We’re beginning a series of essays reviewing conversations from our eponymous TV show, The Next Wave. Did I hear you murmur that you did not know we had Next Wave on air? Well, now you know! If you go ahead and watch the episodes from the last season and you have questions or comments, I will be happy to chat briefly and find a way to work your thoughts into the coming essays (after an early intermission next week). Deal?

Previous episodes of The Next Wave are available on YouTube. New episodes air on Wednesdays at 4:30 PM WAT on DStv Channel 410. Hopefully, we’ll add more viewing options in the coming months.

If you’ve been a regular reader of Next Wave for at least four months, you will have noticed the appearance of a blue “Lire en Français” (Translation: Read in French) button early this year. I’ve changed it to “C’est article aussi disponsible en français” (Translation: This article is also available in French). There’s a backstory to it that is also a good primer for today’s essay.

In the last few months of 2022, some Next Wave essays found their way into the emails of readers in several French-speaking countries in Africa. It was definitely not the first time TechCabal or even Next Wave articles were being read by an audience in French-speaking Africa, but this time was different. Some readers were having none of it. “Je ne sais ni lire ni parler anglais. Il faut me renvoyer les messages en français pour me permettre de comprendre. Merci,” one reader wrote. It translates to “I can neither read nor speak English. You have to send me the messages in French to allow me to understand. Thank you.”

So I did a bit of Googling and customised a code snippet that creates a Google-translated web version of these Sunday emails. Not perfect, but the problem was solved! I share this story to illustrate how a media business like TechCabal cannot afford—even if we wanted—to ignore the rise and growing importance of technology businesses and startups in French-speaking African countries. The undeniable fact is that technology is being increasingly used by people across all social strata even in parts of Africa that are all too easily unseen.

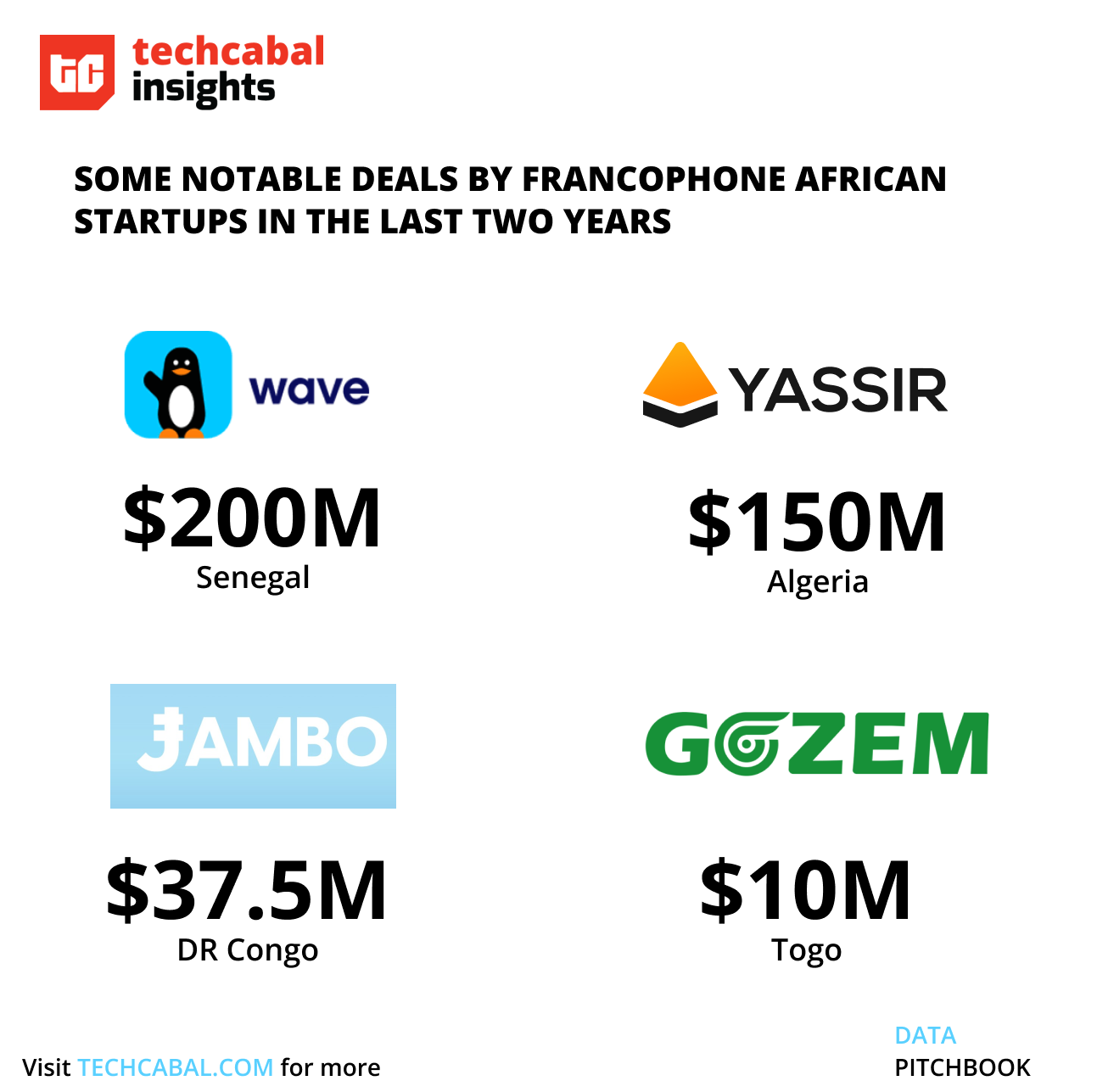

In 2021, Wave, a fintech founded in Senegal became the first $1billion+ company in Senegal, and the first to emerge outside of the Big Four—Nigeria, South Africa, Egypt and Kenya. Three of the Big Four have the English language as one of the languages used in official documents in business, generally. So when Wave raised a $200 million war chest, it was guaranteed to get attention. If any African company raises $200 million, it’s huge news. But investors, including the IFC, putting $200 million into a company in Senegal has arguably done, for francophone Africa, something akin to what Stripe’s acquisition of Paystack in 2020 did for Nigeria. It put a spotlight on the mostly unheard progress of technology in the region. People sat up and took notice.

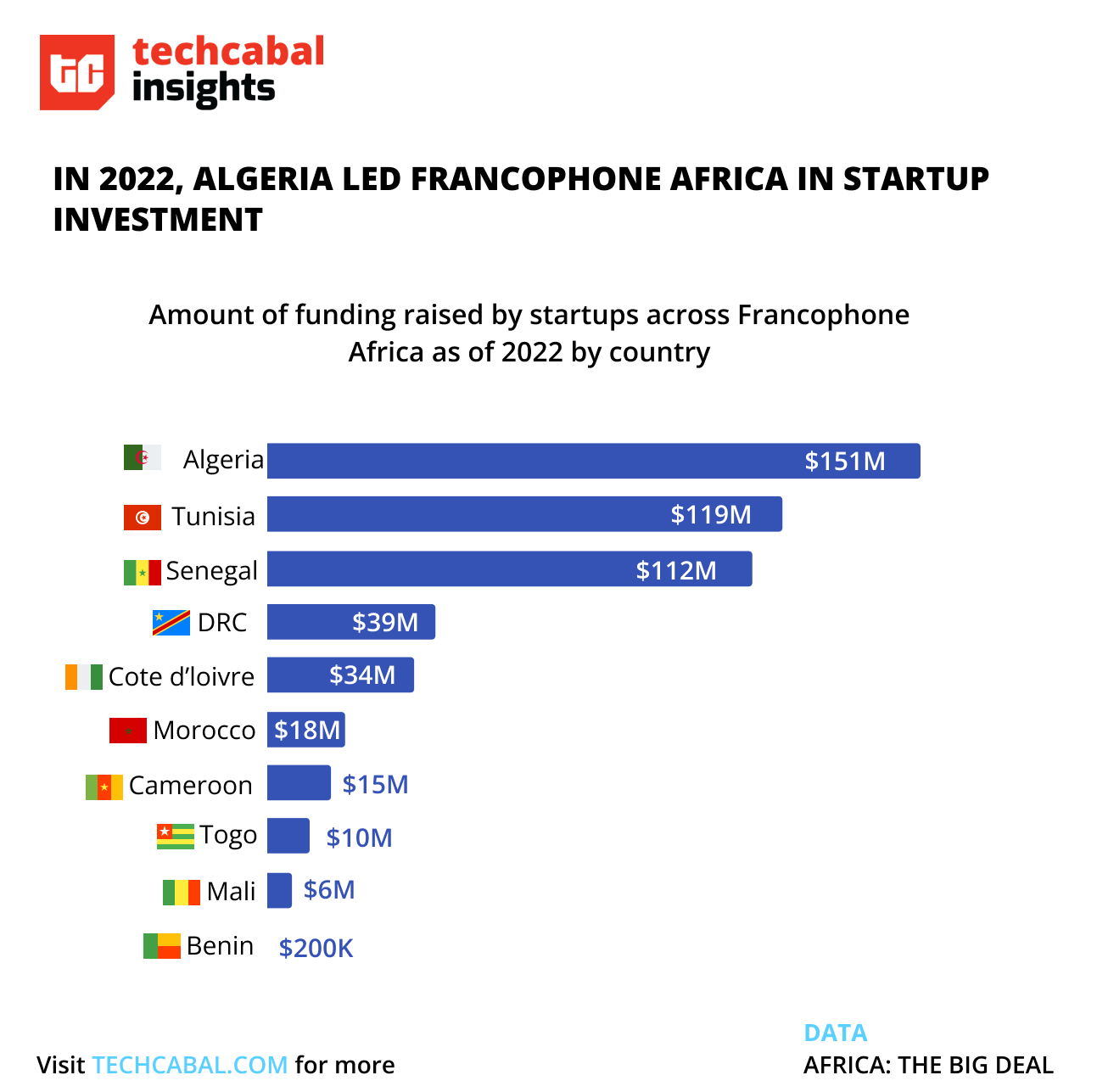

Recent startup investment inflows into Francophone African countries. French speaking African countries have pulled in a few heavy hitters recently. | –Chart: Ayomide Agbaje — TechCabal Insights

“Tech startups in the region were mostly surviving,” Moulaye Taboure, co-founder and chief executive of ANKA, an e-commerce company told Tomiwa, on the Next Wave show. “Because they could not count on going to France to get funding, they were focused on being profitable,” Taboure added.

Funding to French-speaking Africa has increased steadily since then, with corporate and regular VC investors paying more attention to these companies. As more companies have been funded, more have been born, putting more spotlight hours on French-speaking Africa.

Partner Content:

Young African Catalysts Exits Pilot, Set to Democratise Access to Venture Ecosystem

But other forces have been at play. Rashmi Pillai, head of public policy at Wave, points to “an enabling policy environment for innovation” and nuanced appreciation of the market potential of francophone Africa as factors that support an upsurge of investments in francophone startups in Africa. Wave itself was able to force open the almost monopolised payments market in Senegal by reducing charges to 1%. The company followed this up by quickly expanding its footprint into other countries, making the market size question moot.

Startups closing deals in Francophone Africa are on the rise, with Wave setting the highest fundraising record. | Infographic: Ayomide Agbaje — TechCabal Insights

Rebecca Enochong, a Cameroonian tech entrepreneur and chief executive of AppsTech, an enterprise software business, has this to say about the market size: “A lot of these francophone countries share a common currency and a common central bank, which means that it is easier for them from a regulatory and forex exchange standpoint to scale across the region.”

Business researcher and consultant, Abderrahmane Chaoui, conducted a months-long study on the digital innovation space in francophone Africa. He says the drivers of innovation and the readiness of francophone markets to accept tech-enabled products or services vary widely even between neighbouring countries. Writing for Founder Factory Africa, a corporate-backed startup accelerator, Chaoui notes, “Ecosystems around the world are fundamentally shaped by these different aspects. To consider Africa as a whole, or to imagine subsets based on the spoken language or the geographies they are in, does not make much empiric sense from an ecosystem analysis point of view.”

I love that Chaoui’s research takes a broader look at francophone countries because it allows me to point towards Tunisia’s InstaDeep, Morocco’s Chari and Algeria’s Yassir, as examples of firms whose offering has caught the attention of stakeholders in Africa’s technology space. The more interesting point is that all three firms operate in different spaces in different countries.

Capturing the francophone ecosystem with a wider lens also reveals the misalignment between the region’s ambitions and the available resources. In countries like Senegal for example, Chaoui decries the ecosystem’s over-exposure, noting that “It is this external attractiveness that has led investors into the ecosystem come and go, harming Senegal’s international ecosystem reputation.” It is an interesting point to make, especially since the narrative is that technology in French-speaking Africa is unseen, but Chaoui makes the point without deference.

To be fair, his point can apply to the entire continent. For example, that francophone ecosystem “needs more coordination and collaboration between its different players to gain efficiency and bring more value to entrepreneurs,” is true for Senegal as it is for Egypt or Nigeria. Both countries may take in more venture funding compared to the rest of the francophonie, but the shared ecosystem problems won’t go away because there’s more money in the bank.

We’d love to hear from you

Psst! Down here!

Thanks for reading The Next Wave. Subscribe here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and feel free to send a reply to let us know if you enjoyed this essay

Subscribe to our TC Daily newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Abraham Augustine,

Senior Reporter, Business and Insights

TechCabal.