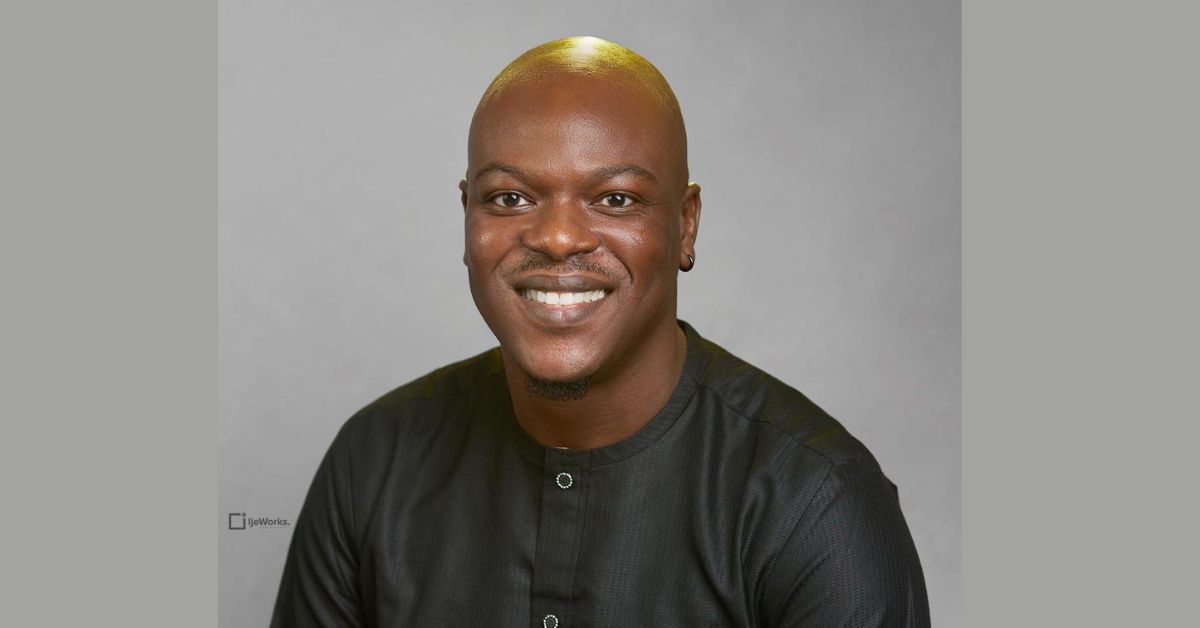

MTN South Africa’s chief financial services officer Bradwin Roper speaks on the recently launched MTN MoMo 2.0 platform.

Two weeks ago, MTN South Africa announced a slew of products on its mobile money (MoMo) super app. Some of the services unveiled include MoMo Business Wallet, which will enable businesses to receive payments in real-time with no transaction fees. MoMo Eazi, a more consumer-facing product, enables users to make payments.

Another product launched was International Remittances which will allow foreign nationals in South Africa and local residents to send money across 12 African countries without any data charges. MoMo also launched a point-of-sale device to take card payments from customers as well as a life insurance package.

With these products, MoMo continues to double down on the South African market which it returned to in 2020 following a three-year hiatus. Currently, the service claims to have 9 million subscribers and has an outlined goal of “becoming one of South Africa’s premier financial services platforms”.

To get a deeper understanding of the rationale for the launch of such an extensive suite of products, TechCabal spoke to Bradwin Roper, chief financial services officer at MTN South Africa.

In the interview, Roper touches on why MoMo returned to South Africa after a three-year hiatus, the super app route was chosen for the new iteration of MoMo, as well as the future of the product in the southern African nation.

Why were the new products launched in super-app format as opposed to launching them individually?

Bradwin Roper: We want to offer convenience and access to products and services like no one else. Technically, I think every major company with a major fintech product has essentially the same strategy. We looked at the industry verticals and the industry opportunities and tried to solve them at a client level. So we look at the client and we say from when you kick start your day, commute to work, etcetera, how can we help you throughout the day and offer convenience?

So we wanted to offer convenience on the mobile platform like never before. We wanted clients to have access to their wallets, payments, insurtech services, all in one place. Also, it makes sense to keep the features and benefits in sort of one app for customers to understand them. Additionally, from a digital and financial literacy perspective, it also makes sense that we aren’t siloed and we’re doing everything in one place.

So if we can, for example, entice you and get you interested in prepaid funeral cover, you will get comfortable and recognise another product from the app to add to your list. A super app packs a very simplistic user journey and convenience for consumers. We will continue to innovate and add more features and benefits to it but in all honesty, we are not really chasing super app status but just convenience for our customers.

Do you think that being within MTN, which is the second mobile network operator in SA, will help with the adoption of the product?

BR: Yes, because we have the benefit of being a FinTech inside an incredible organisation. So, if you look at the accolades that MTN Group has achieved at the continental level, it is very impressive. It is a known brand which comes with a level of trust and sophistication.

The group has always stood for digitisation as evidenced by what it has done in fintech across the continent where it has products which have tens of millions of customers. So for us as the SA team, it is great to solve problems within such an organisation and have a user base that is already familiar with the company’s vision.

How do you plan to attract and retain customers within the product?

BR: The level of sophistication that we have brought to the market with this launch signals to the market and customers that we will continue to look for opportunities where we believe customers are being exploited.

So, for example, with the Business Wallet product, zero fees means that as a customer, when you transact R100, it remains R100. So, we will continue to look for opportunities where we can add value for customers. As MTN, we strive for shared value. Wherever we can leverage technology and digitisation to unlock shared value and create shared prosperity for our customers, that’s what we will be doing.

We don’t really look much at the competition, but rather, we look at the industry and realise, for example, that less than 4% of people have insurance in the country. Then we ask ourselves, what’s the thing holding people back from actually getting insurance? Well, it’s a debit order. And, also, it’s the fact that I need to pay R55 until the day I die to be able to qualify for insurance.

So then we go, how do we out-engineer that? And how do we say to citizens, “Hey, you can get insured, but you pay once from a mobile wallet, and by doing so, you’re going to save more than half what you would if it was running off a debit order?” So, in short, we will continue to scour the market for opportunities where we truly believe that customers can save. And in so doing, that’s how we’re going to continuously drive adoption.

Where we believe we’re going to win is by creating shared value, but also really being revolutionary in terms of client experience and addressing the questions of clients’ needs and how we can use technology to innovate and solve those needs like never before.

As the platform grows, will you build more in-house or consider some M&A deals and collaborations with startups along the way?

BR: Because we want to solve for customers, we’re always going to be seeking for the best way to go about this. Do we build or buy or partner? I’ll give you an example. The remittance product that we launched was done with a South African called ClickSendNow. So they own the licensing and they take care of all that tech for us. And because we were able to partner with them, they also have the opportunity to access the 9 million customers on MoMo.

Additionally, the point-of-sale device was done in partnership with another South African startup, and they are helping us with the deployment, development, manufacturing, and software of the device. So, we’re constantly optimising for partnering with other entities in order to solve the customer’s pain points. Our secret sauce is how we can deliver unprecedented value for our customers and drive a digital revolution in South Africa. That’s what we we aim to do whether it’s via building in-house or partnering with external entities.

In South Africa, MoMo went on a hiatus and came back and now with MoMo 2.0, it seems you are doubling down on the mobile money industry in the country. What opportunities inspired this pivot?

BR: If you think about it, the fact that 15% of South Africans are still unbanked is a huge market opportunity. Additionally, there is the R100 billion spaza industry whose customer base is 80% of citizens. So, where traditional financial services would see a problem, we see an opportunity. And I guess that’s the difference for us. We’re not trying to be a bank. Rather, we’re trying to solve for citizens and find them and innovate solutions where there were none before. We’ve got 22,000 agents scattered across South Africa already and offer them digital and financial solutions on a scale that’s never been done before.

In terms of the growth trajectory of MoMo 2.0, what are you aiming for?

BR: We don’t truly have a market share size or profit number that we are aiming for. For us, it’s really again about creating shared value and bringing the 15% unbanked into having access to banking services.