An age of innovation awaits us if entrepreneurs invest in finding and putting the complementary partnerships of B2B2C business models to work.

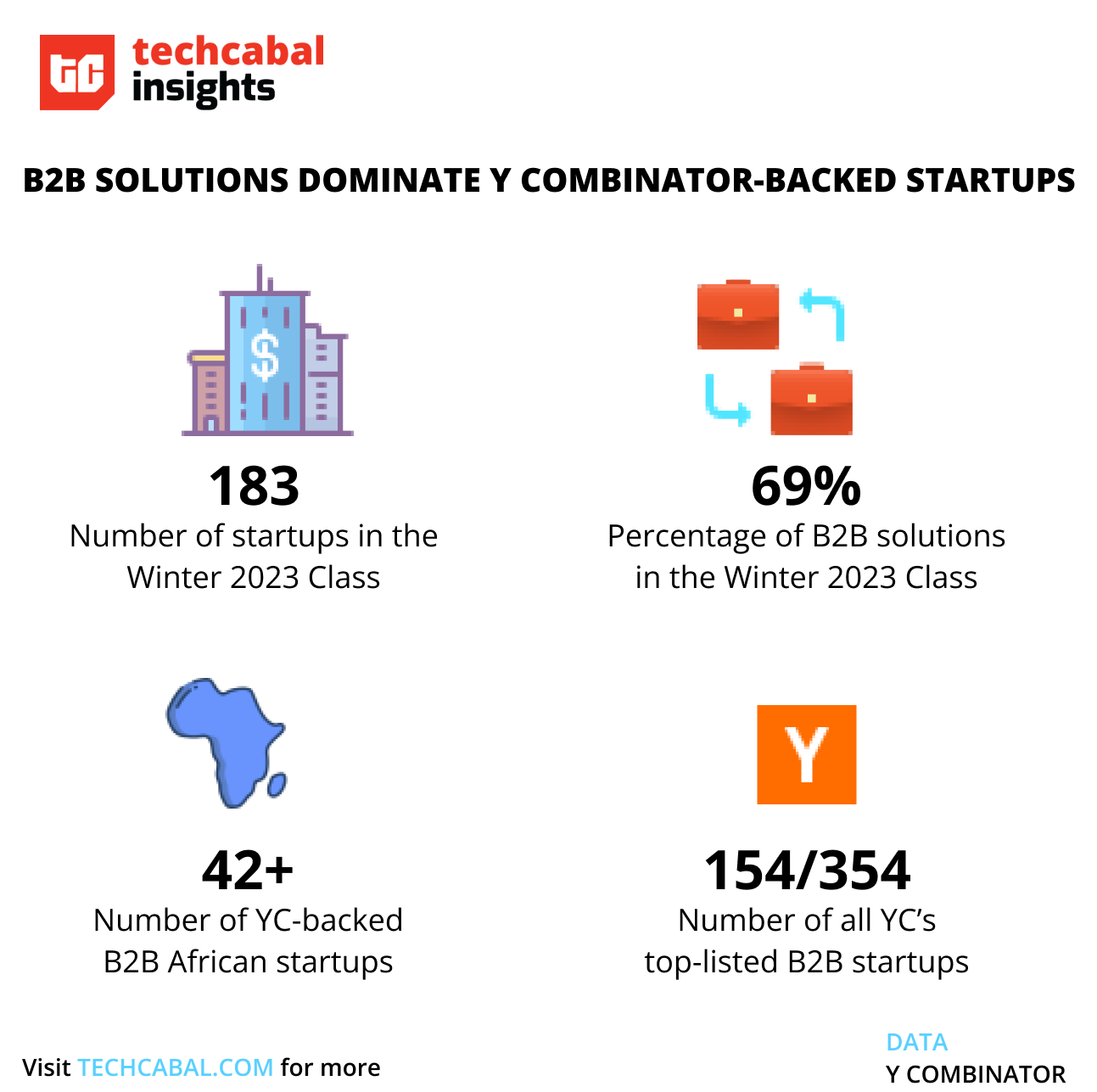

One common piece of advice for tech startup founders is to focus on building business-to-business (B2B) solutions. That is, to find a B2B space which they can plug into. Y Combinator (YC), for example, is an accelerator that demonstrates a clear and sustained preference for B2B tech business models. The argument is understandable and is more or less thus: Africa lacks a large enough middle class to sustain multiple competitive consumer business models.

At $1.4 trillion, Africa’s retail market is not insignificant. However, due to costs and challenges arising from poor infrastructure, it is hard to profitably serve much of the retail market segment because they do not have significant disposable income. The Centre for Strategic & International Studies puts China’s middle class at over half of the population, constituting nearly 707 million people. Africa’s middle class sits somewhere around 200 million people, depending on who you ask. To quote a piece we published two weeks ago, contributed by our friends at DFS Lab:

Once you factor in acquisition and distribution costs, these models break and are forced back to serving those living on $10/day or more, which are only 5% of the continent’s population. Unless you’re able to fundamentally innovate around your cost structure, B2C marketplace models selling food and necessities potentially break under this logic. At DFS Lab, we think B2B models that aggregate consumers through small businesses probably have a stronger chance.

But B2B in Africa faces a unique set of problems. Especially the problem of market access in spaces where political or other forms of “informal” (to put it nicely) business practice exert significant control on how the market operates. Operating a B2B model does not always mean being asset-light. Very often, the realities of building an African business force entrepreneurs to acquire costs in the form of physical assets or to create distribution partnerships.

But there is a third way that acknowledges this reality. Acknowledging that B2B can operate maximally when it is a complement of or complements a B2C model creates even stronger opportunities for creating systemic value, especially for African tech firms.

Finding complementary angles

Like YC, a cursory look at the portfolios of three of Africa’s biggest accelerators shows a similar preference pattern for B2B or B2C. The reason for preferring either is strong on their own. But there is a cost of looking at the opportunity landscape from a binary B2B or B2C perspective.

Premier startup accelerator, Y Combinator, has a clear, notable trend of mostly selecting B2B startups, also evident in its newest class. | Infographic: Ayomide Agbaje — TechCabal Insights

The business-to-business-consumer (B2B2C) model easily lends itself to e-commerce. But the advantages that make it an easy option for entrepreneurs who create online spaces for selling and buying stuff apply widely too. After all, all business is commerce—the exchange of value in different forms of utility. Outside of common e-commerce spaces, however, it takes more work to identify how a B2B2C model may work in other settings.

Traditionally, B2B2C means that two or more companies partner to provide complementary goods or services to reach the same end consumer. A complementary product or service adds value to another service or product. To derive maximum value, the end consumer has to use both services together. Consider the fictional example below.

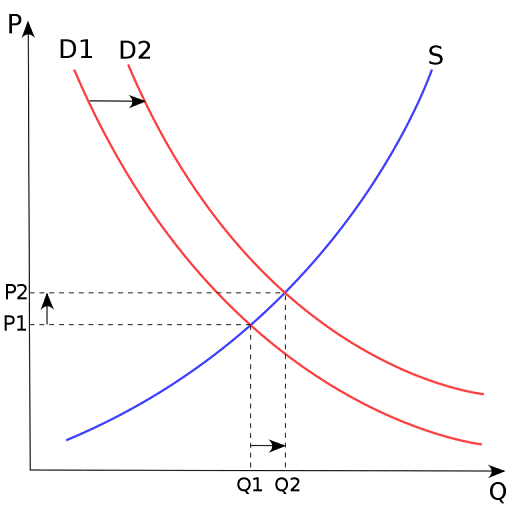

Let’s assume that the initial demand for cars is represented by D1. And the initial price of cars is represented by P1 while the quantity is represented by Q1. If the price of petrol were to decrease, more people would want cars. But because more people want cars, the demand curve for cars and petrol will shift rightward to a new position D2. Assuming a constant supply curve (represented by S) of cars, the new increase in the quantity of cars demanded will be at Q2 with a new increased price P2.

Supply and demand of cars when the price of petrol decreases. Chart: Wikipedia.

One of Africa’s most successful business segments is a good example of this complementing business approach in Africa. The telecoms industry in Africa continues to grow as mobile phones get cheaper. Because of its unique structure, the telecoms industry, as a whole, is predicated on variations of this B2B2C model. The same principle holds even outside Africa. Blackberry dallied between focusing on making devices that its corporate consumers (the same demographic that helped the phone maker find success) were used to. And ultimately paid the price for failing to see that its corporate relationships were made of people who were visibly turning to a different type of consumer phone.

For companies seeking to digitise X in informal consumer sectors or informal business spaces, finding these complements may be a useful exercise to help deepen customer relationships. Thinking in B2B2C does not necessarily mean creating new products. It is also a way to think about forming new operating partnerships or even mergers and acquisitions.

I have spoken with founders and startup operators, especially in B2B e-commerce who point out that they hope their credit offerings will help them create better profit margins. It sounds like a product complement, but it is not the same thing as demand for credit should reduce over time as the retail business grows. Except it somehow creates a strong lock-in effect, it is easy for vendors to switch to other producers/suppliers.

Partner Content: Data intelligence startup, Towntalk, Graduates Techstars 2022 Lagos accelerator and launches it’s flagship product, Area!

We’d love to hear from you

Psst! Down here!

Thanks for reading The Next Wave. Subscribe here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and feel free to send a reply to let us know if you enjoyed this essay

Subscribe to our TC Daily newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Abraham Augustine,

Senior Reporter, Business and Insights

TechCabal.