Emata, the agro-financing startup in Uganda, is leveraging farmer cooperatives and whatsapp chatbot in Uganda to disburse collateral free loans to small holder farmers in the country.

Emata, a two-year-old agro-financing startup for small-holder farmers in Uganda, launched with one goal in mind: to offer collateral-free loans to small-holder farmers. While the majority of Uganda’s seven million farmers live in rural areas, their outputcontributes 35% of the country’s export earnings. But agencies like the World Bank say that these farmers could be more productive and command better profits. One of the ways to ensure improved outcomes is access to loans.

Emata’s founders, Lillian Nassanga, Dave Agaba, and Bram van den Bosch launched a study throughout rural Uganda to understand how farmers work, and realised that there was a huge financial gap for farmers in the region. Africa’s agricultural financing gap is about $240 billion, with Uganda’s estimated between $1.5 billion and $2 billion annually. “We realised that if farmers in Uganda and Africa are given the correct support and financing, they will be able to feed the world. This is not happening because banks are not offering loans to farmers, and that’s when Emata began,” Nassanga said.

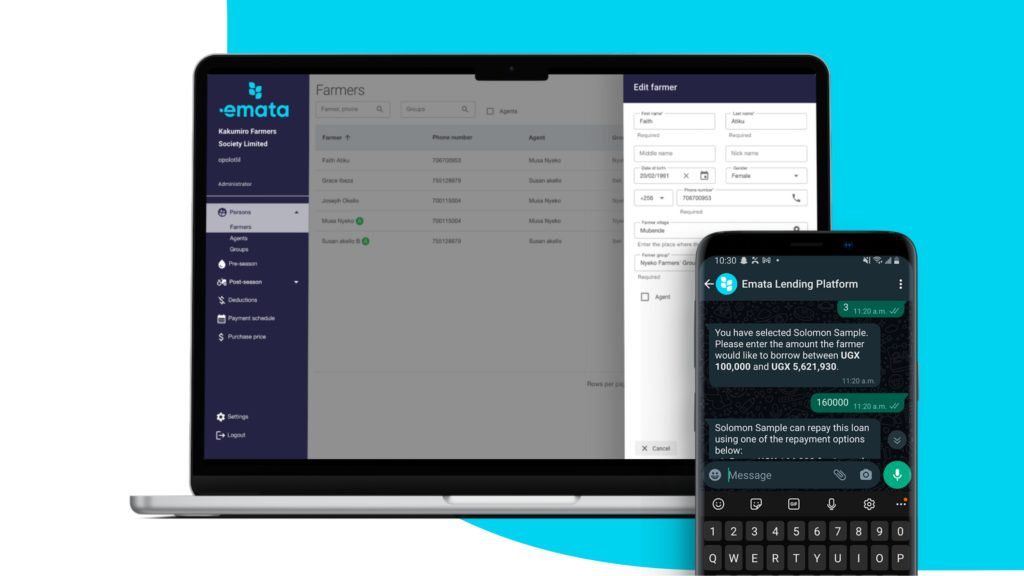

Emata started by issuingloans to dairy farmers before expanding into coffee and oil seed farmers. The startup relies on data obtained from cooperatives and farmer-based organisations to make loan decisions. “The first thing we do is to ask whether they [the cooperatives] have digital records of the farmers. The records allow us to understand how the farmer has performed over a period of time, how much the farmer has been yielding for the month,” Nassanga told TechCabal. “We combine this data with the farmers’ living expenses and weather data so we can understand what the farmer’s potential will be for the seasons coming.” Once Emata concludes this task, they apportion credit limits to each farmer. The credit limits determine how much loan a farmer can obtain. “No one farmer has the same limit. We reward loyalty over one-hit wonders because we want this smallholder farmer to grow,” she said.

How Emata disburses loans

Cooperatives are a way of life for smallholder farmers in Uganda. These farmers often lack the resources to access financial services, agricultural inputs, and marketing support on their own. Pooling their resources in these cooperatives—such as Kiruhura Dairy Cooperative, Rushere Dairy Farmers’ Cooperative Society, Kigezi Highland Tea Cooperative, and Nyabyeya Coffee Cooperative—allows the farmers to access better prices for agricultural inputs and higher prices for their crops. Emata leverages this farmer-cooperative relationship to disburse loans easily to the farmers.

The farmers apply for loans through a cooperative agent. These agents then apply for loans on behalf of the farmers through Emata’s WhatsApp chatbot. The farmers receive the loans in their mobile money wallets—MoMo wallets are the most popular for these unbanked farmers. According to Nassanga, loan processes take up to 5–10 minutes. “We have a person trained to use our WhatsApp chatbot to request loans on behalf of the farmers. Once they put in information about the farmers, we look through the farmers’ data points and approve or deny the loans. Once the loan is approved, the agents get notified on WhatsApp, and the loans will be disbursed to the farmer.”

Due to low digital literacy in some rural parts of Uganda, working with cooperatives has been a difficult task for Emata. “Sometimes, there is no digital record of these farmers, so we have to train the staff to input the data into the computer,” she said.

Emata does not have a loan cap, but its minimum loan size is about $25. “Our loans are getting bigger by the day even as the farmers grow,” said Maren Hald Bjørgum, chief communications officer. Bjørgum did not disclose Emata’s interest rate but says the agro-financing firm’s interest rates are competitive. According to her, interest rates differ from partner to partner and from value chain to value chain according to the risk.” Loan tenure ranges from two weeks to nine months, and farmers repay at the end of the harvest. Farmers can also get increased loan prizes depending on their previous performance. “We match our loan periods for the start and end of each season; as long the model shows you can repay it, you will get a loan,” Bjørgum disclosed.

According to Musoke, Emata has disbursed loans worth $1 million to farmers and hopes to double that in the coming year. The startup recently raised a $2.4 million seed round, a mix of $1.6 million debt and $800,000 equity funding, The startup plans to use the funding to deepen its offerings in Uganda—where it currently has no competitor—and expand into Tanzania. Emata has onboarded 56 partners, 40,000 farmers, per Musoke.

“The structures we have developed here are easily transferrable to other markets,” she told TechCabal. Emata is hoping to strike partnerships with farmer based organizations for its next growth phase, according to Musoke. The agro-financing startup is in talks with dairy potato partners in Tanzania and Ethiopia and will enter the countries in the coming days, Musoke shared with TechCabal.