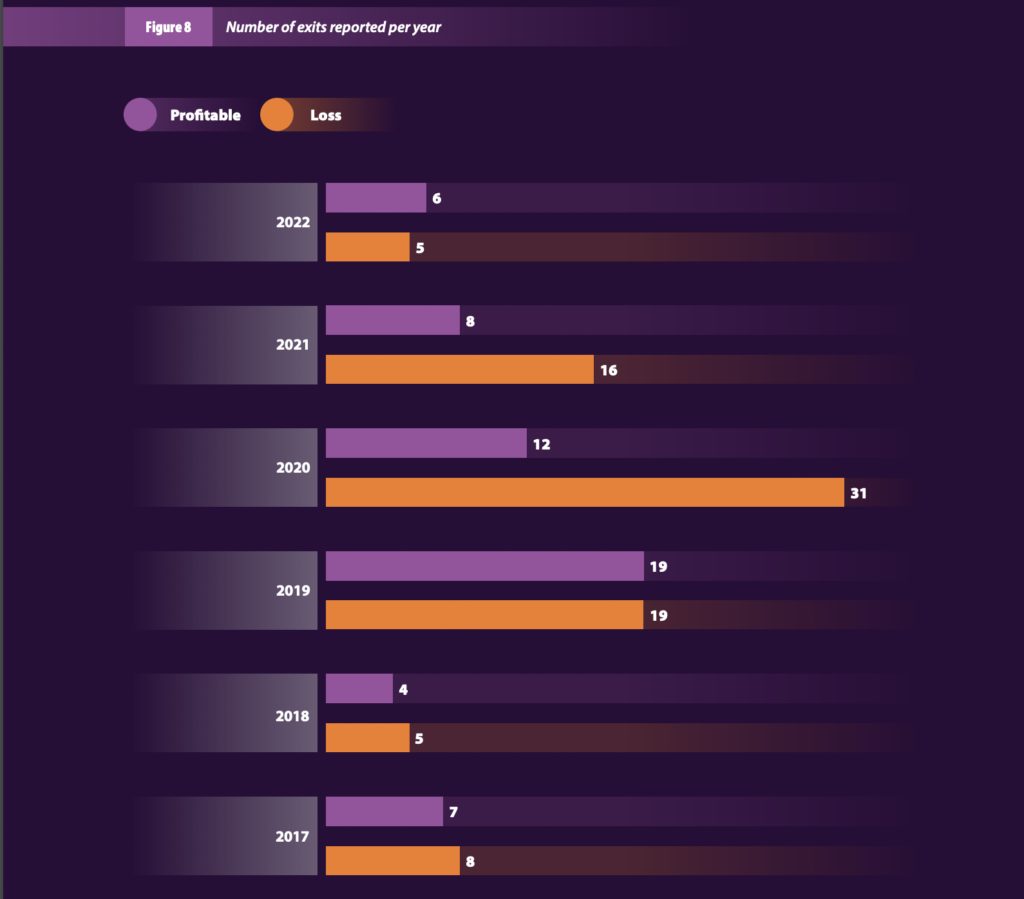

SA VC investors made $17 million from exits in 2022, a 3x return. However, loss-making deals still outnumbered the return-making ones.

According to the 2023 Southern Africa Venture Capital Association (SAVCA) survey, exits in the South African ecosystem returned investors R318 million (~$17 million). This represents a 3.8x return multiple on the R83 million (~$4.4 million) invested in such deals.

However, despite the returns, the total number of losses incurred on exits was R80 million (~$4.2 million). Additionally, the returns represent the third consecutive year where exit returns have plummeted in the country. Since 2017, the only year that exit activity did not record a loss, in the cumulative sense, was 2019 when the number of returns and losses on exits was the same.

SA’s complex exit market

Over the years, South Africa has been heralded as the exit hub of the continent, consistently leading other VC hubs in Africa. Several reasons have been attributed to South Africa’s impressive mergers and acquisitions (M&A) dominance. These include active capital markets and banking systems, mature companies that can snatch up startups, and others.

However, as more data becomes public, it has been clear that most of the exits have been loss-making for investors. Exiting too early has been hypothesised as one of the reasons why such transactions might not reap the desired results for those involved.

According to Keet van Zyl, co-founder and partner at venture capital firm Knife Capital, there is some legitimacy to the hypotheses. Van Zyl states that in some instances, there is a disconnection between the growth capital needed by startups and what is available, so it makes sense to sell instead of trying to embark on more fundraising. On average, according to van Zyl, South African startups exit after three to four rounds of funding.

“Despite the increasing availability of deal-flow, there remains a significant follow-on financing gap for high-growth local startups with proven traction,” van Zyl told TechCabal in May. “Therefore sometimes when startups try to raise growth capital, they turn to strategic investors who seize the opportunity and make a full acquisition offer.”

However, according to van Zyl, this trend is not necessarily bad as it allows for an increased number of smaller exits – which then recycles capital into the ecosystem – instead of a long road to unicorn building and a lack of liquidity for investors.

In August, van Zyl’s Knife Capital announced a $50 million expansion fund which would invest in B2B companies that are globalising South African technologies and opportunistic investments in the rest of Africa. The specific focus will be on growth and expansion stage companies at Series A extension and Series B funding stages.