Ardilla Africa is a fintech company taking a hands-on approach to providing financial inclusion and freedom for Africans. The company merges technology with traditional financial systems like Ajo, to provide financial inclusion to Africans. With its recently launched product, Ardilla Retail, the company is providing financial inclusion to petty traders in tier 3 cities in Nigeria.

The current state of financial inclusion

Despite the proliferation of modern financial services and the massive funding fintech receives, there is still a large number of unbanked and underbanked people on the African continent. According to data from the Enhancing Financial Innovation & Access org. (EFInA), about 47% of Nigerians remain excluded from formal financial services. This means that even with the fintechs available, we’re failing to properly tackle the barriers to financial inclusion. Without access to proper financial services, many Nigerians are unable to participate in the modern economy, access credit, start or grow businesses, escape poverty, they also miss out on profitable economic opportunities.

Nigeria also has a massive informal sector; the millions of petty traders and micro businesses that can be found on every street corner. This sector is the backbone of the Nigerian economy, contributing to both employment opportunities and economic growth. It is estimated that about 80% of Nigerian businesses are medium and small businesses, with an estimated 36.9 million MSMEs in Nigeria. These businesses have the potential to develop the communities they serve and be a catalyst for urbanization and economic growth. Despite the potential, a lot of micro-businesses and petty traders suffer because they do not have access to financial services. They make up a significant portion of the unbanked in Nigeria. These businesses need access to credit and financially inclusive services to help them grow and scale.

The reasons often cited for not owning a formal bank account include a lack of money, the distance to financial institutions, and insufficient documentation. How much do you think the mechanic by your street who has no form of identification makes daily? Or the woman with a kiosk down the street? If the woman who sells roasted plantain at the market makes ₦4,000 in profit every day, it’s unlikely that she will go to the bank to deposit it. The journey will cost her money in transport fare and bank charges. So for her, it’s easier to keep her money at home until the next market run.

Issues with traditional banking, like these, show that there is still ample opportunity to create financial solutions that tackle the problems of financial inclusion from the root. The problem with existing fintech solutions is that they are still inaccessible to everyday Nigerians. Most fintechs provide services through purely digital means and can be just as inaccessible as traditional banks. The question is; how does one solve a financial inclusion problem like Nigeria’s?

Answer; You create Ardilla Retail, a solution that combines traditional and modern finance for Nigeria’s informal sector.

Empowering Petty Traders

Ardilla Africa, itself is a financial platform where you can save, send, receive, and request money. Ardilla Retail, on the other hand, is Ardilla Africa’s financial product that caters specifically to petty traders and other tier 3 users.

According to the co-founder of Ardilla, Onyinye Dallas, what inspired Ardilla was the widening gap between Nigeria’s elite and the poor. Ardilla was created with the mission to close this gap by providing better rates, more effective financial products like Ardilla Retail, and also financial education to users. Unlike other fintechs who tout the number of sign-ups they have, Ardilla is more interested in active users and they aim to make sure that every user they acquire is active. They do this by adding something needed but lacking in modern banking—the human touch.

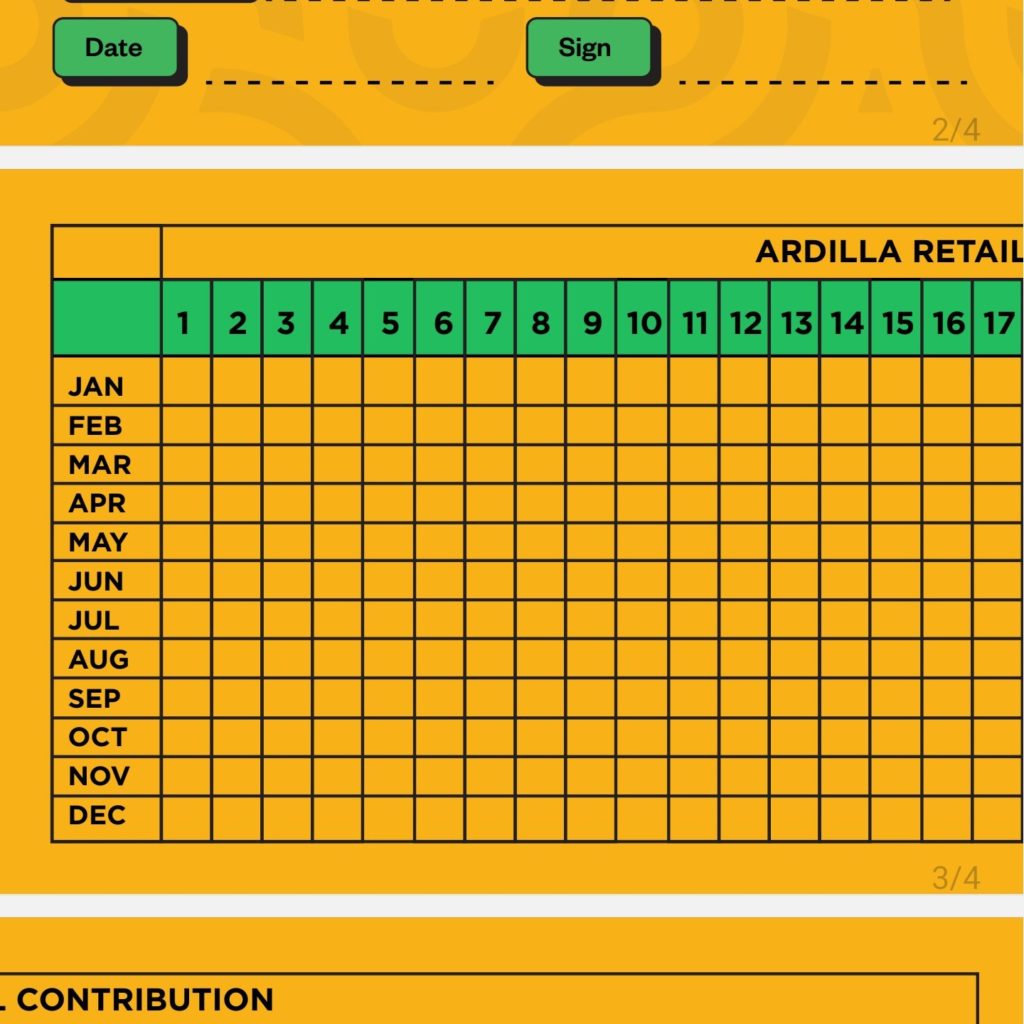

When Ardilla Retail launched in November, they deployed over 200 agents who went into markets and informal communities. These direct sales agents are charged with onboarding petty traders one-on-one into Ardilla. These agents provide these traders with what they call Ajo cards (a counting-style card to know the exact amount saved in the Month), help them download the mobile application if they’re interested, and start them on the journey to access Community-guaranteed loans.

This community-guaranteed loan is a standout feature of Ardilla Retail. In many areas today, petty traders in markets save together in an Ajo system; a group of people contribute a particular sum monthly, weekly, or daily and then take turns collecting the lump sum of that contribution. For example, if five traders contribute N10,000 monthly, at the end of the month, one trader in the group collects N50,000 to invest in their business. This is done on rotation; the next month, another trader gets the sum. Ardilla has taken this traditional system that petty traders are familiar with and added a modern twist to it with loans.

Community-guaranteed loans work in a way that, if a trader uses one of Ardilla’s savings plans and hits the savings target, they get a chance to access double the amount they’ve saved as a loan at a small interest rate. Ardilla rates are as follows;

- For the Vault Lite users there’s an 8% interest on savings, 20% interest on loans and Ardilla takes a 10% management fee on loans.

- For the Vault Extra; savings – 10%, loan – 19%, and management fee – 9% on loan

- For the Vault Premium; savings 12%, Loan – 18%, and management fee – 8% on Loan

Another method to access these community-guaranteed loans is to save as a group. This is a method petty traders in Nigeria are used to. With Ardilla’s community-guaranteed loans, a group of traders who know each other can choose an appointed leader and save together amongst themselves. When they hit the loan target, the leader collects a loan and spreads the money among the participants. This is simply a modern iteration of traditional banking. The only difference between Ardilla and the traditional Ajo system is that Ardilla has added a mobile app and they have agents and Account Officers.

Every petty trader using Ardilla Retail is assigned an account officer. These officers are assigned to markets and communities and show up every day to collect cash from traders and then they deposit it into the petty trader’s savings account. For the corn seller who cannot go to the bank every day, these account officers are a blessing. By deploying these officers, Ardilla is helping petty traders who might make small daily profits to save diligently. With this system, these petty traders can save towards concrete goals, make better financial decisions, and leverage hard-won savings to access loans that can help their businesses thrive.

Speaking to TechCabal about Ardilla, Co-founder, Oluwatamilore Kadiri states that the goal is to double the number of account officers they work with, “We currently have about 400 officers, but the goal is to double that in the coming months. When we started Ardilla, the main product, we realized that market women needed something like Ardilla Retail more than they need a full tech product. Since other fintechs already provide solutions for tech-savvy users, we decided to cover the non-tech-savvy retail side of the population.”

According to Kadiri, they have users saving as little as ₦1,000 a day, every single day. Since launching Ardilla Retail in January, the company has acquired over 400 active users who have collectively saved up to ₦7 million from daily petty cash collection. An impressive number from a group of people who had no savings in the bank two weeks prior. Ardilla also gives upfront interest to savers and 3% cash back on the first month’s savings to incentivize these petty traders to save.

[ad]

Currently, Ardilla has penetrated Iyana Ipaja, Katangua, one of the biggest markets in Nigeria, and Computer Village, the tech hub of Nigeria. Ardilla hopes to continue expanding to other markets and discharge 50 agents in every market. The long-term goal is to significantly close the financial literacy and inclusion gaps in Nigeria.

By merging traditional and modern financial systems, Ardilla has the potential to include a largely untapped market into the formal financial sector and give them access to all the benefits that come with it. The company’s innovative approach tackles major problems for petty traders and creates growth opportunities for them; and by helping this large and important sector, Ardilla is ultimately creating a better economy for all Nigerians.

Are you a petty trader interested in Ardilla? You can request a visit to your shop here. You can also download the Ardilla Retail app and get started; download it from the Play store here or the IOS store here.