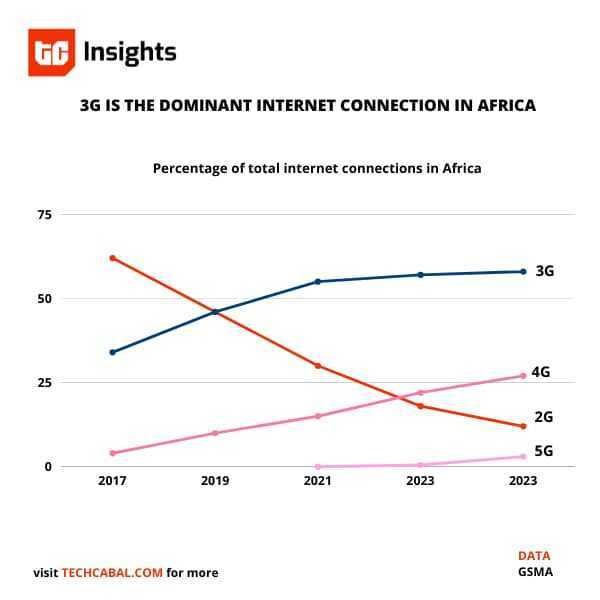

5G in Africa

Ethiopia is not the first country to roll out 5G.

Globally, at least 81 countries—outside Africa—have 5G available in certain regions. In Africa, at least 18 countries are testing out 5G or have plans to launch it, and 6 countries—South Africa, Kenya, Mauritius, Botswana, Zimbabwe, and Seychelles—have launched 5G. Ethiopia will be the seventh.

And Nigeria may be 8th. After running tests, both MTN and Mafab—having recently acquired their operating licenses—announced that 5G rollout in Nigeria will kick off in August 2022.

In Africa, 5G adoption stands at 4%, and this isn’t surprising considering the financial requirements involved in setting the service up. Presently, only 1% of mobile connections on the continent are 5G, but experts predict that the rate will reach 7% by 2026.

Don’t just send money, send money fast. Send and receive money directly to mobile wallets, bank accounts, Barter or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

FACEBOOK IS GETTING SUED IN KENYA

If you’re wondering why this headline sounds familiar, it’s because it’s the latest edition of Facebook’s troubles in Kenya.

Remind me, what’s up?

In February, Meta-owned Facebook came under fire after TIME Magazine revealed the poor treatment of Facebook’s content moderators in Africa.

It was revealed that Sama, the managing company for Facebook’s African content moderators, was underpaying moderators in Kenya, Ethiopia, and South Africa. The company was also appraising the employees based on a set quota of screen time activity, a practice Facebook denied in 2019.

In March, a month after the article was published, Sama announced 30–50% salary raises for its employees, stating that the raise had no connection to the article. 😉🤫

And now?

Now, one of the employees who was fighting Sama’s—and Facebook’s—poor management is launching a lawsuit against Facebook.

You may remember Daniel Motuang, the South African employee who was fired in 2019 after he attempted to lead a strike in Nairobi that could have ended in unionisation.

Motuang has filed a lawsuit against Facebook and Sama on behalf of a group of employees. The lawsuit alleges poor working conditions of the employees and seeks financial compensation, standard Facebook healthcare, and unionisation rights for all moderators in Kenya. The lawsuit also seeks an independent human rights audit of the Sama office.

In a response posted by Reuters, Facebook said, “We take our responsibility to the people who review content for Meta seriously and require our partners to provide industry-leading pay, benefits, and support. We also encourage content reviewers to raise issues when they become aware of them and regularly conduct independent audits to ensure our partners are meeting the high standards we expect.”

In everything, moderation

In recent years, social media platforms have been under scrutiny for the working conditions of their moderators. Some of these employees have to sift through thousands of pictures, messages, and videos containing explicit content like murder, child sexual assault materials, and rape.

In Daniel Motuang’s case, the first video he remembers moderating was of a beheading, and he had to watch similar content afterwards. He, and many other Sama employees, are presently living with mental health conditions they cannot afford to treat.

Across the world, moderators are suffering from trauma they experienced as part of their jobs. Kenya is not the first country where Facebook is facing heat for the poor working conditions of its moderators. Last year, it had to pay $85 million as settlement in a lawsuit levied by a traumatised content moderator. In Ireland, the company has been sued by different moderators as well.

This will be the first on the continent, and the results will shape the way forward for future moderators.

A PAN-AFRICAN UNION IN KENYA

Several weddings are happening in Kenya, but that is not the kind of partnership this news is about.

United Bank of Africa (UBA) Kenya and payments company Cellulant have come together in business matrimony to launch a pan-African payment gateway to accelerate the adoption of cashless payments in Kenya.

This solution is reportedly a one-stop platform. With it, businesses will no longer need to sign up to multiple payment providers and will be able to receive, view, and reconcile all their payments in a single interface.

The partnership builds on Cellulant’s payments infrastructure which includes 46 mobile money operators in Africa, 211 banks, and its service in 35 African countries—inclusive of a physical presence in 18 of these countries.

One for all

This partnership is in a bid to improve cashless transactions across Africa. As reported by PwC, the volume of global cashless transactions is set to grow by more than 80% between 2020 and 2025. Chike Isiuwe, CEO of UBA Kenya, affirmed that the collaboration is in response to consumers’ needs and will consequently drive financial inclusion and empowerment in Kenya.

Speaking on the digital solution, he said, “The platform aligns with current customer payment behaviours and is expected to spur growth for local businesses, contributing positively to the expansion of the country’s economy.”

It’s not the first pan-African partnership

This is not the Pan African bank’s first partnership with a fintech company nor is it the first partnership of such nature. Banks have been partnering with fintech companies across Africa to optimise payment infrastructures for businesses and individuals and drive cashless transactions and financial inclusion. Telcos are also reading the signs and taking opportunities to provide financial solutions to the rapidly digitising Africa.

With all hands on deck, the African payment scene might be unrecognisably improved and financial inclusion fast-tracked in a few years.

Payment collection just got easier on Fincra!

Receive payments from your customers via debit/credit cards or bank transfers and settle these payments to your Fincra wallet or your bank account.

Create an account in less than 2 mins and Try the Fincra checkout here.

This is partner content.

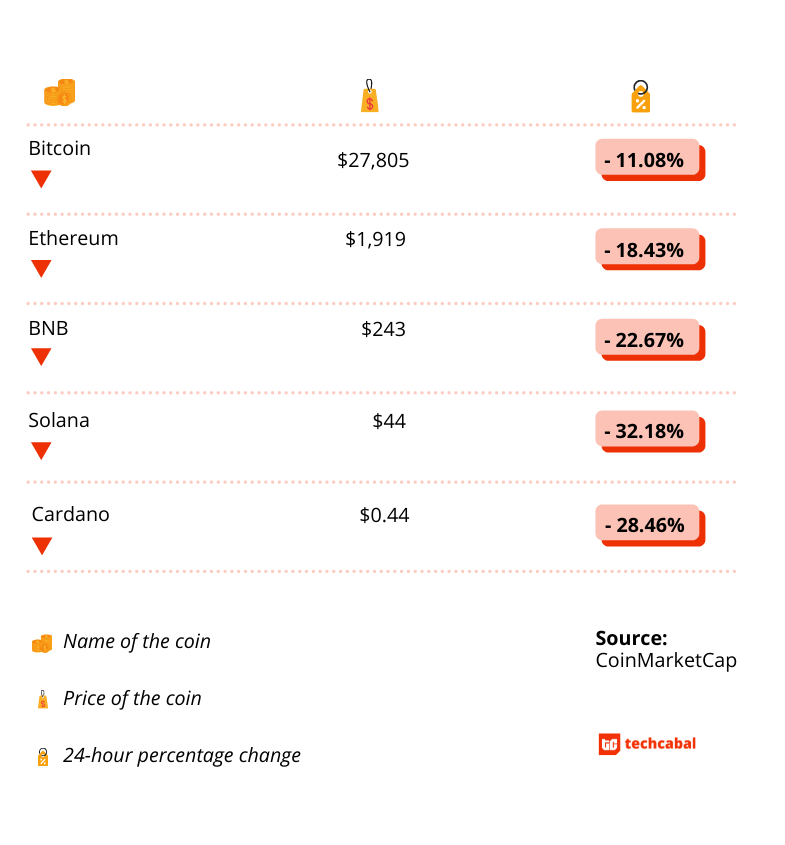

MILLION-DOLLAR CRYPTO RAISES

Congo-based web3 startup Jambo has raised $30 million in a Series A funding round led by Paradigm Investment Group. Additional participation in the round comes from ParaFi Capital, Pantera Capital, Delphi Ventures, Kingsway Capital, Gemini Frontier Fund, BH Digital, Graticule Asset Management Asia, Shima Capital, and Morningstar Ventures, among others

Jambo’s plan for the money

Launched this year, the 5-month-old startup will use some of the funds to hire more staff. To achieve its mission of building the most influential web3 user acquisition portal across the continent, Jambo needs more talent.

This includes engineers that will execute its plan to expand its product suite by building a “super app” that will enable Africans to trade crypto and NFTs, access play-to-earn crypto games, and other credible web3 applications.

In addition, Jambo has expansion plans. It hopes to expand into 15+ additional cities by the end of the year. In line with this, the web3 startup will strive to grow an active community of over 200,000 members, students, and ambassadors affiliated with its educational efforts.

Jambo has also revealed plans to partner with others to launch the AfricaDAO investment fund to invest in startups that share its vision for Africa.

Paradigm dives into Africa

This is not the first raise of the Congolese web3 startup; in February, the startup raised $7.5 million.

This is, however, the first African investment of San Francisco-based Paradigm Investment which raised a $2.5 billion crypto fund last year. This large investment comes as no surprise as Africa is notably a fast-growing region for crypto adoption. Last month, the Central African Republic adopted bitcoin (BTC) as legal tender, the first African country to do so. However, in the same month, countries like Uganda clamped down on crypto transactions. In April, Nigeria fined 3 banks for crypto trading. Crypto adoption is rising, and it appears funding is too, but both face fierce opposition from African governments who believe that crypto is a threat.

In other related news: MARA, a pan-African crypto exchange platform has also raised $23 million, possibly the largest seed round by an African crypto startup, from Coinbase ventures, FTX and other investors.

EVENT: FINTECH WEEK LONDON

The second edition of Fintech Week London is set to take place from July 11–15, 2022.

Fintech Week London is a week-long series of events that highlights and celebrates London’s innovative fintech scene, bringing together senior decision-makers from leading fintechs, banks, investment firms, regulatory bodies, media companies, and service providers.

This year’s edition will feature 150 speakers including Ghela Boskovitch, founder of FemTechGlobal; Leda Glyptis, Chief Client Officer at 10x Future Technologies; and Huy Nguyen Trieu, co-founder of the Centre for Finance, Technology and Entrepreneurship (CFTE).

The panels will also discuss several topics including the development of fintech, open banking, crypto, and digital sovereignty.

Virtual and in-person ticket options are available from £45 ($58). You can also get a 15% discount using the code TechCabal15.

OPPORTUNITIES

- The Seedstars Migration Entrepreneurship Prize 2022 is now open to Applications. Twenty startups from the Middle East and Africa (MEA) region harnessing the positive benefits of migration will get to join the Seedstars Investment Readiness Programme, join the Online Seedstars World Competition activities, and access increased visibility. Move it!

- The Last Mile Money Startup Accelerator is now open to ventures working at the intersection of last-mile users and financial empowerment. Selected startups will receive design support, access to Last Mile Money’s network, and up to $50,000 in equity-free grants. Apply here.

- Applications are now open for the 2022 Africa’s Business Heroes Prize Competition. Ten outstanding entrepreneurs across the continent will get to share a myriad of prizes including access to a community of international leaders and a $1.5 million grant. Co-founders of African origin can apply or be nominated for the prize here.

What else we’re reading

- Kenya is set to hold the 1st Kenya Drone week to showcase drone technology.

- Nigerian clean-tech startup Kaltani secures $4 million seed funding.

- Twitter made a browser game to help explain its privacy settings.

- Facebook is warning its users about a new profile pic app that is sending users’ data to Russia.