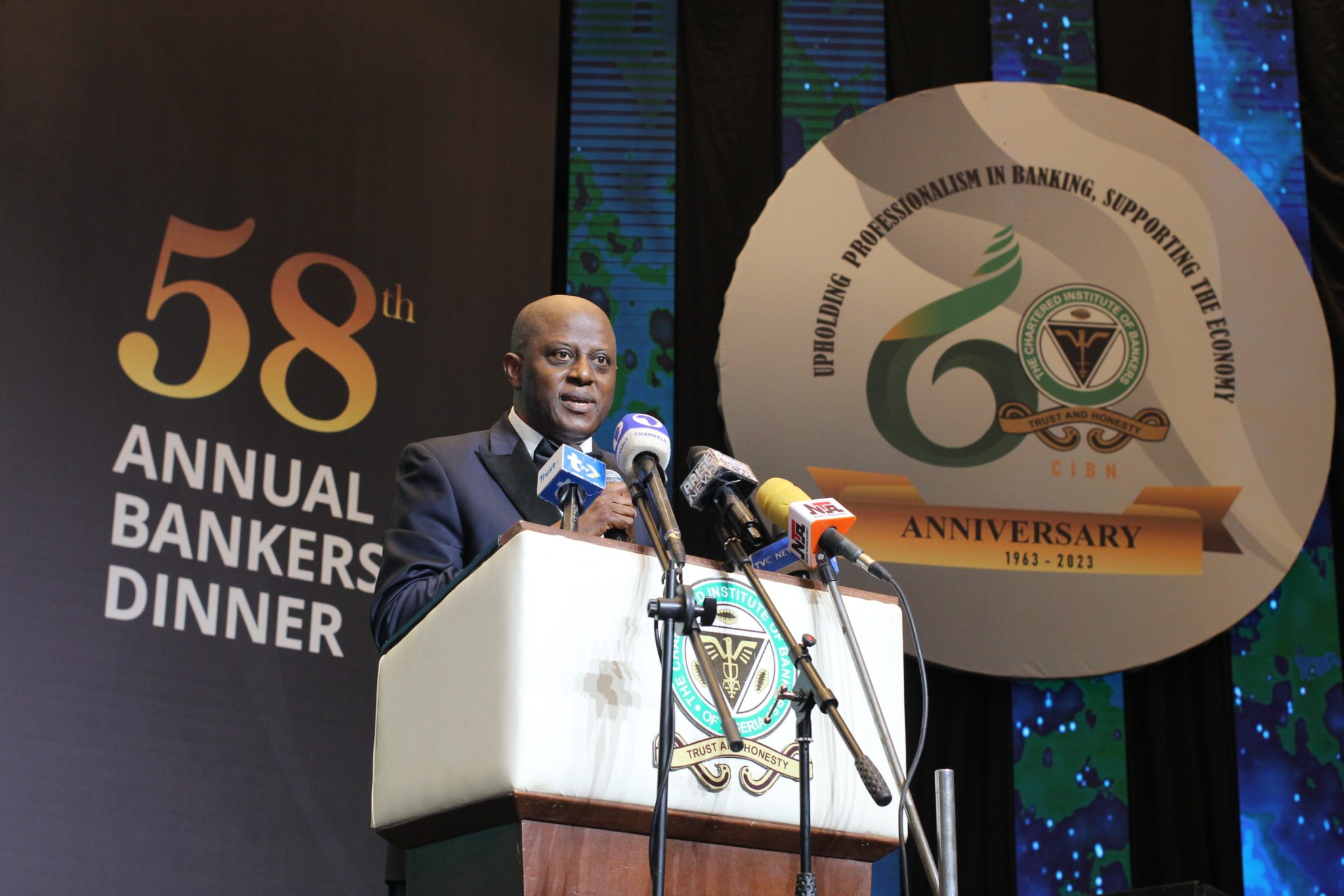

Olayemi Cardoso, Nigeria’s Central Bank Governor, will chair a monetary policy meeting next week, the first since he was appointed in September 2023. The consensus among three analysts who spoke to TechCabal is that the CBN will elect to raise interest rates in response to worsening inflation.

Headline inflation reached a 27-year high of 29.90% in January 2024. Only Zimbabwe (34.8%), Congo (42.5%), Sierra Leone (52.16%), and war-torn Sudan (63.3%) have higher inflation rates.[ad]

In a meeting in early February, Cardoso said he expects inflation to moderate to 21.4% in 2024 using CBN’s inflation-targeting policy; next week’s MPC meeting will be a stern test of the bank’s ability to match talk with action.

Bloomberg analysts expect an interest rate increase of 500 basis points. However, Basil Abia, a co-founder at Veriv Africa and policy analyst, believes the CBN will take a more moderate path and increase rates by 100 basis points instead, from 18.75% to 19.75%.

“It is difficult to see how raising rates can make an impact,” Abia argued in an email response.

“Nigeria’s inflation is a cost-push inflation buoyed by a steep increase in energy costs across the board, frequent energy scarcity, a nationwide food supply shortage problem, an illiquid power generation value chain, foreign exchange scarcity,” he added.

Mayowa Badejo, a partner at 213 Capital, an investment and risk advisory firm, believes inflation will only moderate after the naira begins to strengthen.

It’s a nod to Cardoso and the CBN’s other troubles, like a volatile Naira that has resisted every policy thrown at it.

The central bank hiked open market rates to 19% from under 12% to mop up excess liquidity and has tweaked the rules for oil companies to repatriate FX from Nigeria, but the Naira’s slide has only worsened this week.

Cardoso, who previously dismissed the impact of monetary policy meetings, is under pressure to deliver stability. This week, an aide of President Tinubu urged Cardoso to consider the “political implications” of the CBN’s policies.