Join us for TechCabal Battlefield, Moonshot’s startup competition where you can showcase your startup idea to a global audience and an esteemed panel of judges and stand a chance to win up to 2.5 million naira in funding for your business!

Click to register for TC BattlefieldFirst published 1 October 2023

Tech startup founders face a series of challenges on the path to success. When do they finally get to reap their rewards?

The thing with arguments like how much a founder should earn is, it is subjective. We can speculate and harmonise based on an industry standard but who sets it anyway? If indeed there is a standard for how much a founder should earn, it is still subjective and mostly dependent on the founder to set.

Over the past few weeks, some of the work done by the TechCabal team has not gone unnoticed. Ngozi Chukwu’s story on PayDay and its current up-for-sale status set off a major debate on X, formally Twitter, regarding what founders should actually earn. I know these issues are usually thrashed out at the ideation stage but the decision on whether to earn your coins from the first day or not, as a founder, is still open-ended. This is according to interviews I held with four founders, including the founder of a startup studio I spoke with for this article.

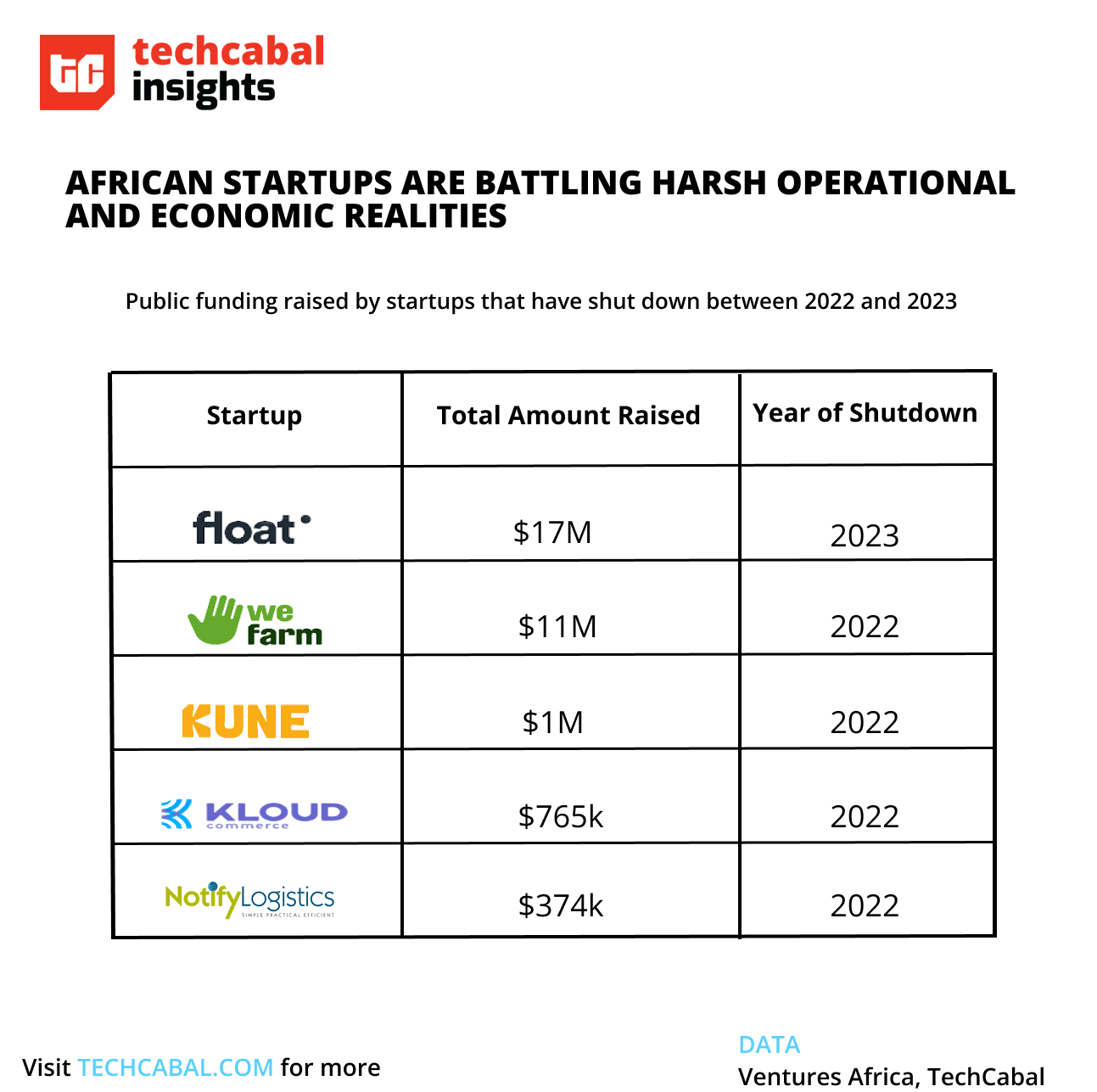

Abraham Augustine argued in the last edition of the Next Wave that investors betting on African founders have their work cut out for them. At least five startups including Float and Kloud Commerce had bitten the dust between 2022 and 2023. A lot of times the issues behind these failures are familiar—cash burn, corporate governance, toxic work environments, power tussles, and so on—but the core of the problems is always down to conversations about money. More money means more staff, more inventory, greater advertising spend and an audacious will to execute.

A sample of African startups that have gone from raise to bust. | Infographic by Victoria Olaonipekun, TC Insights

In 2022, 47% of startups failed after running out of cash, according to Skynova, a firm that makes invoicing software for small businesses. Money, which is usually decided by the startup founder in the very beginning, can set the tone for further hires. Entrepreneur and venture capitalist Peter Thiel is of the opinion that low CEO pay is one of the ground requirements for a startup’s success.

How much should startup founders earn?

Startup founders don’t earn much globally. On average, the pay generally oscillates between $50,000 to $150,000 a year. Estimates from 80,000 hours say that founders in a Y Combinator program pay themselves $50,000 at the very beginning. If it flops, the figures stay the same but if they go on to raise funding, the money could go up. A 2022 report from an accounting firm, Pilot, says that 46% of founders get paid less than $100,000 annually, while over 5% of founders get paid nothing. Pilot estimates the average salary among founders at $114,000 a year. And if you are bootstrapping, the salary is way less than a founder who is VC-backed. Others have different categories for paying founders and the salary tends to rise at the different levels of fundraising.

Article continues after this ad

All of the CEOs — Ope Onaboye of Renda, Uche Ukonu of Smallchops.ng, Ikpeme Neto of WellaHealth, and David Lanre Messan, who runs a venture studio—First Founders —agreed founders should pay themselves modestly. The trio of Onaboye, Ukonu, and Neto followed the same journey of bootstrapping before raising capital from venture investors.

Ukonu and Neto emphasise taking a small salary while hoping for a return on the equity the founder owns. Ukonu’s case is special because he bootstrapped all the way to ₦100 million in revenue, with just nine employees. He told me he once took a salary of $27 (₦20,000) and augmented himself with other side hustles while he grew Smallchops.ng.

Partner Content:

Driving e-commerce and boosting African entrepreneurship: A look at Payaza’s payment solution

Messan strongly believes that a founder can only earn $1,000 per month at the product market fit stage, adding that founders should take lesser amounts before getting there. His argument is that founders should invest in their businesses until it pays them back. According to him, the stages to a huge payout start from building, scaling, and then growth. For the majority of founders, the ultimate payout is equity. But the question is if they will ever get to payday from an exit or a major liquidity event (i.e. when the founder can sell all or some of their stake in the business for cash.

It is important to note that a lot of tech founders start their business hoping never to fail but the harsh reality is that not all startups succeed. At least 20% of businesses shut down in two years and 45% during the first five years. Only 25% finally make it to 15 years, according to data from the U.S. Bureau of Labor Statistics (BLS). Per Statista, the average startup failure rate in Africa stood at 54 per cent in 2020. Nigeria recorded a 33% failure rate in that year. The West African nation recorded a 61% failure rate between 2010 – 2018, according to The Better Africa report, by Weetracker, an African media firm. Ethiopia (75%), Rwanda (75%), and Ghana (73.91%) topped the chart in that regard.

With these high failure rates, there is a tendency to think that many founders never actually earn their deserved worth if they choose to deny instant gratification and take little or no pay while at the building stage.

Some founders slowly have to relinquish their control to the board as they consider further expansion, list their shares or prepare for the ultimate exit. This is what Harvard Business Review summarises as the founder’s dilemma— whether to stay on longer as founder-CEO or hold onto control. “The faster that founder-CEOs lead their companies to the point where they need outside funds and new management skills, the quicker they will lose management control.

Success makes founders less qualified to lead the company and changes the power structure so they are more vulnerable, ‘Congrats, you’re a success! Sorry, you’re fired,’ is the implicit message that many investors have to send founder-CEOs,” Noam Wasserman author of the HBR article, pointed out.

A thankless job?

Some founders may not even have enough money saved up for retirement. It does not mean that the future for founders is all gloomy in the end. But as a founder, the more you give shares away for venture capital or relinquish power to the board, the less you are seen. After working so hard on a startup and making the tough calls in the business, there is tendency to think the job is thankless.

Is being a founder truly a thankless job till you exit? Or where is the eldorado in all of this? Well, there is no fixed answer to this question. What is certainly fixed thought is that not every founder will end up like Jeff Bezos enjoying themselves on a yacht after appointing a CEO to continue in his stead.

Joseph Olaoluwa, Senior Reporter

TechCabal

Senior Reporter, TechCabal.

We’d love to hear from you

Psst! Down here!

Thanks for reading today’s Next Wave. Please share. Or subscribe if someone shared it to you here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

As always feel free to email a reply or response to this essay. I enjoy reading those emails a lot.

TC Daily newsletter is out daily (Mon – Fri) brief of all the technology and business stories you need to know. Get it in your inbox each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.