Nollywood is on a path to globalisation, and the deep pockets of tech operators will help achieve global success.

On August 25, Editi Effiòng, a Nollywood director, shared a list of executive producers for his film, The Black Book. It featured African startup founders and investors like Nadayer Enegesi (Eden Life), Olumide Soyombo (Voltron Capital), and Ezra Olubi (Paystack). While this is not the first time African tech players have invested in film projects, the long list of executive producers for The Black Book has shown that tech operators are increasingly funding film projects.

For decades, inadequate funding has slowed Nollywood’s growth, affecting film quality and limiting profitability. Niyi Akinmolayan, a filmmaker, shared on X that because of these issues, many Nigerian films submitted to streaming platforms are underpriced compared to those from other industries or rejected.

[ad]

Anita Eboigbe, a journalist and film writer, told TechCabal that more money in the film industry could help solve some of these problems. “Right now, there are monopolies everywhere that can only be disrupted by more money. When it comes to streaming platforms, there are still a lot of negotiation problems that haven’t been solved. These all boil down to how we handle the process, and to fix this, we need money,” she said.

Investments from streaming platforms like Netflix and Amazon Prime and partnerships with local studios like Inkblot and EbonyLife are improving film quality. It is translating to better commercial performance at the cinemas. The highest-grossing films in Nigerian box-office history as of 2022 have been local productions: The Wedding Party ($1.5 million) and Omo Ghetto: The Saga ($1.5 million); and Nollywood now accounts for 55% of ticket sales in Nigeria.

In the first quarter of 2023, Nollywood accounted for 42% of box office revenue.

It’s in contrast to Nollywood’s early beginnings when direct-to-video sales at local markets were the preferred distribution method. Tech investors are now riding Nollywood’s newest growth wave. Subomi Plumptre, CEO of Volition Cap and one of The BlackBook’s investors, told TechCabal that she decided to fund Nollywood films because of the industry’s long-term financial potential. Olumide Soyombo, the founder of Voltron Capital, told TechCabal that he’s investing in Nollywood films to drive profitability in the industry.

Investors are building their appetite for Nollywood

Victoria Popoola, co-founder and CEO of TalentX Africa, a film-financing marketplace, told TechCabal that “the more significant revenue opportunities currently come from streaming, with cinemas helping to drive streaming leverage depending on performance.” TalentX has invested “close to $1 million” in Nollywood movies.

Plumptre’s Volition Cap also provides structure around film investing by creating a model that “looks like traditional African cooperatives.” For The Black Book, investors participated via “relatively small ticket sizes”, said Plumptre, and were supported by more prominent institutional investors. She added that the film’s investors earned dollar payouts because Netflix took up the movie.

Soyombo told TechCabal that the collaboration between tech investors and Nollywood has helped change how filmmakers approach filmmaking. “Now we are seeing (filmmakers) keep an eye on money and not just the creative side.”

Another significant challenge the film industry faces is the lack of physical infrastructure and production talent. Being unable to afford the appropriate technical equipment and talent affects the kind of stories that get told, with filmmakers sticking to plots—mainly drama—that don’t require a lot of technicality, missing out on the revenue that popular genres like action produce. Patient capital can solve this problem.

Soyombo told TechCabal that he has invested over £1 million in Rushing Tap Studio, a physical studio where filmmakers can rent studio space to create movie scenes. Plumptre told TechCabal that Volition Cap prefers creative projects with a maximum time frame of 24 months. The firm is also thinking of investing in physical infrastructure.

Popoola echoed the same thoughts, telling TechCabal that although she believes that “there’s a critical need for investment in more distribution infrastructure” and “a need to rethink the cinema experience,” Talent X is not investing in physical infrastructure. To address the talent problem, Popoola and Plumptre told TechCabal that their firms were open to partnerships.

Nollywood offers good returns

Unlike founders in the tech space who know where to go when they’re looking for funding, filmmakers rely on relationships. Eboigbe believes that making a public list of tech founders in a film would add to the diversity of funding sources. “You’re not going to see a large impact until there’s a clear pipeline for filmmakers to access funding rather than relying on personal relationships,” Eboigbe said.

Plumptre told TechCabal that her firm is structuring its second VEMA (Volition Cap’s Entertainment, Media, and Arts) fund, which is worth $20 million. She said the firm would use the fund to become “the number one destination point for African creatives seeking funding for their original projects.”

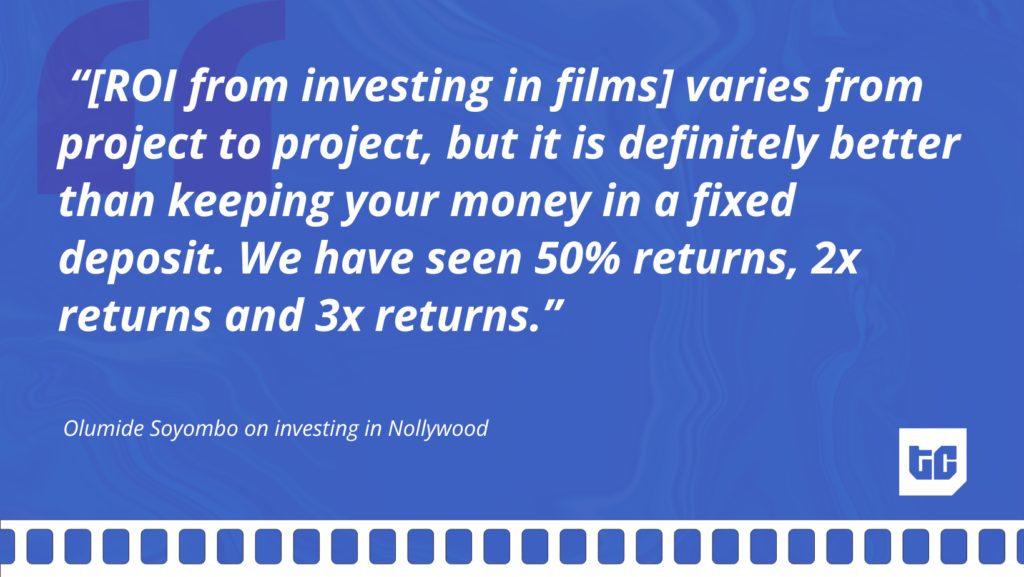

According to Soyombo, who has invested in movies like Gangs of Lagos and Brotherhood, the return on investment varies for each project. “[ROI] varies from project to project, but it is better than keeping your money in a fixed deposit. We have seen 50% returns, 2x returns and 3x returns.” With these returns, more retail and institutional investors would see Nollywood as an investable asset class.

More money, less problems

Eboigbe told TechCabal that more investors would provide filmmakers with more audacity to pursue bigger projects and more profitability. “More money means more space to experiment, but filmmakers also have to think about how to be profitable so that it makes sense for the people putting their money into these projects,” she said.

The increase in tech investors in Nollywood will only help improve the industry’s global standing. Movies like Gangs of Lagos have already broken records as one of the most-watched non-English titles on Prime Video, and this has spurred even more adoption of Nollywood content on streaming platforms. But a lot more can be done to create a lasting impact. The distribution pipeline for Nollywood has a lot of problems, the most prominent being a lack of funding and strong gatekeepers. According to Eboigbe, this breeds monopolies and makes it harder for indie filmmakers to profit.

Have you got your tickets to TechCabal’s Moonshot Conference? Click here to do so now!