Multiple entities have owned Telkom Kenya over the years. Currently, the government runs the carrier, but poorly. Will it ever catch a break?

Telkom Kenya is the country’s third-largest operator behind Safaricom and Airtel Kenya. Its operations have been marred by interruptions and customer complaints over the last couple of days. It has a little over 3 million mobile subscribers as of December 2022. Safaricom leads with about 65 million subscribers, followed by Airtel Kenya at under 18 million.

Over the last few days, the telco has been unable to say which areas and services have been affected explicitly.

Tower shutdown

In 2018, Telkom Kenya and the American Tower Corporation (ATC) announced a deal that would see ATC acquire up to 723 towers from Telkom Kenya. The transaction was expected to improve Telkom Kenya’s network quality and reliability and expand ATC’s presence in Kenya. The deal was completed by the end of 2018. According to people familiar with the matter, Telkom had anticipated that it would cut operational costs by selling its towers and leasing them from whichever company owned them.

According to a report published by Kenya Broadcasting Corporation (KBC), Telkom Kenya owes the ATC KES 200 million ($1.4 million). These charges haven’t been remitted to the tower company, which has reportedly switched off half the masts leased to Telkom. The tower blackout is what has been causing interruptions within the Telkom network.

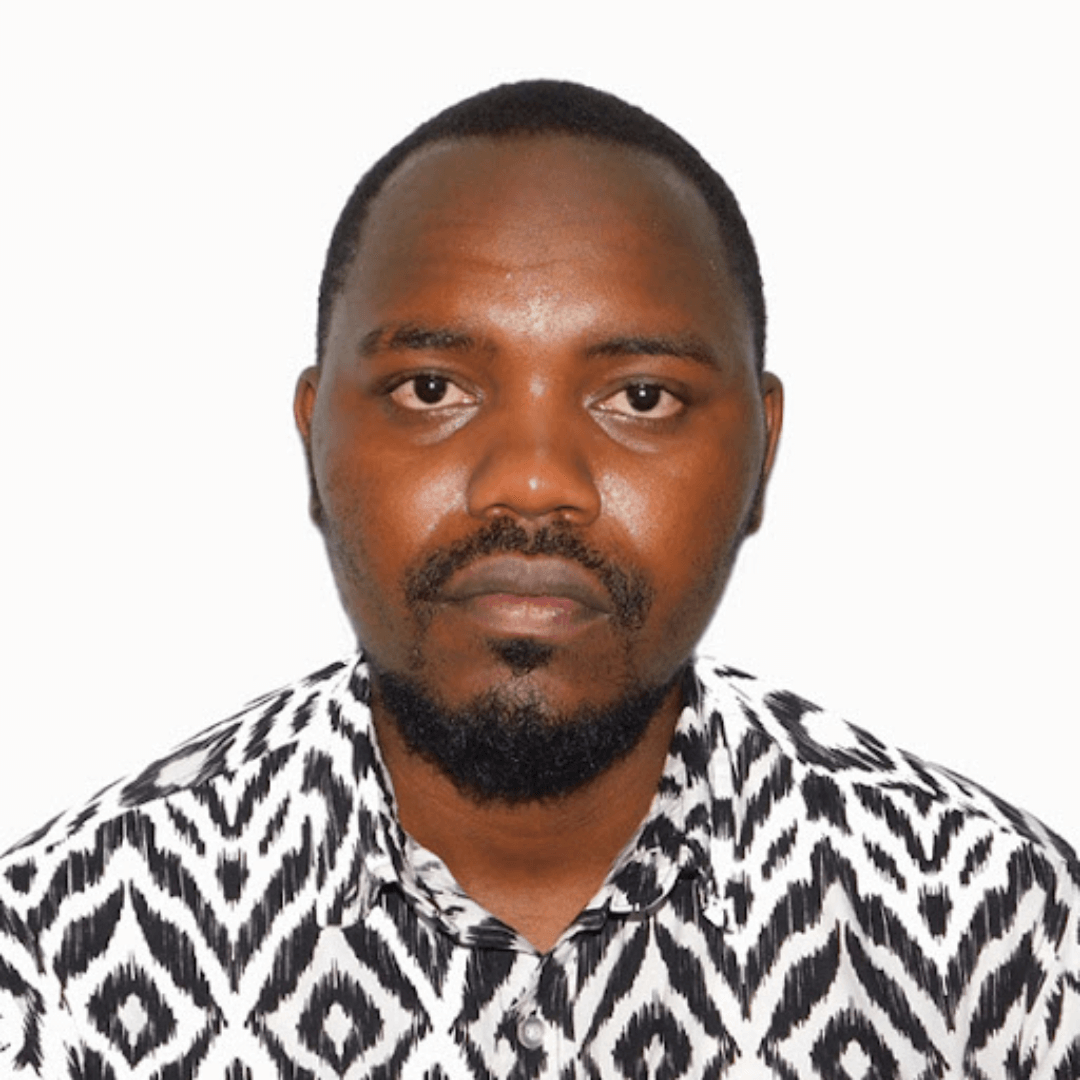

TechCabal wanted to substantiate these claims, but a statement, signed by the telco’s CEO Mugo Kibati, reads, “Service provision has been impacted in some parts of the country resulting in service degradation. We apologise for the inconvenience caused to our esteemed customers. Telkom is actively engaging all stakeholders to restore the impacted services. Telkom Kenya and its stakeholders are in the midst of reviewing the short to long-term strategic imperatives that will improve and guarantee services to our esteemed customers.”

How did Telkom get here after years of promises and network improvements? Why do customers report the same network concerns that were promised to be addressed years ago? Could the latest network blackouts be related to possible tower shutdowns?

A brief ownership history of Telkom Kenya

In 2022, the Kenyan government acquired a majority stake in Telkom Kenya. The deal was seen as a way for the government to boost Telkom Kenya’s performance and competitiveness in the telecoms market. This was not the intended goal, following conflicting reports that were revealed later. Telkom Kenya has been and continues to struggle to compete with market leader Safaricom. The government hoped that by acquiring the carrier, it would be able to turn it around. The deal was reportedly worth KES 6.09 billion ($43 million).

Telkom Kenya, formerly known as Orange Kenya, was one of the three mobile operators in Kenya when it seriously sought to enter the telco space in 2007 after France Telecom acquired more than half of the company’s shares and named it Orange Kenya. Going back a few years, Telkom (basically Kenya’s first operator) is the predecessor to Safaricom. Safaricom was opened as its subsidiary in 1997 before it was purchased by Vodafone in 2000. Nevertheless, Telkom (then known as Orange Kenya) was acquired by Helios Investment Partners in 2016 and rebranded back to Telkom Kenya in 2017. It was also the second telco in Kenya to roll out 4G services in 2018 after Safaricom.

After revamping it from Orange Money, Telkom operates a mobile money product called T-Kash. Both T-Kash and Airtel Kenya’s Airtel Money have been unable to match Safaricom’s M-PESA, which continues to lead Kenya’s mobile money space. According to the Communications Authority of Kenya’s sector statistics, M-PESA leads the pack at 96.8% in subscriptions, followed by Airtel Money at 3.1%. T-Kash closes the chart at 0.1%.

Multiple publications have mentioned the controversial acquisition of Telkom Kenya, which did not receive approval from the company’s board, according to reports. The board members did not authorize the deal, which gave the government full ownership of Telkom. This development raises questions about the acquisition’s legitimacy and whether the government should bail it out of its financial constraints. It would also be interesting to see how Telkom will untangle itself from its current mess.