First published 24 September 2023

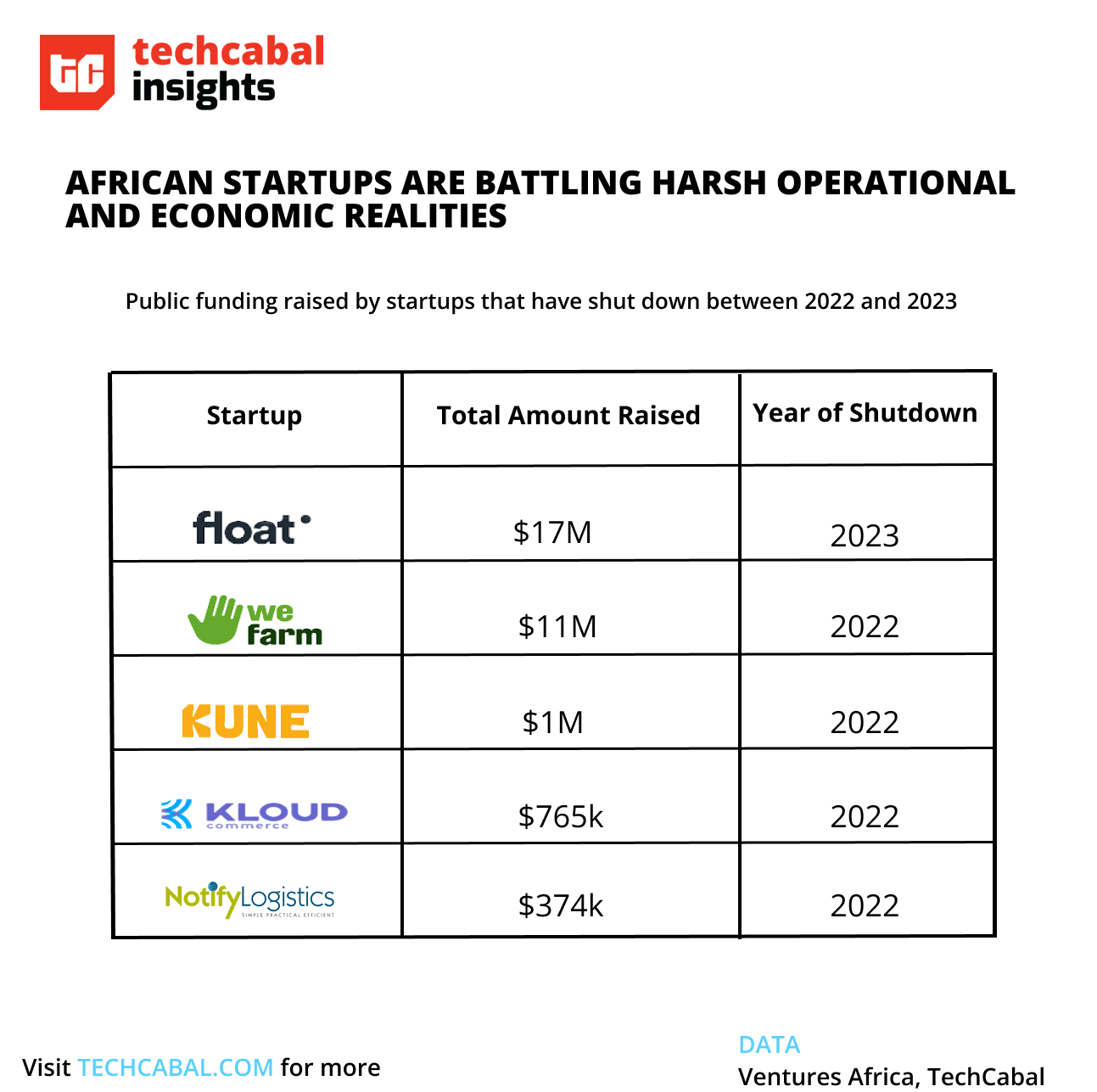

One of the biggest news stories last week, at least in Nigerian tech circles, was my colleague’s (Ngozi Chukwu) reporting about Payday, the virtual card app. Per her reporting, Payday which announced a $3 million pre-seed earlier this year is now seeking a buyer after a potential deal with Moniepoint fell through amidst internal strife and customer complaints. Like Payday, two other fintechs, Dash and Float, raised significant sums which were subsequently lost or misappropriated. Stories like this, where startups raise significant sums only to go bust months down the line, inevitably get a lot of attention. The businesses involved usually have thousands of customers and interested stakeholders from investors to regulators.

A sample of African startups that have gone from raise to bust. | Infographic by Victoria Olaonipekun, TC Insights

The stories are a reflection of the inflection point Africa’s startup and startup investing industry has come to. Namely, the age of accountability. Not just accountability for founders, but accountability for a venture investing model where the proper signals have been overwhelmed by the noise of the herd and the momentum of hot deals.

It is not an African thing. Globally, the venture capital industry appears to be at a junction where its most potent narrative—that it funds breakthrough innovation no one else will touch, and generates superior returns—is wearing out. Startup busts are expected given the nature of the market. But not fraudulent implosions. In short, venture investors are being held liable for the implosion (especially where fraudulent) of apparent portfolio winners. Don’t believe me? Talk to any limited partner (LP) worth their salt, or call your general partner friend and ask for an honest summary of how conversations with their fund’s investors are going.

Investing in private untested businesses is supposed to be difficult. In Africa, due to the lack of widespread and efficient formal systems, the uncertainty inherent in mostly informal markets raises the difficulty level a notch, or several notches higher. This means that both entrepreneurs and investors take a mutual oath to fight through the risks of building anything on the continent. It also means African VCs, more than their American, European or Asian counterparts, have to fight the tendency to groupthink.

Leaving the in-group

For an asset class whose name and preferred origin narrative celebrates anti-pattern matching, venture investing is susceptible to herd thinking. Following the herd is not always a bad thing. But this is typically only true when the herd is following established and clear standards. Where the herd is trying to find a way, everyone doing the same thing and kissing the ring of Lord Average raises the risk premium for the group.

The last 18 months are perhaps the best illustration of the capital-destructive power of groupthink and how it can affect even the most respected venture firms. As a result, following the herd is now (at least on social media) openly railed against.

What is bigger than the schadenfreude (of which there’s not too much because somehow everyone was touched) is the lesson that for venture capital to be taken seriously. It ought to be reoriented around clear standards. At first glance, this looks like it’s opposed to be anti-herd thinking. But it is not. Venture capital suffers from an acute lack of standard definitions and methodologies in much the same way startups need to come clean about what “revenue” means. In this scenario, leaving the in-group can simply mean doing the hard work even if it clashes with the latest trend. Take a minute and think about what doing venture investing this way can mean for Africa where areas like financial inclusion have been squeezed for every ounce of milk?

Partner Content:

Cenoa, the dollar account for emerging markets, launches in Nigeria

Momentum is one of the reasons a herd of buffalo is not something you want bearing down on you. We’ve heard stories from investors and entrepreneurs alike of how much momentum crushed term sheets and upended cap tables (much later). However, momentum investing is not a viable venture capital strategy.

Again, this is a global problem. To quote Professor Aswath Damodaran, Wall Street’s Dean of Valuation:

While there are a few exceptions, venture capitalists for the most part are traders on steroids, riding the momentum train, and being ridden over by it, when it turns.

In Africa, it can be the precursor to startup death, and capital destruction that will (unlike the Americas) be difficult to rebuild and recover from.

Dumping the fluff

Narrative is powerful. Narrative properly harnessed can create a world of difference and value. But in the finance world, narratives only last so long. The simpler the narrative, the easier it is to become folklore. But the worst thing about narrative-driven financials is that in an environment where knowledge is dreadfully imperfect, the best storytellers (not necessarily the best businesses) win.

Look, narrative investing is cool, maybe even fun. But it can also suffer from an inadequacy to demonstrate substance when cattle dung hits the fan.

That is not to say an investment thesis or term sheet that can be distilled into a story is bad. The point is that over-indexing on this type of substance is a great way to get caught up in the buffalo herd stampede.

Partner Content:

Tech Studio Academy celebrates five years of empowering tech enthusiasts with ₦5 million scholarship

Whether you are trying to raise from local LPs or hitting up DFIs and foreign LPs, it is only a matter of time before reality catches up with the story. In Africa, this will not be the first time.

Spreading the lessons

Part of why our narratives have remained simple is because of the failure to bulk up the story with lessons from the ground. Like how Float lost investor funds and other startups’ assets for months, but everyone kept quiet until the damage was more than done.

The funny thing is that, more lessons from pitfalls and successes may do more to catalyse capital inflow than relaying the same tired old reasons why one must “invest in Africa”.

The price of this fluffy narrative, groupthink and the lack of teachable moments is millions of investor cash.

Abraham Augustine,

Senior Reporter, TechCabal.

We’d love to hear from you

Psst! Down here!

Thanks for reading today’s Next Wave. Please share. Or subscribe if someone shared it to you here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

As always feel free to email a reply or response to this essay. I enjoy reading those emails a lot.

TC Daily newsletter is out daily (Mon – Fri) brief of all the technology and business stories you need to know. Get it in your inbox each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.