IN PARTNERSHIP WITH

TGIF 🌄

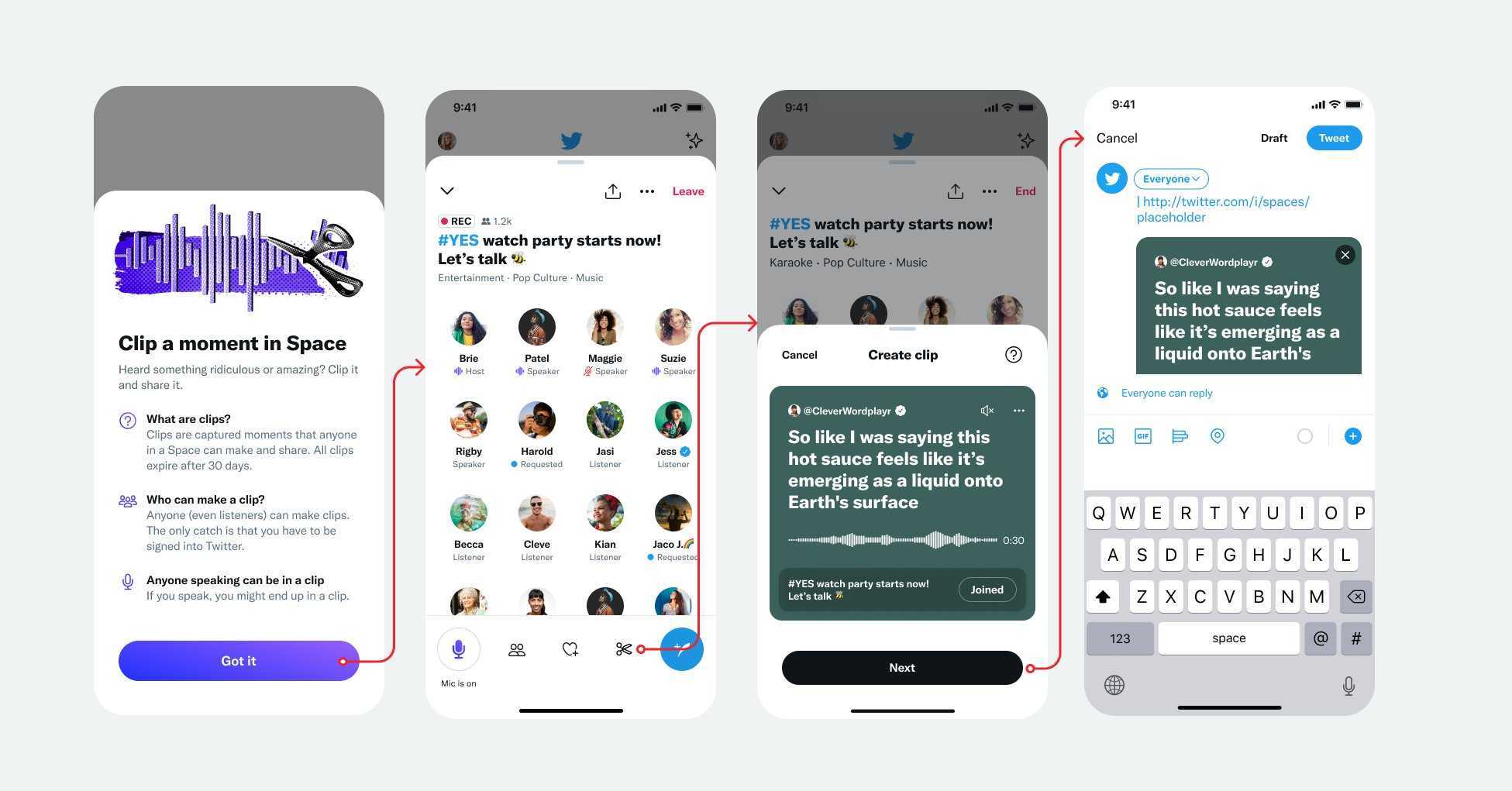

Twitter Spaces has a new update.

With clipping ✂️, all Android and iOS users will be able to share bits and pieces of any Twitter Space they find themselves in.

You can share the clip on your profile and it’ll be available for 30 days before it disappears forever.

So if you ever find yourself in a Space where someone is moaning about something 🌚, make sure you share a clip so you can relive the memory.

CRYPTO MARKET: TESLA CASHES OUT

|

|

|

|---|---|---|

|

Bitcoin

|

$22,995 |

+ 0.77% |

|

Ethereum

|

$1,564 |

+ 6.16% |

|

BNB

|

$264 |

+ 5.07% |

|

Solana

|

$42.75 |

+ 0.06% |

|

Cardano

|

$0.49 |

+ 3.10% |

|

|

Source: CoinMarketCap

|

|

* Data as of 05:20 AM WAT, July 22, 2022.

According to Tesla’s 2022 Q2 financial results, the electric car company has sold 75% of its bitcoin holdings this quarter for $963 million.

Tesla had bought $1.5 billion worth of cryptocurrency in February last year and announced that it would soon accept bitcoin as payment for its vehicles, sending cryptocurrency prices up.

That excitement was short-lived though as Elon Musk announced in May the same year that the company was abandoning plans to accept crypto payments, citing concerns over the “rapidly increasing use of fossil fuels for bitcoin mining”

QUICK FIRE 🔥 WITH ISAAC AKANNI

Isaac Akanni is a digital transformation and SaaS specialist with years of experience guiding blue-chip and medium-sized businesses to leverage new and existing technologies for maintaining relevance and competitiveness in their industry

Explain your job to a five-year-old

I study how technology affects businesses and make sure they use it in a way that helps them to grow and become really successful.

What’s one piece of advice you wish you had earlier in your career?

When it really matters and the stakes are high, exploring different tech solutions to see what works will only give you a sense of activity but no real progress. You’ll be very busy deploying, training, and testing but will get very little value and nothing will change.

I learnt this the hard way and do not wish it on any business.

What’s the biggest misconception people have about your job?

Many people believe digital transformation is a new field, but it’s not. Business leaders have been transforming their operations for decades and will continue to do so with the amount of digital knowledge and resources available to them. The advantage we have in this era is our access to data and AI, and the next generation will have much more.

I’ve even heard experts say we’re leaving the phase of digital transformation and moving to the phase of digital surge. What a time to be alive!

Are there any immediate risks to African businesses and SMEs who don’t digitise or use technology?

Unfortunately, there are no immediate risks, and maybe that’s the risk in itself because it gives these businesses a false hope that all is well and that there is no need to digitise.

Traditional businesses are usually more affected by this because most new-generation African businesses are digital natives who are at the peak of digital excellence. With traditional businesses, there is always a resistance to change from the strategies that brought them historic success forgetting that the strategies that were good for the past are never enough to produce those same results as the world evolves.

Imagine if the companies that went through the first wave of digital transformation stopped evolving after they reached the peak of digital excellence for their time. They would surely have been obsolete by now.

The risk of not digitising is long-term. It creeps in like a chronic disease, and before you know it, younger, technology-driven and disruptive entrants have taken all the market share and are running you out of business.

No company wants to be the Blackberry of the future.

What hacks can companies or businesses use to increase customer engagement or revenue? Or is it all grit and elbow grease?

There’s no silver bullet or hack to increase customer engagement or revenue. What I know from experience is to focus on 3 things: strategy, data, and partnerships.

Strategy helps you think of how to remain competitive and focus on being the best at doing the core thing that brought you into business in the first place. If you get this right, customer engagement will be organic.

Data helps you see trends, make insightful decisions, and create feedback loops that will optimise all your business processes. If you get this right, you’ll make fewer mistakes.

Partnerships help you unlock new digital solutions, markets, expertise, and resources faster. If you get this right, you won’t have to recreate the wheel at every phase of your growth.

Helping businesses understand this is the point of the work I do.

Do you think we need more people in tech? Or is this an over-flogged notion like the 1990s push to get people into medicine, law, or engineering?

I think we need more people doing what they are really passionate about. Most people in tech today came from non-tech backgrounds so we can postulate with a high degree of accuracy that the push to get people into certain fields in the 1990s didn’t produce many results. If everyone is actively invested in what they are passionate about, there’ll be more innovation, growth, and advancement for all ecosystems.

Regardless of the career path you choose, there will be times it will look too hard to continue. You may even doubt your choices and start plotting an escape thinking you made the wrong move, but ultimately, what will keep you pumped and motivated is your passion.

There’s space for everyone at the top, if you’re willing to do the work regardless of the career path you choose.

What’s something you’re good at but dislike doing? And something you’re bad at but love doing?

By my own standards, I’m a good cook but I’d rather eat than cook. I think cooking involves too many long, meticulous processes for a meal that will be finished in 5–10 minutes. I’m also yet to see someone that loves cooking and eating so it seems like you can’t like both, and never the twain shall meet.

I’m not bad at anything (let the weak say I am strong 😃), but my drawing skills could use some help. I really admire digital artists so I bought a digital illustration app, Procreate, watched a TED talk by Graham Shaw on how everyone can draw, and I’ve been doodling since then. Only a few people have seen my doodles, and maybe one day I’ll sell them as NFTs. One day!

What book or movie are you hyped up about, and why?

I won’t call it a hype, but I strongly recommend the book The Innovators’ Dilemma by Clayton Christenson because it’s one of the most remarkable books I’ve ever read on innovation and disruption.

I wrote about it on my LinkedIn page earlier in the year describing how you can come up with great business ideas and gain market share by exploring gaps left by older businesses in the same industry. Really fantastic read.

Don’t just send money, send money fast. Send and receive money directly to mobile wallets, bank accounts, Barter or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

CAN THE CBN ENFORCE “ILLEGAL” DOLLAR-BUYING RULE IN NIGERIA?

In more Nigerian legislation news, Godwin Emefiele, governor of the Central Bank of Nigeria (CBN), recently made statements that got the country buzzing.

Speaking at the Monetary Policy Committee (MPC) on Tuesday, Emefiele said that using the naira (Nigeria’s currency) to buy dollars is illegal. The governor threatened to arrest and prosecute any perpetrators caught in the act.

Can Emefiele deliver this time?

Well, we spoke to some experts to find out, and the general consensus is no—there’s no legal backing that allows the CBN to sanction Nigeria for using their own hard-earned money to buy assets. 🤷🏾♂️

According to one expert who wished to remain anonymous, it’s all “words from a man who loves to hear his own voice a lot”.

Chinyere Okafor, managing partner at Acelera Law, said, “There however appears to be no guideline, regulation, rule, or enabling law authorising the CBN to arrest and prosecute Nigerians using naira to buy dollars, or that declares the use of naira for the purpose of buying dollars illegal in Nigeria.”

Adedeji Olowe, the founder of Lendsqr, told TechCabal that the CBN will hurt its reputation further if it brings yet another rule it can’t enforce to the market. “There is also a possibility that this can be challenged in court,” he added.

Godwin wants to win

The experts also explain that the CBN governor’s statement is a signal of the apex bank’s desperation to bring down dollar prices and demand for foreign exchange in the country.

Over the past 1 year, the CBN has taken a number of regulatory actions to drive down the devaluation of the naira. It banned the sale of foreign exchange to bureau de change operators in the country, and even declared the founders of AbokiFX, a forex publishing platform, wanted for devaluing the naira. Despite all this, the naira dropped from ₦525/$ to ₦570/$ within the same month. A year later, the currency has further devalued to an all-time low at ₦620/$.

Zoom out: The CBN has come out to clarify the statement of its governor, stating that the warning was for those seeking forex for election campaigns.

NIGERIA’S SENATE PASSES STARTUP BILL

On Wednesday, the Nigerian Senate passed the Nigeria Startup Bill after 4 months of deliberation.

With the bill one step closer to a presidential assent, it means Nigeria’s tech ecosystem may see an improved enabling environment in the near future. While tech startups in Nigeria suffer from a lack of basic amenities like constant power supply and limited funding, there’s also a number of regulatory hurdles they face. Crypto startups, for example, have had to innovate since the Central Bank of Nigeria reinforced a ban on crypto trading in 2021. In 2020, state regulations also banned bike-hailing startups in Lagos, Nigeria’s most populous city, and sent mobility startups like ORide, Max.ng, and Gokada running from the city.

One of the 3 objectives of the Nigeria Startup Bill is to bridge the engagement gap between startups and regulators and ensure that harmful regulations like these are shut down. While a draft of the bill is not available to the public yet, the summary of the bill is. Among other things, the bill also seeks to provide for the establishment, development, and operation of startups in the country via incentives like tax breaks, government loans, and credit guarantee schemes.

With the Nigerian Senate’s passing, the bill now moves onto the House of Representatives (HoR) where it will pass through 3 readings. If the HoR agrees with the contents of the bill, the bill will be sent to the president for his assent, and will thus become law.

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

👉🏾 Learn more at paystack.com/storefront

This is partner content.

TC INSIGHTS: FUNDING TRACKER

This week, Cassava Technologies, an African-focused integrated tech company secured $50 million in investment from C5 Capital (C5).

Here are the other deals for the week:

- Bloom, a Sudan-based fintech, raised a $6.5 million seed round from fintech giant Visa, Y Combinator, US-based VCs Global Founders Capital (GFC) and Goodwater Capital, and UAE-based early-stage firm VentureSouq. Other investors include angels Arash Ferdowsi, Dropbox co-founder; Nicolas Kopp, former US CEO of N26; footballers Blaise Matuidi and Kieran Gibbs; and early employees at Revolut and Tide.

- Moroccan startup Aza Petrolsolutions raised $296,000 in funding from the Maroc Numeric Fund II.

That’s it for this week!

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements.

EVENT: TC LIVE

What does it take to build a successful product for the African market?

Building a great product is a tough job and in the African market, like other different markets, also has its complexities. As a result, making the right product development decisions can make the difference between the success and failure of the product.

Don’t miss our next TC Live conversation on the 29th of July, at 11 AM (WAT), as Kelechi Njoku, Senior Editor at TechCabal chats with

- Yarmirama Ashama – Senior Product Manager, Cowrywise;

- Makera Kigaraba – Principal Product Manager, M-KOPA;

- Tolulope Saba – Head of Product, Brass; and

- Busayo Oladejo – Product Manager, Big Cabal Media.

Want to attend? Register here.

Fincra provides easy-to-integrate APIs developed and designed to launch seamless and reliable global payment solutions.

With Fincra’s customisable APIs, developers can build quick financial applications.

Build the best payment solutions on Fincra.

This is partner content.

IN OTHER NEWS FROM TECHCABAL

Netflix has announced that its imminent ad-supported plan will not allow users to access all the movies currently on its catalogue.

Spotlighting the 5 African startups in Y Combinator’s Summer 2022 batch.

JOB OPPORTUNITIES

- Big Cabal Media–Head of Events, Financial Analyst – Lagos, Nigeria

- Klasha – Senior Backend Engineer, Senior Frontend Engineer, Content Marketing Manager – Cape Town, South Africa

- TeamApt – Senior Graphics Designer, Technical Product Manager, Senior Software Engineer, Business Analyst – Remote

- Heroshe – Senior Product Manager – Africa (Remote)

What else is happening in tech?

- TikTok is the fastest-growing source of news for adults in the UK, survey finds.

- Global rights groups want Meta to stop gagging South African whistleblower.

- Airtel Money has been split from Airtel Kenya.

- IMF wants M-Pesa shielded in CBK digital shilling plan.