The startup struggled to meet payroll and pay suppliers and has laid off staff after potential funding and M&A deals fell through.

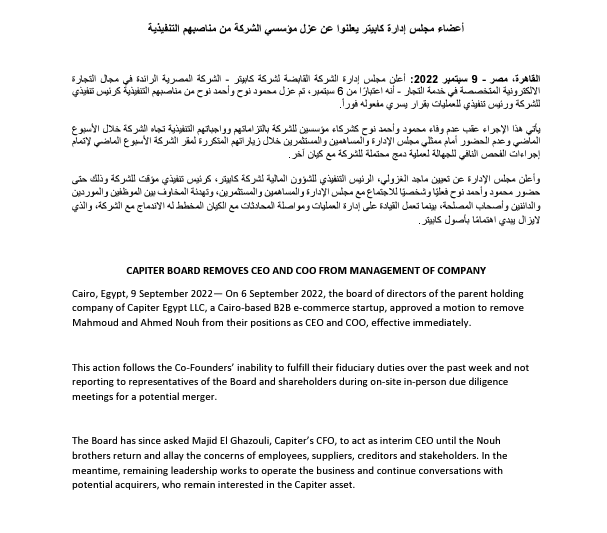

The board of directors of Capiter, an Egyptian B2B FMCG startup, has reportedly fired the company’s CEO and COO. According to an unsigned statement seen by TechCabal, Mahmoud Nouh, the company’s CEO and his brother Ahmed Nouh who served as COO were removed from the company’s management for failing to “fulfil their fiduciary duties… and not reporting to representatives of the Board and shareholders during on-site in-person due diligence meetings for a potential merger.” According to local media reports, the board has also begun an internal investigation into Capiter.

In the meantime, Majid El Ghazouli, Capiter’s CFO, has been appointed interim CEO.

One of Egypt’s fastest growing companies

Founded in 2019, Capiter supplies retailers and corner shops in Egypt with consumer goods which they source in bulk from manufacturers and other bulk suppliers. Customers place orders through the company’s mobile app and then the company ships the orders through third-party delivery partners. Capiter also offers a BNPL scheme to Egyptian retailers.

Last September, Capiter announced that it had raised $33 million in Series A funding from a group of investors led by Quona Capital and MSA Capital. Other investors include Savola, Shorooq Partners, Foundation Ventures, Accion Venture Lab, and Derayah Ventures. When the fundraise was announced, CEO Nouh told TechCrunch that the company hoped to reach annual revenues of $1 billion in 2022.

With $33 million raised, Capiter went on a hiring spree, adding almost 500 new members between September 2021 and March 2022. With more than 800 listed employees on LinkedIn, Capiter is one of Egypt’s largest startups by employee count.

In March this year, Capiter also entered a financing agreement with Contact Financial Holding, an Egyptian investment firm, under which Contact Financial Holding would provide an initial EGP100 million to support Capiter’s expansion in Egypt.

Around the same time, CEO Nouh told Al Borsa News, an Egyptian daily newspaper that it hoped to raise $75 million in a new round of financing from investors.

What happened at Capiter?

Egyptian media have been awash with the story, with some reports claiming that the Nouh brothers had run off with $33 million, the money they raised one year ago.

However, according to people familiar with the matter, the reality may be different. One local angel investor who spoke to TechCabal on condition of anonymity explained that not only did Capiter fail to raise the $75 million investment it had hoped to, but when it eventually got an investment offer from a different investor, it was at a lower valuation that was rejected by existing investors.

As Capiter’s financial position grew worse potential acquisitions by a Jordanian firm and later a Saudi firm failed to close. So, in order to meet their financial obligations, the Nouh brothers took out personal loans totalling $3 million from local banks in Egypt.

In a now-deleted Facebook post that corroborated what our source told us, Waleed Rasheed, CEO of VOO, a Cairo-based delivery aggregator, explained that the Nouh brothers left Egypt because they were being harassed by suppliers at their homes and hoped to be able to negotiate a settlement from outside Egypt.

Nouh (CEO) also told Enterprise, an Egyptian business publication, that he had not received any official notice from the board about his removal from the company.

In an interview on a widely watched talk show on El Hekaya, a local TV station on Saturday night, Nouh (CEO) blamed Capiter’s challenges on Egypt’s economic crisis arising from Russia’s invasion of Ukraine. He also said he and his brother have attended BoD meetings “held virtually” from Dubai.

Aly El Shalakany, CEO of the Cairo Angels Syndicate Fund (CASF), told TechCabal that it was common knowledge in Egypt’s close-knit tech ecosystem that Capiter’s growth-at-all-cost model was running into difficulties, even though no one understood how much of a difficulty the company faced until last Friday. Mahmud Nouh admitted this when he spoke on TV Saturday night. According to him, “Everyone knew that the company was going through a financial crisis. The money available was very little.”

“Capiter’s business model was quite aggressive and they were, therefore, quite cash-hungry,” Shalakany told TechCabal. “They were very much going for the growth at all costs approach. And that was OK when they started… Then suddenly the narrative changed to financial discipline and [finding] a path to profitability and I think it was difficult for them to switch,” he said.

“It’s a bit negative that some people have decided to turn this into a telenovela,” Shalakany added.

Trend of layoffs and M&As in Egypt and across Africa

Egypt’s economy has been severely impacted by Russia’s war in Ukraine. Tourists from Russia and Ukraine account for 40% of travellers who visit Egypt and Egypt’s revenue from tourism has taken a hit since the war began in February. The country also imports 80% of its wheat consumption from both countries. In March, rising prices and a decline in foreign reserves forced the government to devalue the Egyptian pound by 14%. The government is in talks with the International Monetary Fund to access a $12 billion loan.

In response to a tighter funding market, Egyptian tech businesses have been laying off workers in the past few months as this combination of a tighter venture funding market and economic crisis compress consumer spending.

Like its peers, Capiter has been quietly laying off employees since July, at least. When news of the Nouh brothers’ dismissal by the board of directors broke on Friday, several employees of the company took to LinkedIn to express their shock and surprise.

“To be honest no one knows what happened, most of us were working normally,” one former employee told TechCabal. As the financial problems worsened, salary payments began to be delayed. While recently laid off staff received salaries, several others had not been paid for August.

“We started to ask about our salaries with no reply from anyone. Later we saw the news and social media posts,” an employee said. “The PR is true and not sugar-coated,” one disappointed employee told TechCabal via text, “It is terrible news for the ecosystem and all my colleagues who are grieved.”

TechCabal reached out to Mahmoud, Ahmed and a member of Capiter’s board of directors, but is yet to receive a reply.

Tech companies—especially growth and pre-IPO firms—have been hit hard by the funding crunch following last year’s highs. By May 2022, Tiger and Softbank’s Vision Fund, both of which are some of the biggest backers of growth-stage companies, had registered losses amounting to $17 billion and $27 billion respectively.

Capiter’s bad turn of events is reminiscent of Airlift, the Pakistani quick-commerce startup that shut down less than a year after raising $85 million in Series B funding.