IN PARTNERSHIP WITH

Happy pre-Friday ☀️

What are the biggest myths about working in tech?

That all techies have triple-monitor setups? That there are dollar-paying jobs waiting for everyone? Or that all tech companies operate remotely?

In this week’s edition of #EnteringTech🚀, we bust a few of these popular beliefs and talk about the hard truths of being a techie.

CRYPTO MARKET

|

|

|

|---|---|---|

|

Bitcoin

|

$19,097 |

– 0.02% |

|

Ether

|

$1,286 |

– 0.37% |

|

BNB

|

$269 |

– 1.04% |

|

Solana

|

$30.69 |

– 1.61% |

|

Cardano

|

$0.37 |

– 4.87% |

|

|

Source: CoinMarketCap

|

|

* Data as of 05:30 AM WAT, October 13, 2022.

MTN USERS EXPERIENCE OUTAGE IN SOUTH AFRICA

MTN may have broken it’s “everywhere you go” promise in South Africa.

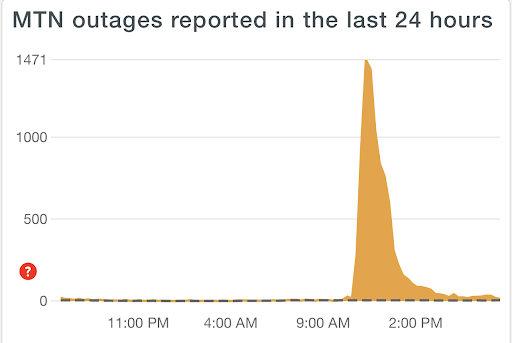

Yesterday, for five hours, users across South Africa reported that the network was down or slow. Users couldn’t access voice or data services in the region and many took to social media to confirm the outage. Corporate users including Vox, Afrihost and Supersonic confirmed the outage to South African tech publication, MyBroadBand.

Downdetector, a platform that reports on network outages, also showed over 1,500 reports of outages from users across South Africa between 11:30 AM and 3 PM (SAST).

In response to MyBroadBand’s query, MTN South Africa executive for corporate affairs, Jacqui O’Sullivan, confirmed the outage and revealed that the company was working to restore connectivity.

Connectivity was restored by 3:30 PM, with O’Sullivan and MTN South Africa reporting that the telecoms is still investigating what led to the blackout in the first place.

Join members of the tech ecosystem at Flutterwave’s first developer conference —Flutterwave Dev Jam (FDJ22).

It’ll be a day of exciting presentations and panel discussions focusing on building and scaling fintechs and best practices in engineering & payments.

Register here to attend physically, and for an online experience, register here.

This is partner content.

ORANGE MONEY AGENTS ON STRIKE IN BOTSWANA

Agents and distributors of Orange Money in Botswana have suspended the service following the mobile money service’s decision to cut their commissions by 60%.

The spokesperson for Orange Money Distributors, Sunil Jog, said dealers and agents suspended the service after receiving notice of the unilateral commission cut decision on August 31 and attempted to engage the company, but without success.

Reasons for the commission cut

Orange Money’s reasoning for cutting agents’ commissions is that the service is not making any money at the current commission rate.

Orange Money’s response

Orange Money Botswana CEO, Seabelo Pilane, has since confirmed that services at some dealers and retailers were temporarily unavailable at point of sale, as they [Orange Money] underwent contract negotiations with the agents.

Zoom out: According to statistics, Orange Money currently leads the mobile money industry in Botswana with a 30% market share and over P4.5 billion (~$351 million) in transactions since its launch in 2011.

M-SHAWARI LEAVES ITS PARENT COMPANIES

Kenya’s M-Shwari, which offers loans and savings services, is set to become independent from its parent companies (lender NCBA and telco Safaricom).

If you are feeling déjà vu while reading this, it’s because we told you just yesterday about Airtel Money Kenya doing the same and leaving its parent, Airtel Network Kenya. Two other mobile money products owned by Safaricom’s M-Pesa and Telkom’s T-Kash will be doing the same before the year ends or in early 2023.

The nation’s telecommunications providers are making their products autonomous to protect their fintech products from the commercial uncertainty that comes with operating a telecommunications business. Additionally, these divisions give the Central Bank of Kenya the control it requires to standardise Kenyans’ use of mobile money services.

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

👉🏾 Learn more at paystack.com/storefront.

This is partner content.

GOOGLE CLOUD TO ACCEPT CRYPTO AS PAYMENT IN 2023

By 2023, some Google Cloud users will be able to pay for cloud services with crypto.

Google Cloud has partnered with Coinbase to make that happen. This news comes right on the tail of the announcement that Google made about building a cloud region in South Africa—its first on the continent.

Google isn’t all in, at once

This payment feature will be available in early 2023, but it will not roll out to all Cloud customers at once. Google Cloud will make this available to only a subset of its customers and roll it out to all the others over time. This is not because Google is wary of cryptocurrencies—on the contrary, despite the crypto winter, the Alphabet-born company is keen on exploring the Web3 front in hopes of gaining an edge over its competitors (Microsoft and AWS), which are currently more profitable than it but do not yet accept crypto payments.

This is all good news, but there is a slim chance that any of these Google Cloud’s African clients will be included in the group of users who will experience the cryptocurrency payment platform for the first time. Some of Google’s Cloud’s major clients in Africa, like Safaricom and MTN, e-commerce startups like Takealot and Konga, Kenya’s Twiga Foods, and others, won’t be able to use the crypto payment integration. But with the exception of MTN, which purchased land in the metaverse, none of these businesses has shown a particularly keen interest in Web3 or cryptocurrencies. This may be because the majority of African governments have expressed their disapproval of cryptocurrencies and punished those who break their laws prohibiting them.

NALA LAUNCHES PAY BILLS FEATURE FOR THE KENYAN DIASPORA

Africans are the largest group of migrants globally. But here’s the good part: when people leave for greener pastures, they send money back home.

NALA, an African fintech startup, wants the African diaspora to do more than send money. They want them to be able to pay bills directly in their home country. And now, NALA has launched a feature to that effect for the Kenyan diaspora.

NALA’s solution allows its Kenyan diaspora customers to safely and securely send money directly to the Pay Bill or Lipa na Mpesa number of businesses and individuals in Kenya.

UK, US, or “U are on your own”

NALA’s solution is only operational for the Kenyan diaspora who live in the UK or US.

According to the founder, Benjamin Fernandes, NALA is focusing on these two countries not because they’ve been allies since the world wars, but because they jointly hold the greatest population of East African migrants outside Africa.

Mobile money on steroids

Mobile money has been majorly used for payments since it became a new normal in Africa, even to the point of minting francophone Africa’s first unicorn, Wave. Other players like M-PESA have taken it a notch higher, integrating credit facilities into the mobile money system.

What we have not seen before is mobile money payments as a form of international remittances. International remittances are traditionally operated by institutions like MoneyGram and fintechs like Remitly and Wise. With this move, NALA is pioneering an innovative interplay of fintech elements. Mobile money on steroids, basically.

Zoom Out: NALA is not tired of disruption anytime soon. Fernandes confirmed that Tanzania is the next country that’ll access NALA’s pay bill feature. Then more African countries will follow. In all this, we see NALA building on mobile money rails.

IN OTHER NEWS FROM TECHCABAL

GITEX, the world’s biggest tech show, is coming to Africa in 2023. Can it help the Maghreb tech ecosystem break even?

Namibia may be getting a central bank digital currency soon. Here’s what the Bank of Namibia is thinking.

Join Endeavor Nigeria on Thursday, 13 October 2022, as they host the 4th edition of their annual scale-up entrepreneurship summit, Catalysing Conversations. This year’s hybrid event, with TeamApt as the lead sponsor, is tagged “Building Big Bubbles… investing in the next generation of entrepreneurs”.

Register today at www.endeavornigeria.events.

This is partner content.

OPPORTUNITIES

- Expedia Group is inviting small businesses that have been existing for less than 10 years in the travel and hospitality industry to apply to its six-month remote accelerator programme. Among other things, selected participants will receive $20,000 in non-equity funding. Apply by October 21.

- The Fondation Maison des sciences de l’homme and the Institut Français de Recherche en Afrique of Nairobi are offering a three-month long fellowship in France for postdoc researchers from Kenya, Tanzania, Uganda, Burundi, Rwanda, and Eastern Congo (Kivu) who have presented their thesis from 2017. Laureates will receive a monthly stipend of €1,600 at the start of each month. Apply by December 9.

- If your startup or innovation is focused on climate-smart agriculture practices, apply to the THRIVE|Shell Climate-Smart Agriculture Challenge for a chance to win $100,000, a spot in a prestigious accelerator, publicity and more. Apply by December 11.

- Telecel Group’s African Startup Initiative Program is now open for applications. The 10 selected startups will receive €15,000 in cash each and benefits valued at more than €500,000, including credits from AWS, Google Cloud Services, Hubspot, and more. Apply by November 11.

What else is happening in tech?

- FlapKap raises $3.6 million in seed funding to provide business financing for e-commerce and SaaS businesses in MENA.

- Gridless, a Kenyan crypto company is using excess energy from hydro generators to mine bitcoin.

- MFS Africa is tightening its security; the company has selected ThetaRay to protect its services against financial crimes.

- Here are the biggest announcements from Microsoft’s Surface event.