According to reporting by BusinessDay, Africa’s most valuable company by market capitalisation, Naspers, has shut down its venture capital fund Naspers Foundry in an effort to scale down its operations.

Post the sunsetting of the fund, the Foundry will continue to maintain the investments it has made which include in startups like Naked Insurance, SweepSouth, and most recently, Planet42’s $100 million megaround.

“The global investment environment, as well as the local SA one, has changed and we have made clear the need for our business to adapt,” a Naspers spokesperson told BusinessDay.

“In line with changes across the wider business, we have reviewed our early-stage investment strategy within SA to bring it in line with our international approach. Naspers will continue to support the development of SA’s early-stage tech sector, assessing the market and new opportunities in a way that is consistent with our other global markets.”

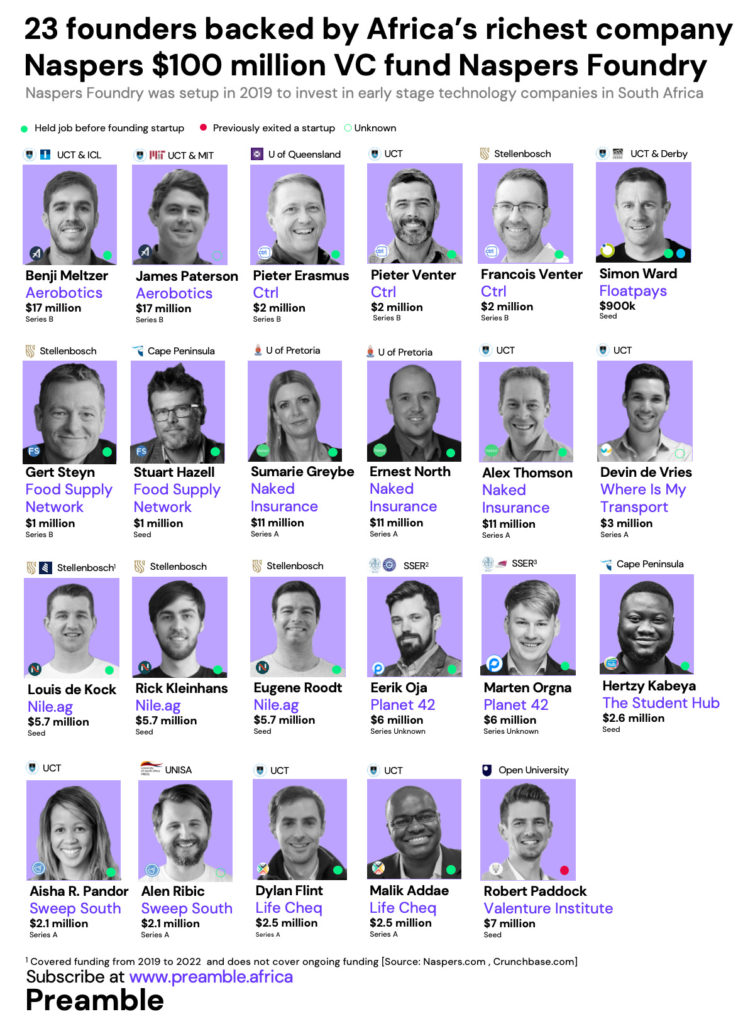

Since its launch in 2019, Naspers Foundry has funded over nine startups to the tune of over R740 million (~$40 million).

Diversity problems

Last year, South Africa’s Competition Commission released a report which called out online intermediary platforms for excluding historically disadvantaged persons (HDPs) from South Africa’s Internet economy. The report called out the Naspers Foundry for having no mandate to support historically disadvantaged peoples (HDPs), which include people of colour.

After four years and R740 million (~$40 million) of disbursed funds to 23 founders, only 13% of the recipient founders were persons of colour (3 founders) and only 8% were women (2 founders).

Way forward

Prior to the shutdown, just over half of the Naspers Foundry’s fund had been deployed in startups. Henceforth, investment in South African startups will be done through the group’s international venture unit, Prosus Ventures.