Christian Duffus, an African American entrepreneur from Washington DC with roots in Nigeria has reimagined one of Africa’s most iconic digital innovations, prepaid airtime, with the help of a polarizing technology – crypto. His mission, to unlock the potential for millions of Africans in web3, a term ascribed to a supposed rebrand of the internet.

But crypto, web3 and its proponents are facing an uphill climb in convincing everyone else, especially in light of recent mammoth-sized algorithmic liquidations, wild volatility price swings and a wave of regulatory clampdowns. The industry can’t seem to catch a break and the aftermath is fueling a brutal news cycle that is piling pressure on crypto entrepreneurs to prove utility.

In the midst of crypto winter, Christian is bucking the trend by doubling down on his bet that, prepaid airtime, combined with crypto, is the key to unlocking the potential of Africans in the new web economy.

It was prepaid that made us fortunes

In 1990 only two countries in sub saharan africa had introduced mobile cellular service with fewer than ten thousand subscribers between them ( IFC World Bank Group).

Mo Ibrahim, a Sudanese telecoms engineer working in the United Kingdom (UK) , puzzled his Western colleagues with an odd bet. Mo wagered there was a business opportunity in developing mobile communication in sub-Saharan Africa – a region where most people were considered poor and had never used a phone, let alone owned one. (HBR)

Many of them were locked out because they could not afford monthly contracts, had no credit nor banking history required for post paid billing models popularized in the West.

But hope arrived around 1994 in the form of prepaid billing model, an invention by Portugal Telecom’s mobile telephone division, discovered while researching ways to lower barriers to credit and thus, reach a wider audience with their services ( Niti Bhan )

Prepaid airtime billing proved to be an uncanny fit for the paltry, volatile income streams of millions of Africans in the informal economy, allowing telecoms to bundle prices and offer cellular services for as little as a few cents.

Gradually, then all at once, prepaid airtime caught on, like wildfire, surprising many.

By 1995, half the countries in the region had introduced mobile service with a total of about half a million subscribers; by 2000 virtually all countries in Sub Saharan Africa had mobile service surpassing ten million subscribers; within five years, subscribers had increased to 90 million, expanding to almost 400 million subscribers by 2010 and about 750 million by 2015 (IFC).

In that time, Mo Ibrahim’s odd bet unlocked millions of subscriber bases in Sub Saharan Africa for his company Celtel and a healthy exit for, $3.4 billion to the Kuwait-based Mobile Telecommunications Company (now Zain) earning him a spot in Africa’s tech mavericks. (HBR)

It has been thirty years since the bold bet by Mo.

Prepaid airtime accounts for 85% – 95% of all mobile subscriptions; an indispensable onramp into mobile commerce for 600 million African mobile subscribers who are now on digital platforms, consuming content, apps and services on the regular.

The number of use cases for prepaid airtime has grown beyond simple calls, sms, texts, and now includes data bundles that power the access and delivery of rich content delivered on affordable smartphones.

Since the Covid pandemic, digital transactions accelerated by 25% as par the International Telecommunications Union (ITU) and African governments are doubling down on digital strategies, with billions more doled out by the European Union (EU) and G7 to support implementation.

Christian Duffus, a serial fintech entrepreneur with 3 exits to his name, is convinced that crypto presents an opportunity to onramp millions of everyday Africans to a new web3 economy, just like Mo did for mobile connectivity.

His venture backed company Fonbnk is on a mission to enable billions of mobile subscribers in cash based economies, underserved by existing financial services, to get the same financial services available to any Westerner. With the existing network of mobile phone accounts, anyone with a prepaid mobile SIM card can now have access to the global digital economy.

So far, 250,000 user generated wallets in Nigeria, Kenya, Uganda and South Africa use Fonbnk to convert airtime into digital money such as crypto.

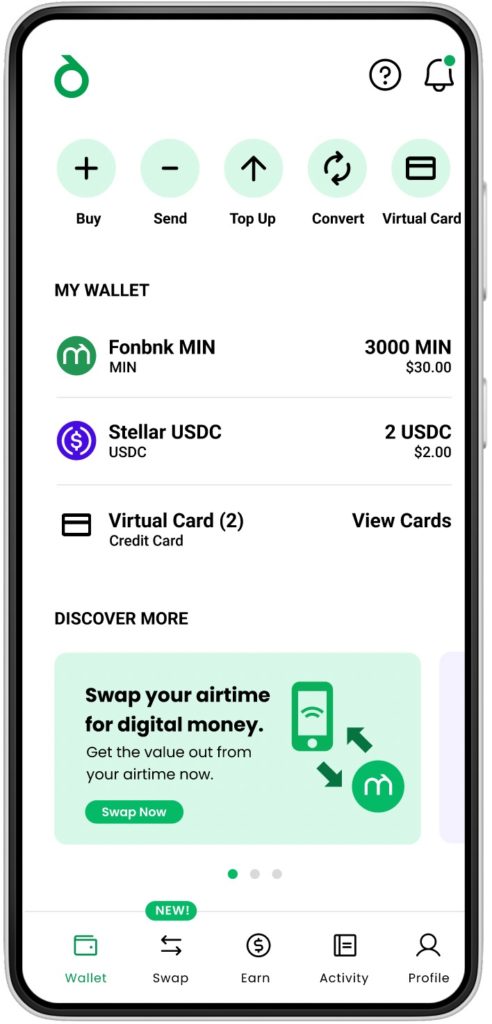

The Android app is catching on especially amongst youthful Africans who, for as little as 5 KES or 150 Naira of prepaid airtime, can access MIN, an in-app digital currency pegged to the USDC stablecoin issued by Circle, a licensed US e money issuer. Every 100 MIN is equivalent to $1, and once in it they can – save, hedge against local inflation, invest, make payments online and even earn from micro tasks using Fonbnk’s capabilities.

Fonbnk’s relationship with a regulated money issuer allows seamless interoperability with both traditional financial networks like MasterCard and Visa and leading cryptocurrency protocols such as ETH, MATIC, CELO, BTC, AVAX, ALGO, FLOW, HBAR, SOL.

“We created a decentralized, market-making dApp [dApp stands for decentralized app] through which users can convert the value on their existing prepaid mobile SIM cards into cryptocurrency, acting as a bridge from no financial services or NoFi to decentralized financial services.” Duffus explained in an online post.

Christian and his team have their work cut out for them.

As per GSMA a Forbes report, there are over 8 billion prepaid mobile SIM cards predominantly across emerging markets like Sub Saharan Africa, driving over $1 trillion in annual prepaid revenue to Mobile Network Operators, and all of them need to be brought online.

“That’s a whole lot of SIM cards” he jokes “ and a lot of work left to be done”

Adding prepaid Visa virtual gift cards to allow users to cash out MIN to Visa cards, was a welcomed move by users in Nigeria challenged by dollar card based limits. Fonbnk’s relationships with Visa and Mastercard, as part of the Visa Fast track program Mastercard Crypto path program is bearing similar fruits, adding to a growing list of utility for Fonbnk’s growing community of users.

In addition, a marketing grant partnership with the Stellar Development Foundation helped the company’s user base grow by 20% in one quarter. Working with partners like Stellar is opening up new possibilities to leverage Moneygram’s cash out network.

The company’s recent $3.5 million seed round in February, means Fonbnk is well funded for the next few years.

Rather than debate the merits and demerits of crypto and blockchain, as crypto pushes through a public evisceration, Christian, who was voted one of Washington DC’s most important tech titans, is hunkering down to focus on building.