Have you ever had one of those days where you see a group of kids walking

around in the middle of the day and you think “Shouldn’t you be in school?” If you’re a parent, you’ve probably noticed a couple of the 20 million children of school age who are currently out of school. Between insecurity and poverty, a lot of parents lack the means and/or are reluctant to send their kids to school. With millions of school-age children loitering on the streets, there are clearly issues with the educational ecosystem in the country. When parents send their kids to school, besides the quality of the school, they are concerned about two things mainly: money for school needs and the safety of their child.

Parents spend a lot of money on a number of charges when their wards begin school. From school fees to buying textbooks, to uniforms and other miscellaneous charges, there is constant money exchange along the process of securing a child’s future. Edtech and fintech startups all over the African continent have arisen to create solutions for this sector. One such startup straddling the unique line between fintech and education is Schoolable, the fintech app for schools. What Schoolable does differently is catering to all the stakeholders along the school value chain, including parents, school administrators, students, and even the banks. Their latest solution in this ecosystem is Little, a better way for parents to give their children money.

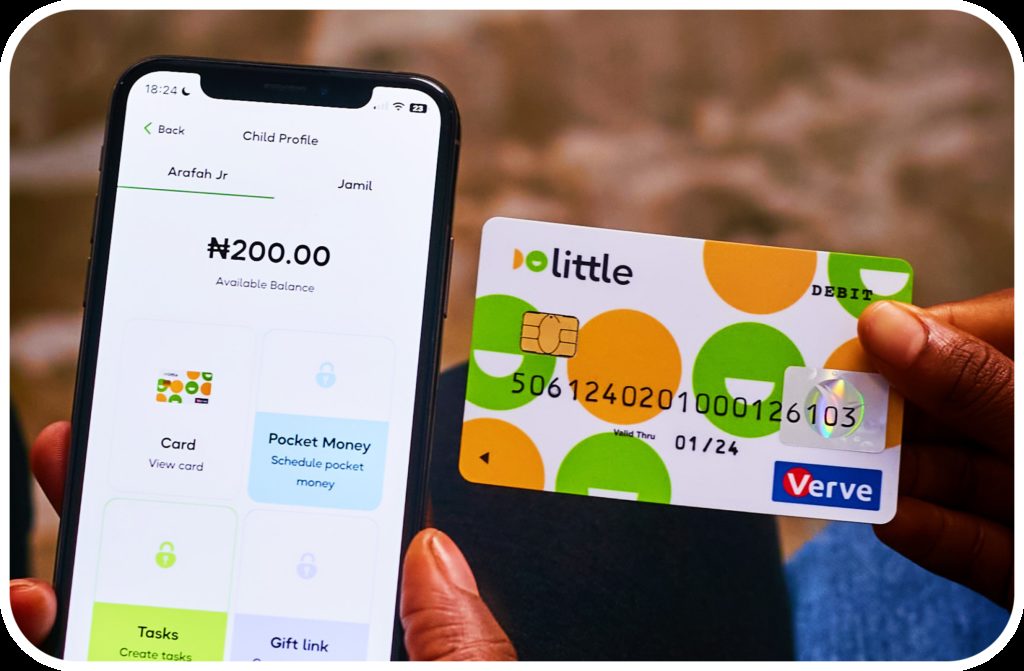

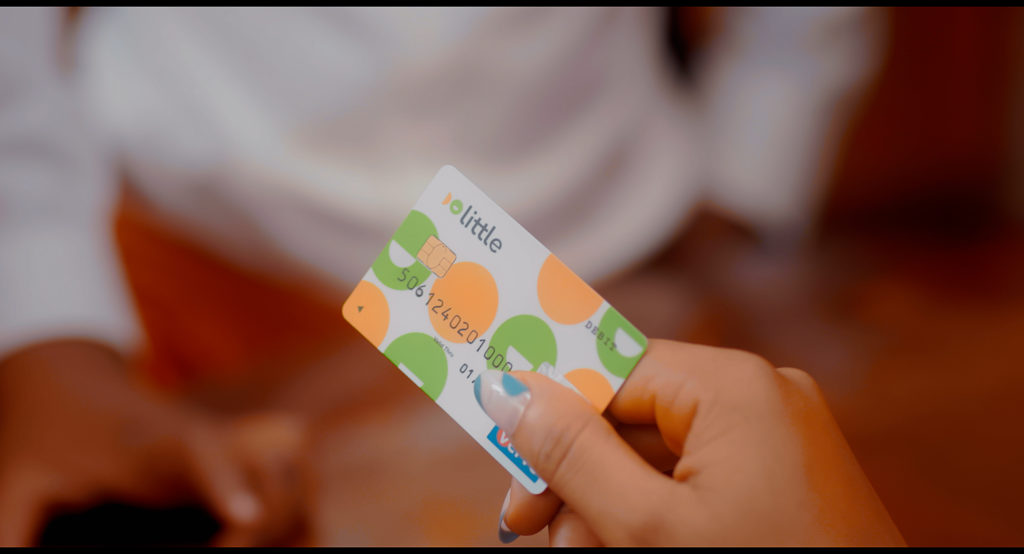

At its core, Little is essentially a pocket money card. Little is a mobile money wallet that comes with a personalised ATM card with a security pin, for children aged nine and above to use. Parents with children can deposit money into this wallet and their kids have access to it for needs within and/or outside school premises. With these cards, kids can make tuition payments, buy food and snacks, and withdraw cash. The company also provides payphones to boarding schools, and kids can make calls to parents using the payphones and pay with their cards. These cards make it easier for kids to access money for their needs within and outside school premises so they stay safe which gives the parents peace of mind. With Little, parents are now able to give their kids some financial access while also being able to monitor, limit, and secure this financial freedom.

Little was born out of the gaps the company identified while running Schoolable. According to CEO and co-founder of Schoolable, Henry Chibuzo, Schoolable was doing so well in helping parents organize school fees payment that some parents began to have leftover cash in their accounts and they thought a good use of that money will be to give their kids access to it for other more personal needs. Schoolable was founded in 2019 by Henry Chibuzo and Angela Essien to mainly function as a payment collection and disbursement platform for schools. Schoolable helps schools keep track of who pays them, when they pay, and how much they pay and by simply streamlining finance for schools, they have solved multiple layers of problems in the educational field.

While building a fintech solution catered towards parents and schools, the team at Schoolable realized that a lot of parents are not tech-savvy enough to bother with online payments which often do not work. Kids born today are born into a technologically more advanced world than their parents so even though they are tech-savvy, their parents are often not. The most popular tech app among Nigerians is Whatsapp with 91.9% of internet users in the country communicating with it even though Whatsapp is a basic level of technology–just an app for texting–a lot of adults still have difficulty navigating that. This was Schoolable’s biggest challenge. Keeping this in mind while building, the team decided to meet parents where they already are and build solutions that create ease without disrupting their already established patterns, which in this case is bank transfers.

What Schoolable does differently for parents is that they give them 3 invoices per child (one per term) and with this invoice they can pay for school needs multiple times, from tuition to textbooks to uniforms and everything is charged to that one invoice at no extra cost. Traditional banking fees are too high, especially for parents who are catering to more than one child. Without a solution like Schoolable, these parents often have to make large and expensive transactions multiple times and often have to visit physical banking institutions to do this.

For banks and schools, before Schoolable’s solution, school payments were often fragmented and spread across multiple banks. Parents all use different banks and schools have to provide them with multiple bank accounts so they have the option of picking the most convenient one for them. Schools also hold multiple accounts for various purposes and these multiple payments and accounts create confusion and increase operational costs. How Schoolable solves this is that it functions as a direct payment processor and streamlines these payments into one account for schools. As parents pay all fees per term into one Schoolable account, schools can tell who pays for what and when without sorting through multiple invoices. By partnering with schools using Schoolable, banks get 100% of the invoices paid directly to them, instead of sharing these deposits across multiple banks and accounts. Turning previously fragmented payments into bulk deposits in one account not only reduces account operational costs for schools but also improves their credit rating with the banks.

Schoolable has changed the way parents pay school fees and automatically how educational institutions and banks manage fee collection. Now they’re extending this to the rest of the family with the Little card for kids.

Why Little?

The appeal of little is that it provides kids with financial independence while giving parents control and assurance of their kids’ financial safety. Parents can stay up to date on how much their kids are spending and even where they’re spending it as transaction reports are sent directly to them. Parents with kids in boarding schools also no longer have to travel long distances to provide money for their kids and can rest easy knowing their kids are taken care of financially, regardless of location. This app also allows parents to limit the places where these cards can be used. Say for instance your child tries to gamble or buy something inappropriate online, as a parent, you can block certain merchants from transacting with your child.

Another benefit of using a card for transactions is that it eliminates problems like bullying and stealing. Sometimes kids are scared to speak up, so you may know that your child’s lunch money is being taken by a senior student. When you can see your child’s spending pattern, you can know when something is off about their habits. Parents can limit the daily amount spent on the card and because it’s secured with a pin, older or stronger kids can no longer bully their kids for their pocket money. These kids become bolder because parents trust them to be in charge of themselves and they no longer have to shrink themselves to avoid being bullied. These cards also eliminate the need for cash and therefore stealing as your child performs all their financial transactions via card and they simply don’t have money to be stolen. So now kids can go to the mall with friends or buy a midday snack without losing their cash either accidentally or to thieves.

Little is catching kids young and helping them develop better money habits, from little steps to becoming financially responsible adults. This is a great financial literacy app for kids as it gives them early access to money management which is an essential life skill. Research has shown that early financial literacy helps kids make better money and life decisions like what university to go to, and how to save and plan for future events. As kids are granted more financial decision-making powers early on in life, they become more independent and financially responsible.

“We hope to create a generation of kids that know how to manage money. A generation of kids that have financial literacy from a practical standpoint, not a theoretical one, who grow up to become financially responsible adults” Henry Chibuzo, CEO and co-founder of Schoolable says to TechCabal on the matter.

Currently, Little is working on extending its solutions into transportation. With this feature, kids will be able to use their cards to pay for bus rides and live GPS location will be sent to parents telling them when and where their kids board and where they alight. The benefit of a system like this is that it creates responsible and independent kids while giving parents safety assurance. With this, you can now know when your child leaves anywhere including school and you can be sure they’re safe and financially covered without having to physically be there all the time. This transport feature is still in private testing and parents can look forward to a rollout in the near future.

Since its launch, Little has served 31,000 families and 46,000 students in 1,350 schools. In the last year alone they have processed over 200,000 transactions and are growing rapidly.

To sign up and get early access to Little, visit the website.