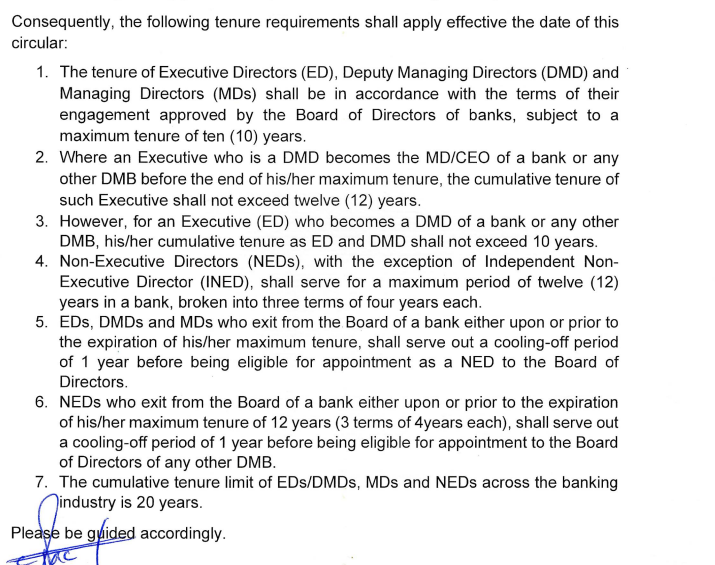

In news that could have easily slipped under the radar last week, Nigeria’s Central Bank announced an important change in the tenure limits of banking executives and non-executive directors. The most significant shift by the CBN is that bankers will now serve a maximum total of 20 years as executive or non-executive board members. Tenure limits for bank executives were introduced in 2010 by former CBN governor Sanusi Lamido to improve corporate governance. The 2010 rules set a limit of two terms of five years each.

Those limits led to the ouster of Jim Ovia and Tony Elumelu in July 2010 as CEO of Zenith Bank and UBA bank, respectively. Per the same 2010 rules, those bank executives could not be appointed to other roles at the bank (or its subsidiaries) for three years. It explains why Tony Elumelu and Jim Ovia became Chairmen of UBA Group and Zenith Bank, respectively, in 2014.

Under CBN’s new tenure limit shared last week, both men would have to leave next year, which marks their 20th year as top executives. The rule will affect other bank executives like Segun Agbaje, who became Guaranty Trust HoldCo CEO in August 2021, and Herbert Wigwe who became Access Holdings Plc CEO in March 2022. Both men have also spent over 20 years as top executives at both banks.

New tenure limits will affect HoldCos

In 2020, many Nigerian banks began exploring changing their structure to stay competitive and explore other businesses. By law, Nigerian banks cannot delve into businesses unrelated to their core banking functions. The change in structure also meant that the CEOs nearing their tenure limit of 10 years could instead become CEOs of the Holding Company (as in the case of Wigwe and Agbaje).

Unfortunately for them, the new CBN rules also apply to the Holding companies of banks, making their exits likely. Several Nigerian publications claim that the move to cap the tenure of executives across board in Nigerian banks is to curb brain drain.

The pros and cons of the new rules

Mr. Ijezie, a former banker, told TechCabal,”Industry knowledge is a valuable asset that should be shared across the board, rather than retained within a single organization.” Under the new policy, executives with 20 years of experience at one bank will have to move to another bank. These kinds of moves will inadvertently spread industry knowledge as they will apply their expertise and expertise elsewhere. Other observers argue that “sit-tight” executives have reduced the possibility of upward mobility for other employers. They say that the new rules will ensure that more people can aspire to top leadership positions.

Other analysts disagree, with one writer at ProShare calling it “a clumsy overreach of power and responsibility,” especially because of the way the CBN grouped parent and subsidiary entities. Beyond this, some question if the CBN should force out executives who have delivered value to shareholders.

Ultimately, the new rules will prompt a shakeup of a banking system where leaders are often well entrenched. While some pushback against the policy has some merit, it’s easy to understand that the CBN is acting to prevent abuse of power by established executives.