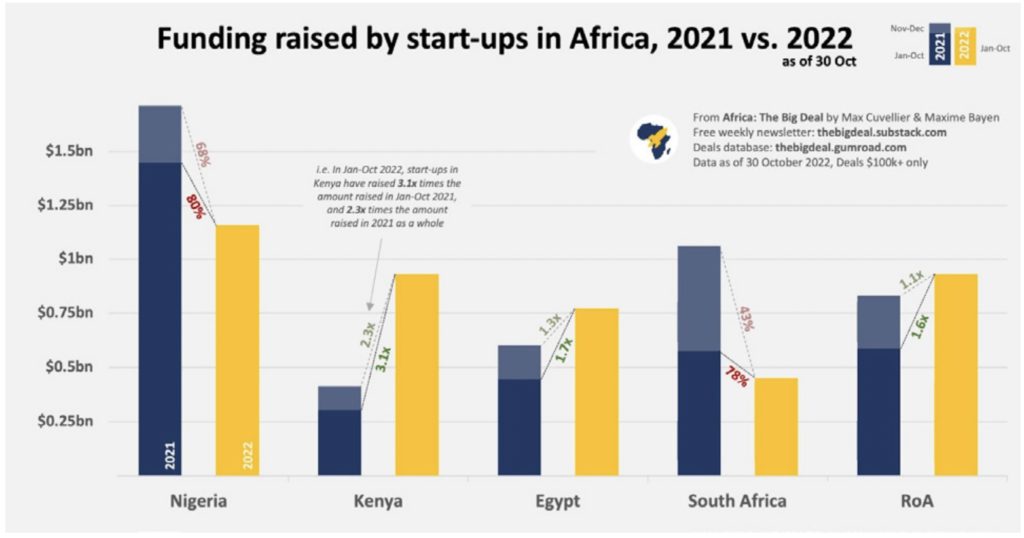

According to data by venture funding tracker Africa: The Big Deal, out of the “Big 4” tech ecosystems in Africa, South Africa recorded the second highest year-on-year decline in the value of deals in 2022, dropping by as much as 78% from the previous year.

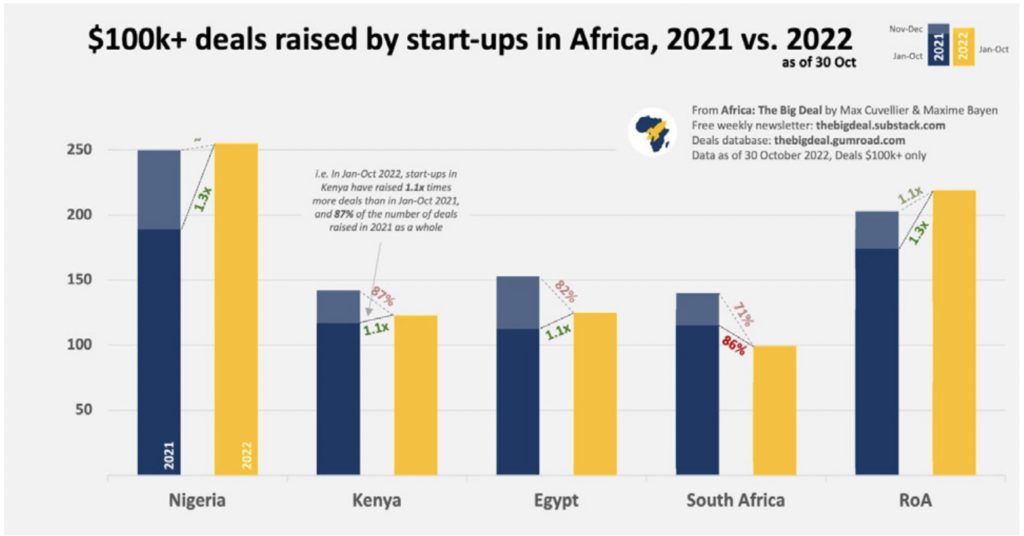

When it comes to the volume of deals, South Africa topped the charts, in a not-so-good way, as the country saw the number of $100,000 deals plummet by as much as 87%.

At the moment, according to analysis [pdf] by AfricArena, a Cape Town based accelerator, South Africa faces a real risk of being toppled by emerging ecosystems including Ghana and Tunisia for a spot in the coveted “Big 4” list.

“South Africa is now way below Nigeria in terms of growth in startups and funds raised. Egypt is now second in total startups and funds raised and Kenya, third. In addition, although South Africa is still within the Big 4 tech startup ecosystems of Africa, they are getting chased by the likes of Tunisia, Senegal and Ghana for that 4th place all due to the slow response by the South African government in recognising the need for a Startup Act now,” states AfricArena.

The impact of a Startup Act

Although their penetration is still relatively low across the continent, Startup Acts across Africa’s tech startup ecosystem are slowly being adopted by several countries. Tunisia was the first country to adopt one in 2018, followed by Senegal in 2019 and Nigeria in 2022. Kenya’s Startup Act, which was approved by parliament in December 2021, is expected to be signed into law by President William Ruto sometime in 2023.

In countries where they have been passed into law, Startup Acts have shown significant effectiveness in advancing the respective countries’ tech startup ecosystems. For example, in the five years that Tunisia’s Act has been in effect, the country has seen venture capital inflow balloon from $5 million dollars in 2017 to $26 million in 2021, an impressive 31% increase.

In 2022, data from Statista shows that Tunisian startups raised more than $173 million, a large portion of that funding coming from AI startup InstaDeep’s $100 million Series B round. InstaDeep was acquired by UK firm BioNTech for $685 million in January this year.

Tunisia’s Startup Act is largely credited by analysts for the country’s tech startup ecosystem boom as it “provided policy and legislation that opened the markets for startups and venture capital investors and allowed for supportive resources to be directed at growing innovative Tunisian startups.”

Ghana, which also has a Startups Bill currently in formulation, has made much progress and presents real competition for South Africa in attracting venture capital funding.

“With less investment coming into South Africa, there is undoubtedly a chance that Ghana, which was rated number 5 on the continent in terms of financing raised in 2022, will eventually surpass South Africa. It is an attractive country to do business in due to its continued political stability and much more liberal business environment compared to South Africa, making it particularly appealing to tech companies. In the long run, South Africa will probably remain in the top 5 until countries like Algeria, Tunisia, or the Democratic Republic of Congo fully fulfil their potential,” said Dan Mabbyalas ,project manager at AfricArena.

And then there is South Africa…

According to the report by AfricArena, among the “Big 4”, South Africa has shown the slowest progress in drafting and implementing its Startups Act, a situation which is credited to the government’s slow adoption of policy suggestions put forward by ecosystem players including startups, venture capital firms, incubators, and accelerators.

However, according to Matsi Modise, a member of the steering committee of the Startups Act movement, much progress has been made in engaging with the government towards the implementation of the act.

“In October 2021, we had a meeting with the President where we presented this idea of a Startup Act and got what I would call a positive response. From then on, that’s when we started engaging the government. To date, we’ve been able to meet with the Deputy Minister of Finance and Minister of Science and Technology to discuss our stance,” said Modise in an interview with TechCabal.

Modise further states that some of the issues facing the South African tech startup ecosystem which could be addressed by a Startup Act include unfriendly visa requirements for foreign talent and the presence of exchange controls in the country which severely limit the ease of doing business for startups.

“We are not making it easy for talent to come into South Africa because we don’t have a very clear, straightforward, and easy-to-follow startup visa regime where it’s easy for startup talent to come here. And then also we have exchange control which creates a lot of limitations for capital and intellectual property to flow in and out. So those are the issues that we are engaging the government on as the Startup Act movement,” added Modise.

The need for interventions through a Startup Act to address the challenges facing the South Africa tech startup ecosystem, specifically the venture capital side, is also reiterated by Shelley Lotz, head of regulatory affairs at the South Africa Venture Capital Association (SAVCA).

“The interventions proposed in the act include providing tax breaks and incentives to qualifying startups, removing barriers that inhibit employment flexibility and special skills visas, removing regulatory barriers that hamper globalisation and investment into qualifying startups, exempting qualifying startups from preferential procurement limitations,” said Lotz.

Much progress made but still a long way to go

According to Modise, in order to accelerate the establishment of the Startup Act in South Africa, the focus is on advocating existing legislation to align with the needs of the tech startup ecosystem instead of trying to create a new Act altogether which, according to her, would take much more time.

“South Africa is unique in the sense that we don’t necessarily need an Act.What we have in South Africa are various policies and legislation, or legislative frameworks, that just need to be adjusted. So instead of creating a whole new legislation, we are saying, within what already exists, let us just refine it so that it accommodates startups and in my opinion, that is a process that can happen within a year,” concluded Modise.

South Africa has been and is still, without a doubt, one of Africa’s most valuable tech startup ecosystems. Its mature economy and various other factors including an active private sector, high internet penetration and high quality tertiary education give it a comparative advantage in comparison to other ecosystems like Nigeria and Kenya. The country has also consistently registered more exits than other ecosystems in Africa, a show of its strength.

However, over the last five years or so, the country’s failure to create an enabling environment, through legislation, to allow startups in the country to flourish has seen other countries on the continent like Nigeria and Egypt eventually catch up and even surpassing it when it comes to attracting VC capital, which is an important measure of the attractiveness of an ecosystem.

To eventually go back to the glory days and claim its previous spot as the destination of choice for tech startup investment on the continent, a Startup Act, or similar legislation, could prove to be effective in achieving that mandate. Through removing the current barriers affecting the growth of the ecosystem, South Africa could also benefit largely from an enabling environment fostered by such legislation.