IN PARTNERSHIP WITH

Happy salary week 🎊

TikTok is going hard on cancel culture.

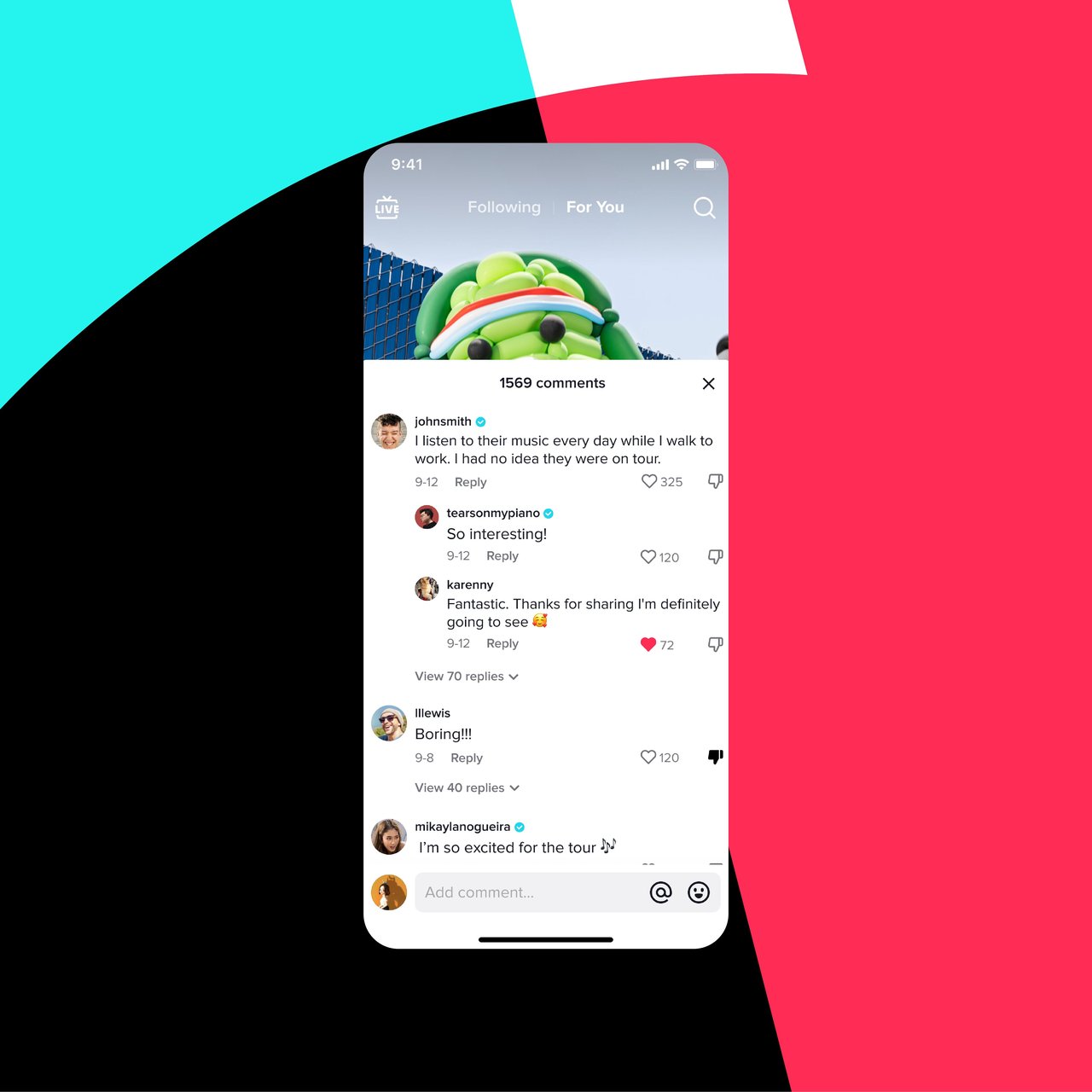

Last week, the platform released a new feature: downvotes.

Users will now be able to downvote comments they don’t like or find helpful. The downvote button will appear next to likes on individual comments under videos in the form of a thumbs-down icon that users can click. Neither the creators nor the viewers will be able to see how many downvotes comments have.

TikTok doesn’t want users to use the new button to cancel people, of course—but when have features ever been used according to the creator’s imagination? The platform says the button is there to help community members identify “irrelevant or inappropriate”.

The feature doesn’t appear to be available to all users in all regions though as no TechCabalian is yet to downvote all comments that suggest that its recently concluded Future of Commerce conference was in fact not the bomb.

CRYPTO MARKET

|

|

|

|---|---|---|

|

Bitcoin

|

$18,944 |

– 0.87% |

|

Ether

|

$1,293 |

– 3.46% |

|

BNB

|

$274 |

– 1.34% |

|

Solana

|

$32.93 |

– 2.39% |

|

Cardano

|

$0.44 |

– 2.80% |

|

|

Source: CoinMarketCap

|

|

* Data as of 18:35 PM WAT, September 25, 2022.

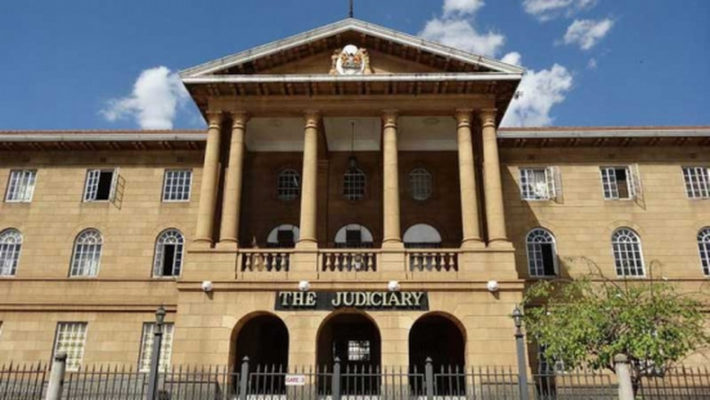

NIGERIAN INVESTORS SUE FOR FUNDS RECOVERY IN KENYA

Over 2,000 Nigerian investors have petitioned Kenyan courts to release funds which were earlier frozen by the Asset Recovery Agency (ARA) in a fraud investigation against fintech unicorn Flutterwave.

Backstory: In July, Kenya’s Asset Recovery Agency (ARA) got a court order to freeze 56 bank accounts which seven companies had used to launder Ksh 7 billion (~ $59.2 million). Of the seven companies, Flutterwave had about Ksh 6.7 billion frozen in 52 accounts from several banks including Guarantee Trust Bank, EcoBank, and Equity Bank.

Later in August, the ARA received another order to freeze more accounts belonging to the fintech. The court froze funds worth Ksh 400.6 million ($3.3 million) across three banks including UBA, Access Bank, and Safaricom M-Pesa.

And now?

Well, about 2,468 investors say their money is part of the money frozen by the ARA in its pursuit of Flutterwave.

Spokesperson Morris Ebitimi Joseph explained to Business Daily that they invested in a company called 86 Football Technology—also known as 86FB, 86Z, or 86W. The investors made deposits for an investment scheme that promised better returns which did not come to fruition.

Investigations by the investors led them to believe that they had been swindled to the tune of Ksh 1.44 billion ($11 million) by a dubious person via transactions on Flutterwave.

Now, they want Kenyan courts to separate Ksh 1.44 billion out of the frozen Ksh 6.7 billion released to them.

“I believe that the issuance of an order compelling Guarantee Trust Bank, Equity Bank and Ecobank to deposit the sums excluded in the bank accounts of our advocates, justice shall be served to the 2,468 interested parties who were swindled of their hard-earned money through the scheme,” Ebitimi said.

Zoom out: While the Central Bank of Kenya has accused Flutterwave of operating without a license, the fintech has maintained that it submitted an application for licensing back in 2019, citing the country’s notoriously long licensing process. Meanwhile, the ARA’s freeze order is valid only for 90 days as it gears up for its case against Flutterwave which is set to appear in court in November.

Don’t just send money, send money fast. Send and receive money directly to mobile wallets, bank accounts, Barter or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

MULTICHOICE ACQUIRES NAMOLA

MultiChoice is looking to expand its options beyond just entertainment.

Last week, the DStv parent company announced its acquisition of Namola, an on-demand emergency response app.

So, more choices for MultiChoice?

Yup.

MultiChoice South Africa CEO, Nyiko Shiburi, said “Namola is part of our strategy to expand our ecosystem beyond entertainment and to offer a suite of consumer services that meet the needs of our customers.”

Namola describes itself as South Africa’s leading response solution “that allows all citizens get help fast”. On the app, users can get access to the public emergency services in South Africa including the police, fire service, ambulance and other community services. Its premium plan, Namola Plus, even allows users opt-in to receive help in emergency situations where they can’t reach or answer their phones.

Namola’s individual plan costs R29 (2$) per month, the couples plan is R59 ($3.30), and the family package is R99 ($5.6) monthly.

With MultiChoice’s acquisition, Namola will now be available to all DStv users—at extra cost, of course. From October 26, South African users can add the service to their bill.

Big picture: MultiChoice has big plans for its future. Other than its recent acquisition of Namola, it also recently launched an internet service called DStv Internet, and it’s planning to launch its own smart TV called DStv Glass. MultiChoice Group CEO, Calvo Mawela, also announced last week that the company is looking to foray into fintech, although we might not be seeing that for a while.

BAMBOO EXPANDS INTO GHANA

Bamboo, one of Nigeria’s leading online brokerage firms, has expanded into Ghana, making it the first trans-national West African brokerage app. Through a partnership with 10th Capital Investments, a licensed Ghanaian firm, the more-than-50,000 users on Bamboo Ghana’s waitlist will now be able to buy and invest in stocks from US companies like Apple Inc and Tesla.

When Bamboo raised a $15 million Series A round in January, its CEO announced that Ghana’s market was the company’s next frontier. Nine months and another $17.4 million raise later, the Ghana plans have become a reality. In a statement shared with TechCabal, Bamboo said it recently received a No Objection Letter from Ghana’s Securities and Exchange Commission (SEC) to operate in the country, enabling it to launch successfully.

“We believe strongly that all Africans should earn a return on their investments and build intergenerational wealth. That’s why we created Bamboo: we wanted to create an easy and secure way for everyday Africans to invest in the US stock market, and eventually, in all types of asset classes,” said Richmond Bassey, Bamboo CEO and co-founder.

Since its 2019 launch, Bamboo and other retail investment apps providing access to foreign securities like Chaka, Trove and Rise have had to deal with harsh regulatory conditions in their home country, Nigeria. In April last year, Nigeria’s Securities and Exchange Commission (SEC) labelled this category of companies as illegal and warned operators in the capital market to desist from operating with them. This was followed by Nigeria’s central bank describing Bamboo as unlicensed and freezing its bank accounts for a while. Despite the struggles, Bamboo has maintained its resolve to work “very closely with regulators in Nigeria” to ensure mutual satisfaction from both parties.

Now in Ghana, Bamboo has committed to working with the country’s SEC on an ongoing basis to develop a standard regulatory framework for the retail investment industry Bamboo is pioneering. Through Bamboo’s US digital investing partner, DriveWealth LLC, the Nigeria-born company assures users that all accounts can claim insurance of up to $500,000 via the US Securities Investor Protection Corporation (SIPC). With regulations and insurance in place, Bamboo is ready to make retail investment a norm in Ghana.

Albert Asiamah, 10th Capital Investments COO, was effusive about the performance of Bamboo’s product in Nigeria, describing the investment as ideal and beneficial.

“We’re thrilled to work with [the Bamboo team] to bring Ghanaians the opportunity to invest in the US and eventually the local stock market. Their impeccable track record in Nigeria, stellar product and educational tools make them an ideal collaborator,” he said.

“Together with Bamboo, we’ve been able to provide investors across Africa with affordable access to the US markets. Today, we’re thrilled to extend that same access to the people of Ghana,” said John Shammas, head of technical sales at DriveWealth.

“As we continue our international expansion, we look forward to empowering more customers with the tools they need to improve their financial well-being and engage with the markets,” he added.

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

👉🏾 Learn more at paystack.com/storefront.

This is partner content.

TC INSIGHTS: FASTER INTERNET

Across the globe, the internet plays a huge part in people’s daily lives. In Africa, its importance is extra critical as activities ranging from financial services to social commerce depend on its availability.

Yet, internet speeds across many African countries are far below the global average. At 68.9 megabits per second (mbps), South Africa leads the continent in terms of internet speed, though it fell short of the 77.7mbps global average according to Ookla’s Speedtest Global Index. The effects are dire as it restricts young Africans from harnessing more opportunities in the global digital economy where reliable and fast internet remain key.

While 3G and 4G internet services are largely available across the continent, they pale in comparison to the speed 5G internet brings. Currently, about 13 nations are testing 5G networks, with over 40 nations yet to lay down a foundation for the creation of 5G spectrums.

The impact of the 5G internet is already obvious on the continent. According to Sylwia Kechiche, principal industry analyst, enterprise at Ookla, MTNSouth Africa performed better than its competitors on the continent as a result of the 5G technology.

“We can clearly see the impact that 5G has on overall performance as South African operators came first thanks to having 5G networks in place. MTN South Africa was well ahead of the rest of operators, despite facing challenges with load shedding, with a median download speed of 65.95 mbps If we take 5G out of the equation, Safaricom Kenya was the fastest operator among the analyzed operators,” he said.

While analysts predict that 5G will add $2.2 trillion to Africa’s economy by 2034, the transition doesn’t seem so smooth. Existing challenges include spectrum regulation clarity, commercial viability, deployment deadlines, and low citizen purchasing power of 5G enabled smartphones and expensive internet.

To accelerate adoption of 5G technologies in Africa, African countries must develop clear and comprehensive frameworks for infrastructure deployment, use, regulation, and management. Spectrum pooling should be implemented to optimise the benefits of available spectrum and increase available bandwidths for mobile operators. Furthermore, spectrum trading should be pursued to enable cost-effective and efficient spectrum use to optimise the transfer of spectrum rights to users who require the 5G network spectrum the most, thereby lowering auction spectrum prices.

You can download all our reports here and watch videos from our events. Send your custom research requests here.

Start cashing out your bitcoin for naira today. With Cashout, you can own a bitcoin exchange and start receiving payments with bitcoin. Cashout makes it easy to exchange bitcoin for naira.

Get started today! Cash out with Cashout.

This is partner content.

IN OTHER NEWS FROM TECHCABAL

The diversity, equity and inclusion question in Africa’s burgeoning tech ecosystem.

Nairobi-based accelerator The Baobab Network invests $200,000 in four African startups.

JOB OPPORTUNITIES

- TechCabal – News Editor – Remote

- Mainstack – Community Manager – Remote

- Mainstack – Product Manager – Remote

- Nexford University –Channel Marketing Manager – Lagos, Nigeria.

- TFGLabs – Social Media Strategist – Cape Town, South Africa

What else is happening in tech?

- Constitutional Court strikes down parts of South Africa’s Copyright Act.

- Ghana’s most popular language will be available to more people online as Mozilla adds Twi to Common Voice.