TGIF ☀️

Safaricom is paying for its time. Literally.

To make up for M-Pesa’s three-hour downtime on Tuesday which surprised everyone including regulators, customers were given cashback or airtime tokens ranging from KES20–KES100.

If you didn’t get anything, you need to up your M-Pesa game so you too can reap the rewards of a telecom currying favour from probing regulators. 👊🏾

Police nab 7 suspects linked to Patricia’s hack

The Nigerian Police Force (NPF) has identified seven suspects who reportedly stole ₦142.8 million ($155,734) from fintech Patricia.

If this sounds familiar, it’s because Patricia has been in the news for quite some time now. In May 2023, we revealed that the Nigerian fintech suffered a hack in 2022 which cost it $2 million in customer funds. The hack led to several customers being unable to withdraw funds. Patricia then tried several measures to placate its understandably angry users, including a botched app relaunch, a stablecoin backed by the dollar, and fundraising.

In November the NPF arrested gubernatorial candidate William Bonse for the hack. According to the police, Bonse admitted his involvement in diverting ₦607 million ($760,000) of Patricia’s funds to his account.

New developments: Techpoint reports that six more suspects, including a special assistant to a Nigerian governor, have been apprehended, while a seventh remains at large.

Meanwhile, Patricia might still be struggling to repay its customers. CEO Hanu Fejiro had previously said customers would start receiving payments in batches on November 20, 2023, but it appears the process has been slow.

Access payments with Moniepoint

Moniepoint has made it simple for your business to access payments while providing access to credit and other business tools. Open an account today here.

Amazon cuts down its Prime Video & MGM teams

Heads up, streaming fans! Amazon is giving Prime Video and MGM a makeover, and that unfortunately means saying goodbye to some folks.

The tech company is laying off hundreds of employees across Prime Video and the recently acquired Metro-Goldwyn-Mayer (MGM) Studios, because it wants to focus on creating high-impact content.

This isn’t Amazon’s first rodeo when it comes to layoffs. Last year, the company laid off over 27,000 employees. In this round Twitch, Amazon’s live-streaming site, is also preparing to cut off 35% of its staff, after several top executives left the company in the final months of 2023.

Amazon isn’t alone: Beyond Amazon, the broader streaming landscape is grappling with economic headwinds, prompting layoffs at industry giants like Disney and Warner Bros. Even tech behemoth Google isn’t immune; on Wednesday, it reportedly cut 1,000 employees from its voice assistant, augmented reality hardware, and engineering teams. This is in addition to the 12,000 let go in January 2023 and further cuts in its recruitment division last September.

Why the persistent layoffs? Layoffs have been steady across the global ecosystem since 2022, with about 500,000 employees laid off since. The big question now is if companies should still be blaming these layoffs on the economic downturn, especially when profitable companies do it too. For context, Amazon’s profits more than doubled in 2023. These moves point to underlying factors like AI or a shift. This isn’t just about weathering the economic storm, it’s about asking if these layoffs are a smart play or just a quick cash grab with some nasty long-term side effects.

CBN appoints new board members for Nigerian banks

Nigeria’s apex bank has appointed new board members for the three commercial banks whose boards it dissolved on Wednesday.

Why the overhaul? The Central Bank of Nigeria (CBN) dissolved the board of directors of Union, Keystone and Polaris banks citing regulatory non-compliance and corporate governance failure.

The dissolution and replacement of board members comes weeks after Jim Obazee’s investigation into the Central Bank under former Governor Godwin Emefiele’s alleged questionable bank acquisitions. Obazee’s report claims Emefiele used proxies to purchase these banks without evidence of payment.

Who are the new appointees? Yetunde Oni takes over the helm of affairs at Union Bank alongside Mannir Ubani Ringim, the bank’s new executive director. Hassan Imam will head KeystoneBank as CEO, while Chioma A. Mang will play the role of Keystone’s executive director. Lawal Mudathir Omokayode Akintola will now lead Polaris Bank as CEO, and Chris Ofikulu will be its executive director.

Lights out: The CBN appears to be increasing scrutiny and tightening regulatory controls over commercial banks since the appointment of its current governor, Yemi Cardoso. However, the recent dissolution of commercial bank board members is not a first in the country. In 2016, the CBN sacked the board of directors at Skye Bank for a failure to meet the regulated capital adequacy ratio, a measure of the bank’s capacity to handle financial risks.

Secure payment gateway for your business

Fincra payment gateway enables you to easily collect Naira payments as a business; you can collect payments in minutes through cards, bank transfers and PayAttitude. Create a free account and start collecting NGN payments with Fincra.

Seedstars Africa Ventures secures $30 million from EIB Global

Seedstars Africa Ventures, a pan-African venture capital firm, has secured a $30 million investment from EIB Global, an arm of the European Investment Bank.

Maxime Bouan, Tamim El Zein, and Bruce Nsereko Lule launched the Seedstars Africa Ventures I fund in 2020, aiming to raise between $80 million and $100 million. They’ve already partnered with LBO France and Seedstars, secured $8 million from LBO France, and invested in companies like Poa Internet, Beacon, Shamba Pride, and Bizao. This new injection from the European Investment Bank adds even more fuel to their mission.

Here’s what it means for African startups: Startups can get between $250,000 and $2 million, with the potential for follow-on investments up to $5 million. Up to half of the funds will be directed towards promising startups in French-speaking African countries.

Beyond cash, startups gain access to Seedstars’ vast network, valuable tools, and increased visibility to help them thrive.

EIB’s injection also comes on the heels of Seedstars Youth Wellbeing Ventures, another $20 million fund launched seven months ago to specifically support early-stage ventures focused on improving lives in Africa.

EIB continues its African focus: Seedstars Africa Ventures is not the only pan-African impact-focused VC fund the EIB has backed. EIB has supported Partech Africa, a leading investor in African tech startups with €45 million ($49.2 million) in 2022 and Atlantica Ventures, an early-stage pan-African impact-focused VC fund with over $50 million in February 2022.

Accept fast in-person payments, at scale

Deploy your in-person point-of-sale solution to hundreds of sales agents, in seconds. Learn more →

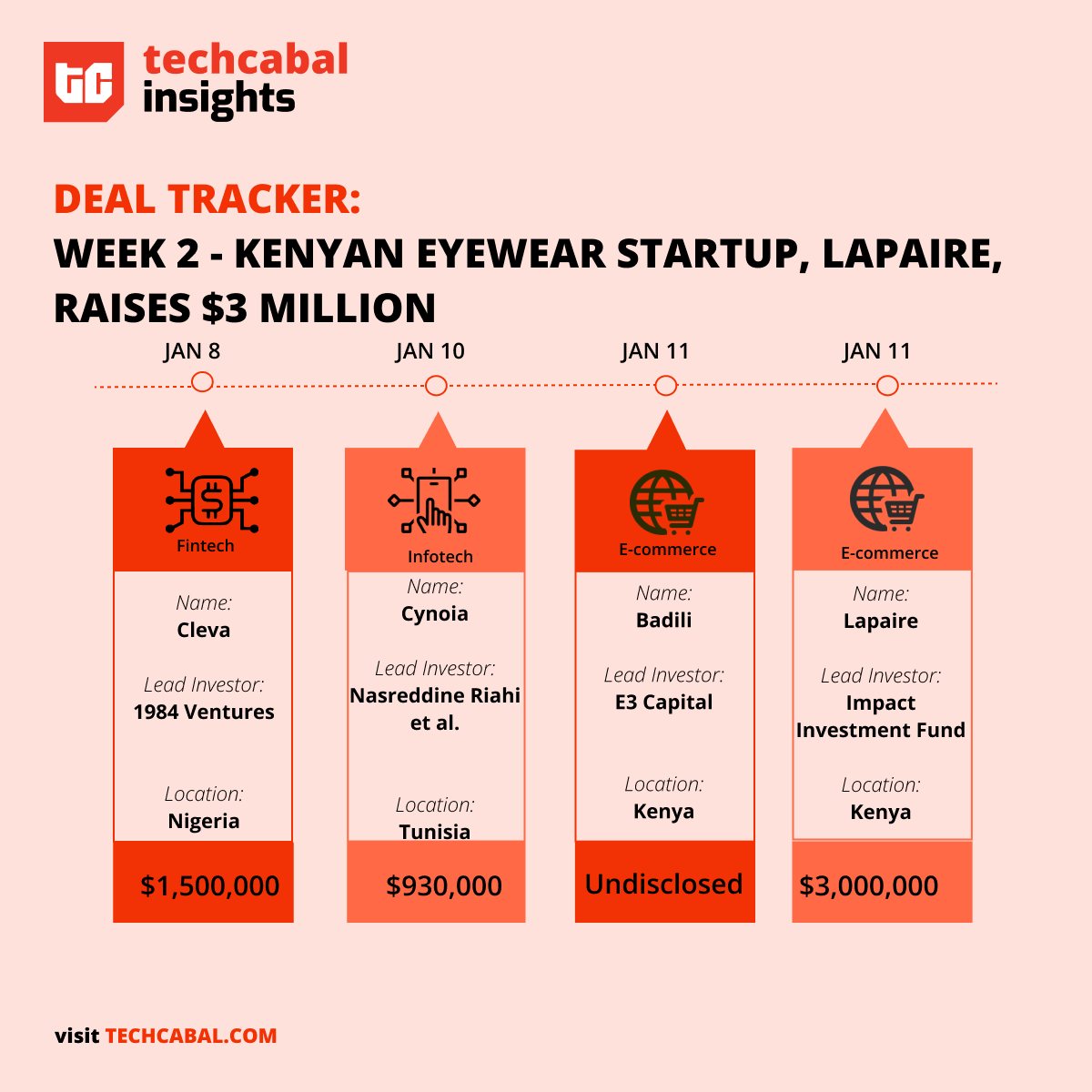

Funding tracker

This week, Lapaire, a Kenya-based eyewear startup, raised $3 million to expand across Africa. Impact investment fund Investisseurs & Partenaires (I&P) led the equity round with AAIC, FINCA Ventures, and Beyond Capital pitching in.

Here are other deals for the week:

- Kenyan startup Badili, a reverse commerce platform for refurbished phones, secured an undisclosed amount of seed funding in a funding round led by E3 Capital.

- Cleva, a Nigerian fintech startup, raised $1.5 million in pre-seed funding. 1984 Ventures led the round with the participation of The Raba Partnership, Byld Ventures, Firstcheck Africa, and several angel investors.

- Cynoia, a Tunisia-based startup, raised $930,000 to expand into West Africa.

That’s it for this week!

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. You can also visit DealFlow, our real-time funding tracker.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $46,263 |

– 0.40% |

+ 12.18% |

|

| $2,600 |

+ 2.11% |

+ 17.22% |

|

|

$1.00 |

– 0.01% |

+ 0.07% |

|

| $306.88 |

+ 0.15% |

+ 19.87% |

* Data as of 23:35 PM WAT, January 11, 2024.

Effortlessly make global settlements in over 30 currencies across 120+ countries spanning four continents, delivering cost-effective and reliable solutions to your clients, suppliers, and customers. Get started today.

It finally happened. The US Securities and Exchange Commission has approved bitcoin ETFs. CoinDesk reports that the SEC made the announcement early yesterday morning and the buying and selling already began.

If you’re wondering what the fuss is all about for bitcoin ETFs, here’s a thought: crypto investors in the US can invest in bitcoin without owning any actual bitcoins. It’s basically a basket of stocks that mimics the price of bitcoin, but you can buy and sell it easily like regular shares on the stock market. It’s critical because gold ETFs quadrupled gold prices in the US, and everyone is hoping bitcoin ETFs will do the same and help bitcoin get back to the sweet $60,000 spot it was before the great crypto crash of ‘22.

- Rubicon – Business analyst – South Africa (on-site)

- Voltrox – Full stack developer – Lagos, Nigeria (remote)

- Sun King – Technical product manager – Lagos, Nigeria (Hybrid)

- Areeb – UI/UX designer – Egypt

- Duplo – Bizdev and partnerships manager – Lagos Nigeria(Remote)

There are more jobs on TechCabal’s job board. If you have job opportunities to share, please submit them at bit.ly/tcxjobs.

What else is happening in tech?

- A raid on billionaire Dangote’s office is spooking Nigerian businesses

- Lagos Tech Fest is set for February 15. Here’s what you need to know.

- Domestic workers in South Africa say they’re forced to work extra hours for free

- TikTok has surpassed $10 billion in customer spending

- Kara Swisher is Silicon Valley’s most-feared and most-liked journalist. How does that work?

Written by: Mariam Muhammad & Faith Omoniyi

Edited by: Kelechi Njoku & Timi Odueso

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.