Last month, the Naspers Foundry, one of the largest venture capital funds in South Africa, shut down. As Foundry sunsets, the country’s venture capital market is going through what one would call a rough patch, as evidenced by its inability to attract venture capital funding in 2022.

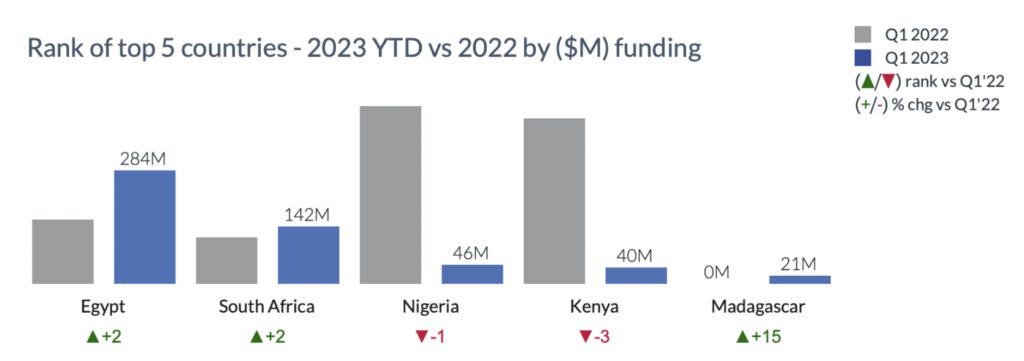

As the funding data for Q1 of 2023 poured in last week, it appears that South Africa’s fortunes might be improving. According to funding tracker Magnitt, South African startups raised $142 million last quarter, a 22% increase in funding, albeit with fewer deals than in the same period last year.

According to Clive Butkow, CEO at Kalon Ventures, a Johannesburg-based venture capital firm, although a decline in funding for growth-stage startups is to be expected considering the overall global trend, the fact that early stage funding is also shrinking is worrying.

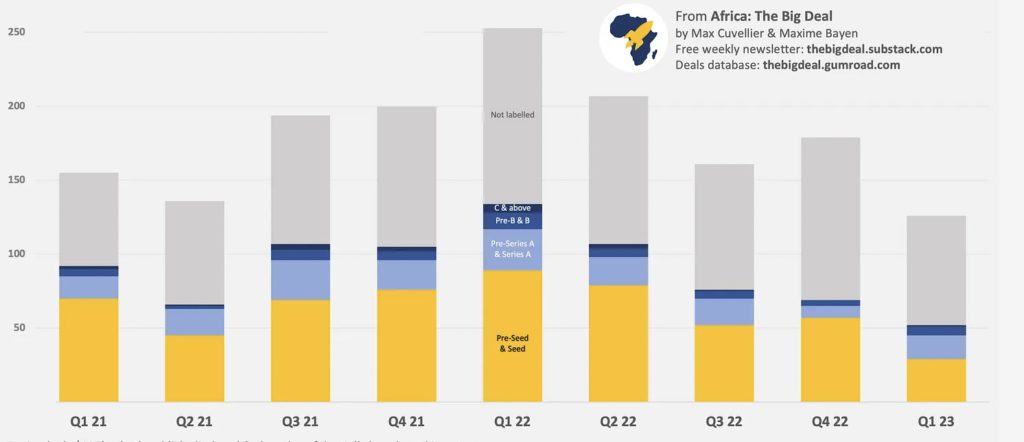

“Seed investments are slowing down substantially as well, both in South Africa and Africa which is a worrying sign, because one can only get a company off the ground with that initial seed capital. Without it, it’s hard to even start,” said Butkow.

The slowdown of seed investment across the continent is also reiterated by Africa: The Big Deal, another funding tracker monitoring venture capital activity on the continent. According to this tracker, seed investment has decreased by a third compared to the same period last year.

On the closure of the Naspers Foundry, Butkow believes that although it is an unwelcome development, it is not exactly surprising considering the global investment environment. Additionally, there are numerous other avenues of raising capital in South Africa.

“There are still a lot more companies in South Africa raising capital from pension funds, development financing institutions and other entities who, prior to recently, had not been active in venture capital investing. I think this is because a lot of these institutions are realising now that venture capital is a great asset class and that you can make a decent return compared to other asset classes like stocks and equities. This is a good sign for the ecosystem,” added Butkow.

Diversity in South African VC

Gender and racial diversity in South Africa’s venture capital ecosystem remains a troubling concern, with the majority of funding going to startups founded by mostly white males.

According to Will Green, programme director at Cape Town-based accelerator GrindStoneXL, who have a 50% gender and race mandate for their programmes, addressing the issue of diversity should start at the grassroots level.

“I believe the key to this racial and gender balance is in grassroot programmes, targets and ambassadorships. Women in Tech is a primary example of an organisation that is driving positive change in the ecosystem. I joined them on the advisory board to be the change in the world for female founders. As a father of a young teenage girl, we need to all work together to rebalance the gender ecosystem, so there are equal opportunities for all,” added Green.

Octavius Phukubye, venture capitalist at Microtraction, believes that although there are some efforts aimed at addressing the issue of diversity, there is still much work to be done to get anywhere near a point of parity.

“There are some exciting initiatives launched recently, like WomHub to accelerate diversity but we still have a long way to go. For example, the main focus and attention is on addressing gender and racial diversity, which is good, but if you look at other historically disadvantaged groups like LGBTQI+, not much is being done to address their limited involvement in the VC ecosystem,” said Phukubye.

Phukubye believes intentionality, rather than mere lip service, is key to accelerating the impact of diversity initiatives in the ecosystem.

“Although we have emerging fund managers programmes, training, etc, for underrepresented communities, this does not translate to significant amounts of capital being allocated to these asset managers in comparison to their counterparts. This situation does not do much to aid the funding for startups which are supposed to be backed by these fund managers,” he added.

“I think all VCs have this front and centre of their mind that they need to invest more in female founders and founders of colour. The current figures are simply not enough. Most of the VCs I’m speaking to are all looking for female and persons of colour founders to invest in and the wish is that we had more deal flow of these founders to invest in. But we know and appreciate that we have to go out there and look for them because they are out there, so that’s where the current efforts are going,” concluded Butkow.

All hope is not yet lost

Although the current economic climate is less than desirable and the country’s performance over the last few years has been uninspiring, compared to its continental peers, South Africa remains a force to reckon with in Africa’s venture capital ecosystem.

With that in mind, Butkow believes that startups who have solid business models and are addressing actual pressing problems will raise the capital they need.

“In the current environment, capital efficiency is key. If you’re spending a million dollars and generating a million dollars in new average revenue run rate, that’s a good multiple of one and an incredible space to be. But if you’re burning $5 million, and you’re only getting $1 million, those economics don’t work for a VC. In these times, to a VC, bottomline growth is much of a factor compared to just top line growth,” said Butkow.

For Green, only focused startups will thrive under the current economically uncertain times.

“Startups coming out of the next 9-12 months with a strong capital efficiency will get their asking valuations, as the pile of dry powders looks for the strongest investment opportunities,” he adds.

Additionally, Green predicts that the current energy crisis will provide opportunities for startups to enter the market at an accelerated rate.

“In some cases I have heard of founders based in California moving to Cape Town to help solve for the current challenge.”

As Africa’s most industrialised nation with an advanced tertiary education sector, banking systems and entrepreneurship ecosystems, as well as direct air access from North America, Europe and Asia, despite its recent shortfalls, it is always wise to not underestimate South Africa’s full capability in attracting venture capital.

With various ecosystem growth-enabling initiatives underway, including a startup act, South Africa seems poised to retake its position as Africa’s tech capital over the next few years.