Lending among family and friends is integral to the Nigerian financial landscape, particularly in the informal sector where access to formal financial services is limited.

Fig. 1: The rate of access to financial services in 2020.

In Nigeria, more than 1 in 2 Nigerian adults are financially excluded – with no access to formal financial services such as payment, savings, and credit. Data from World Economics puts it that the size of the informal economy in Nigeria is estimated to be 57.7% representing $1,164 billion at GDP PPP levels. This means that financially underserved communities and young entrepreneurs, often have to rely on social capital for financial support.

The low barrier to access and inherent trust makes family lending a popular alternative to formal credit. However, the market faces several challenges, including high-interest rates, lack of transparency, limited access to formal credit infrastructure, and lack of regulation.

A new report titled; Lending in Nigeria: Can tech make borrowing from family and friends sustainable? aims to provide a comprehensive analysis of the family and friends lending market in Nigeria. The report which was put together by TechCabal Insights and Sycamore, a peer-to-peer lending startup discusses the major stakeholders, why it exists, common challenges, and its implications for the Nigerian financial economy, as well as the possibilities therein, especially with the advent of digitalization in the space.

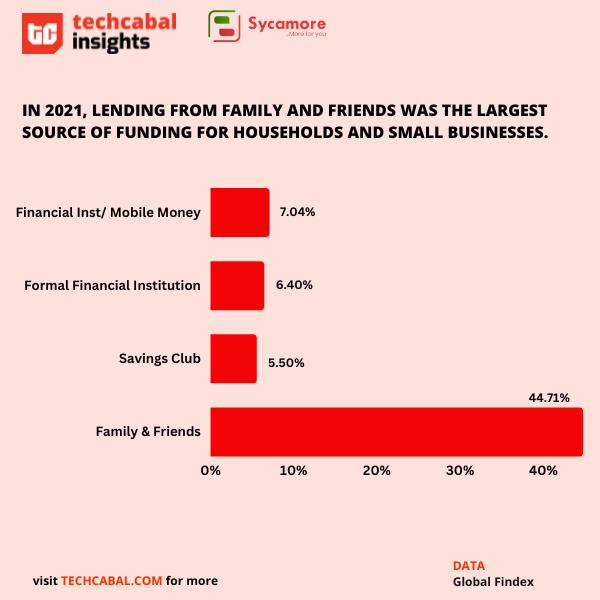

The report draws on a range of relevant studies to support its analysis. It cites a recent survey conducted by Enhancing Financial Innovation and Access (EFInA), approximately 43% of Nigerians are financially excluded, with no access to formal financial services such as payment, savings, and credit. According to the report, borrowing from family and friends accounts for 44.7% of lending channels for young people in Nigeria.

Fig 2: Commonly used channels for lending among individuals and small businesses in 2021

Addressing the challenges facing the family and friends lending market will improve access and ultimately drive financial inclusion for underserved communities. One major challenge is that collection and repayment are difficult, as revealed in the report. In many cases, borrowers have little recourse in cases of fraud or other illegal practices as a result of the lack of regulatory policies that guide that space.

Technology presents various solutions to tackle the inefficiencies in this sector through the emergence of digital lending platforms. These platforms provide an opportunity to increase transparency, improve access to credit for underserved communities and provide borrowers with greater recourse in cases of fraud or other illegal practices. The provision of regulatory frameworks by the government will also help to further consolidate the market.

“We at Sycamore have been particularly interested in this subject because we have been aware of this problem for a while, and have even created a product tagged “Loan Friends” to solve it,” said Tunde Akin-Moses – CEO, Sycamore. “Borrowing between friends and family is a practice that has lasted for generations. We are confident that technology would further cement this practice by increasing its sustainability.”

The report recommends several strategies to promote financial inclusion and improve access to finance for underserved communities in Nigeria, including the development of stronger credit scoring systems, the promotion of financial literacy, and the provision of peer-to-peer digital lending platforms like Sycamore’s “Loan Friends”.

Join us on Friday, April 28th at 5 PM (WAT) for the launch of our report titled: Lending in Nigeria: Can tech make borrowing from family and friends sustainable? We will bring together fintech experts to discuss the ways to navigate the inefficiencies of communal lending. They will also be discussing insights from the report. Register here. Download the report here.