IN PARTNERSHIP WITH

Good morning ☀️

Roses are red

Violets are blue

TechCabal is here

To ask something of you

What have you read

Give us a clue

It’s time you got heard

Tell us your view

We’ll continue to make cringeworthy parodies until we get enough reviews. 🥹

Drop us a review and stand a chance to win a $50 gift card.

CRYPTO MARKET

|

|

|

|---|---|---|

|

Bitcoin

|

$16,576 |

– 0.32% |

|

Ether

|

$1,175 |

– 2.69% |

|

BNB

|

$269 |

– 0.83% |

|

FTX Token

|

$1.44 |

+ 1.88% |

|

Binance Coin |

$1.00 |

0% |

|

|

Source: CoinMarketCap

|

|

* Data as of 19:30 PM WAT, November 20, 2022.

JUMIA SUSPENDS ITS PRIME SERVICE

The “Amazon of Africa” has been having a fulfilling year.

In Q3, Jumia reported $50.5 million in revenue, a 6% growth compared to $47.6 million in Q2, and 18.4% increase compared to $42.7 million revenue in the same period last year. Gross merchandise value (GMV) declined to $240.7 million from $252.7 previous quarter despite increasing from $238.1 million realised in the previous quarter.

Its operating losses also fell by 33% and gross profit rose by 29% compared to last year.

But it’s not enough

Despite having what appears to be a good year, Jumia is planning to implement changes that will reduce its operating costs.

First, it’s shutting down Jumia Prime, its loyalty programme that offered unlimited free deliveries on all orders in nine countries including Nigeria, Egypt and Kenya.

Jumia is also increasing the minimum basket size threshold for free delivery. It will also suspend its logistics-as-a-service offering in selected markets that don’t have sufficient logistics infrastructure ready to support third-party volume. This suspension, according to Jumia, excludes Nigeria, Côte d’Ivoire and Morocco.

The company will also lay off staff at its Dubai branch and move senior leadership to markets where they can be closer to consumers.

Zoom out: Earlier this month, Jumia’s long-standing co-founders and co-CEOs Jeremy Hodara and Sacha Poignonnec stepped down. Managing director of Jumia Côte d’Ivoire, Francis Dufay, was appointed as acting CEO while CFO Antoine Maillet-Mezeray was appointed as executive vice president of finance. Both executives were charged with reducing operating losses, and it appears they’re already at work.

Receive money from family and friends living abroad in minutes this holiday season with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

HEALTHLANE STRUGGLES TO STAY ON TRACK

While some companies are having to lay off staff, one is having its employees willingly walk out.

Amidst a funding winter, several African startups have started cutting costs in order to extend their lifelines.

For Nigeria and Cameroon-based healthtech, Healthlane—founded in 2019—it may already be too late.

Despite raising $2.4 million in 2020, the startup is battling to stay afloat following allegations of mismanagement of funds by founder and CEO, Alain Nteff.

According to 12 ex-employees of Healthlane who spoke to TechCabal, an implosion started in the second half of 2021 when Nteff started making erratic decisions.

What went wrong?

Employees say Healthlane made some big spends that were unnecessary for a startup its size.

The company, which had no more than 12 employees at any given time, was headquartered in a six-bedroom $50,000/annum mansion in Lekki, Nigeria which had a pool and a cinema room. Weekly feeding costs for employees—some of whom were offered accommodation in the mansion—averaged $700 per week. The company also paid for security services at ₦500,000 ($1,162) per month.

Nteff was also reportedly prone to making last-minute changes to critical projects. These erratic decisions led to wastage and redundancy in the procurement of medical equipment. For example, even though the company had a functioning haematology analyser, it purchased four more which were later abandoned because they were slow.

Co-founder, Agbor Ashu, who was more involved in procuring equipment, was also described as a figurehead by some employees.

Healthlane’s financial troubles began to surface in December 2021 when it could not pay staff salaries or vendor fees. According to documents seen by TechCabal, Healthlane owed vendors in Cameroon XFA 35 million (~$55,000) as of August 2022. In Lagos, the company owes utility bills (power and local government levy) of ₦714,000 (~$1,000). The company has also failed to repay over $407,000 taken in loans from three other startups—Infiuss Health, Float and PayHippo.

Over the next couple of months, Nteff assured worried staff members that the company had over $1 million in the bank but could not convert it from crypto to dollars. By the first half of 2022, several employees had quit due to unpaid salaries and some were fired.

More recently, in September 2022, the startup was announced as one of the 60 startups selected for the second cohort of the Google for Startups Black Founders Fund. The selection comes with equity-free funding of up to $100,000 for Healthlane but Nteff—who has been avoiding employees all year long—is yet to mention the fund to employees.

Zoom out: TechCabal reached out to Nteff and Ashu for comments on these allegations, but the co-founders declined to speak. Nteff, in an email, stated that the allegations were “factually incorrect”. The founder also shared that Healthlane is conducting an investigation into the “illegal access of Healthlane files by journalists” and will issue a statement when the investigation is complete.

GOOGLE TO DELIST ALL UNREGISTERED LOAN APPS IN NIGERIA AND KENYA

Google is finally borrowing a leaf from the Central Bank of Kenya’s book.

Last week, Google updated its Developer Programme Policy, and these updates will stem the activities of digital lenders in Kenya and Nigeria.

In Kenya

According to the new policy, loan apps—or Digital Credit Providers—must be licensed by the Central Bank of Kenya. “Currently we only accept declarations and licences from entities published under the Directory of Digital Credit Providers on the official website of the CBK,” the policy reads.

Last year, the Kenyan government announced new registration requirements for digital lenders with the enactment of the Central Bank of Kenya (Amendment) bill.

The deadline for application expired in September 2022, and only 10 of the 288 applicants were approved and licensed by the CBK.

With Google’s new policy updates, these ten will be able to list their apps on Google Play while others have until January 31, 2023, to comply.

In Nigeria

Similarly, in Nigeria, Google is requiring all digital lenders to get approval letters from the Federal Competition and Consumer Protection Commission (FCCPC).

Google also expects these apps to adhere to the Limited Interim Regulatory/Registration Framework and Guidelines for Digital Lending which was recently adopted in August 2022. Among other things, this regulation requires digital lenders to declare their fees and explain how they solve complaints.

The big picture: In the past two years, digital lenders across city countries have come under fire for predatory and unethical lending practices. In March of this year, Nigeria shut down six illegal digital loan companies. More recently, Kenya announced it was investigating 40 digital lenders for misappropriating customers’ data.

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

👉🏾 Learn more at paystack.com/storefront.

This is partner content.

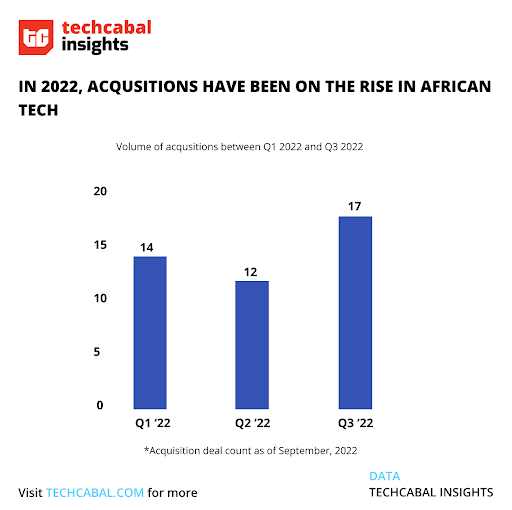

TC INSIGHTS: ACQUISITIONS ARE ON THE RISE

The last three years have been the best of times for African startups. Venture capitalist (VC) funding grew from $366 million in 2016 to a record $5.2 billion in 2021. This year seemed to be on a similar trajectory. The value of VC deals reported in the first six months of 2022 reached $3.5 billion in 2022 H1, equating to a 133% YoY increase from 2021 H1—far above the global average and sufficient enough to establish Africa as the only region to register double-digit growth within the period.

Then, a slump began In the third quarter of 2022, with funding dropping by 46% compared to Q2 2022.

Interestingly, acquisitions have taken an opposite direction. In 2021, TechCabal Insights tracked 32 acquisition deals on the continent. By the end of Q3 2022, there have been about 43 acquisition deals. A closer look at the Q3 deals—with a 41% QoQ increase—might signal a stronger consolidation.

This year, startups have not been able to raise venture capital funding as easily as in 2021 and in the case where cutting costs won’t suffice in ensuring longevity, the next logical step is leveraging alliance to avoid shutting down operations. This could mean that acquisition deals that happen for startup survival are mostly between startups playing in the same market. They usually lack an expansion play since cross-border expansion costs more and the entire aim of consolidating for survival is to lower costs.

With the increase in the number of local acquisitions, it could mean that a good number of startups in Africa might be feeling the venture capital funding drought more than imagined. “We’re in a situation where cash is king and it’s a perfect environment for acquisitions. A very natural way of growing is that when you look around and see startups starting to slow down and worrying about runway, you start to think of M&A since the prices are falling,” says Stephen Deng, Partner at DFS Lab.

Another perspective to the increasing number of acquisition deals is the pressure of growth on larger tech companies. This cluster of companies have the opportunity to scale up to continental leadership and since cross-country expansions are harder to work on, acquisitions become their bread. “Growing 100% from $10 million revenue means adding $10 million, growing 50% means adding $25 million and in Africa, it’s simply hard to generate revenue at that scale in what remains a relatively small economic base,” says Victor Basta, co-head at DAI Magister. He argues that the majority of the M&A deals began before the current market downturn and that companies do not consolidate to save themselves from shutting down because “it is almost always too late”.

“What is driving boards to consider M&A deals is the reality of funding markets and concerns about raising next rounds,” he concluded.

More likely, African tech is in an intermission between business epochs. We’ve mostly passed through the era of low funding and the funding glut era. But in the past few months, the explosion of acquisitions signifies that something is on the horizon. A few years from now, looking back at this trend, we may say that this moment was a battle between future growth and survival.

You can download our State of Tech in Africa Q3 report here and watch videos from our events. Send your custom research requests here.

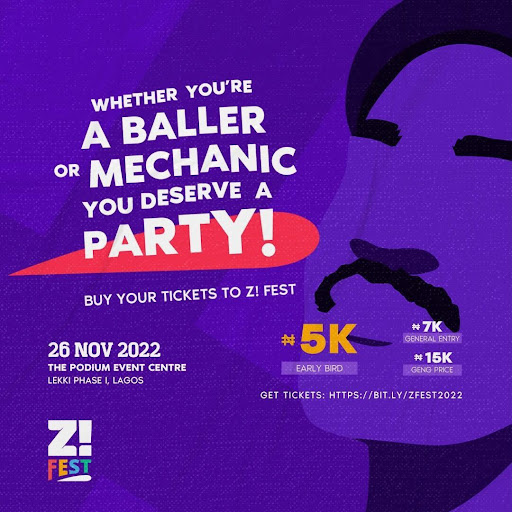

EVENT: Z! FEST

2022 has been a lot. From crypto crashes to inflation, and even regulation scares, our heart rates and hairs have been up all year.

Our sister publication, Zikoko, wants to bring that all down to the dance floor with the second edition of its festival, Z! Fest.

Z! Fest’s Class of ‘22 offers techies the chance to break away from their screens in a party designed for stress relief. If you like food, drinks, loud music, and the sheer threat of meeting new cool people, then Z! Fest is the place to be.

Register now to join Ayra Starr, YKB, Yinka Bernie, Dwin the Stoic and other artistes at Z! Fest.

IN OTHER NEWS FROM TECHCABAL

Who are “digital nomads” and how much impact do they have in Africa?

Here’s how Losode is helping African fashion entrepreneurs reach a global audience.

Africa’s tech ecosystem’s success lies in the hands of its governments.

JOB OPPORTUNITIES

- Chowdeck – Sales Associate, Social Media Manager – Nigeria (Remote)

- Big Cabal Media – Learning & Development Executive, Software Developer, Commercial Director, Sales Associate – Lagos, Nigeria (Hybrid)

- Zikoko – Money Writer, Inside Life Writer, HER Writer, Copy Editor – Nigeria (Remote)

- TechCabal – News Editor – Africa

There are more jobs on TechCabal’s job board. If you have job opportunities to share, submit them at bit.ly/tcxjobs.

What else is happening in tech?

REFER A FRIEND

| Click to share | |||

Share your unique link | |||

| https://techcabal.com/referral/?email={$email} | |||

Share on social | |||

| |||

| Powered by Viral Loops | |||