Read this email in French.

IN PARTNERSHIP WITH

Merry Monday 💀

Good news for some people: you can now pay for Twitter.

Months after the subscription service was relaunched, Twitter Blue is now available in South Africa and Nigeria.

In addition to getting to edit tweets and bookmark folders, the relaunched Twitter Blue service also comes with the coveted verified checkmark that tells people which users are better than the rest.💀

With discounts of 12% for Nigeria and 13% for South Africa, iOS and Android devices will pay flat rates of ₦5,000 and R200.00 monthly; while those subscribing to the web service will pay ₦3,650 and R144.99 monthly.

The annual subscription costs ₦38,500 and R1,519 for web, while those on iOS and Android devices will pay ₦52,900 and R2,099.

THE WORLD WIDE WEB3

|

|

|

|---|---|---|

|

Bitcoin

|

$20,624 |

+ 1.95% |

|

Ether

|

$1,477 |

+ 2.57% |

|

BNB

|

$278 |

+ 0.91% |

|

Solana

|

$18.22 |

+ 4.28% |

|

|

Source: CoinMarketCap

|

|

* Data as of 14:30 PM WAT, March 12, 2023.

One of the world’s largest stablecoin operators, Circle, has confessed that it has $3.3 billion stuck in Silicon Valley Bank. Fortune reports that the company has now called for urgent rescue plans from the Federal Government. The revelation has also caused the price of its stablecoin token, USD Coin, to crash.

Echo VC, a pan-African VC firm, has announced a $8 million fund for blockchain-powered startups on the continent. TechCabal reports that the fund will be deployed to blockchain startups that are substantiating the utility of blockchain products and solving some of Africa’s pressing challenges.

Meta has dropped all its metaverse ambitions and is now working on a decentralised text-based social media platform. TechCrunch reports that the platform is Meta’s attempt to compete with Musk-owned Twitter and open-source social network host Mastodon.

A Premier League star, Gustavo Scarpa of Nottingham Forest, lost £1 million ($1.2 million) investing in crypto and has now filed a lawsuit to get it back. The Mirror reports that the star used a crypto company called WLCJ to invest the funds for a 3.5%—5% interest rate, but the company is now dissolved.

Be part of 5 women selected to join Moniepoint in various roles, getting mentorship, fantastic perks and the opportunity to join the company full-time. Sign up for the Moniepoint Women-In-Tech internship 3.0.

Visit womenintech.moniepoint.com.

This is partner content.

WHAT’S HAPPENING IN SILICON VALLEY?

On Friday, news broke that the US Federal Deposit Insurance Corporation (FDIC) had shut down Silicon Valley Bank (SVB).

Here’s a quick breakdown of why this is a big deal.

SVB, the 20th largest bank in America, is the go-to bank for tech startups across the West. In 2019, right before COVID, the bank had about $60 billion from customers’ deposits—most of its customers being startups. COVID, however, brought a funding boom that doubled the startup funding for most regions including America, Europe and Africa. For SVB, this meant customers’ deposits grew from $60 billion in 2019 to $189 billion by 2022.

Like all banks, SVB decided to invest some of this money. Its choice investment was mortgage backed securities (MBS) for which it invested—or paid—$80 billion at 1.25% for a 10-year term. Unfortunately, by 2023, the interest rates for MBS grew to 4.65%, which meant that SVB would lose $1.8 billion if it tried to sell the bonds, instead of holding them for the 10-year term.

Side bar: Anyone who bought the bonds would be buying them at the 1.65% rate, not the 4.65% rate. Think of how 1 bitcoin in November 2021 was worth $65,000 and now it’s worth $20,000.

Well, SVB decided to pack it in and sell the bonds. It planned to gain back the $1.8 billion it would lose via a capital raise from its shareholders. Unfortunately, it announced its $1.8 billion loss and its raise plans at the same time.

All its customers got spooked and most started requesting withdrawals. Unfortunately, though, SVB didn’t have the money to recoup.

What happens now?

Yesterday, the FDIC and the US Federal Reserve announced that all deposits—insured and uninsured—will be protected. Depositors will reportedly be able to acceess their funds starting this week. “No losses associated with the resolution of Silicon Valley Bank will be borne by taxpayers,” the statement read.

This means everyone will get their money back as quickly as possible.

It is unknown at this time how many African startups are affected, but fintech Chipper Cash is one of the bank’s customers; SVB also invested in Chipper’s Series C round in 2021. Yesterday, the fintech announced that it had $1 million stuck in the hassle, but the FDIC had assured it that it would get half the funds back this week. The fintech also assured the public that customer operations were not affected. VC firrm Future Africa also announced minimal exposure the bank.

ACCOUNTS FROZEN OVER ILLEGAL FLUTTERWAVE TRANSFERS

Last week, Techpoint Africa reported that fintech unicorn Flutterwave had suffered a hack by culprits who transferred about ₦2.9 billion ($6.3 million) from the startup’s account.

The fintech promptly denied the hack, stating that it only noticed and reported an “unusual trend in transactions”.

Several sources have, however, told TechCabal a different story. Court documents seen by this publication also show the fintech seeking an order to freeze 106 bank accounts—across 27 Nigerian banks and financial institutions—which had directly or indirectly received money from the illegal transfers.

Alex Onyia, CEO of Educare, who first tweeted about the hack, told TechCabal that his company lost ₦8 million ($17,391) which was moved from his company’s Flutterwave account by the hacker. His bank, Access Bank, upon investigating, froze the account after noticing the large cash flow.

Another victim, Ajeka Illiasu Opaluwa, who is the CEO of crypto exchange platform Pajek Signatures also reports that ₦1.6 billion ($3.4 million), which he received from a Chinese named William Atong Chen, for the sale of USDT, was tagged as part of the stolen Flutterwave funds by his bank. People who received money from Opaluwa also had their accounts frozen, including David Ofedu Audu who had five of his bank accounts affected.

TechCabal also spoke to affected people who claim to have no connection to Flutterwave, including Henry Awaka whose Fidelity bank account was listed as the fourth beneficiary in Flutterwave’s suit. Awaka received ₦1,199,291 ($2,607) for the bulk sale of alcoholic drinks—his usual trade—but the amount marked him as a fourth beneficiary for the illegal transfer.

So far, there are reportedly 108 victims with frozen accounts who are waiting on Flutterwave for an answer. The fintech is yet to respond to any requests for comments or explanations.

Curacel Grow helps you easily embed insurance with your products and on your platforms to increase customer loyalty and grow revenue. Our embedded insurance products give you tailored and on-demand insurance to suit your specific business needs.

To learn more about how we can help you expand your business, visit Curacel.co, send an email to marketing@curacel.ai or call 08035257749.

This is partner content.

MTN NIGERIA RAISES $271 MILLION

MTN Nigeria is currently divesting its assets.

Last week, the telco announced that it had raised ₦125 billion ($271 million) as part of its commercial paper issuance.

Side bar: Commercial papers are exactly what they sound like: expensive IOUs. They are unsecured loan instruments used by companies that need to raise money fast.

In February, the telco announced its plans to raise ₦100 billion ($217 million) to support its working capital and general operating expenses. The Series 4 subscription had a 188-day tenor and was offered at 11%, while the series 5, with a 267-day tenor, was 12.50%.

While the company only sought ₦100 billion, it received a 125% subscription. The issuance was completed on March 1, 2023, almost a week after its scheduled date of February 23.

Stanbic IBTC Capital arranged the deal while Stanbic IBTC Capital, Chapel Hill Denham Advisory, Coronation Merchant Bank, FBNQuest Merchant Bank, and FSDH Capital were the dealers.

TC INSIGHTS: FUNDING AFRICAN DIGITAL MEDIA

Africa’s digital media sector is corresponding with the rising demand for online multimedia content consumption on the continent. Yet, most African digital media outlets have a funding problem.

In 2020, African digital media outlets earned 26% of their income from advertising, down slightly from 29% in 2019, with many relying on grant funding as their primary revenue source, according to a study. However, with an advertising-driven business model, the digital media landscape has not proven to be a fertile ground for investment, attracting a paltry amount of VC funding to scale.

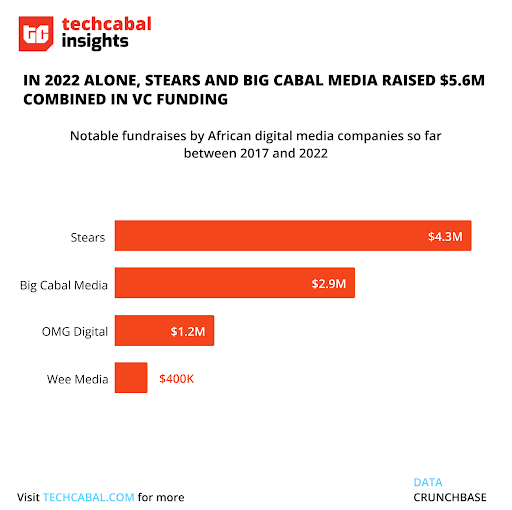

For example, according to Quantum Media, VC investment in digital media plummeted in the US down to $115 million in 2021 from more than $1 billion in 2015, but not much came to Africa. This makes media outlets in Africa more likely to receive grants than raising VC funding from local and institutional investors. In 2022, there were shining lights in African digital media outfits like Big Cabal Media raising $2.3 million and Stears also announcing a $3.3 million seed round. Also, Ghana-based OMG Digital and Kenya-based Wee Media have raised $1.1 million and $400,000 in seed funding, respectively.

David Adeleke, a media analyst and publisher of Communiqué, believes African digital media companies should be raising venture capital, but it depends on the kind of products they can build at zero marginal cost to produce recurrent outsized revenues VC firms look out for. “African digital media outlets cannot generate outsized returns purely based on subscriptions and advertising, as they have to be able to make revenue at five or ten times the level when they first raised funding,” he said. “This paves the way to a clear and good exit path for them, like an acquisition within or outside the continent. Whichever the case may be, their options are still limited.”

Africa is projected to be one of the world’s major media consumers by 2030, according to data from Statista. This means the revenue drive of African digital media companies can be accelerated with high-growth digital products by going the extra mile to move beyond ad dependency and experiment with new technologies.

EVENTS: TECHCABAL AT 10

Here’s a list of all the Twitter Spaces we’ll be holding to celebrate our 10th-year anniversary.

- March 14—Beyond Funding: Meet the team leading TechCabal’s newsroom. Why is TechCabal telling the kinds of stories we are telling now, and how this thinking has influenced our expansion drive. How is TechCabal’s editorial leadership driving this? Register here.

- March 16—Building newsletters readers want. How has TechCabal grown to build seven newsletter products, and what drove this growth? How does TechCabal measure success when it comes to its newsletter products, and what are its plans? Register here.

- March 21—Meet the team telling African tech stories that matter. TechCabal captures the players, human impact and business of tech in Africa. We provide the content, reporting, data, and context to help the world understand how tech is changing Africa. Who are the journalists doing all of this important work? Find out here.

- March 23—What is the future of tech in Africa? In the last 10 years, the African tech ecosystem has evolved quickly. We know this firsthand at TechCabal. What does the future look like? Join us for an insightful conversation with Ola Brown, Stephen Deng, Hope Ditlhakanyane, and Ngozi Dozie where we answer these questions. Set a reminder here.

- March 30—The role of the media in covering African tech. How can the media help Africa’s developing tech ecosystem? What responsibility does the media owe the ecosystem, and what can the media expect in return? Should the media only cover the good stories? Find out here.

IN OTHER NEWS FROM TECHCABAL

Why Zikoko’s website got a facelift, and the team behind it.

How to retrieve lost JAMB registration numbers in 2023.

OPPORTUNITIES

- The Jasiri Talent Investor Programme is looking for highly driven individuals with a history of achievement and/or entrepreneurial action who aspire to launch a high-growth venture. Apply by April 23.

- The Growth Africa Accelerator Programme is calling for applications from ambitious and committed entrepreneurs from Kenya, Uganda, Ethiopia, Zambia or Ghana with the potential to grow and create impact through their businesses. Apply now.

- The HiiL Justice Accelerator Programme is now open for applications from Kenyan startups with solutions that help people resolve their legal problems. Eight selected startups will receive $10,000 in equity-free funding as well as the chance to win up to $21,000 on Demo Day. Apply by March 31.

- Google has announced that the Google for Startups Black Founders Fund is now accepting applications from Black founders across the African continent. Apply by March 26.

- The Africa Business Heroes (ABH) Prize Competition, a philanthropic initiative sponsored by the Jack Ma Foundation and Alibaba Philanthropy, is calling for participation from Africa’s entrepreneurial talent. Apply by May 12.

- Rwandan startups have been invited to apply for the ZEP-RE InsurTech Programme, which will support scalable startups in creating new markets and optimising efficiency. Apply by March 15.