Happy salary week 🎉

Our sister company, Zikoko, is hiring some content creators.

So if you’re a wizard at creating vox pop content but hate being called a TikToker, here’s your chance to make magic happen. Apply here.

Angola’s central bank escapes hack

Last week, Angola’s apex bank revealed that it escaped an attempted hack on January 6, 2024.

The news: Banco Nacional de Angola (BNA) says there’s nothing to worry about. Per its statement, the bank’s security systems caught the cyber threat quickly and prevented any major damage to its computers or data. They were able to keep their online services running safely and efficiently, although maybe a bit slower than usual.

It’s more common than you think: While cyberattacks on commercial banks and fintechs raise eyebrows, silent alarms are often ringing at central banks across Africa. The governor of the BNA José de Lima Massano, in May 2023, said that the apex bank records about 350 attempts per day. In December 2022, the South African Reserve Bank (SARB) was, ironically, alerted by the FBI to a breach it still denies to this day. Months before the SARB hack, the Bank of Zambia had fallen victim to a hacker collective called Hive which had ransom demands. That same year, the Bank of Gambia suffered two separate cyberattacks. More recently, in December 2023, the Central Bank of Lesotho suffered an attack that crashed inter-bank transactions in the country. 🤷🏾♂️

African governments take action: In the face of rising cyber threats, 33 African nations, including heavyweights like Nigeria, South Africa, and Egypt, have taken the first step by enacting cybersecurity legislation. The bad news is that this may be one of those things where the tech is two steps ahead of the legislation. A 2018 hack on Bangladesh’s apex bank account left regulators and operators dumbfounded. The hackers made away with $81 million using SWIFT, the financial service used by over 11,000 institutions globally. Since then, no major legislation has been made to prevent another hack, but the IMF suggests that international cooperation is key to stopping these hacks.

Access payments with Moniepoint

Moniepoint has made it simple for your business to access payments while providing access to credit and other business tools. Open an account today here.

Kenya warns Airtel and Telkom over poor service

Kenya’s phone regulator, the Communications Authority of Kenya (CA), has slapped Airtel and Telkom Kenya with warning notices and fines for failing to meet quality of service (QoS) standards. This action by the regulator indicates that customers on these networks have likely faced issues like dropped calls, slow internet speeds, and inconsistent coverage across various regions.

Side bar: The CA regularly tests mobile networks against benchmarks for call success rate, internet speed, and coverage. To be considered compliant, networks must score at least 80% on these key performance indicators (KPIs). In the latest report covering June 2023, Safaricom, the market leader, exceeded expectations with 90%, but Airtel and Telkom significantly missed the mark with 79% and 65%, respectively. This reflects a broader trend of declining service quality in the Kenyan telecoms industry, with the average score dropping from 82.3% in 2022 to 72.4% in 2023.

Why it matters: Poor mobile network quality directly impacts people’s lives—just consider the numerous times you’ve found yourself asking “Can you hear me?” this year. Dropped calls can disrupt business; slow internet hinders productivity and access to information; and inadequate coverage leaves people unconnected in rural areas.

Are penalties working? Between 2015 and 2021, Airtel coughed up KES85.9 million ($540,000) as a bitter reminder of its QoS shortcomings. Telkom has also forked over KES59.3 million ($373,000) in penalties for its bad behaviour coverage. In fact, CA has fined Kenyan telecoms over KES500 million ($3.1 million) in the past five years for poor coverage, but the telecoms keep disappointing their 86 million mobile subscribers. This raises questions about whether the current penalty structure is strong enough to incentivise lasting change.

Secure payment gateway for your business

Fincra payment gateway enables you to easily collect Naira payments as a business; you can collect payments in minutes through cards, bank transfers and PayAttitude. Create a free account and start collecting NGN payments with Fincra.

Telecom Egypt to test 5G within three months

Talk about a quick turnaround time. Egypt’s government-owned telecom has announced that citizens can expect 5G this year.

The news: Telecom Egypt (TE) has begun testing 5G services in five locations across the country, aiming for a full rollout later in 2024. This follows the company’s recent acquisition of Egypt’s first 5G licence for $150 million last Wednesday. In an interview with Asharq Business, the company said the tests will span three months, followed by a nationwide rollout.

Mo’ spectrum, mo’ subscribers: 5G has the potential to be a significant revenue stream for TE, attracting new customers for its 13 million subscriber base and boosting its bottom line. TE trails behind Vodacom and Orange which have 46 million subscribers and 28 million subscribers respectively, and it thinks 5G will bring more Egyptians to its table. CEO Mohamed Nasr expects the financial impact to be evident by the end of 2024. Already the telecom saw a 48% net profit in 2023, and more subscribers means even better margins, especially with the $150 million hole in its pockets.

Will it though? Out of Egypt’s 97.5 million devices, only 8%, or about 7.8 million, are 5G-enabled, as admitted by Nasr earlier this month. While Nasr expects that the numbers will increase in the coming months, it’s unlikely that this will mean a revenue spike for TE. For one, the Egyptian government isn’t done handing out 5G licences yet. More telecoms are expected to get the licence and with Vodacom and Orange holding quadruple of TE’s users, it’s only a matter of time before they capture the market TE is targeting.

Investors look ahead: Meanwhile, TE’s 5G play will make it a juicy subject for investors later this year. The company is included in the Egyptian government’s IPO programme which will generate $5 billion by offering 35 state-owned companies to strategic investors by June 2024.

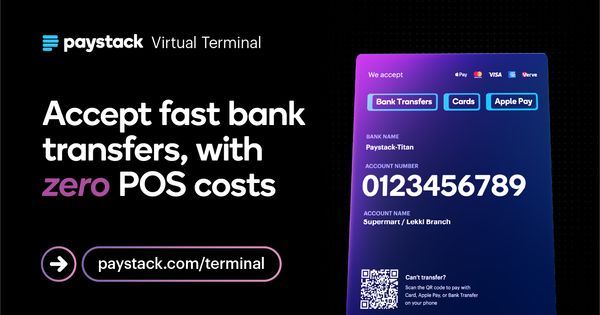

Accept fast in-person payments, at scale

Spin up a sales force with dozens – even hundreds – of Virtual Terminal accounts in seconds, without the headache of managing physical hardware. Learn more →

Nigeria to hold rate meeting next month

Just one week after official data revealed Nigeria’s inflation had reached a 27-year high, the Central Bank of Nigeria (CBN) is poised to hold its first Monetary Policy Rate (MPR) meeting of 2024. Scheduled for February 26-27, this meeting takes on paramount importance in the face of an economic situation increasingly dominated by inflationary pressures.

Cardoso faces a test: CBN Governor Yemi Cardoso, who assumed leadership in September 2023, will face his first major policy test as the CBN grapples with this critical decision. The MPR, currently at 18.75%, stands at the centre of the debate, potentially serving as a key tool to reign in inflation or, if miscalibrated, potentially jeopardising economic growth.

A divided stance: A firm rate hike might be necessary to curb inflation and stabilise the naira, but it also has potential negative consequences for borrowing costs and economic activity. The CBN’s decision will be closely watched by both domestic and international stakeholders.

Start and scale your company on Notion

Thanks to TC Daily, startups can apply to get up to 6 months free, including unlimited AI. To register your interest fill this form here by February 1, 2024.

6 years: That’s the average time it takes African tech unicorns to hit a $1 billion valuation.

Source: AfriDigest

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $41,628 |

– 0.03% |

– 4.75% |

|

| $2,470 |

+ 0.53% |

+ 10.58% |

|

|

$2.46 |

+ 9.77% |

+ 8.42% |

|

| $0.42 |

+ 7.03% |

+ 18.31% |

* Data as of 20:10 PM WAT, January 21, 2024.

Effortlessly make global settlements in over 30 currencies across 120+ countries spanning four continents, delivering cost-effective and reliable solutions to your clients, suppliers, and customers. Get started today.

It’s been 10 days since the US approved bitcoin ETFs and one company had already reached a $1 billion milestone. CoinDesk reports that BlackRock’s spot bitcoin ETF hit the $1 billion assets under management mark on Wednesday, five days after it started trading.

X’s (Twitter) latest launch is raising eyebrows in the crypto community. Over the weekend, the platform launched dedicated accounts for its upcoming payment feature. CoinTelegraph reports crypto enthusiasts are now wondering if the platform, in the future, will allow crypto payments or stick solely to fiat currencies.

- TechCabal is excited to bring you a comprehensive roundup of funding, acquisitions, and significant developments in Africa’s tech ecosystem for Q4, 2023. We’re launching the State of Tech Report for Q4 2023 on Friday, January 26, 2023. Want to attend? Click this link to register.

- This Friday, The Enablers Meetup is organising an event in Abuja for founders and other stakeholders in the tech ecosystem. Come prepared to unwind and network with other people in the tech space. Click on this link to register and attend. There will be fun activities and exciting prizes.

What else is happening in tech?

Written by: Timi Odueso

Edited by: Ope Adedeji

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.