As South Africa’s national power provider Eskom goes through its seemingly never-ending challenges which have plunged the country into literal darkness, the demand for alternative energy sources is surging [pdf].

In December 2021, energy minister, Gwede Mantashe, stated that the South African government had allocated $2.8 billion in contracts for 25 renewable energy projects to the private sector to address the growing demand.

These projects include wind farms and photovoltaic plants and could increase South Africa’s electricity capacity generation by nearly 5%.

Venture capital not left behind

The private sector is not getting left behind. Last month, venture capital and private equity firm Grovest announced its Section 12B fund which will give significant tax deductions to investors who back alternative energy startups.

The launch comes on the back of an announcement by the South African national treasury to temporarily expand the tax Section 12B incentive available for businesses to promote renewable energy, to encourage private investment to alleviate the electricity crisis.

The incentive allows businesses to deduct the costs of qualifying investments over one year or three years, which creates a cash flow benefit in the early years of a project. Businesses will be able to claim a 125% deduction in the first year for all renewable energy projects, with no thresholds on generation capacity.

According to Jeff Miller, the Twelve B Green Energy Fund could raise as much as R500m in capital in its first year of operation. The initial target capital raise is R200m but strong demand for the investment vehicle could see a further R300m raised from individuals, pension and provident funds, companies and trusts over the next 12 months.

“Investors can invest directly into the partnership which owns the solar assets, which then sells the electricity it generates to off-takers. In doing so the investor can not only claim the allowance in the year in which the solar energy starts being produced, but they also get a biannual distribution of the profit that is generated from selling the electricity,” said Miller in an interview.

The Section 12B incentive follows in the footsteps of the Section 12J incentive which allowed investors to write off capital invested in technology-focused startups. Eventually sunsetted by the government in 2021, the Section 12J incentive rallied the boom of venture capital into South African startups as numerous venture firms set up dedicated 12J funds to fund early stage tech startups.

Perfect timing

Venture capital inflow into greentech startups has been few and far between. According to Michael Maas, founder of Zimi, a startup whose flagship product is an app that allows users to charge their electric vehicles, most local venture capital firms have not shown much interest in greentech startups.

“There are a couple of VCs that are climate focussed in Africa, but very few in SA,” said Maas. “I think there is a larger capital inflow from institutional investors, but not so much on the VC or Angel side. “

The lack of local VC involvement has seen South African startups look elsewhere, specifically to the US and Europe, for alternatives.

“There is availability of capital for investment from VCs and Angels from the US and Europe. To take advantage of that, South Africa needs more relaxed exchange controls and easier vehicles for foreign investors to push money into startups,” added Maas.

On whether the introduction of Section 12B offers any hope to greentech startups in boosting the availability of VC capital in the sector, Maas prefers to see the actual figures of capital invested into startups before being too excited.

“It is great to see these types of funds being launched. My question would be how many investments they have actually made to date and the outcomes of those investments. There is a lack of this type of information from multiple VCs and funds, but it is where the rubber hits the road for climate focussed startups looking for investment,”said Maas.

A long way to go

Although it just recently got launched, the incentives offered by the Section 12B legislation look promising, especially considering the success garnered by the Section 12J legislation.

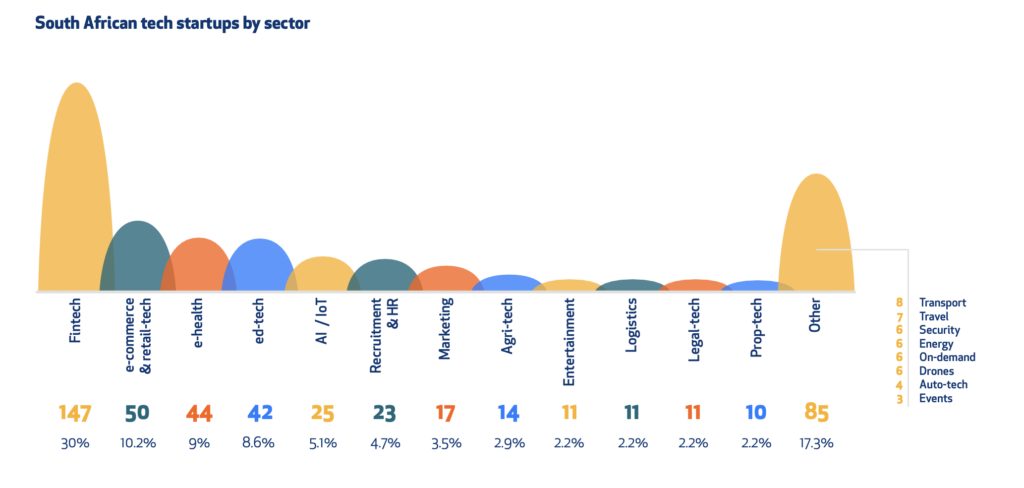

However, startup activity in the alternative energy sector is still relatively low in South Africa despite the high demand. According to the South Africa Startup Ecosystem report by Disrupt Africa, energy startups make up a minuscule portion of the country’s startups compared to other areas like fintech, e-commerce and edtech which are buzzing with activity.

An influx of capital into the sector could see much more activity in the sector as a combination of demand and funding creates an enabling environment for innovators to pull up their socks. Until South Africa’s venture capital and private equity firms start creating 12B funds to fund these startups, all these potential benefits remain theoretical but their promise of a literal bright future for South Africa cannot be ignored.

In a country with such an ailing national grid, greentech startups seem well placed to become the next big thing in South Africa, propelling the country to alternative energy dominance, and through a combination of capital and innovation, it will be very interesting to see the state of the sector over the next few years.