Good morning ☀️

ICYMI, venture funding soared to $916 million in Q2, fueling innovation across the continent. And interestingly, energy startups are now leading the pack, securing a massive $486.9 million.

What’s happening with fintech startups? Is West Africa still the go-to destination for investors?

We’ve answered these questions in our State of Tech in Africa, Q2 2023 report. Download the report here 📥 to find answers and more.

Patricia converts users’ assets into tokens

Last week, Nigerian cryptocurrency exchange Patricia converted its user assets into its newly minted Patricia Token (PTK).

The move came as part of the relaunch of its app, Patricia Plus, which was originally launched in April 2023.

Per the company, the move is a way to protect customer funds. The company noted that the PTK token is backed by the US dollar and that 1 PTK is equal to $1. Customers who had their funds converted to PTK will be able to access them through the Patricia Plus app.

Unfortunately, it appears that users were not informed of the conversion beforehand. The question on many minds is if customers will be able to access their funds now.

ICYMI: Earlier in May, Patricia revealed that it suffered a hack in January 2022 which cost it nearly $2 million. Patricia partially froze withdrawals after the 2022 breach, allowing customers to deposit funds but not move them from wallet to wallet. Instead, Patricia offered to buy those coins from customers and pay them cash to manage the situation. This workaround continued until March 2023.

By April 2023, the company launched Patricia Plus, its new app which had no withdrawal restrictions, which triggered a bank run and led to a deficit of 75 bitcoins. The company was then forced to reinstate the freeze in May 2023.

Since then, customers have been unable to access their assets. And now, Patricia has converted it all to the new PTK.

An unstable token? Some experts have raised concerns about the legality of Patricia’s move and the stability of the PTK token. While some argue that the company cannot unilaterally convert customer funds to a new token, others argue that the token is not backed by any assets and that its value could fluctuate wildly.

Zoom out: It is unclear what the next steps will be for Patricia and its customers. At this time, the company has not responded to questions from users or the media. The hack and the subsequent conversion of customer funds to PTK have left a cloud of uncertainty over Patricia and its future.

Secure payments with Monnify

Monnify has simplified how businesses accept payments to enable growth. We are trusted by Piggyvest, Buypower, Wakanow, Fairmoney, Cowrywise, and over 10,000 Nigerian businesses.

Get your Monnify account today here.

Twiga breaks off more branches

Kenyan e-commerce startup Twiga is effecting another round of layoffs.

This time, the company will lay off ⅓ of its 850 employees—about 283 employees. This will be the startup’s second round of layoffs.

In November 2022, it laid off 21% of its then-workforce. About 211 employees were let go and its sales team was shuttered. In June 2023, it confirmed the layoffs to TechCabal but argued that it had not laid off its sales team, but had instead converted them to “free agents”.

The company cited an increasingly challenging business environment as the reason for the second round of layoffs. Per CEO Peter Njonjo, Twiga has been “on a transformative path in the last few months to become a lean, agile, cost-efficient organisation, undertaking several interventions to adopt and sustain the business during these economic times.”

Employees across its businesses in East Africa will be affected and the company noted that it will compensate them based on appropriate labour laws.

Twiga is still in Uganda: The CEO also denied rumours that the startup had exited Uganda. “There is no closure of operations, we continue to operate in Uganda, and our farm is operational,” said Njonjo.

When asked how Twiga is rebuilding confidence among investors and customers, Njonjo responded, “Our investors are fully supportive of this transformation with the objective of Twiga continuing to provide affordable goods and services to our customers into the foreseeable future.”

Nigeria reinstates BDCs

Nigeria’s central bank is bringing winds of change.

Last week, the country’s apex bank ended a two-year ban on foreign exchange (FX) sales to Bureau de Change (BDC) operators.

ICYMI: In 2021, ex-governor of the Central Bank of Nigeria (CBN) Godwin Emefiele halted the sale of FX to BDC operators. At the time, the bank accused BDC operators of speculative, rent-seeking behaviour, involvement in money laundering activities and illegal FX trading.

And now? The apex bank believes lifting the ban will help ease the strain on exchange rates.

In its announcement, it noted that when BDCs buy and sell FX, the prices should be within 2.5% more or less than the average rate from the previous day. Following this announcement, the naira experienced a surge in value. By Friday morning, it traded at ₦855/$1 on the unofficial market and around ₦744 on the official market.

Monitoring BDCs: The CBN has said that it will be issuing new guidelines for BDCs in the coming days. The guidelines will set out the specific requirements that BDCs must meet in order to be eligible to buy and sell FX.

The CBN will also be monitoring the activities of BDCs closely to ensure that they are complying with the new guidelines. The bank has said that it will not hesitate to take action against any BDCs that are found to be violating the rules.

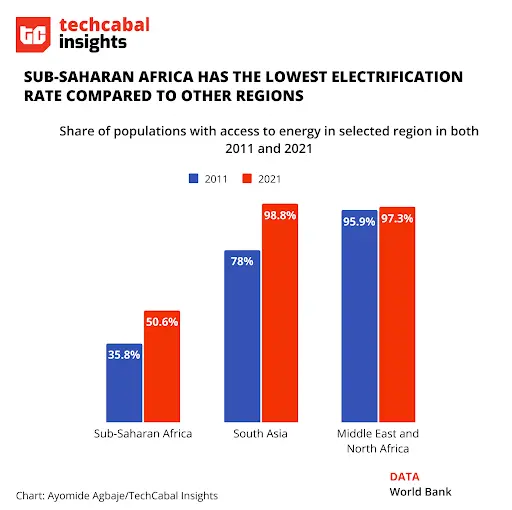

Rethinking energy accessibility in Africa

Despite being an essential need, electricity has been a scarce resource for many living in sub-Saharan Africa. In 2021, 50.6% of the population in sub-Saharan Africa lacked access to electricity, while also having one of the most expensive electricity in the world.

The journey towards accessible electricity in Africa is not without its challenges. Overcoming official scepticism, securing financing, and navigating tax and shipping burdens are obstacles that stand in the way of realising off-grid energy solutions.

One compelling approach to making electricity accessible to underserved communities is by providing solar equipment on a pay-as-you-go basis. This approach enables low-income earners and remote residents to gradually pay off their investments while gaining access to a consistent source of power. In 2022, the energy in Africa showed promise as 22 African energy startups received funding, with 9 of them raising over $1 million each. The collective sum of $104 million raised by African energy startups in that year indicated a remarkable 48% YoY increase in funding, highlighting growing recognition of the sector’s potential and growing investor confidence.

More than ever, investors and VC firms need to stake more bets towards collaborative efforts to drive the financial support needed to scale innovative energy ideas. Systems that provide energy financing options through a pay-as-you-go model will power up last-minute and affordable retail distribution of energy.

By leveraging partnerships, financial investments, and a commitment to sustainable progress, there is a genuine opportunity to bring light to the darkest corners of the continent. The road ahead is challenging, but the potential rewards — a brighter and more sustainable future for millions of Africans — are immeasurable.

Save costs with QoreID

Seamless customer onboarding made easy! Onboard users instantly and save costs with CBN compliant regulations. To learn more, visit www.qoreid.com or book an instant demo at sales@qoreid.com

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $26,048 |

– 0.23% |

– 12.83% |

|

| $1,675 |

+ 0.44% |

– 11.49% |

|

|

$4.41 |

+ 5.27% |

+ 144.43% |

|

| $1.46 |

-3.54% |

– 12.57% |

* Data as of 05:12 AM WAT, August 21, 2023.

NTICE Expo 2023

The Nigeria Office for Developing the Indigenous Telecom Sector (NODITS) is hosting the second edition of the Nigerian Telecommunications Indigenous Content Expo (NTICE).

The 2nd edition, NTICE 2023, is themed “Harnessing Indigenous Content for Economic Growth”, and is set for August 22 to 24 at Landmark Centre, Lagos, Nigeria. The event will emphasise manufacturing, service, people, and R&D in line with diversifying the economy.

- Visa is open to applications for its Africa Fintech Accelerator Program. Startups up to the Series A stage are encouraged to apply for a chance to gain unparalleled expertise, valuable industry connections, cutting-edge technology, and potential investment funding. Apply by August 25.

- If you are an aspiring economist entering your first year of undergraduate studies in the 2024 academic year, the South African Reserve Bank’s (SARB) Economic Research Department in collaboration with the SARB Academy, invites you to apply for competitive SARB bursaries in the field of economics, economics and econometrics, economics and mathematical statistics and economic science. Apply by September 30.

- Applications are open for the Cambridge Africa ALBORADA Research Fund 2023 for sub-Saharan African Researchers ($20,000 in Grants). The Cambridge Africa ALBORADA Research Fund competitively awards grants between £1,000 and £20,000 for research costs, research-related travel between Cambridge and Africa, and conducting research training activities in Africa. Apply by September 4.

- The SaaS Accelerator Programme: Africa 2023 has opened applications for its accelerator programme to enable early startups in Africa to receive funding. Selected startups will receive up to $70,000 in funding. Apply by September 7.

What else is happening in tech?

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.