IN PARTNERSHIP WITH

It’s June 🎊

YouTube is changing the way users view comments on their desktops.

In a recent update, everyone using YouTube on their laptop will be able to scroll through comments while watching a video.

According to YouTube, this feature, previously available on mobile and tablets, will allow users to gain more context into videos without pausing the videos. After all, it’s not like we all have short attention spans or hate spoilers. 🤷🏾

Criticism, however, should not be directed at the utility of YouTube’s new feature. They should instead be directed at people who choose to watch YouTube on desktop.

In today’s edition

- Swvl is laying off 400 employees

- 15 startups will pitch at Createch

- Maisha Meds is SSA’s largest digital pharmacy network

- CASF funds Finclusion Group

- Opportunities

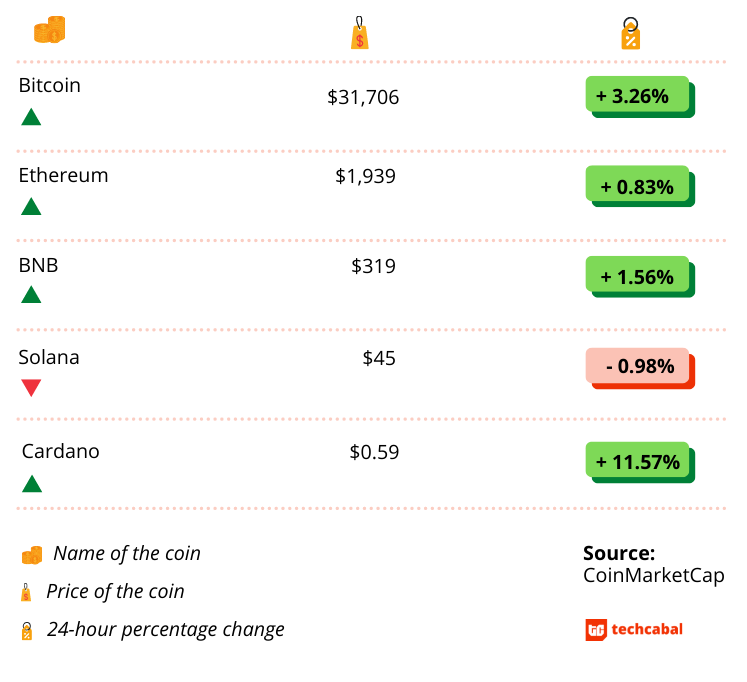

CRYPTO MARKET

* Data as of 08:45 PM WAT, May 31, 2022.

Is this column helpful to you? Please take our survey.

SWVL LAYS OFF 400 EMPLOYEES

Over the past 2 months, we’ve watched as the economic downturn has forced tech companies across the globe to lay off significant numbers of their workforce.

Netflix laid off 2% of its workforce—about 150 employees, Swedish buy-now-pay-later (BNPL) firm Klarna cut 10%, and FAANG companies like Meta are hitting the brakes on hiring. In fact, over 15,000 tech workers lost their jobs in May alone.

Now, the “great lay-offs” may have hit Africa. Earlier this week, Swvl, a ride-hailing company founded in Egypt, announced it would be laying off 32% of its entire workforce, a percentage totalling 400 workers.

According to Swvl’s Chief Financial Officer, (CFO) Youseff Salem, Swvl is making the tough decision in order to “prioritise profitability over growth to ensure that Swvl thrives once we are on the other side of this”.

Swvl’s direction is in line with advice given by tech investors including Y Combinator who advised founders to, “change their plans around spending, runway, hiring, and funding rounds”.

Swvl, whose merger with Queen’s Gambit Growth Capital in April landed it a valuation of $1.5 billion, has since lost more than half of that number and is now valued at $581 million.

The company mentioned that the affected workers hold roles that can be automated. According to some sources, the majority of the layoffs will come from the company’s Dubai and Pakistan offices, but Swvl is yet to confirm this.

The company has however revealed that top management staff would receive salary cuts while expenses such as travel and overhead costs will be reduced.

Don’t just send money, send money fast. Send and receive money directly to mobile wallets, bank accounts, Barter or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

MAISHA MEDS IS SSA’S LARGEST DIGITAL PHARMACY NETWORK

Digital pharmacy Maisha Meds has become the largest digital pharmacy network in sub-Saharan Africa (SSA) with 1,000 active facilities using its technology across Kenya, Uganda, Tanzania, Nigeria, and Zambia. Founded in 2017, it has grown to support over 4 million patient encounters annually across its markets.

What Maisha Meds does

The Kenyan-based digital pharmacy network provides business management software and reimbursement programmes for pharmacies, drug shops, and clinics; and patient support via its point-of-sale pharmacy app.

The Android-based app was designed for low-internet areas so small facilities in rural areas can access a larger health ecosystem. It supports offline use and is available for free download by any clinic, pharmacy or drug shop.

Meisha Meds wants to do more

Meisha Meds wants to enable global health funders to finance health outcomes at the last mile, especially in malaria-case management, injectable contraceptives, prenatal care, HIV pre-exposure prophylaxis, and COVID testing and vaccination. Through its partnership programmes, it has provided over 50,000 patients with medication provided by the World Health Organisation (WHO).

It wants to do more. The startup is designing a digital marketplace and credit solutions for pharmacies and clinics to improve access to high-quality medications.

CEO Jessica Vernon says Meish Meds is raising over $10 million in new funding commitments from USAID Development Innovation Ventures, the Bill & Melinda Gates Foundation, the Children’s Investment Fund Foundation, Grand Challenges Canada, Pfizer, and more.

At this pace, it seems rather frivolous to wish Maish Med godspeed but there’s no such thing as too much goodwill!

Payment collection just got easier on Fincra!

Receive payments from your customers via debit/credit cards or bank transfers and settle these payments to your Fincra wallet or your bank account.

Create an account in less than 2 mins and Try the Fincra checkout here.

This is partner content.

15 STARTUPS WILL PITCH AT CREATECH

Now for some more good news.

The Creative Economy Practice at Nigeria’s Co-Creation Hub (CcHub) has announced the 15 startups selected to join the first Createch Accelerator Programme.

The 15 startups, selected from 4 countries—Nigeria, Ghana, Kenya, and South Africa are FanBase Africa, STARS App, Adirelounge, Tell!, Teraki, Idozi Collective, Fashtracker, Stylebitt, Nollydata, Usanii Space, Mawu Africa, Orange VFX, Vezuh, PayBox, and Twiva.

What is the Createch Accelerator programme?

As you can tell from the name, the Createch Accelerator programme was designed to cater for startups that combine technology with creativity. The 15 selections were made from a pool of African startups working at such an intersection. The programme offers access to knowledge, networks, and support to quicken their path to profitability, scalability, and access to financing.

What is the accelerator driving at?

The organiser, Creative Economy Practice, has nothing but love and support for the ecosystem of African creatives. Established through a partnership between CcHub and Managing Partner Ojoma Ochai, it seeks to boost the African creative economy by encouraging African creators to adopt innovative technology.

How it’s going down

Over the next 4 months, the selected companies will have access to a network of creative economy leaders in talent, content distribution, funding advisory, product advisory and technical support. They will also have access to partner credits from Google, Amazon Web Services, HubSpot and more.

In addition to all that, the participants will get the opportunity to pitch to CcHub Syndicate for up to $250,000 in equity funding.

Europe’s biggest start-up and tech event is back! Viva Technology brings together start-ups, CEOs, investors, global tech actors, and well-pronounced speakers. It will take place on June 15-18, in Paris.

This is partner content.

CASF FUNDS FINCLUSION GROUP

Last month, we reported the Cairo Angels Syndicate Fund’s 2nd African investment—in Kenyan fintech FlexPay.

Now, the fund has announced its 3rd African investment, an undisclosed financing round in Finclusion Group.

This investment will mark CASF’s fourth overall investment and third investment on the African continent. Launched in 2020 by the Cairo Angels, Egypt’s first angel investor network, CASF is a micro venture capital fund that is investing $100,000–$250,000 tickets in post-seed and pre-series A startups in the Middle East and Africa.

Finclusion Group is the latest startup to join CASF’s portfolio. Founded in 2019 by Timothy Nuy and Tonderai Mutesva, Finclusion Group is a Mauritius-based fintech accelerating financial inclusion in Africa with its neo-bank offerings. Presently, Finclusion offers buy-now-pay-later (BNPL) services, salary advance schemes, loan services, and transactional banking to individuals and SMEs across 5 countries—South Africa, Eswatini, Namibia, Kenya, and Tanzania.

The startup reportedly has over 240,000 customers across its 5 markets and has disbursed over $310 million in loans since launch. So far, CASF’s investment is the startup’s third raise since launch. In September 2021, it raised $20 million in a partnership with Lendable. Months later, in January 2022, the startup announced another $20 million raise in a hybrid financing pre-Series A round led by Future Africa and LeadInvest.

With its latest investment from CASF, Finclusion will continue building out its product offerings as it plans for expansion into new markets.

OPPORTUNITIES

- develoPPP Ventures is offering €100,000 ($107,831) grants to high-potential startups from Ghana, Kenya, and Tanzania. Young high-growth startups with less than €2 million ($2.15 million) in funding so far can apply for the grant here.

- The Growth Handbook by Olabinjo Adeniran is a curation of growth, sales, product, design and marketing lessons from over 20 experienced operators working at the most impactful fintech startups in Nigeria. Preorder and learn how to scale your startup.

- The Last Mile Money Startup Accelerator is now open to ventures working at the intersection of last-mile users and financial empowerment. Selected startups will receive design support, access to Last Mile Money’s network, and up to $50,000 in equity-free grants. Apply here.

What else we’re reading

- Breaking down tech terms: augmented reality (AR), mixed reality (MR), virtual reality (VR), and extended Reality (XR).

- Meet Collect Africa—the payment app built for businesses.

- Enko Education closes its $5.8 million Series B funding to ensure its development on the African continent.

- Twitter Circle may be starting to roll out to more users.

MOVE TC DAILY TO YOUR PRIMARY FOLDER