It’s not often that fintech startups make it into viral memes and TikTok videos, but Palmpay, a Chinese-backed digital wallet offering, is the subject of many social media jibes. Most of the joke formats have the same theme: the lengths to which Palmpay agents will go to collect loans from defaulting borrowers. In some videos, the agents are seen stalking, dragging, or even being verbally and physically abusive to these defaulters. The joke format is so popular that social media users create fictional scenarios around those debt collection methods. The social media lore is hard to ignore and two weeks ago, PalmPay released a statement denying the idea that their collection agents harass people.

PalmPay reiterated this in a statement shared with TechCabal via email. Part of the statement read: “We have noted the defamatory online memes over the last few weeks and want to reiterate that they are not based on reality and the alleged PalmPay agents depicted are not affiliated with our company in any way.”

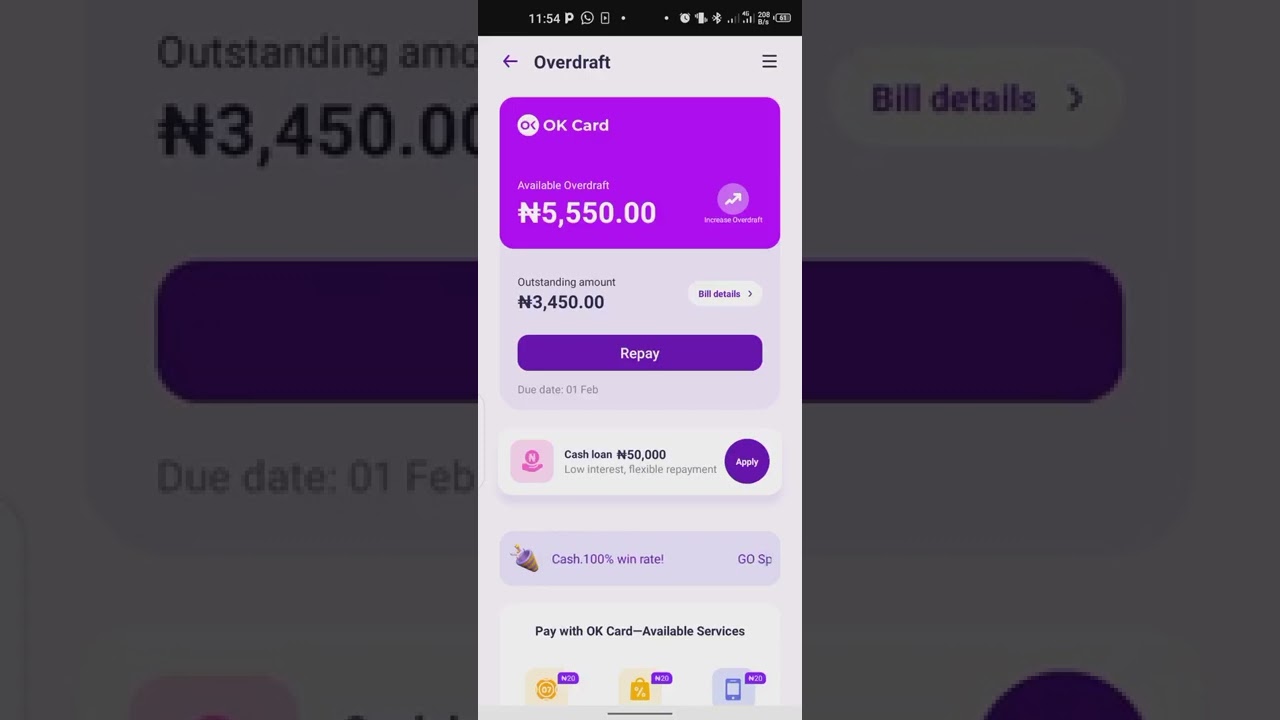

PalmPay’s popularity has grown since its launch in 2019 and the fintech is popular for its quick payment processing. According to Semafor, Palmpay was one of the biggest beneficiaries of Nigeria’s controversial currency redesign policy. But more than that, Palmpay’s digital lending business is wildly popular, with interest rates between 15-30% for payday-type loans. Like most digital lenders, Palmpay’s loans are instant and only needs users to download the app. Yet, as many digital lenders learn, lending is the easy part, ensuring that people repay is where the job gets difficult.

Ethical debt collection remains a concern

Because many digital loans in Nigeria are sub-prime, the lenders often factor the risk into interest pricing. They also often use many unethical practices to try to recover the loans once borrowers default. Most of the tactics revolve around public shaming, calling and texting the contacts of the borrower to pressure them into paying. While writing this article, a PalmPay agent called me to say that someone on my contact list had defaulted on a loan of ₦10,700. They also sent me a picture of said contact to on Whatsapp with the person’s name, phone number, BVN and date of birth. The picture also had the text “wanted criminal.” PalmPay insisted that the calls could not have come from their customer care representatives.

In a statement to TechCabal, PalmPay said that it the company does not share BVN details of customers. “We have strict guidelines in place when it comes to collection practices. It is not our policy to share

user data such as BVN, photographs or telephone contact lists. We want to reassure our users that we have policies in place and wherever it is found that these are not applied we take immediate action to make sure they are enforced. We are in the process of conducting a full audit of Flexi and their loan processes and we have put tighter monitoring systems in place.”

Despite the company’s insistence, on PalmPay’s Facebook and Instagram accounts, hundreds of comments complain about harassment from agents or customer care representatives. This has become so commonplace that the company is now renowned for its savage debt recovery methods on social media than it is for actual loans. Many of the debt recovery methods raise serious concerns about privacy and ethics.

NITDA is slow to act

Reporting on privacy concerns relating to digital lenders is not new, yet the National Information Technology Development Agency (NITDA) has been slow to act. In 2021, it fined Sokoloan, a digital lender, N10 million for unauthorised disclosure, failure to protect customers’ personal data and defamation of character, and to carry out due diligence as prescribed by the Nigeria Data Protection Regulation (NDP).” The expectation at the time was that NITDA would continue to take a strong stance on privacy abuse by digital lenders, but progress has been slow. A new policy, which will block digital lenders from accessing the contacts or photos of borrowers will only take effect from May 31, 2023.

The true cost of loans

Alex borrowed ₦10,000 from PalmPay to be repaid on payday. Unfortunately for Alex, a government employee, his salary was delayed and he was unable to repay the loan. After daily calls from PalmPay’s loan collection team, the company contacted his family.

“I was at work one day when my mother called. Someone had called her, informing her that I owed them money and advising that I repayed before 5 pm on that day else they would publish my picture on TV. She was scared and thought I was involved in some dark business,” he shared. He says that customer service reps called his mother every day for close to a week until they stopped. The following week, they began contacting random people on his contact list.

“My brother-in-law called me to tell me that he received a call from someone saying I was owing them money. My old friend from secondary school also called to ask if everything was okay. They called all my sisters as well and told them that they were going to post their own pictures alongside mine. The customer service reps are rude and uncouth. They call you and go straight to insults, calling me names, and even sending me the pictures of myself that they were going to post which included my full name, date of birth, BVN, and phone number, with ‘WANTED CRIMINAL’ written on it.” He eventually repaid the loan and the harassment ended, but he deleted the app after that for good.

There are hundreds of users like Nafisa and Alex, and their experiences highlight the need for new conversations on data privacy and debt collection methods.

*Editor’s note: This article has been edited to include a response from PalmPay. Nafisa’s story has also been removed.