Venture studios are becoming a default matron—and surrogate in many cases— for early-stage companies in South Africa.

South African startups appear to have weathered the double whammy of a funding crunch and declining economic landscapes better than their Big 4 peers. The country is also a leader in venture building. The two points appear unrelated at first glance, but is South Africa’s concentration of venture builders an underestimated edge? I think so.

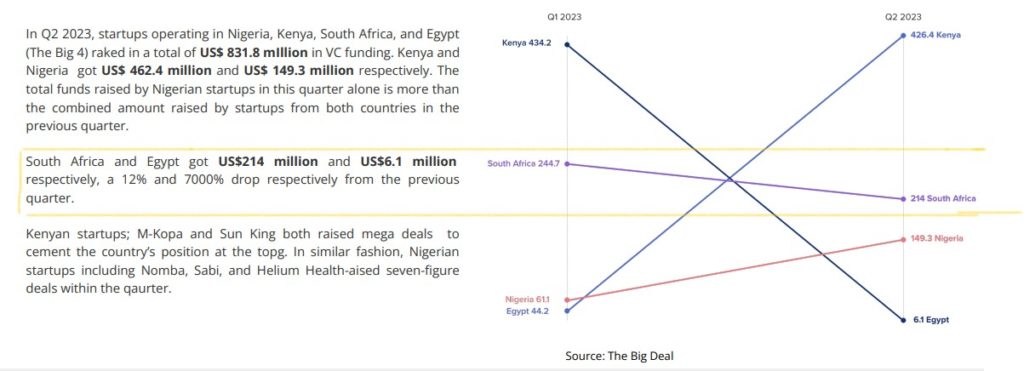

In the second quarter of 2023, South Africa recorded a 12% decline in funding compared to the amount of investment received in the same reporting period in 2022, according to a TC Insights report. But in the previous quarter of 2023, South Africa was the only country in the big four ecosystems (Egypt, Kenya, Nigeria, and South Africa) to record increased funding (by 22%) relative to its performance in Q1 of 2022.

Two quarters is probably not a good indicator of investor sentiment in Southern Africa, and the prevailing wind does not suggest that the venture funding freeze will thaw soon. But still, it is a relative net gain.

This is partly explained by the fact that South Africa is not heavily dependent on capital from foreign investment firms. “While there is a general slowdown, more funds in South Africa are closing compared to elsewhere on the continent,” David Saunders, director of growth and strategy at Briter, a research firm told TechCabal.

Regardless of funding performance, South African startups have to deal with the wider economic headwinds that have slowed growth to a crawl. Individuals, big businesses and small businesses alike have all been affected by a cost-of-living crisis and rolling blackouts.

“It’s hard to ignore the macro environment at the moment. South African consumers are financially distressed, large enterprises are cutting capital expenditure, and power outages continue, putting pressure on startups both commercially and operationally,” Nicole Dunn, co-founder and executive at Revio, a South African payments and invoicing startup told TechCabal. Despite this, she is upbeat about the prospects of South African startups, even though she concedes that a few might fail.

During the funding boom, startups in East and West Africa saw more deal activity at the early stage and tended to raise significant sums as they reached the later growth stage. This helped fuel the rise of unicorns (young and fast-growing companies valued at more than $1 billion) and a U-shaped startup funding pattern, Saunders explained. South Africa on the other hand, follows an inverted U pattern. There was less deal activity at earlier stages. But significantly more deals were consummated for companies at their mid-stage. This was followed by a decline in funding for later-stage ventures.

That South African startups exit early” might partly explain this U-shaped pattern. Keet van Zyl, co-founder and partner at venture capital firm Knife Capital, believes there is some legitimacy to the hypotheses. Because of the “significant follow-on financing gap for high-growth local startups with proven traction,” it makes more sense to sell to a bigger and older company, van Zyl told TechCabal’s Ephraim Modise earlier this year. His firm just closed a $50 million fund to back startups with “high exit potential.”

Against this backdrop of an ecosystem with more exits on average compared to their peers. And participation from larger corporates. venture building is becoming the matron—and surrogate in some cases— for early-stage companies in South Africa.

Venture builders find their mojo

As economic headwinds become stronger and set against the context of a global decline in venture funding, venture builders have emerged as dominant players in South Africa’s startup scene. Especially at the early stage. Venture building is a more hands-on investing model where an in-house team of experts work to build ideas or young companies into full-fledged businesses. Startups get capital and talent who work full or part-time to design products build the startup from the earliest stages and the venture builder gets a significant portion of discounted ownership in the fledgling business. Some venture studios simply charge fees for their services.

One such studio is Specno, an app development agency that combines building apps for clients with high-touch venture investing and consulting. It was founded in 2018 by Daniel Novitzkas and Jacques Jordaan as a side project during their post-graduate program at Stellenbosch University, South Africa. The now five-year-old company has grown from a team of two to a 40-person with clients in South Africa, the Netherlands, the United States, and the United Kingdom. It recently opened an office in the Netherlands.

From its head office in Century City, an upscale suburb in Cape Town, Specno serves roughly 100 global clients and portfolio companies with a mix of corporate and technical consulting, a paid accelerator program and investment support.

Specno does not have a fund it invests from, but it taps a network of 250 global angel investors and also invests capital from its business in favoured startups. Novitzkas says they plan to raise a fund for their investments. Right now, his firm focuses on helping startups “unlock their competitive advantage to growth.” “We reverse engineer the process of raising funding,” Novitzkas said, adding that its investor network allows it to help up to 6 startups find funding in a typical month.

Experience, a steady hand, and appropriate doses of focus and tests are part of the critical appeal of venture builders. Venture studios usually have a broad network of corporate clients or are directly funded by corporates. This network can prove useful as early customers, potential investors or even acquirers in the long run.

Depending on the type of venture, Louis Buys, Founder and CEO of The Delta, also headquartered in Cape Town says his firm provides anchor support and taps its corporate venture-backed network to build early revenue pipelines. “A revenue pipeline is the best security for [future fundraising],” he explained to TechCabal. So “Customer relationships for early traction is probably the most important thing,” he says South African startups should focus on.”

The Delta also maintains a sales team throughout South Africa and the European Union to provide support and connections for its B2B portfolio companies to find early traction as early as pre-seed. For its consumer tech startups, The Delta works to create go-to-market partnerships in addition to marketing and brand support.

Founders Factory Africa is perhaps the best-known South African venture builder. This is not surprising considering it has a presence in three of the Big 4 countries, except for Egypt. Despite not being physically represented in North Africa, it has invested in at least one Egyptian company. Recent trips to Egypt and neighbouring countries suggest a physical presence on the North African front may not be too far out in the future.

But Founders Factory Africa’s appeal cannot be simply credited to its geographic spread. It combines a traditional venture capital approach with what it describes as, “Bespoke hands-on venture support.” In addition to equity checks of up to $250,000, it can invest up to $150,000 in additional equity-free capital to “catalyse investments.” By backing and co-building some of the better-known startups in its key markets that have gone on to raise capital at more mature stages, the firm has endeared itself across Africa.

One commonly shared feature of some of South Africa’s leading venture builders is their European reach. Like Specno, The Delta has offices in Europe (Berlin and London). And Founders Factory Africa while being an independent entity started life as part of the network of London-based Founders Factory which was founded by Brent Hoberman.

South Africa’s venture builders have had some success—the powerful presence of corporate venture funds in the ecosystem helps. The growth of venture builders in the last five years in South Africa is not seen as special. But it is one of the things that sets South Africa apart from its peers. The creep has been mostly silent and other startup ecosystems are beginning to catch the venture builder fever. It is still early days, however. And the extent to which venture builders can help startups work out early-stage kinks and ease into their legs remains to be seen.

Editorial Note:

Corrected the amount of additional equity-free funding Founders Factory Africa invests in portfolio companies.

Corrected a previous statement that implied that Founders Factory Africa is a franchise of Founders Factory UK.