IN PARTNERSHIP WITH

Happy pre-Friday 🌄

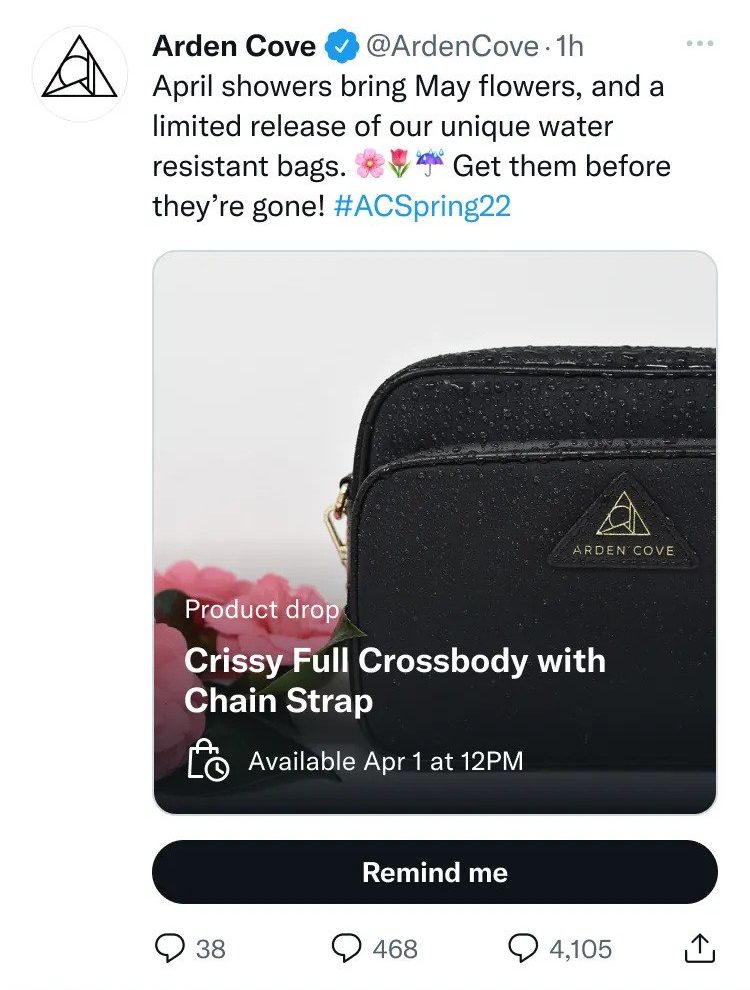

Twitter is testing a feature called Product Drops.

It will allow users sign up to get reminded about product releases and sales from their favourite brands.

It’s basically a notification, a take on the Spaces Reminder that will let you know when your favourite organisations, like TechCabal, are releasing new products.

There’s no update on whether the platform is bringing back Fleets though.

In today’s edition

- Kenya wants to tax digital lenders

- TikTok is fueling political disinformation in Kenya

- Klasha raises $4.5 million

- Africa Data Centres’ 30MW facility in Ghana

- Opportunities

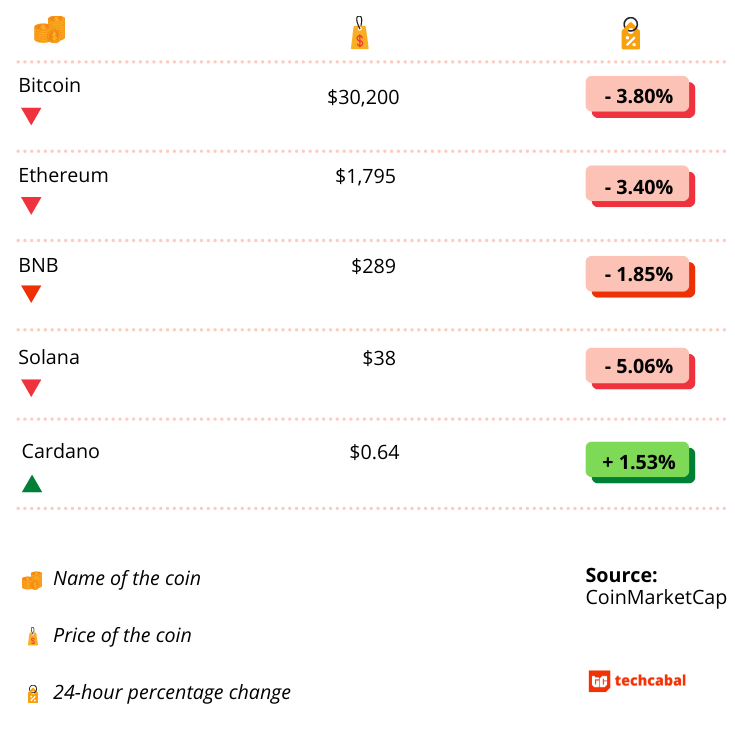

CRYPTO MARKET

* Data as of 9:30 PM WAT, June 8, 2022.

Is this column helpful to you? Please take our survey.

KENYA WANTS TO TAX DIGITAL LENDERS

We’ve got some not-so-good news for everyone in Kenya’s digital lending space.

The Kenyan government has announced plans to introduce a 20% excise tax on fees charged by digital lenders. Earlier this week, Kenyan legislators proposed an amendment to the Excise Duty 2015 of the Finance Bill.

Like many other countries on and off the continent, Kenya’s digital lending space is rapidly growing. At least 13% of Kenya’s population of 53.7 million people have taken digital loans from more than 120 digital lenders operating in the country. As at April 2021, the lenders were disbursing over Ksh 2 billion ($17 million) per month in loans.

Higher, higher every day

This isn’t good news for users either.

If passed, the tax could mean increased interest rates for users of digital loan apps like Tala, Branch, Timiza, and O-Kash, most of which already charge high-interest rates from borrowers. Branch, for example, charges a 17% monthly interest rate, while Tala charges as high as 19%.

Kenya v digital loan apps

It’s even worse news for digital lenders in Kenya who have seen heavy regulation from the Kenyan government in the past year.

Last year, Parliament approved the Central Bank of Kenya (Amendment) Bill which bestowed the Central Bank with the power to regulate digital lenders. The approval also subjected digital lenders to the Data Protection Act, which prevents them from violating users’ privacy through debt-shaming.

This March, the CBK also published the Digital Credit Providers Regulations, 2022 which requires digital lenders to obtain licenses from the CBK in order to operate in the country.

Zoom out: There’s still hope for everyone. The Parliament has till today before it has to take a final decision. So all fingers crossed.

Don’t just send money, send money fast. Send and receive money directly to mobile wallets, bank accounts, Barter or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

TIKTOK IS FUELING POLITICAL DISINFORMATION IN KENYA

Speaking of Kenya, there seems to be a generous helping of political disinformation making its rounds there.

Speaking of Kenya, there seems to be a generous helping of political disinformation making its rounds there.

A new report by the Mozilla Foundation shows that certain accounts are twisting Kenya’s fraught political history ahead of the country’s general elections which will take place later this year.

For the report, the Foundation studied 130 videos from 33 accounts with a combined total of 4 million views, many of which contained explicit threats of ethnic violence.

One of the videos, for example, claims that William Ruto, current Deputy President and presidential candidate, “hates Kikuyus and wants to take revenge come 2022.” Another claims that the United Democratic Alliance (UDA), a notable political party in Kenya, could be used to remove “madoadoas”.

Sidebar: Madoadoas—translation: “blemish” or “spot”—is a derogatory term used by Kenyan politicians to refer to tribes other than their own, especially the Kikuyu, Kisii, Luo and other settlements in Kenya’s rift valley.

Why is this disinformation worrisome?

For many reasons.

Disinformation during election periods is rampant. From the 2016 US elections to gubernatorial elections in Chad, Senegal, and Ethiopia, social media has been found to play a strong role in how people get information and vote. Facebook, for example, has been accused of allowing Ethiopian leaders to use its platform to promote ethnic violence and civil unrest ahead of its elections last year. The same platform was also manipulated for the US 2016 Presidential election.

This kind of disinformation also means that African governments have more excuses to block citizens’ access to the internet. At least 15 African countries including Uganda, Togo, and Cameroon have enforced full or partial bans because of this.

Zoom out: According to Mastercard, TikTok is yet to take down these videos or sanction the accounts posting them despite the fact that the content breaks TikTok’s policy on hate speech, discrimination, and disinformation.

Get up to $5,000 in bonuses when you deposit new money with Trove. At Trove, we believe the reward for new money is more money.

Download the Trove App, get depositing and keep enjoying those bonuses.

This is partner content.

KLASHA RAISES $4.5 MILLION

Nigeria and San Francisco-based fintech Klasha has announced the close of a $2.1 million round led by American Express (AMEX) Ventures and Global Ventures.

This brings its seed round funding to a total of $4.5 million; Klasha had previously raised $2.4 million from other investors.

Investors from its first-round include Seedcamp, Practical VC, Plug and Play, First Fund, 2.12 Angels, MiLA Capital, Berrywood Capital, AVG Basecamp Fund, Expert Dojo and angel investors like Joe Cross of Wise and Michael Pennington of Gumtree.

What Klasha does

Klasha’s business model is centred around helping Africans make payments regardless of their location. It has API enabled features that integrate local payment methods in Africa like bank accounts, cards, USSD, and M-Pesa to facilitate international payments.

With its solutions, consumers can pay merchants with African currencies which Klasha then remits to them in foreign currencies like dollars or euros in two business days. Foreign merchants can also do the same with their suppliers.

It also has an app called KlashaCart—which is only available in Nigeria—that allows consumers to shop from different retailers and receive their goods within 7–14 days via Klasha’s logistics arm.

What the funds will finance

Klasha will use the proceeds to expand into 5 more African countries in 2022 and re-launch its consumer app—renamed KlashaCart—to allow African consumers to shop from eligible international merchants online.

Founder and CEO, Jessica Anuna, said Klasha’s growth has been rapid. In less than a year, the company has signed up over 1,700 merchants, processed over 210,000 transactions and is experiencing 15% month-on-month (MoM) merchant growth.

With this new funding, expansion should be a walk in the park. Right, Klasha?

Europe’s biggest start-up and tech event is back! Viva Technology brings together start-ups, CEOs, investors, global tech actors, and well-pronounced speakers. It will take place on June 15-18, in Paris.

This is partner content.

AFRICA DATA CENTRES’ 30MW DATA CENTRE IN GHANA

Africa Data Centres has announced the building of a 30 megawatt (MW) data centre facility in Accra, Ghana. This is part of its plan to invest $500 million into building many interconnected, cloud-independent and carrier-neutral data centres across the continent.

The pan-African Africa Data Centres already has 6 facilities in South Africa, Nigeria, and Togo. At the completion of this project in Ghana, it might become the largest provider in West Africa.

Why Ghana?

In response to the answer on the mind of every Nigerian 🌚 reading this, Tesh Durvasula, CEO of Africa Data Centers, says, “The region holds massive growth opportunities. We are witnessing an unprecedented demand for digital services, apps, broadband, cloud technologies, and more, all of which are seeing data demand soar to unimagined levels.”

Planting a 30MW facility in Accra, Africa Data Centres hopes to meet these data demands and thereby play a significant role in the deployment of digitisation solutions to West Africa.

As it arrives to meet these digital services needs, the data centre will also create job opportunities through the further digitisation of the economy and employment of local tech talent for its construction and running.

Is Africa Data Centres the only data centre serving Africans?

There are several other data centres across Africa including Main One, JHB1 Midrand Data Centre, and GPX Cairo 1. However, speaking in comparison to others, Durvasula says Africa Data Centres’ $500 million investment in Africa’s digital transformation is unrivalled.

$500 million dollars is a lot of money but with Africa being a hotspot for investment, who is to say a rivalling investment won’t come breezing in soon?

OPPORTUNITIES

- AIESEC is holding an SDG innovation challenge event (Youth Speak Forum) for young Nigerians. The two-day forum will empower youths to create projects that will directly affect their communities and equip them with valuable skills and qualities needed to impact their future work positively. Find out more here.

- The Nigeria Youth Futures Fund (NYFF) Young Leaders Development Fund 2022 is open to applications from young changemakers with experience in media, health, environment, civic participation, education, security, and ICT. Apply for the chance to get up to $40,000 in grants. Check it out.

- The Future Rural Africa’s Female Researchers Grant 2022 is now open to applications to female African researchers who want to gain more visibility and expand their network. Up to €5,000 ($5,300) will be awarded to select participants. Apply here.

What else we’re reading

- Who is Orchestrate and why should fintechs/businesses care?

- GreenHouse Capital and Microsoft select 13 companies for Scaleup Accelerator Programme.

- Ethiopia’s local fintechs are worried about competition from dominant state-owned banks.

- Nigeria’s Guarantee Trust Bank (GTB) has expanded beyond banking to launch Squad, a new payments platform.