For African startups that raised funds in foreign currencies, rising inflation and currency devaluation have affected how they report revenue to investors. Can raising funds in local currencies help reduce the effect?

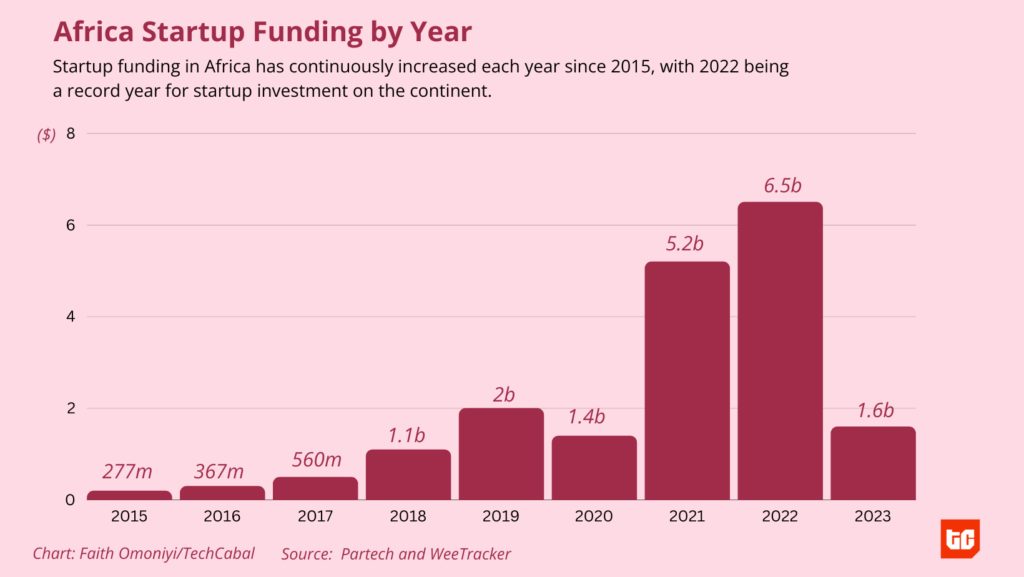

A reversal of fortune—that’s one way to describe the state of VC funding in the African startup ecosystem in 2023. After seven years of exponential growth, 2023 is the year of the bear, and African startups have raised only $1.6 billion year-to-date. As VC firms, once eager to write cheques, are pumping the brakes, African startups also have to deal with inflation and currency devaluation. Last week, Jumia blamed a 15% revenue decline on currency devaluation in nine of its ten African markets.

The past decade has seen African startups attract unprecedented funding from foreign investors. Per Partech, VC funding on the continent grew exponentially from $277 million in 2015 to $6.5 billion in 2022, representing 2,246% growth in seven years.

Like Jumia, many other African startups report their revenues in dollar terms, and as currency devaluations happen, it produces a paradox where revenues dwindle even as their businesses are growing. In Nigeria, for instance, a company with N100 million in revenues would have reported $216,450 in January 2023. Today’s exchange rate will mean it will now report $110,987 for the same Naira revenue. “We have five portfolio companies in Nigeria, so we understand how inflation can reduce our overall returns because of the conversion rates,” Efayomi Carr, the principal at Flourish Ventures, told TechCabal.

The Egyptian pound has lost 50% of its value against the dollar since February 2022. In Nigeria, the Naira has lost 67% of its value against the dollar since June.

To work around this peculiar FX and revenue problem, some investors believe startups should be raising funds in local currencies rather than dollars. Startups that raise funding in local currency would have an easier time returning investments to their investors. “A key part of all entrepreneurial ecosystems is actually building significant domestic investment for startups,” Bolaji Balogun, the CEO of Chapel Hill Denham, a Lagos-based investment bank, told TechCabal. He added that startups that earn in local currency but raise foreign capital are often evaluated by foreign investors in dollar terms, which is not always reflective of their actual progress because of currency devaluation.

Startups seek out dollar-backed investments for two main reasons: because they incur some costs in dollars and a shortage of available local capital for later-stage rounds. But there’s an extra incentive for raising in dollars: it exposes startups to a global pool of investors for follow-on funding and exit opportunities. “In Ethiopia, businesses have to raise local capital because they have strict currency controls. As a result, Ethiopia has a small venture capital industry because it can’t attract external capital. There’s not enough local capital to grow that ecosystem,” Carr added.

Raising funds in local currency for African startups is difficult because local VCs also get capital in dollars. According to Abaz Ibekwe, a venture builder, “The local VC industry in Africa is still in its infancy, and there is a need for more key players to pump money into startup investment on the continent by funding VCs.” Adedeji Olowe, the founder of Lendsqr, a Nigerian fintech, told TechCabal that most local investors who could invest in startups with local currencies are either affected by the economic downturn or are not “sophisticated” enough to invest in startups.

Balogun, however, thinks it’s a waiting game and told TechCabal that startups should find opportunities to engage with local investors to educate them on their businesses. “There is a fair amount of serious domestic investors in startups from pre-seed all the way out to Series A. From Series A and beyond, where businesses have some degree of maturity, I wouldn’t say there’s a lot of domestic capital available, but it will come. We have pension assets worth ₦16.7 trillion (over $20 billion) which can reach ₦100 trillion in 7-10 years, and some of that money will end up in more mature startups that are bottom-line profitable,” he said.

However, some founders think that the currency startups raise in does not matter if African economies are still struggling. “If they [investors] give you money in dollars and your economy is doing well, you are going to be fine,” Olowe told TechCabal. He added that raising capital in foreign currencies might be more advantageous for startups to do global benchmarking, which increases their exit potential.

Another reason investment in local currencies has been touted is that it reduces the ecosystem’s overreliance on capital from foreign sources. Briter Bridges said more than 74% of investors in the top 20 funding deals on the continent in 2021 came from foreign sources. Moustapha Ndoye, the CEO of Chargel, a Senegalese logistics startup, told TechCabal that startups should raise money locally, even if it’s not in African currencies, and he finds it “heartbreaking” that startups have to go to foreign investors for early-stage rounds. “It’s on startup founders to build profitable businesses with exits. This will make more people want to invest in startups,” he added.

Oswald Osaretin Guobadia, a senior special assistant on digital transformation under the Buhari administration, told TechCabal that a combination of investor education from startups and creating incentives for local investors could improve the local VC scene. “In the Nigeria Startup Act, we provided incentives for investors to keep their money locally, for angel investors, and for a credit scheme if founders want to raise credit,” he said. Guobadia added that he believes there are no disadvantages to startups raising funds in local currencies. With the implementation of the Startup Act and a guarantee that startups could return dividends and enforce corporate governance, local investment could rise in Nigeria, he said.

By raising capital in local currencies, startups can be better protected against external shocks and plan for the long term without constant shocks. In a dry funding environment where startups struggle to raise capital, turning to local investors ready to invest in local currencies might offer a solution, but a lack of capacity for later-stage deals and investor education prevents the local investment scene from being a stable source of funding for startups.

Have you got your tickets to TechCabal’s Moonshot Conference? Click here to do so now!